High Yield | AA/Stable Rated | Minimum Investment: 10k Only

Bond overview

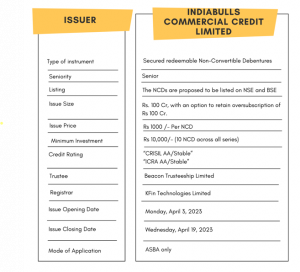

Indiabulls Commercial Credit Limited is issuing the Non-Convertible Debentures. These NCDs are AA/Stable rated by CRISIL and ICRA. The NCDs are being issued in eight series: coupon ranges from 9.6% to 10.50% p.a. and different tenures of 24 months, 36 months and 60 months. The NCDs are secured and redeemable in nature.

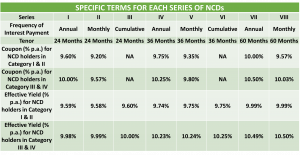

Coupon rates and effective yield for each of the series

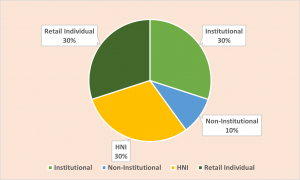

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Indiabulls Commercial Credit Limited NCD-IPO.

Redemption Schedule

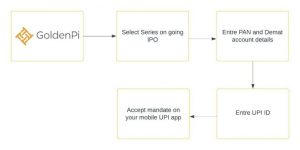

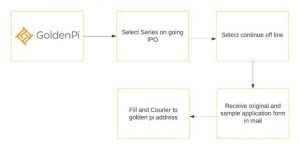

Investment Process for Indiabulls Commercial Credit Limited NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

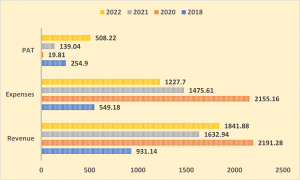

Financial Overview

Snapshot stating the Revenue, Expenses, PAT (In crores)

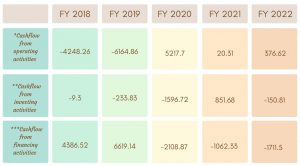

Cash flow for last 5 years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

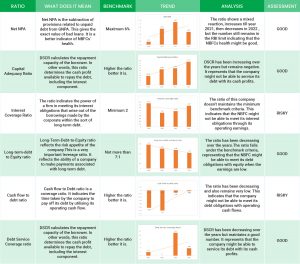

Ratio Analysis

Issue analysis

Pros

- The NCD is AA rated security with a stable outlook.

- The yield offered is 10.6% which is much higher than FDs.

Cons

- Decreasing Cash flows every year

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Indiabulls Commercial Credit Limited

Indiabulls Commercial Credit Limited, incorporated in 2006, is a wholly owned subsidiary of Indiabulls Housing Finance Limited. IBCCL has extensive knowledge in mortgage-based financing and strong parental backing. Small business loans that IBCCL and IBHFL underwrite fall into the category of loans with the lowest risk.

Quick walk through on Financials details for 2023

- Asset Under Management – Rs. 13,771 Cr

- Gross NPA – 3.2%

Strengths

- A sizable net worth of Rs 16,727 crore as of June 30, 2022, supported by strong internal accruals, characterises capitalization.

- IBHFL continues to have a significant presence in retail mortgage finance, robust capitalization, and good asset quality in the retail divisions.

- As of June 30, 2022, IBHFL reported overall gross NPAs of 3.0%, down from 3.2% as of March 31, 2022 (2.7% as of March 31, 2021).

- Presence in the retail mortgage finance sector that is significant

Weakness

- The company’s portfolio performance may be impacted by asset-quality concerns resulting from a sizable large-ticket commercial credit portfolio of Rs 9,065 crore as of June 30, 2022.