|

Getting your Trinity Audio player ready...

|

A recession is a downturn in the economy, which causes a decline in GDP and industry sales. A recession can be caused by monetary policy, natural disaster or severe weather conditions. India has been one of the fastest growing economies in the world since its liberalization in 1991. However, this growth has been unevenly distributed across sectors and regions.

The global economy has been facing challenges due to the pandemic, and Russia-Ukraine war wherein India has been no exception in facing consequences of these events. With the country experiencing one of the worst economic downturns in recent times, many experts have raised concerns about the possibility of a global recession. The global recession will definitely have a negative impact on India’s GDP, growth rate and business activity. The question is: will there be a recession in India before or after 2024? What can you do to prepare for one and what steps should you follow?

Current Economic Scenario in India

Before we delve into the possibility of a recession in 2024, it is important to understand the current economic scenario in India. The COVID-19 pandemic has had a significant impact on the Indian economy, with the GDP contracting by 7.7% in the financial year 2020-21 (World Bank data). This has been coupled with high inflation rates, rising unemployment levels, and a decline in consumer demand.

However, the Indian economy has shown signs of recovery in recent months. The GDP growth rate has improved, and the government has announced several measures to boost economic growth. The Reserve Bank of India (RBI) has also taken steps to support the economy by increasing interest rates and providing low liquidity to banks.

Possibility of a Recession in 2024

While the current economic scenario in India is showing signs of improvement, there are still concerns about the possibility of a recession in 2024. Some experts believe that the impact of the pandemic on the economy will be long-lasting, and it will take several years for the economy to fully recover.

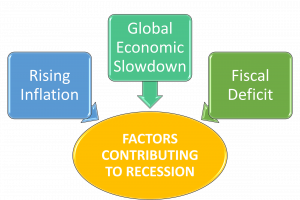

Furthermore, there are some factors that could contribute to a recession in India. These include:

- Global Economic Slowdown – India’s economy is closely linked to the global economy, and a slowdown in the global economy could have a negative impact on India’s growth prospects.

- Rising Inflation – Inflation has been a concern in India, and if it continues to rise, it could lead to a decline in consumer demand and a slowdown in economic growth.

- Fiscal Deficit – India’s fiscal deficit has been a concern for several years, and if it continues to rise, it could lead to a decline in investor confidence and a slowdown in economic growth.

How to Identify the Warning Signs of a Recession in India

Identifying warning signs of a recession in India can help individuals and businesses prepare for potential economic downturns. Here are some indicators that can signal an impending recession:

- Declining GDP growth: A recession is generally characterized by a significant decline in GDP growth. If India’s GDP growth rate declines for two consecutive quarters, it could be an early warning sign of a recession.

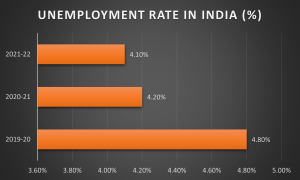

Current Scenario- In the three months leading up to December 2022, the Indian economy grew by 4.4% year over year, which was less than the 3 months leading up to September 2022’s growth of 6.3% and the 3 months leading up to June 2022’s growth of 13.2%. Thus far, the rate has been dropping. - Rising unemployment: During a recession, businesses may cut jobs, resulting in a rise in unemployment. An increase in the unemployment rate can be an indicator of a weakening economy.

Current Scenario-

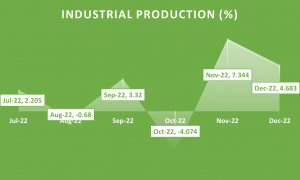

- Falling industrial production: A decline in industrial production can indicate a decrease in economic activity. A fall in industrial production can also lead to lower employment levels and reduced consumer spending.

Current Scenario-

- Decrease in retail sales: Retail sales are a crucial component of the Indian economy. A decrease in retail sales can indicate a reduction in consumer confidence and spending, which can further exacerbate economic slowdown.

Current Scenario- The industry experienced an 8.5% fall in FY 2021, but it recovered in 2022 to reach $836 billion, with conventional retail contributing 81.5% of that total. Nonetheless, the COVID-19 disruptions accelerated the adoption of digital technology and e-commerce. - Tightening credit conditions: Banks and other lenders may tighten their lending standards during a recession, making it harder for businesses and consumers to access credit. This can lead to reduced investment and spending, further contributing to an economic slowdown.

