As attractive as the term high yield seems, an investor’s opinion toward this is varied. Leaning toward the perception of the high yields being associated with higher risk isn’t a fallacy but it is also true that there are impressive opportunities behind the high yield bonds.

What are high-yield bonds?

A high-yield bond is one of the categories under corporate bonds that offers an interest rate higher than government and any other corporate bonds. The coupon rate is enticing such that the company issuing this bond wants to compensate for the higher risk it comes with.

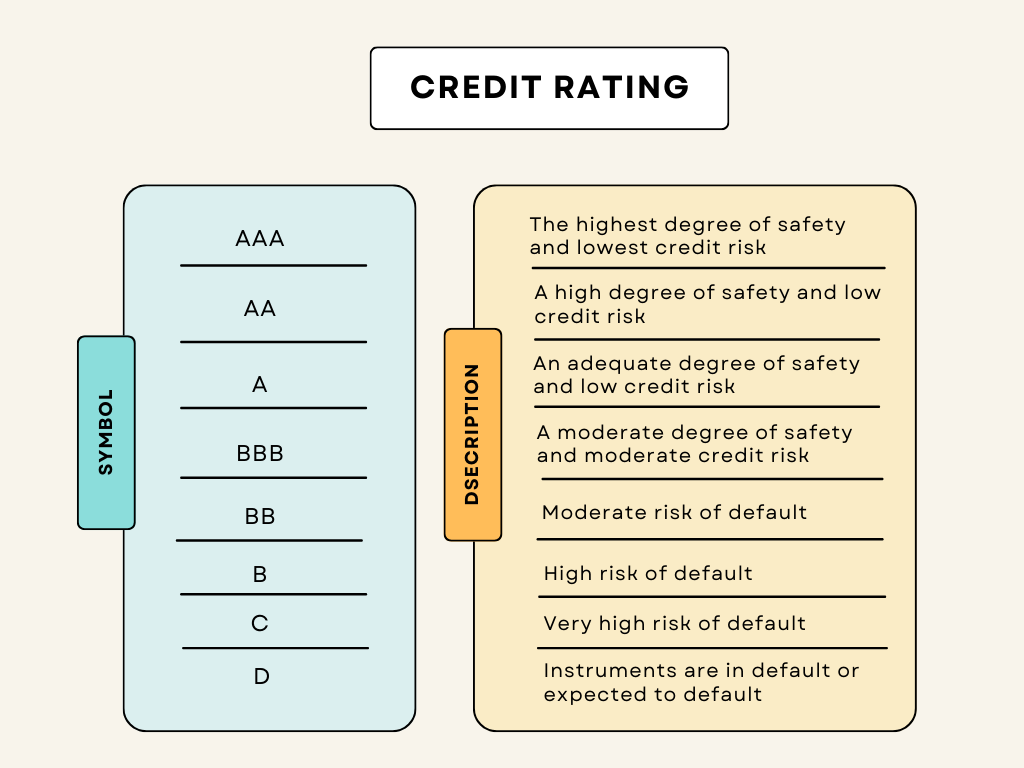

Usually, credit rating agencies assign ratings to the issuers based on the financial stability of the company. The issuers whoever fall below the investment grade are likely to default. But if the issuers want to raise capital despite the low credit rating, they are left with no option but to issue bonds with higher interest rates, only then the investor might consider investing in high-yield bonds. Otherwise, why should they?

The high yield bonds are as well contributed by the emerging companies whose financial plans are a little speculative. To have a clear picture of the credit rating of a bond, consider seeing the below information before investing, as the risk appetite will differ from one investor to the other.

How to analyze the credit worthiness of corporate bonds?

