Investment Opportunity in Embassy Group Company

Invest Now

Invest in Gold Loan Backed Bonds from Muthoottu Mini Financiers Ltd.

Invest Now

Investment Opportunity in Embassy Group Company

Invest Now

Invest in Gold Loan Backed Bonds from Muthoottu Mini Financiers Ltd.

Invest Now

Investment Opportunity in Embassy Group Company

Invest Now

Invest in Gold Loan Backed Bonds from Muthoottu Mini Financiers Ltd.

Invest Now

Home

NCD IPO

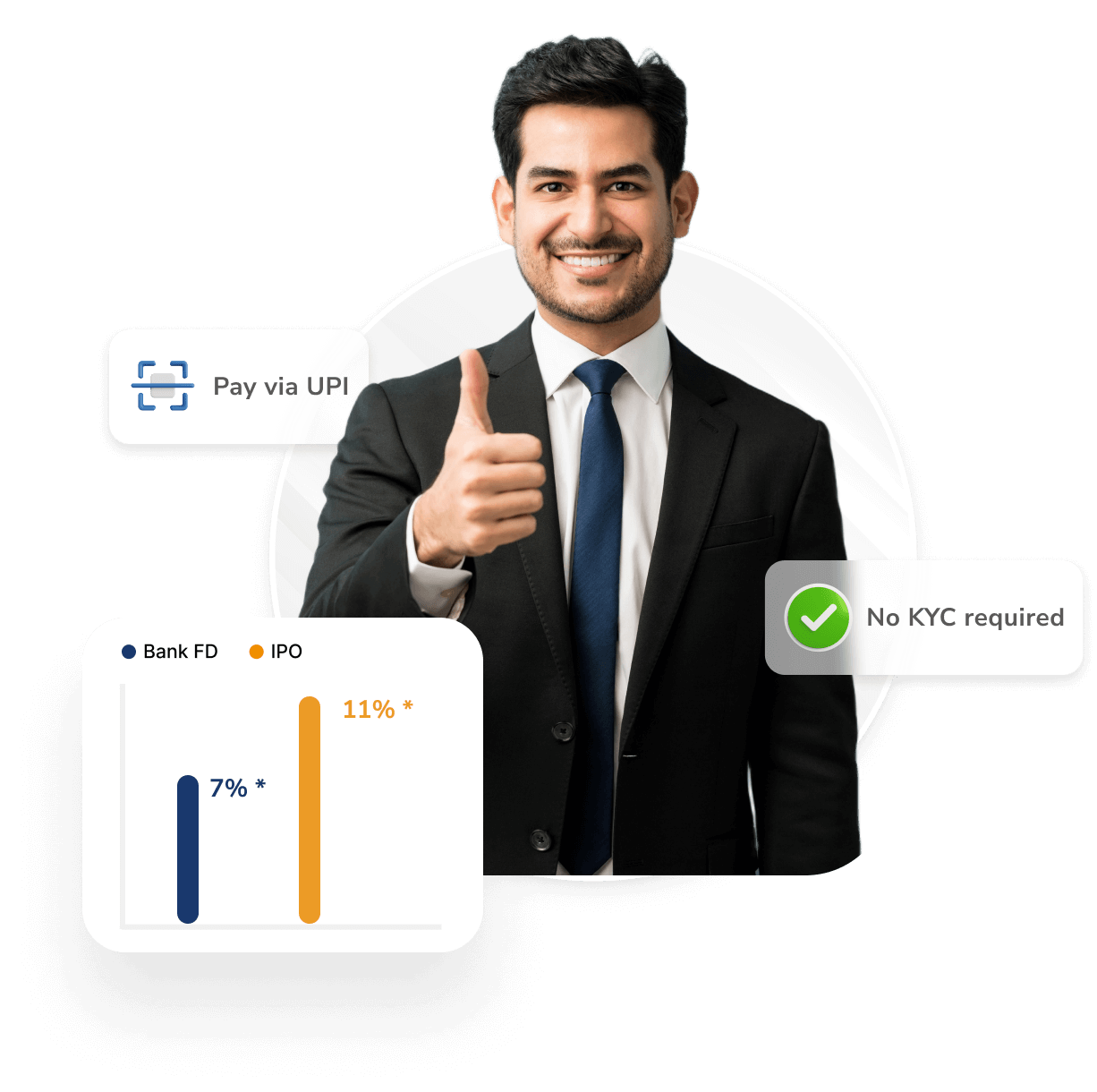

Invest in Bond IPOs

Online, Earn more than Bank FDs

Invest as low as ₹10k and get returns as high as 15%

GoldenPi is a SEBI registered Debt broker and OBPP License Holder

Explore Bond IPOs available on our platform

32.35% more than Bank FDs*

IIFL FINANCE LIMITED

Credit Rating

Returns upto

9%

Closes on*

4-Mar-2026

What is NCD/Bond Initial

Public Offering (IPO)?

