|

Getting your Trinity Audio player ready...

|

The corporate bond market in India is thriving. A CRISIL report suggests that the value of corporate bonds could double between INR 65 – 70 lakh crore by March 2025. Investors are increasingly drawn to various financial instruments that provide attractive returns. Considering the higher interest rates offered by corporate bonds, the dynamics are no surprise. Similarly, the interest rates of corporate fixed deposits have also attracted investors seeking better returns. That said, investors must have a clear grasp of liquidity in the bond market.

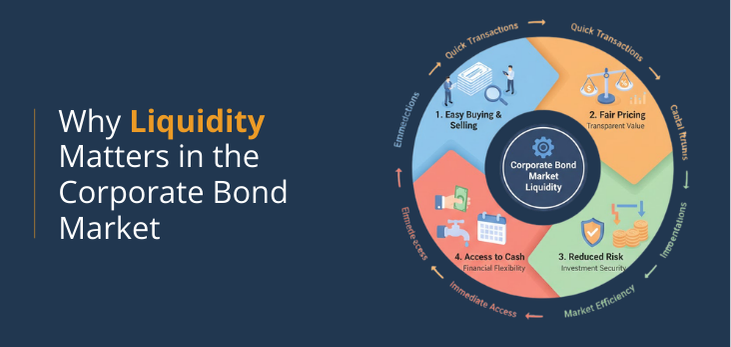

Liquidity has always been an important factor in the world of investment. It indicates how quickly a security or any investment can be traded without negatively influencing the price. The definition of market liquidity in the bond market revolves around the same theme.

Will you be able to sell your corporate bond in the bond market? As an investor, this is the most important thing you must know to invest.

Research and studies have been conducted on large scales to gauge the various conditions affecting the liquidity in the bond market and why a liquid market is essential. Read on as we explore why a liquid corporate bond market is necessary for market participants.

Key Takeaways

- Without losing the price, you could quickly trade your investment in the bond market; that’s liquidity.

- Liquidity is essential for reasons like credit rating, accessibility to assets, boosting investor confidence, yield spreads, efficiency of the price and market resilience.

- During the economic downturn, liquidity has a significant impact on yield spreads and bond prices.

- Even in an unstable economy, high-rated bonds have great liquidity.

Liquidity in the Corporate Bond Market

When the bond market allows the trading of large-scale, low-cost assets without causing a significant price change, it will be considered liquid. In simple terms, the question is whether or not an investor can sell a bond without facing a loss of investment.

Needless to say, multiple aspects can determine the liquidity of the market. The liquidity of a corporate bond can keep fluctuating, especially during economic turmoil. Credit ratings become another influencer here.

It’s simple to look at this way the bond market works a bit differently than the stock market, the stocks don’t mature, therefore to realize the capital and the profits, the stockholder has to trade in the market, whereas the bondholder can hold it till maturity and they infrequently trade in the market.

Thus you see a significant difference in the liquidity on both the markets. This means that in the bond market, you don’t have frequent buyers all the time to sell when you think you should, it doesn’t mean there aren’t any though, there will always be a time when buyers want to enter and you may have to sell it then.

Importance of Liquidity in Corporate Bond Market

Liquidity has been viewed as a positive indicator in the world of finance, and the same stands for the corporate bond market.

Liquidity and Price Efficiency

The value of liquid bonds rises quickly. Trading is easier, more convenient, and less time-consuming. On the other hand, selling illiquid bonds is trickier and requires more effort.

In a liquid market, participants have a better opportunity to determine the fair price of the bonds.

Liquidity and Yield Spread

The difference between various debt instruments’ yields with different maturities, issuers, credit ratings, or risk levels is termed the yield spread. A large yield spread is desired for high-risk investments and vice versa. Liquidity has a noticeable impact on this. Let’s look at the study by Friewald et al. (2012). It shows liquidity accounting for 14% of bond yields in stable markets. During financial distress, the percentage spikes up to 30%.