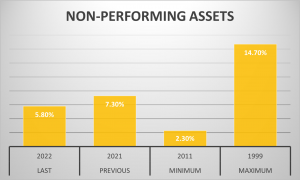

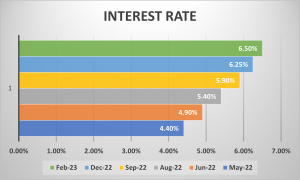

Current Scenario- Increasing repo rate, making loans expensive for people to consume. As the rates have been increasing since May 2022, availability of credit has also become expensive. Therefore, people are not able to consume much. - Increase in non-performing assets (NPAs): An increase in NPAs can indicate a rise in loan defaults, suggesting that borrowers may be facing financial difficulties. This can be an indicator of a weakening economy.

Current Scenario- India’s non-performing loans ratio was 5.8% in March 2022, down from 7.3% the year before.

- Consumer spending: Consumer spending is a critical driver of economic growth, and a decline in consumer spending can be an indicator of a possible recession. If there is a decrease in sales of goods and services, it could be a warning sign of a weakening economy.

Current Scenario-

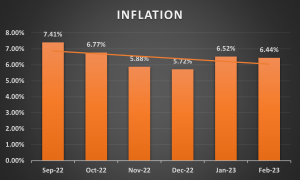

- Inflation: Inflation is the rate at which the prices of goods and services are rising. If inflation rises rapidly and persistently, it could be a warning sign of a recession.

Current Scenario-

- Interest rates: The Reserve Bank of India (RBI) can use interest rates to control inflation and stimulate economic growth. If interest rates are high or if the RBI has to raise interest rates rapidly.

Current Scenario-

It is important to note that no single indicator can provide a definitive warning of a recession. Instead, a combination of these and other factors can provide a more comprehensive picture of the state of the economy. Monitoring economic indicators and seeking expert advice can help individuals and businesses prepare for potential economic downturns.

How is it when the world is in Recession?

Lets analyse the impact of recession on Indian economy and the various other parts of it-

Impact on the Indian Economy

The impact of the recession on India was severe. The GDP growth rate declined from 7.66% in 2006-07 to 3.09% in 2007-08 and further to 5.24% in 2010-11, it also declined by 10.33% in 2019-20. Investment and consumption both declined as a result of lower consumer confidence, reduced corporate profits and increased unemployment during this period.

Impact on Indian Financial Markets

The Indian financial markets have been affected by the global recession. The impact of the recession on Indian financial markets can be seen in:

- Decrease in share prices: The Sensex plunged by 63% in 2008 this was when the Global Financial Crisis originated in the US, eventually leading to sharp crashes in markets globally. This was due to decreased investor confidence, increased risk aversion and reduced liquidity.

- Increase in risk aversion: Investors became more cautious about investing their money into risky assets like equities because they were worried that their investments would lose value if there was an economic slowdown or recession due to falling demand for goods & services (which would result in lower corporate profits). They were also concerned about rising unemployment levels which could lead to social unrest if not handled properly by governments around the world – including those operating within India itself!

Impact on Indian Banks and Non-Banking Financial Companies

The impact of the global recession on Indian banks and non-banking financial companies (NBFCs) has been significant. The rise in non-performing assets (NPAs) has led to an increase in capital requirements for these institutions, which has resulted in tighter credit availability for businesses and consumers alike.

In addition, many NBFCs have had to write down their assets because of falling asset prices during this period; this means that they now hold fewer liquid assets than before, which makes it harder for them to lend money effectively during times of economic difficulty such as recessions or depressions.

Impact on Indian Industries

Indian businesses have been negatively impacted by the recession. Unemployment rates rise as businesses try to decrease costs. In turn, this lowers consumption rates, which lowers inflation rates. Falling prices result in lower business profits, which leads to additional job losses and a downward spiral of the economy.

Impact on Indian Households

The impact of the recession on Indian households has been severe and wide-ranging. The most significant change has been a decrease in disposable income, which has reduced spending on food, clothing, healthcare and education. Households are also cutting back on their savings rates as they struggle to cope with higher prices for basic goods and services such as electricity bills or transportation costs. The second major effect of the economic downturn is an increase in poverty levels.

Impact on Indian Government

The recession has had a significant impact on the Indian government. The government’s revenue sources have been reduced, while its spending has increased. This is due to an increase in unemployment and poverty during this period, which has led to an increase in social security benefits paid out by governments at all levels.

