To appreciate Corporate Bonds, you need to understand their features so that you can make an informed decision. In this blog, we will discuss credit rating, liquidity, returns, risks, advantages, disadvantages, and variants of Corporate Bonds.

What are corporate bonds, what is their role, and does it have more yield than fixed deposits?

Corporate bonds are the debt securities issued by Corporate entities such as private firms, public sector units, and banks. Investors receive regular interest payouts at predetermined time intervals and receive their principal amount on the maturity of the bonds. To understand the Corporate Bond Market, we need to know the features of Corporate Bonds.

The Primary Purpose

The primary purpose of issuing corporate bonds is to raise capital for business operations and expansion without diluting its ownership. Bonds provide regular income to bondholders, and corporate bonds offer higher coupon rates. Additionally, via corporate bonds, the money in abundance with investors flows towards businesses leading to economic growth.

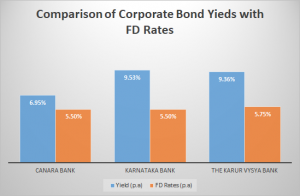

More Yields as compared to Fixed Deposits

*As on 15/3/2021

FD rates are lower than bond interest rates. Banks have to maintain CRR(Cash Reserve Ratio) as per regulations laid down by the central bank. The banks have to reserve a portion of capital received via FDs; entire capital can not be lent. This reserved capital can be utilized to supply closures (or pre-closures) in FD. Such constraints are not there on banks on the capital that is raised via bonds. Hence bond rates are higher than FD rates. Refer to the figure(above). With each one of these banks, you can see bond rates are higher than FD rates.

Bonds are tradable; hence you can sell them in secondary markets when the general interest rates increase, resulting in capital gains. FDs are not tradable, and they come with fixed lockin. The investor has to pay the penalty for the premature closure of FD. Both FD and bonds fall into the category of low-risk securities.

“Most of the NRIs prefer to invest in bonds as the money that is otherwise held in foreign banks at lower rates is now being invested in these bonds more gainfully. And there are no perceptible ambiguities here as the investor is using the LRS money to buy bonds, which is permissible security,” said Nikhil Johri, CEO of Trivantage Capital.”

*For tenure of 5 years, as on 17/3/2020

Few important features of Corporate Bonds are listed below.

Higher Coupon Rates

Corporate bonds offer higher coupon rates than G-secs. G-secs offer coupons of around 6%, whereas corporate bonds offer approximately between 7% (AAA rated)to 12% (A rated) coupons in the current scenario (The year 2021).

Earn Higher Fixed Regular Returns- Find Right Bonds

Have Shorter Tenures compared to G-secs

Tenure is the period during which the bondholder receives interest payments. Once a bond matures, the investor receives the principal amount. Till maturity, the issuer owes money to the investor, and on the maturity date of the bond, the principal amount is repaid along with any outstanding interest, and the contract gets terminated. Compared to Gsecs, corporate bonds have a shorter tenure.

Moderate to Liquidity

The liquidity of security describes the ease of selling it without negotiating on the price. The corporate bond market’s liquidity via OTC can be said as moderate to high (based on the specific bond).

Credit Rating

The credit rating is an evaluation of prospective debtors and their debt securities such as bonds and debentures. In India, “AAA” to “BBB” rated bonds are considered investment-grade bonds, and bonds rated below “BBB” are considered junk-grade bonds.

The rating is a systematic process executed by independent organizations, and they are called Credit Rating agencies. Credit rating agencies are well-regulated entities. Let’s discuss more Credit Rating Agencies (CRA). Click here.

Call Provision

Few bonds come with a unique feature, i.e., call provision. This allows the issuer to buy back the bonds before maturity. All perpetual bonds come with this call provision. To reduce borrowing costs, issuers usually call back these bonds and raise funds at a lower interest rate. When bonds are called, then the issuer pays back the principal and unpaid interest, if any.

Bond insurance

Here an insurance company insures the scheduled payments of interest and principal to the investor. This is called “ financial guarantee insurance.”

