The Indian bond market has steadily grown in recent years compared to the yesteryears. The bond market is growing because of the availability of quantities of information with regard to the bonds and its significant contribution to one’s long-term financial progress. Despite the market’s rapid expansion, individual investors continue to struggle with comprehending specific bond market phrases and terminologies. To be precise, It’s amongst most first-time bonds investors and quite a few of the previous investors are either confused or get stuck to understand What is the difference between coupon rate and yield to maturity? They are not able to proceed further with their bonds investment plan.

This blog may give sort of clarity on those differences, which might pave the way for your decision-making on bond investments, especially when evaluating upcoming bonds in India.

When thinking about buying bonds, it’s important to understand the yield to maturity and coupon rate. Similar to a loan, a bond is a financial instrument issued by a firm (corporate bonds) or the government (government bonds) to raise money from investors.

What is coupon rate?

The rate at which a bond’s investor receives interest payments is known as the coupon rate. It is a percentage that represents the annual interest rate that the bond pays in relation to its face value. The coupon rate is comparable to fixed-income government and corporate bonds, in which the bond’s issuer receives yearly interest payments.

For example:

If a bond has a face value of Rs. 10000, a coupon rate of 10%, an annual payment schedule, and a maturity period of 5 years, the investor will receive Rs. 1000 each year until the bond matures.

Similar to when we obtain a loan from a bank, the interest we may be required to pay the bank on a monthly basis is referred to as the coupon rate in the bond market.

Here, we are lending money to the government or corporations, and in exchange, they are paying interest to us.

Bond Glossary

What is bond yield?

A bond’s yield is the annual interest payment it makes as a proportion of its market value.

Although it may appear to be the same as the coupon rate, it is not. The yield would fluctuate inversely with the bond’s market price.

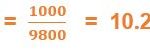

Yield formula

![]()

Let consider three scenarios

Scenario -1

Coupon rate = (10000 * 10) / 100 = 1000 (Interest Payment)

![]()

Scenario -2

If the bond price is selling in discount price either because of the market fluctuation or the bond hold is willing to sell of due his emergencies. If bond face value is Rs. 10,000 and investor is buying it at discount price of Rs. 9800.

The interest payment will always remain constant.

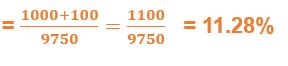

Scenario -3

If the bond price is selling in premium price because the demand of the particular bond in the market, the bond can be sold in the higher rate than the face value. If bond face value is Rs. 10,000 and investor is buying it at higher price of Rs. 10200.

The interest payment will always remain constant.

![]()