Liquidity and Credit Ratings

Bonds with higher credit ratings, such as AAA, receive priority from investors to minimise risk. Likewise, these bonds can still enjoy higher liquidity in an unstable economy than lower-rated bonds, even if the latter promise higher yields. It is obvious that when the market is stable, investors are willing to take bigger risks than their appetite to receive higher returns, but not so much when the uncertainty of the economy looms.

Liquidity and Market Resilience

A liquid market will indeed be more resilient to market turmoil. Inventors will have sufficient time to analyse their position and plan accurate risk management.

Liquidity and Access to Asset

A liquid bond is a bond that is easy to sell. In a liquid market, investors can, hence, have better access to their assets. In fact, they can take their time to study the supply and demand in the market, compare prices, and take the most beneficial step.

Liquidity and Investor Confidence

Investors can proceed more confidently when they know that their chosen investment tool can generate better returns and enjoy high liquidity.

Liquidity and Transparency Challenges in Corporate Bond Market

Liquidity and transparency challenges exist in the bond market. Transparency is often lacking in pricing and available information. All these not only limit investors’ access to corporate bonds but also reduce their desire to invest in them.

However, SEBI has been actively making efforts to improve liquidity and transparency in the corporate bond market.

- As per SEBI’s mandates, bond issuers must present more disclosures on interest payments.

- Investors are more confident when they have all the information on hand. That’s why SEBI has asked for details on the end-use of collected funds.

- It has made it compulsory to present traders’ information uniformly on OTC trades.

- It has permitted brokers to bid on behalf of their clients on RFQ platforms to increase market participation.

- It has restricted the face value of bonds traded through private placement to INR 1 lakh to improve retail participation and liquidity.

- It has tried to boost investor’s confidence by bringing only trading platforms under regulatory bounds.

Invest in Top Corporate Bonds with GoldenPi

Finding top-rated and high-yielding corporate bonds is tough, and so is looking for the most reliable investment platform. GoldenPi will take care of both issues and help you achieve your investment goals. When you visit our platform, you will see an updated list of the best corporate bonds and all the required details, like their interest rates, credit ratings, and maturity.

Our quick and simple 3-step investment procedure will make investing easier than ever! Complete KYC, select the bonds, and make the payment. Now, just relax and enjoy the returns. By the way, you can also monitor your investments at your convenience.

FAQs About Corporate Bond Market

1. Why does liquidity matter in the corporate bond market?

For an investor to be able to trade bonds quickly without having an impact on the price, liquidity must essentially be considered. There are other major reasons, such as helping in understanding yield spreads, and price efficiency, and boosting the confidence of the investor knowing that they can sell. Also, during economic downturns, it supports market resilience and makes assets accessible.

2. What is a corporate bond?

A corporate bond is basically a company taking a loan from the public instead of a bank to collect funds for its daily business operations. It has a preset interest rate and maturity date.

3. Are corporate bonds safe?

Bonds are counted among the safer investments. Corporate bonds can carry certain risks, but they can be easily determined by assessing credit ratings.

4. How should I pick the best corporate bond for me?

Start by evaluating your investment goals and risk appetite. Ideally, you should opt for a corporate bond with a high rating (A or above) that offers good returns.

5. Why are corporate bonds issued?

Applying for a bank loan and getting approved can be time-consuming, costlier, and multiple factors influence the process. Issuing a bond to collect the money is just an easier process.

6. How does the payment work in corporate bonds?

Corporate bonds generate periodic interest payments and return the principal investment amount on the day of maturity. However, zero-coupon bonds have no coupons and only pay the promised face value after maturity.

7. Why choose corporate bonds over government bonds?

The primary reason for choosing a corporate bond over a government bond is the higher interest rate offered by the former.

8. Which credit ratings are reliable for corporate bonds?

CRISIL, ICRA, CARE, and IND’s credit ratings are reliable.