|

Getting your Trinity Audio player ready...

|

Exploring the Indian Budget 2024: Key Changes and Their Impact on the Economy

The unveiling of the Indian Budget 2024 marks a pivotal moment, charting a strategic course towards ‘Viksit Bharat’ with a clear focus on bolstering employment, enhancing skills, empowering the middle class, and fortifying MSMEs. This budget is not just a financial statement but a blueprint for invigorating the economy through comprehensive fiscal changes aimed at maximizing productivity and resilience across key sectors including agriculture, manufacturing, and urban development. With nine priorities set to redefine the landscape—from social justice and human resource development to energy security and infrastructure—this budget promises to catalyze innovation and pave the way for next-generation reforms. Dive into how these thoughtful allocations and visionary policies are poised to reshape India’s economic trajectory, influencing various sectors and heralding a new era of growth and opportunity.

Overview of the Indian Budget 2024

A Fiscal Snapshot

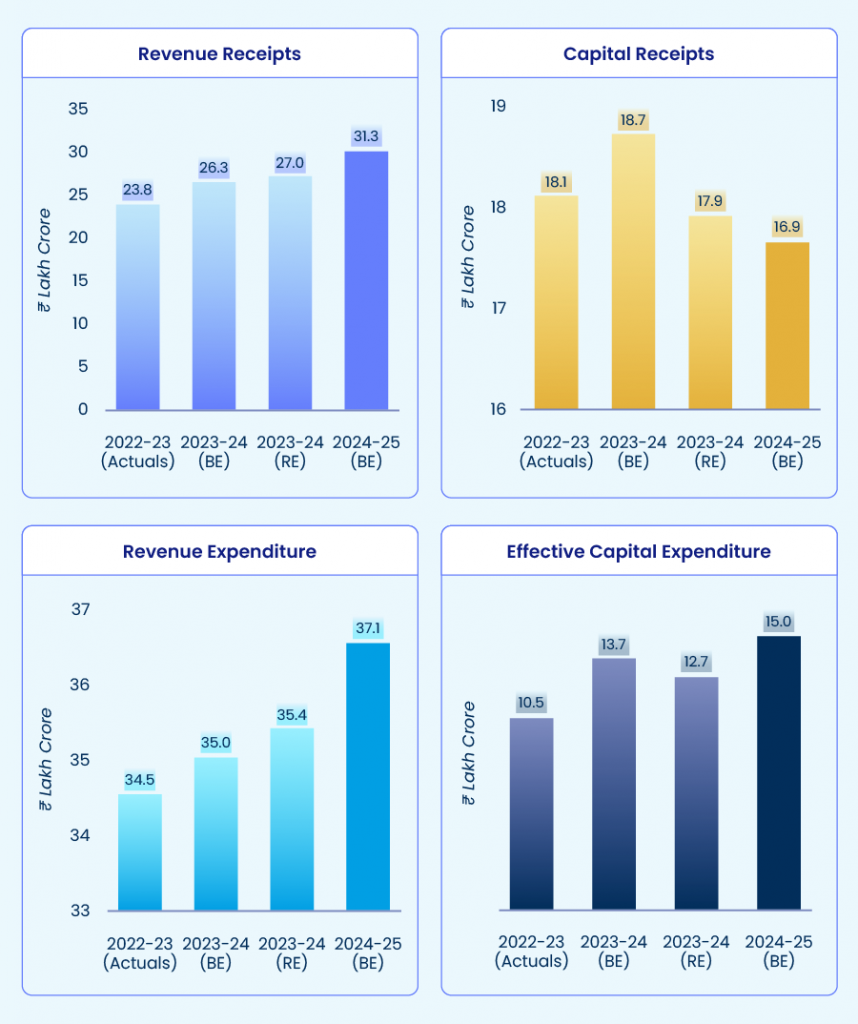

The Indian Budget for 2024 has laid out a comprehensive fiscal strategy aimed at bolstering the nation’s economy while adhering to stringent fiscal discipline. Here, we delve into the main financial figures and targets that form the backbone of this year’s budgetary allocations.