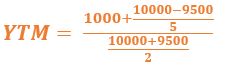

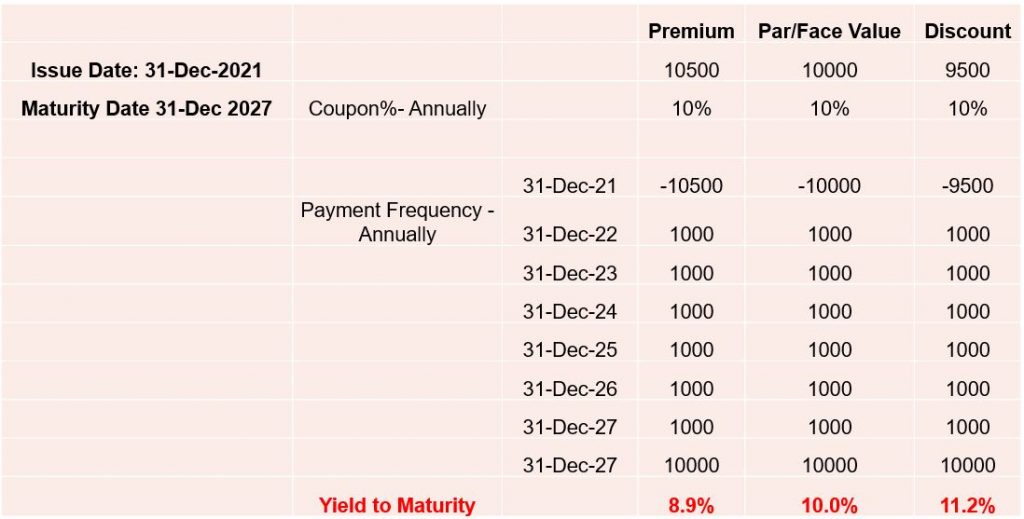

What is yield to maturity

The return rate that investors receive while holding the bond until it matures is known as the yield to maturity, a key metric used when evaluating high yield bonds. The yield to maturity (YTM) figure includes interest received on interest and includes all interest payments made from the day of purchase until maturity.

The formula for calculating YTM is as follows.

Calculation

Example: how it has been calculated and arrived at yield to maturity.

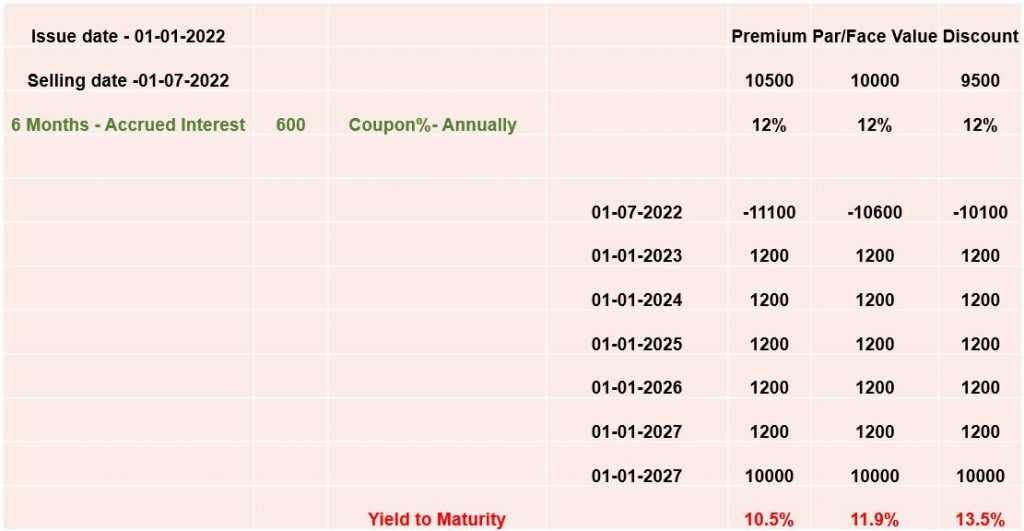

What is Accrued interest?

What is Accrued interest?

When purchasing bonds on the secondary market, many of us would be perplexed if we were requested to pay a greater rate than the rates listed. We shall then be informed that it is accrued interest. Why was accrued interest added to the price of bonds purchased on the secondary bond market? What is accrued interest?

The buyer has to pay accrued interest in the purchase price when purchasing bonds on the secondary market. Given that they will be the bondholder of record, investors who buy bonds between the previous and subsequent coupon payments will be entitled to the full interest on the scheduled coupon payment date. The portion of the interest that the bond seller earned before selling the bond must be paid to the bond seller as the buyer did not get all of the interest accrued during this time.

Example – Calculation while buying bonds with accrued interests

Many investors invest in bonds because they are more appealing investments than equity. Despite their relationship, the yield to maturity and coupon rate differences are not entirely dependent on one another; to varying degrees, the bond’s current value, the gap between its price and face value, and the remaining time to maturity also have a role.

Many investors invest in bonds because they are more appealing investments than equity. Despite their relationship, the yield to maturity and coupon rate differences are not entirely dependent on one another; to varying degrees, the bond’s current value, the gap between its price and face value, and the remaining time to maturity also have a role.

What is the difference between Corporate and Governments Bonds?