India’s government is divided into three distinct levels, known as the Central government, the State government, and the Local Municipal authority. The final layer acts as the system’s weakest layer. In addition to taxes, both the Central and State governments can raise money by selling securities such as bonds and treasury bills as well as by issuing development loans, as both direct and indirect taxes collected from individuals are used by both the Central and State governments for their development projects. In contrast, local municipal authorities are permitted by particular regulations to issue municipal bonds in order to raise money for their development projects.

What are Municipal Bonds?

Municipal Bonds also referred as ‘muni bonds’ are issued by municipal corporations and urban local governments in India. These are another form of debt instruments which are issued when government bodies want to raise funds to finance projects for socio-economic development through building bridges, schools, hospitals, providing proper amenities to households, etc.

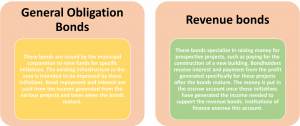

Types of Municipal Bonds in India

In India, the most common types of municipal bonds are:

History of Municipal Bonds in India

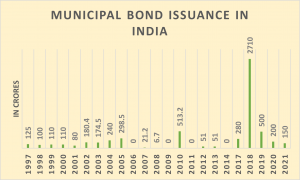

In India, municipal bonds have been around since 1997. The first urban local government in India to issue municipal bonds is Bangalore Municipal Corporation, followed by Ahmedabad in 1998 . Since then, the Indian municipal bond market has experienced steady expansion, with nine MCs generating over 1,200 crore (an average issue size of about 130 crore per corporation) by the middle of the 2000s. Following the 2005 introduction of the Jawaharlal Nehru National Urban Renewal Mission (JNNURM), which envisioned a total investment of over $1 lakh crore being made available to municipal corporations in the form of funds from the Centre, municipal bond issuances abruptly came to an end.

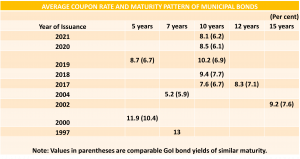

In India, municipal bonds have enjoyed a resurgence between 2017 and 21 thanks to nine MCs raising about Rs. 3840 crores. Recently, Indore, Lucknow, and Ghaziabad MCs raised about Rs. 490 Crores in India through the NSE and BSE bond platforms. In fact, the Ghaziabad MC issued green bonds in India for the first time in 2021, while the Indore MC became the first municipal corporation to list on the NSE in 2018. Despite being recognised as sufficiently safe with low credit risk, the coupon rates offered by the MCs are typically greater than those of government bonds with a similar maturity.

Source – RBI

The above graph shows the total amount raised through the issuance of Municipal Bonds in India.

SEBI Guidelines

For a municipality to be eligible to issue municipal bonds in India, they must:

- The prior three years’ net worth for the municipality could not have been negative.

- The municipality must not have defaulted in the past year on the repayment of debt securities and loans obtained from banks or non-banking financial institutions.

- It is forbidden to include the municipality, the promoter, or the directors on the Reserve Bank of India’s list of willful defaulters (RBI).

- The municipality shouldn’t have any history of making late payments for principal or interest on debt instruments.

TYPES OF GOVERNMENT BONDS

Advantages and Disadvantages of Investing in Municipal Bonds

The following are the advantages of investing in municipal bonds –

- Transparent:

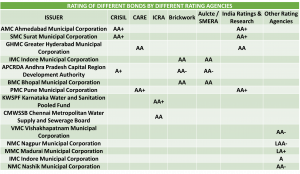

These bonds are rated by credit rating agencies like CRISIL. Investors now have transparency regarding their credibility.

- Minimal Risk:

These bonds are issued by municipal administrations, which suggests a low risk associated with these assets.

The following are the disadvantages of investing in municipal bonds –

- Long Maturity:

Investors must deal with the difficulty of liquidity because of the three-year lock-in term for these bonds. However, if an unpopular municipal corporation issues them, it may be difficult to sell them early on the secondary market. As a result, their reliability and ability to produce are under doubt.

- Low Return:

Returns on these bonds are less than those of market-linked securities.

Source – RBI

The above table shows the average coupon rate and maturity pattern of municipal bonds in India.

Grade of the municipal bonds

For the public offering, the municipal bonds are required by the market regulator to have a rating higher than investment-grade. Public issuance of municipal bonds is permitted if they have a credit rating of BBB or better as reported by India’s main credit rating agencies (such as CRISIL). These ratings have been given in an effort to support and promote the legitimacy of these bonds and to inspire investor trust in them. Financial entities like banks must be designated as a fiscal bureau, and the bonds must have a three-year maturity period.

Source – RBI

The above table shows the different rating assigned to different bonds issued by various Municipal Corporations.