The world financial market has never remained stable and has been throwing idiosyncratic shockers, either it would exceed expectation or steeply decline. Such unpredictability causes colossal pressure and fear among constant investors. Initially, most of the investment market has been predominantly controlled by a few segments of investors, but gradually the concept of investment has penetrated every individual. Primitively, investment was associated with purchasing land, until the introduction of the stock (equity) market trading in the year 1611 at Amsterdam. It was introduced in India in 1895. Since then, the world financial market has been revolving around the stock market and has become the deciding factor in financial market.

The stock market became imperative among investors for building their investment portfolios. It has not only witnessed an upsurge domestically, but, has also experienced cross border acceleration. The evolution of technology has brought access to everything. Though the stock market has been exponentially growing, it is not always green pastures, it has the deadliest dark side to it. That comes in the form of market volatility and fluctuations which make the market bleed. The market volatility can occur due to various reasons like war since every event occurring in one country has a significant impact on the rest of the world, as well as the countries are either dependent on each other for trade or are connected geographically or politically.

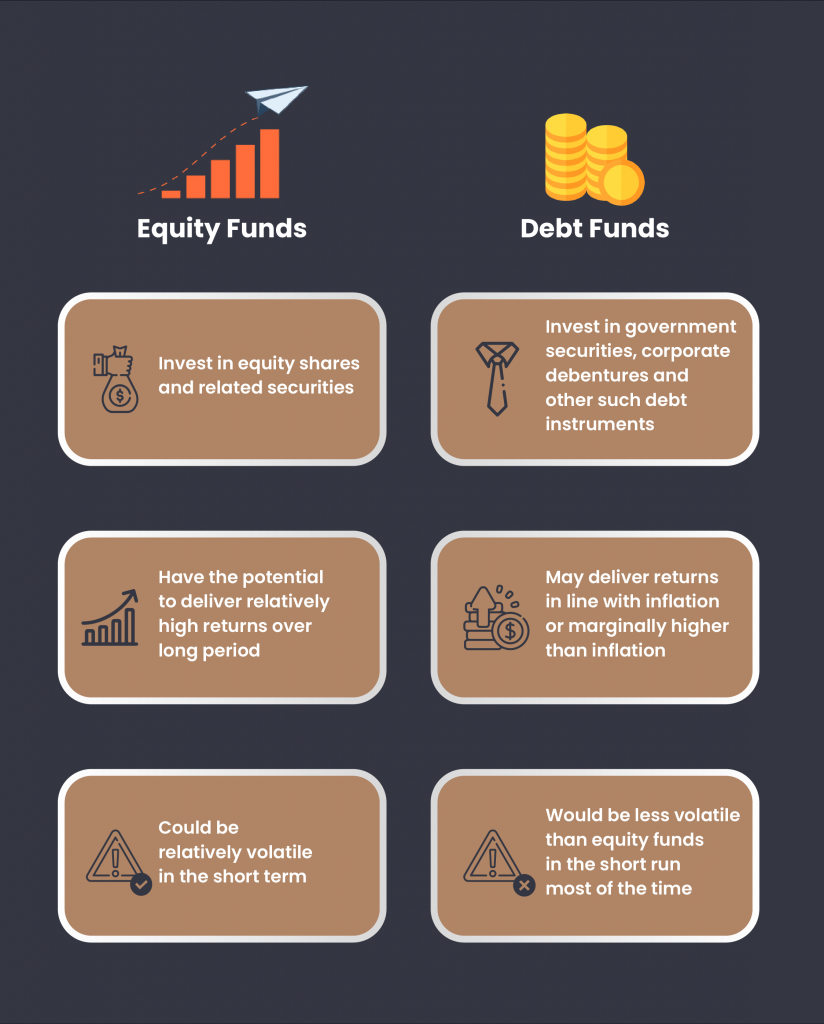

Before, we dive in and let’s have a comprehensive understanding of equity funds and debt funds.

After an epic introduction of the equity market, you might have a lot of questions in mind. What is market volatility and what causes it? How to sustain the investment portfolio during such market conditions? This article may help you to comprehend the questions that prevail in your mind.

Earn Higher Fixed Regular Returns- Find the right bonds

What is Market Volatility?

Volatility is an investment term that refers to periods of unpredictable, and sometimes sharp, price movements in a market or security. People frequently associate volatility with price declines, but volatility can also refer to unexpected price increases.

When stock prices change dramatically over a short period of time, this is referred to as ‘high market volatility’, Changes can be both positive and negative. If stock prices do not fluctuate significantly and remain stable, the market is said to be a ‘low volatility market.’