The recession also led to higher interest rates on government bonds, making it more expensive for them to finance their debt obligations through bond sales or loans from international lenders like the World Bank or International Monetary Fund (IMF).

Impact on Indian Society

There are several ways in which the recession has impacted Indian society. The most obvious is an increase in inequality, as those with money were able to spend more on luxury items while those without it had to cut back on necessities. This led to an increase in social unrest, as people who were struggling financially felt that their government wasn’t doing enough for them and began protesting against it. The recession also caused crime rates to rise as people turned to illegal means of making a living when they couldn’t find jobs or earn enough money through legal channels.

Impact on Indian Debt Market

A recession can have a significant impact on the Indian debt market. During a recession, economic activity slows down, and businesses and individuals may find it harder to repay their debts, leading to an increase in defaults.

In such a scenario, investors in the Indian debt market may become more risk-averse, leading to a decrease in demand for corporate bonds and other debt securities. This can result in a drop in prices of these securities, causing losses for investors holding them.

Additionally, during a recession, the Reserve Bank of India (RBI) may take measures to stimulate the economy, such as reducing interest rates or increasing liquidity in the market. These actions can impact the yields on government bonds, which are considered safe-haven investments. If the RBI lowers interest rates to boost economic growth, the yields on government bonds may also decline, leading to lower returns for investors.

Overall, a recession can lead to increased volatility in the Indian debt market, with potential impacts on both investors and issuers of debt securities. It is important for investors to monitor the economic conditions and make informed decisions based on their risk tolerance and investment objectives.

What Should You Do During an Economic Downturn in India?

During an economic downturn in India, it’s important to be proactive and take steps to mitigate the impact on your finances. Here are some things you can do:

- Prioritize your expenses: Identify your essential expenses, such as housing, utilities, and food, and prioritize them over discretionary spending. This will help you make the most of your resources during tough times.

- Cut back on unnecessary expenses: Identify areas where you can cut back on expenses, such as eating out less, canceling subscriptions you don’t use, and buying generic brands instead of name brands.

- Look for ways to increase your income: Consider taking on a side gig, freelancing, or exploring new job opportunities to supplement your income during a downturn.

- Build an emergency fund: If you haven’t already, start building an emergency fund to cover your expenses for at least three to six months. This will provide a financial buffer in case of unexpected expenses or job loss.

- Take advantage of government schemes: Stay informed about government schemes and initiatives aimed at supporting individuals and businesses during a downturn, such as unemployment benefits, loan restructuring, and tax breaks.

- Re-evaluate your investments: Take a look at your investment portfolio and make adjustments as necessary. Consider diversifying your investments and focusing on low-risk options during a downturn.

- Seek professional advice: Consider seeking the advice of a financial planner or advisor to help you navigate the challenges of an economic downturn.

- Diversify your income sources: Try to diversify your income sources by taking on side gigs or exploring new opportunities. This will help you generate additional income in case of a job loss or salary cut.

By taking these steps, you can better prepare yourself and your finances for an economic downturn in India. Remember to stay positive, stay informed, and focus on the long-term.

Conclusion

In conclusion, it is important to note that the global recession has had a significant impact on India’s economy. The country has been forced to take steps in order to recover from this downturn and ensure its long-term growth prospects remain strong.

The outlook for the future of India remains positive despite these challenges; however, there are still many areas where improvement is needed if we want our economy to continue thriving into the future.

While the possibility of a recession in India in 2024cannot be ruled out, it is important to note that the Indian economy has shown signs of recovery in recent months. The government has taken several measures to boost economic growth, and the RBI has provided support to the economy through its monetary policy.

However, there are still several challenges that need to be addressed, including rising inflation, the global economic slowdown, and the fiscal deficit. It is important for the government to continue to take steps to address these challenges and ensure that the Indian economy remains on a path of sustained growth.

FAQs About Recession in India

1. What causes a recession?

In response, aggregate supply (total production) and aggregate demand (total demand) interact to produce economic growth. Two main categories of factors are principally responsible for economic recessions: supply shocks, which are defined as unexpected events that abruptly alter the supply of a good or service, leading to an unexpected change in price; and demand shocks, which are defined as sudden unexpected events that dramatically increase or decrease demand for a good or service, usually temporarily.

2. What is the impact of the recession?

The overall demand for goods and services is reduced, which is why the unemployment rate nearly always rises and inflation marginally declines. Recessions are frequently accompanied by volatility in the financial markets in addition to the decline in the value of homes and stocks.