Advantages

Corporate bonds offer higher coupons. They are slightly riskier than Gsecs yet safer than equities. They come with a shorter maturity, and they are liquid in nature.

Disadvantages

The associated risk with Corporate Bonds is higher than G-secs. In the long run, the returns from corporate bonds can be lesser than that of equities. At times, the availability of specific bonds in the secondary market may fluctuate.

Risks associated with Corporate Bonds

Default risk is the loss the investor incurs when the issuer fails to pay the interest or principal on the debt obligations. The number of corporates failing to meet their debt obligations is scarce; nevertheless, default risk is a significant risk that can dampen investor’s sentiment.

Few other risks are :

- Interest rate risk: Interest Rate Risk is the risk of getting a lower sell price than the price at which the bondholder bought the bonds in the first place.

- Liquidity risk: This is the risk that an investor may face if he tries to sell bonds before maturity and fails to get buyers.

- Reinvestment risk: This is the loss that an investor can incur when he receives a lump sum payment of principal and cannot find investment instruments with good returns.

- Call Risk: Call provision is a privilege that can be leveraged only by the issuer; hence after bonds are called, the investor won’t be getting any interest payout. This can reduce their effective yield.

- Inflation risk: Rising inflation causes bond prices to fall and bond yields to rise. So with rise in inflation, bondholders will see the market value of their bond investment reducing. Holding the bonds till maturity (HTM) shields the investors from this risk completely.

Bonds can be relatively safer than all other asset classes. Nevertheless, bonds do come with a couple of risks. Let’s get aware of them and learn a few simple strategies on how to mitigate them.

Frequently Asked Questions

- How are corporate bonds different from Government Bonds?

Government bonds offer a lower coupon rate than corporate bonds. Corporate bonds are relatively riskier than G-secs. But the point that we should remember here is all bonds come under the category of low-risk instruments.

- Where can I find the Best Corporate bonds?

No investment is best or worst. The Corporate Bonds which can meet your financial requirements and match your risk appetite are the best Corporate Bonds for you. You can find a list of Corporate Bonds on NSE and BSE websites. You can also visit our collection of Corporate Bonds.

Customer’s Voice

Golden Pi Technologies is a prudent company in the field of primary and secondary market bonds. The company’s knowledge and the area are vast and veteran. Associated staff and client relation executives are knowledgeable and always more than happy to help. I’m using the facilities of the following company for four months if I’m not wrong, and the procedure and ease of investing made me completely biased on Golden Pi. Now, I stopped investing through other brokerage houses, in particular the investment fields of Bonds.

Golden Pi Technologies is a prudent company in the field of primary and secondary market bonds. The company’s knowledge and the area are vast and veteran. Associated staff and client relation executives are knowledgeable and always more than happy to help. I’m using the facilities of the following company for four months if I’m not wrong, and the procedure and ease of investing made me completely biased on Golden Pi. Now, I stopped investing through other brokerage houses, in particular the investment fields of Bonds.

To read reviews on GoldenPi, click here.

- What is a Credit Rating?

The credit rating is an evaluation of prospective debtors. The debtor could be a country or organization that owes money. Credit Rating Agencies study the debtor’s credit history and predict the ability to pay back the bonds or other debt instruments and a forecast on anticipated debtor defaulting. Credit ratings help both institutional and individual investors to invest appropriately.

- How to avoid default risk associated with Corporate Bonds?

Default risk associated with corporate bonds can be avoided by investing in investment-grade bonds. In India, AAA to BBB rated bonds are considered investment-grade bonds.

- What are investment-grade bonds?

The set of bonds that carry relatively low risk are called Investment Grade Bonds. Default risk is very low; hence they are given high credit ratings. In India, “AAA” to “BBB” rated bonds are considered investment-grade bonds.

- Where can I find the details like coupon, yield, and maturity of corporate bonds?

The websites of the stock exchange, such as BSE and NSE, do provide last traded reports. These reports include bond-related details. Alternatively, you can visitgolden.com. GoldenPi is an online platform for individuals and corporates to buy or sell bonds and debentures.