Benefits of investing in high-yield bonds

1. Lower impact of interest rate risk with a shorter duration

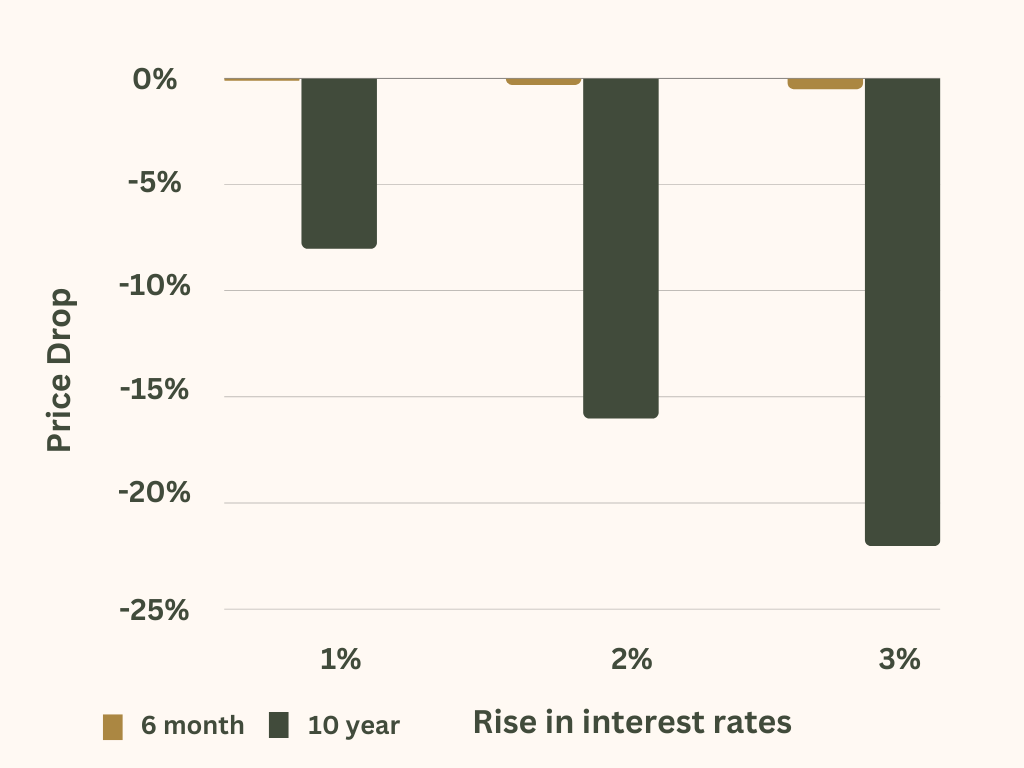

Usually when the interest rates are increasing the bond value declines and vice-versa. Thus the impact of a rise in interest rate is more susceptible for bonds with longer duration than the shorter duration.

It is good to be invested in high-yield bonds with a shorter duration as they mature in lesser time. So that not only ensures the principal amount is returned earlier, but also it is less exposed to increasing interest rates and hence the decline in the value of the bond is negligible.

The above-said statement could be visualized well in the illustration below. It considers two bonds with coupon rates of 5% and a duration of 10 years and 6 months respectively. It is seen that the bond with a longer duration has a higher impact on the rise in interest rate compared to the bond with a shorter duration.

That way in the case of increasing interest rates, high yield bonds with shorter duration are doing better as their impact hardly affects the bondholders.

2. Appreciation of the capital invested

The price of a bond can’t just remain as it is when there are mergers, acquisitions, elevated performance, product developments, and so on. In this scenario, the high-yield bonds are beneficial as the price of the bond shoots up, and being invested in it is worth a shot to receive higher returns from the increased bond price.

Yet it is also true that in the downturn of the issuer’s financial statements, the value of the bond can decline.

3. Diversification within bonds

Though the bonds are giving high yield, it is coming with the certainty of risk which is a well-known fact. At any given probable instance of risk, the high yield bond with the portfolio of other fixed income bonds can stabilize the investment if not nullify the loss.

In the other possible scenario when all the investment instruments in the portfolio are reaping good returns and has no defaults then the portfolio is on the profitable side.

What is the relationship between bond prices and interest rates?

The drawback of investing in high-yield bonds

1. The risk of default

It is known that the low credit rating of the bonds signifies that bond issuers tend to default on the interest and the principal to be paid. That is one of the concerns the high-yield bonds come with and is called default or credit risk. And the default in the worse scenario is mostly due to financial difficulties that the company may fall into.

2. The risk of economic crisis

The economic crisis, like covid pandemic, was an uninvited guest. Despite this, some sectors could survive and some couldn’t withstand its effect on business operations.

Generally, bond issuers with high risk can’t sustain during the economic crisis and have a higher probability of defaulting on regular payments. The investors at this point want to sell their high-risk bonds and shift towards low-risk bonds during the paradigm and is a norm to think of their safety. But when the demand for high-yield bonds gets lower than the supply, at this time, the bond value declines in the market.

3. The risk of liquidation

Being able to sell the bonds at any point in time to cash is called liquidity. Bonds can be liquidated when they are frequently traded. But the point to be noted in regards to liquidation is that when the high-yield bonds don’t get sold at their true value in the market, it’s a situation of loss to bear.

4. High volatility rate

Comparatively high yield bonds are more volatile than investment grade bonds. Because of the high risk, it carries and it is also more sensitive to the economic crisis. That being said, it is more equivalent to having market volatility like that seen for stocks.

Why do some bonds give higher yields?

There are a couple of reasons for the interest rates to increase, if that thought ever pondered the mind, here they are:

1. Rise due to inflation

Inflation is the phenomenon that influences and lowers the purchasing power of an individual due to a spike in prices. When the inflation rates are high, it signifies the value of the goods has increased, and to tackle it, the investors ask for higher interest rates by thinking ahead of the future circumstances.

2. Government decisions

An increase in inflation refers to a drop in the purchase of goods and services from the people, that in turn drips the growth of the business. What’s observable is the fact that the GDP is declining, which is not a good thing for the government. In order to combat the rising inflation in the economy, RBI increases the interest rates to keep a balance in the rising inflation and encourage people to start saving rather than borrowing.

That‘s just one of the instances of the spike in the interest rate but the uninvited economic crisis can influence the decision abilities of the government in increasing the interest rates to work towards the betterment of the economy.

3. Demand and supply conditions

Imagine a circumstance where buying a product you wish to have a huge demand in the market and due to an increase in demand the seller might want to increase their profits. Similarly, it works for bonds, when the demand increases the interest rate increases. In the case of the supply, if it decreases, the interest rate increases for that bond as well.

4. Influence of the credit rating

One of the major reasons for higher interest rates is that the issuer may have a lower credit rating and to attract investors, the issuers must have to sell the bonds for higher interest rates. Otherwise, there is no way that the issuer can expect financing. So that’s how investors get attractive higher interest rates with higher risk and so do the issuers get the capital they seek for.

How Bond Price Impact Yield

Concluding thoughts

It started with the thought that investors have varied opinions about the high yield bonds and that’s certainly true depending on the risk appetite of an individual. Though to a few folks, it might not seem like a go-to option, for many others the higher interest rates despite the risk is an alluring factor to consider.

High-yield bonds are often rewarding when it’s taken into account for diversification. So while picking high-yield bonds, consider high-quality-shorter duration bonds to expect lower volatility in the market and still be on the safer side.