A Non-Convertible Debenture (NCD) Initial Public Offering (IPO) is a type of debt security that companies or other entities can issue to raise funds from the public.

Investors who buy Bond IPOs in India, get an opportunity to earn regular returns till maturity, calculated based on the predetermined coupon rate.

What it means?

NCD

IPO

Coupon

Earn Regular and Fixed Return

Flexible tenures

Various Payment Frequencies

100% Online investment Process

How to Invest in Bond IPOs Online

Step 1

Select from the IPO Series

Step 2

Enter Demat Account and UPI Details

Step 3

Accept UPI Payment Mandate

Step 4

Get Bond units in your Demat Account after allotment

Closed Bond/NCD IPOs

Kosamattam Finance Limited

Kosamattam Finance LimitedA IND

10%

09-Feb-2026

17-Feb-2026

-

-

MUTHOOT FINCORP LIMITED

MUTHOOT FINCORP LIMITEDAA- CRISIL

9.1%

03-Feb-2026

10-Feb-2026

12-Feb-2026

-

POWER FINANCE CORPORATION LTD

POWER FINANCE CORPORATION LTDAAA CRISIL

7.3%

16-Jan-2026

30-Jan-2026

3-Feb-2026

-

ADANI ENTERPRISES LIMITED

ADANI ENTERPRISES LIMITEDAA- CARE

8.9%

06-Jan-2026

8-Jan-2026

12-Jan-2026

-

.png) MUTHOOT MERCANTILE LIMITED

MUTHOOT MERCANTILE LIMITEDBBB IND

10.75%

04-Dec-2025

17-Dec-2025

19-Dec-2025

-

Milestones

10 Lac+

registered users & growing

₹4,000 CR

worth of bonds available on the platform everyday

₹4,000+ CR

total transaction through our platform

Why to invest in Bond IPO with GoldenPi

100% Online

Seamless Investment process

In-depth Product Information

Review all information before you invest

SEBI Registered

Registered debt broker and OBPP license holder

Hear it from our Happy Customers

Learn about Investment in Bond IPOs Online

13 May 2022 | NCD IPO

What is the Difference between Equity IPO and NCD IPO?

5 July 2021 | NCD IPO

How to invest in NCD-IPO online?

2 September 2022 | NCD IPO

What is the difference Between Convertible and Non-Convertible Debentures?

FAQs about investment in Bond IPOs India

What happens when I cancel my IPO application?

When will I get the money back if I cancel?

We regret to inform you that our platform currently

supports only resident Indian applicants.

supports only resident Indian applicants.

Select your risk profile suiting your investment requirement

Low Risk

Low Returns

Moderate Risk

Moderate Returns

High Risk

High Returns

I am an investor balancing risk and return.

I am comfortable taking some risk for moderately higher returns. I can tolerate short-term fluctuations but want to avoid major losses. My aim is a blend of safety and yield, with a medium to long-term outlook (3–5 years).

I am comfortable with:

Example instruments:

AA/A Rated Corporate Bonds, Tax-free Bonds

Are you sure you want to logout?

Thank you for your interest in the IPO

Your Relationship Manager will send the Application Form over email and help you to complete the process.In case of any query, please get in touch with your RM over email or phone.

Please provide your PAN details to invest

Incorrect Details

Apply IPO through ASBA Process

Request IPO application form. It will be sent to your registered email Id

Request IPO application form. It will be sent to your registered email Id Fill in the form with required details along with your signature

Fill in the form with required details along with your signature Send a scanned copy of the signed form to Customer Support at GoldenPi via email for bidding

Send a scanned copy of the signed form to Customer Support at GoldenPi via email for bidding

Customer Support

080-45685666

contact-us@goldenpi.com

Our working hours are 9:00 am to 6:30 pm from Monday to Friday.

Enter number of units

Units

Total Investment

₹ 10

Fetch your KYC

We have found your KYC. Click 'Continue' to fetch your KYC details to complete the KYC process faster.

Thanks for Subscribing

Visit our blog to learn more about bond investments and NCDs.

Close

Takes less than 5 min

We request you to update your KYC to be compliant with the central KYC authority

We are now a SEBI registered broker

The online bond platform goldenpi.com is now owned by GoldenPi Securities Pvt Ltd (GSPL) which is an OBPP and a Debt Broker registered with SEBI

GSPL is a wholly owned subsidiary of GoldenPi Technologies Pvt Ltd (GTPL).

Kindly review and accept our updated Terms and Conditions for our continued and dedicated services to all our valued customers.

I agree to Terms & Conditions & Privacy Policy

I/We agree to share my KYC information as per the Terms & Conditions

Fetch your KYC

We have found your KYC. Click 'Continue' to fetch your KYC details to complete the KYC process faster.

Are you sure you want to logout?