Fiscal Consolidation Efforts: The budget prioritizes fiscal deficit reduction, aiming for a target of 4.9% of GDP for FY25. This signifies the government’s commitment to responsible spending and controlling debt levels.

Boosting Infrastructure Growth: Capital expenditure, a crucial driver of economic activity, has been significantly increased to ₹11.11 lakh crore, representing 3.4% of GDP. This allocation reflects the government’s focus on infrastructure development, which is expected to create jobs and stimulate economic growth.

Understanding Expenditure and Revenue: Total expenditure for FY25 is projected at ₹47,65,768 crore, which is a 6% increase compared to the previous year. It’s important to note that interest payments constitute a significant portion (25%) of this expenditure, highlighting the government’s debt burden. Additionally, interest payments take up a substantial share (40%) of Indian government revenue receipts. This underscores the importance of fiscal consolidation efforts to free up resources for other priorities.

Revenue and Borrowing Projections: Excluding borrowings, revenue receipts are estimated at ₹32.07 lakh crore, while expenditure receipts are projected at slightly higher, at ₹48.21 lakh crore. This necessitates net tax receipts of ₹25.83 lakh crore to bridge the gap. The budget also outlines a reduction in both gross and net market borrowings compared to the previous year, indicating a planned decrease in government borrowing. The gross and net borrowings are set at ₹14.01 lakh crore and ₹11.63 lakh crore respectively.

Focus on Key Initiatives: The budget dedicates a significant portion (7.5% of total capital outlay) to the Department of Economic Affairs, with a new scheme allocation of ₹70,449 crore. This underscores the government’s commitment to implementing key economic initiatives.

Key Dates and Implementation

The Indian Budget 2024 sets a clear timeline for its implementation, with various initiatives and allocations taking effect from the beginning of the fiscal year on April 1, 2024. This budget is not just a set of numbers; it is a roadmap for the government’s commitment to fostering growth, creating jobs, and enhancing the quality of life for all citizens.

Budget Implementation 2024

The budget’s implementation will be phased, with immediate effects on certain sectors while others will roll out over the fiscal year. For example, the capital expenditure allocation of ₹11.11 lakh crore will be strategically deployed throughout FY25 to ensure that infrastructure projects are initiated promptly and completed efficiently. This allocation represents 3.4% of GDP, highlighting the government’s focus on sustainable growth through infrastructure development.

Key Dates and Milestones

- July 23, 2024: The budget officially takes effect, with funds allocated for various projects and initiatives starting to flow.

- Quarterly Reviews: The government plans to conduct quarterly reviews of capital expenditure to monitor progress and ensure that funds are utilized effectively. This will help in making necessary adjustments to keep projects on track.

- Mid-Year Assessment (October 2024): A comprehensive review of the budget’s impact on economic growth and sectoral performance will be conducted. This assessment will focus on the effectiveness of the initiatives aimed at employment generation, skill development, and support for MSMEs.

- End of FY25 Review (March 2025): A final evaluation will be conducted to measure the overall success of the budget in achieving its targets, including fiscal deficit reduction to 4.9% of GDP and revenue receipts projected at ₹32.07 lakh crore.

The budget timeline underscores the government’s commitment to transparency and accountability, ensuring timely benefits reach the intended beneficiaries.

Major Changes Introduced in the Budget

Taxation

The Indian Budget 2024 has introduced several significant changes in the realm of taxation, aimed at simplifying the system, enhancing compliance, and providing relief to taxpayers. These changes span across various aspects, including income tax, GST, and corporate tax reforms.

Income Tax Changes

The budget proposes a review of the Income Tax Act, 1961, to simplify the tax structure and make it more taxpayer-friendly. Key changes include:

- Revised tax slabs that could save individuals up to ₹17,500 annually

- ₹0-3 lakh: Nil

- ₹3-7 lakh: 5%

- ₹7-10 lakh: 10%

- ₹10-12 lakh: 15%

- ₹12-15 lakh: 20%

- ₹15 lakh and above: 30%

- Standard Deduction for salaried employees increased from ₹50,000 to ₹75,000

- Deduction on family pension for pensioners increased from ₹15,000 to ₹25,000

GST Amendments

The budget proposes to deepen the tax base by simplifying GST compliance and reducing litigation. Key measures include:

- Simplification of charities and TDS provisions

- Streamlining of appeal processes to reduce litigation

Sector-Specific Customs Duty Proposals

The budget also introduces targeted customs duty changes to support specific sectors:

- Fully exempt 3 more cancer medicines from custom duties to make them more affordable

- Reduce Basic Customs Duty (BCD) on mobile phones, mobile PCBA, and chargers from 20% to 15% to support the domestic mobile industry

- Reduce customs duty on gold and silver to 6% and platinum to 6.4% to encourage domestic value addition

- Reduce BCD on shrimp and fish feed to 5% to enhance competitiveness in marine exports

- Fully exempt custom duties on 25 critical minerals to boost strategic sectors

These taxation changes aim to simplify the system, provide relief to taxpayers, and support the growth of specific industries. By enhancing compliance and reducing litigation, the government hopes to create a more favorable environment for businesses and individuals alike.

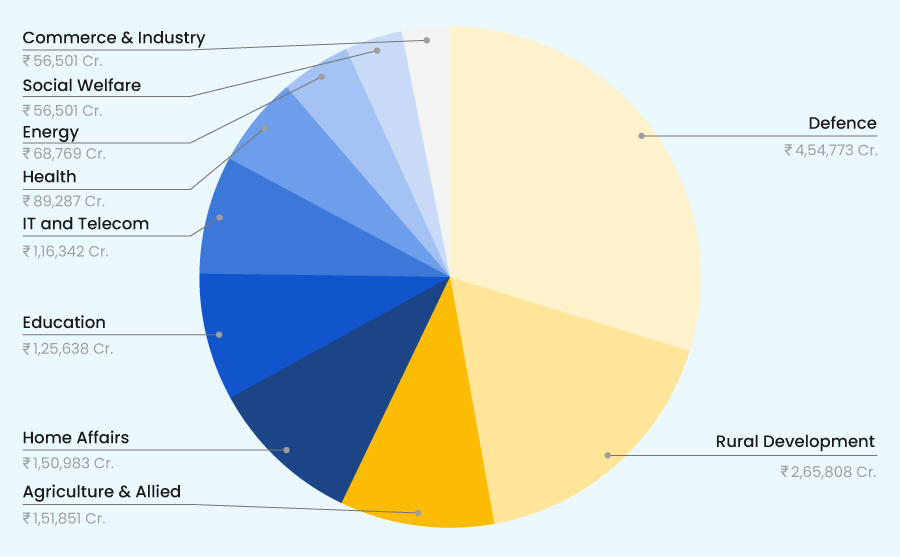

Sector-Specific Investments

The Indian Budget 2024 has earmarked significant investments across various key sectors, demonstrating a focused strategy to drive growth and development nationwide. Here’s how the allocations break down for healthcare, education, infrastructure, and defense, reflecting the government’s priorities for the fiscal year.

Impact on Personal Finance

The Indian Budget 2024 implements key changes aimed at improving personal finance, with a focus on enhancing savings, investments, and pensions. Here’s a concise summary of the updates:

- Taxonomy for Climate Finance: Boosts access to funds for climate-friendly investments like green bonds, offering individuals attractive returns and potential tax advantages.

- FDI and Overseas Investments: Simplified regulations now make it easier to engage in Foreign Direct Investments and utilize the Indian Rupee for international investments, aiding global diversification and potentially enhancing returns.

- NPS Vatsalya Program: Enables parents to contribute to the National Pension System on behalf of minors, promoting early financial planning and long-term savings growth.

- Data Governance Improvements: Strengthened data management practices will increase transparency and reliability, supporting better-informed financial decisions.

- New Pension Scheme (NPS) Updates: Proposed reforms aim to fix current inefficiencies, protect contributors’ interests, and ensure fiscal responsibility, leading to more secure and stable retirement savings.

These initiatives are designed to strengthen financial stability and expand investment opportunities across various sectors.

