Yield more than 8% | Payment via UPI | ‘AA’ rated by CRISIL | Minimum investment amount is 10 K

Piramal Capital & Housing Finance Limited is a wholly-owned subsidiary of Piramal Enterprise Limited, the flagship company of Piramal Group. Piramal Capital & Housing Finance Limited is issuing NCDs. Piramal NCD coupon rates are between 8% and 9%. These are secured, senior, listed, and redeemable NCDs. NCDs will be issued in five series. The tenor of the NCDs varies from series to series; however, tenor ranges between 26 months and 120 months. The issue opens on July 12 and closes on July 23.

Apply Now for Piramal NCD – IPO

| Issuer | Piramal Capital & Housing Finance Limited |

| Type of instrument | Senior, Secured, Listed, and Redeemable NCDs |

| Listing | Proposed to be listed on BSE and NSE |

| Size | Base size- Rs.200 Crores (Maximum- Rs. 1000 Crores) |

| Price | Rs. 1000 per NCD |

| Minimum Investment Amount | Rs. 10,000 |

| IPO Opening Date | July 12, 2021 |

| IPO Closing Date | July 23, 2021 (*if oversubscribed may close early) |

| Payment Mode | ASBA |

| Issuance | Dematerialized |

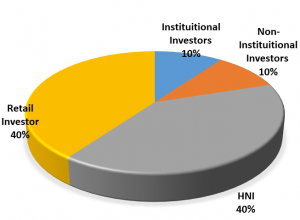

Allocation Ratio for Piramal NCD – IPO

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Piramal Capital & Housing Finance Limited’s IPO.

What are the coupon rates for retail, HNIs, institutional & non-institutional investors?

| Series | I | II | III | IV | V |

| Payment Frequency | Annual | Cumulative | Annual | Annual | Annual |

| Tenor | 26 Months | 26 Months | 36 Months | 60 Months | 120 Months |

| Coupon for Category I & II | 8.10% | NA | 8.25% | 8.50% | 8.75% |

| Coupon for Category IV & V | 8.35% | NA | 8.50% | 8.75% | 9.00% |

| Yield for Category

I & II |

8.12% | 8.10% | 8.24% | 8.50% | 8.74% |

| Yield for Category IV & V | 8.37% | 8.35% | 8.49% | 8.75% | 8.99% |

Piramal NCD: Issue Analysis

Pros

- These NCDs are secured, senior, and listed securities.

- The returns from these NCDs are 2-3 % higher than that of FDs.

- These are ‘AA’ rated by ICRA and CARE.

Cons

- Though these NCDs are “AA’ rated, they have a ‘negative outlook.’

- The returns are higher than that of FDs but compared to a few other NCDs, and returns are low.

About Piramal Capital & Housing Finance Limited

Piramal Capital & Housing Finance Limited (PCHFL) is a housing finance company. It provides wholesale and retail financial assistance to the real estate and non-real estate sectors. Within the real estate sector, the company offers a wide range of financial solutions such as private equity, debt instruments, Flexi lease, and housing finance. Piramal Capital & Housing Finance Limited was founded in 2017, having its registered office in Mumbai. PCHFL is a wholly-owned subsidiary of Piramal Enterprise Limited, which is the flagship company of Piramal Group. Khushru Jijina is Managing Director, and Jairam Sridharan is the Chief Executive Officer at Piramal Capital & Housing Finance Limited.

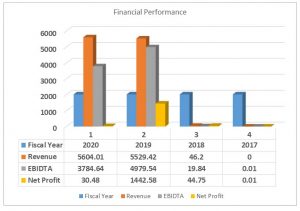

Financial Performance of Piramal Capital & Housing Finance Limited:

(Rs. In Crores)

Strengths

- The Piramal Group has been well established in the space of real estate and has earned brand equity.

- Strong focus on the risk management system to monitor asset quality and loan approval process.

- Piramal Group and PCHFL can raise capital, and Piramal Group is strongly supporting PCHFL in capital raising.

Weaknesses

- Customer concentration in real estate may increase the risk and reduce asset quality and profitability.

- Considering the NPAs, it can be said the company is demonstrating a moderate liability profile. If the company’s assets and liabilities are compared, then the company is showing moderate financial well-being.

Awards & Recognitions

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is more than 8 Lakhs –

A.Fill up the form with the required information.

B.Take a photo of your form and share it with your Relationship Manager for bidding on exchange.

C.Courier the filled up IPO form to our office address as early as possible. The issue closes on the 23rd of July, 2021. The earlier you send it, the better it is.

Our Address: IndiQube Orion, Ground Floor,

24th Main Road, Garden Layout, Sector 2,

HSR Layout, Bangalore, Pincode: 560102

If the investment amount is less than 8 lakhs

If the investment amount is less than 8 lakhs, retail investors can apply for an IPO online in three simple steps.

- Select the product- Visit GoldenPi.Com and go to the collection page. Visit the IPO section and choose the issuing company. The product page provides information such as a coupon, yield, maturity, and payment frequency. The product page also displays credit rating and issuer details that help investors to make an appropriate decision.

- Decide Investment Amount – Decide the amount you want to invest. You need to select the series and the number of units you want to purchase. The calculator displays the total investment amount.

- Pay via UPI- Now provide UPI handle. You will receive a mandate in the UPI app. Go to the respective UPI app and make payment by approving the mandate.

To know how to invest in Piramal NCD-IPO online, read this blog.

IPO allotment

IPO will be allotted to you on a first-come, first-serve basis and credited to your Demat account.

Dos and Don’ts of Piramal NCD IPO

- Every individual can submit only one IPO application.

- The Demat account must be active.

- After applying for an IPO, you can not change your contact details such as email id and cell number until allotment.

- If you are paying via UPI, then the UPI mandate must be accepted within 48 hours.