The cause of volatility;

a) Politic and economic factors

Governments play a decisive role in regulating industries and have the ability to influence an economy when they make decisions on trade agreements, legislation, and policy. Even the election speeches can elicit investors’ reactions, which in turn impact the share prices.

Economic data is also having a significant impact on investor decisions because when the economy is doing well, investors tend to react positively. Economic data like job reports, inflation, and quarterly GDP can have a greater impact on market performance. In case these miss the market expectations, then the market may become more volatile.

b) Industry factors

Certain events can cause volatility within an industry or sector. For example, in the oil sector, large-scale meteorological events in major oil-producing areas can increase oil prices. As a result, oil distribution-related companies can expect profits and their stock prices may rise, while companies with high oil costs in their businesses may have their stock prices fall. Similarly, tightening government regulations in certain industries can lead to lower stock prices due to increased compliance and labour costs, impacting future earnings.

c) Company performance

Volatility does not necessarily span the entire market and may relate to individual companies. Positive news, such as strong earnings reports and new products that excite consumers, can make investors feel better about the company. If many investors are considering buying, this increase in demand will help boost stock prices significantly. In contrast, if an investor sells shares, product recalls and, data breaches can adversely affect stock prices. Depending on the size of the company, this positive or negative development can also affect a wider market.

Stabilisation of market volatility through bonds.

It’s never easy to predict market volatility but once it occurs, it could be an arduous task either to stop or control. Nevertheless, market volatility can be stabilised from the investors’ perspective which would prevent drastic damage to their investment. It may have a considerable positive impact on overall market performance. The better way is to diversify the investment portfolio, which can avert losing entire money in the equity market.

Diversification

Diversification is the method of constructing a portfolio comprised of various types of classes of investments in order to balance the risk and reward. Such diversification can help the investors in managing stock market volatility over time as the market moves through various cycles.

When the portfolio is diversified, it helps the investors to avoid one of the worst investing mistakes of putting all eggs in one basket.

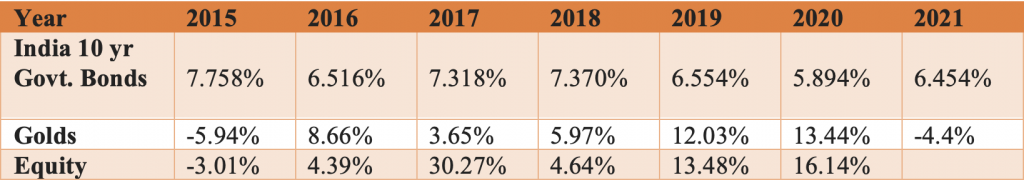

The above table explains the importance of having a multi asset portfolio, as it is difficult to win through a single asset portfolio. The multi asset portfolio helps an investor to optimise portfolio returns across different market cycles. Also, the table signifies, that a multi asset portfolio has lower volatility when compared to single asset portfolio.

The above table explains the importance of having a multi asset portfolio, as it is difficult to win through a single asset portfolio. The multi asset portfolio helps an investor to optimise portfolio returns across different market cycles. Also, the table signifies, that a multi asset portfolio has lower volatility when compared to single asset portfolio.

Explore high yield bonds

Diversifying investments is essential because all the investments are not equally risky. Market may react to different scenarios in various ways, that compels the investor to take wiser investment decisions. The reactions are known as market volatility, which may rise or fall, as the economy progresses through various stages. It is highly dependent on the types of investment the investor owns; this can result in gains or losses for the investors.

For instance: stocks can generate the highest returns over time, but prices can fluctuate depending on market conditions. Bonds, on the other hand, are more conservative investments and offer investors a lower rate of return. However, both can be central to diversified investment strategies.

Holding a portfolio that is 100% stock can be too risky. In the event of a major dip, the value of the portfolio drops sharply and can take months or years to recover. In the meantime, holding a portfolio that is 100% fixed income means that you may not be taking enough risk to get the return you want.

Let’s understand with an example- Hypothetically an investor has invested Rs. 30,000 in Equity, which is down by 10% post a year, but at the same time when he invested into Equity, he made another investment of Rs. 30,000 in Bonds, which yielded him 12% annually. So down the line the investor’s portfolio would be in profit of 2%, as the risk of loss in equity investment is hedged against the profit he derived out of bonds.

Therefore, in order to sustain in such volatile conditions, one has to diversify the investment portfolio, which would save one from market disaster.

1 comment

Thank you for your kind words. Keep reading our blogs.

Comments are closed.