Impact on Businesses and Investors

Business Reforms

The Indian Budget 2024 introduces a range of business reforms designed to stimulate growth, encourage investment, and provide substantial support to startups and small and medium-sized enterprises (SMEs). Here’s how these reforms could reshape the business landscape:

Startup Incentives 2024:

- Abolition of ANGEL Tax: In a significant move to boost startup funding, the ANGEL tax has been abolished for all classes of investors, making it more attractive for venture capital and individual investors to fund startups without the burden of additional taxes.

Business Tax Reforms:

- Simplification of Tax Regime for Domestic Cruise Operators: The tax regime for operating domestic cruises has been simplified, which is expected to boost tourism and related business revenues.

- Corporate Tax Rate Cut: The corporate tax rate for foreign companies has been reduced from 40% to 35%, making India a more competitive destination for foreign investment.

- Safe Harbour Rates for Foreign Mining Companies: New safe harbour rates have been introduced for foreign companies dealing in raw diamonds, which will simplify tax issues and reduce litigation risks.

SME Support:

- Enhanced Mudra Loans: The limit for Mudra loans under the ‘Tarun’ category has been doubled to ₹20 lakh. This expansion will provide greater financial flexibility to budding entrepreneurs and small businesses looking to scale.

- Credit Support During Stress Periods: New credit support mechanisms have been introduced for MSMEs during economic downturns, including a new assessment model for MSME credit, aimed at ensuring continued financial support and stability.

- Development of Industrial Parks: The commitment to develop twelve industrial parks under the National Industrial Corridor Development Programme aims to enhance industrial growth and provide state-of-the-art facilities for manufacturing and services sectors.

Investment Opportunities

The Indian Budget 2024 presents a range of investment opportunities that will influence how investors approach various financial instruments, including bonds, real estate, and equities. Here’s a closer look at how the budget impacts these sectors.

Indian Bond Market:

- Taxation on Gains: The tax rate on short-term capital gains from financial assets has been increased to 20%, which may affect short-term trading strategies in the bond market. Conversely, long-term gains on both financial and non-financial assets will now be taxed at a more favorable rate of 12.5%, promoting longer holding periods.

- Exemption Limit Increase: The exemption limit for capital gains on financial assets has been raised to ₹1.25 lakh per year, providing a slight relief and potentially increasing the attractiveness of investing in bonds and other financial assets.

Real Estate Sector:

- Removal of Indexation Benefit: The 2024 budget has eliminated the indexation benefit for property sales, where sellers previously could adjust the acquisition cost for inflation to reduce taxable capital gains. While the capital gains tax rate on property sales has been reduced to 12.5%, the removal of indexation could result in higher taxable gains, making real estate less attractive from a tax perspective compared to previous years.

These fiscal adjustments present a mixed bag of challenges and opportunities. Investors may find bonds more appealing due to the increased exemption limits and reduced tax on long-term gains, while the new real estate tax structure could shift investor interest towards more tax-efficient investment vehicles.

By recalibrating investment portfolios to align with these new tax rules, investors can continue to navigate the evolving financial landscape effectively, ensuring their investments are both strategic and compliant with the new regulations.

Conclusion: Envisioning the Impact of Indian Budget 2024

The Indian Budget 2024 marks a transformative stride towards a more inclusive and robust economy. Designed to stimulate growth and enhance the standard of living, its broad spectrum of initiatives is set to influence not just the economy but every citizen’s life directly.

For the average citizen, the revised tax slabs and increased exemptions promise more disposable income, fostering greater financial freedom and consumer spending. The abolition of the ANGEL tax and the enhancements in Mudra Loans and NPS schemes provide individuals and small businesses with new opportunities to invest, save, and grow.

On the broader economic landscape, the emphasis on infrastructure spending and sector-specific allocations is likely to spur job creation and bolster industries across the board—from agriculture to technology. This strategic infusion of capital is anticipated to accelerate India’s journey towards becoming a global economic powerhouse.

As we digest these changes, it is crucial for individuals and businesses to consider how these reforms can be leveraged for personal and professional growth. Reflect on your financial strategies—whether it’s reevaluating investment plans, reconsidering savings approaches, or even reshaping business models to align with new government policies.

Disclaimer: The information provided in this blog is derived from initial budget commentary. For precise data and verification, please consult the Financial Bill once it is officially published.