Introduction to Credit Ratings and Their Significance in India

Credit ratings are an assessment of the creditworthiness of a borrower. They are assigned by credit rating agencies (CRAs), which are independent organizations that specialize in evaluating the credit risk of borrowers. Credit ratings are used by lenders to assess the risk of lending to a borrower and to determine the interest rate to charge.

Credit ratings are important in India because they help to promote financial stability and transparency in the financial system. They also help to reduce the cost of borrowing for borrowers with good credit ratings.

Importance of Credit Ratings

Credit ratings are important for a number of reasons, including:

- Lenders: Credit ratings help lenders to assess the risk of lending to a borrower and to determine the interest rate to charge. Higher credit ratings indicate a lower risk of default, so lenders are more likely to lend to borrowers with good credit ratings at lower interest rates.

- Borrowers: Credit ratings help borrowers to obtain loans at lower interest rates. Borrowers with good credit ratings can save money on interest over the life of a loan.

- Investors: Credit ratings help investors to assess the risk of investing in a company or security. Higher credit ratings indicate a lower risk of default, so investors are more likely to invest in companies and securities with good credit ratings.

- Regulators: Credit ratings are used by regulators to monitor the financial system and to identify potential risks. For example, regulators may require banks to maintain a certain level of capital reserves based on the credit ratings of their borrowers.

The Role of Credit Rating Agencies in India’s Financial System

Credit rating agencies (CRAs) play a vital role in India’s financial system. They provide independent assessments of the creditworthiness of borrowers, such as individuals, businesses, and governments. These ratings help lenders to assess the risk of lending to a borrower and to determine the interest rate to charge. CRAs also help investors to assess the risk of investing in a company or security.

The following are some of the key roles of CRAs in India’s financial system:

- Promoting financial stability: CRAs help to promote financial stability by providing independent assessments of the creditworthiness of borrowers. This helps to reduce the risk of systemic shocks, such as a large number of borrowers defaulting on their loans at the same time.

- Promoting transparency: CRAs promote transparency in the financial system by making their credit ratings publicly available. This helps to ensure that all market participants have access to the same information, which can lead to more efficient markets.

- Reducing the cost of borrowing: CRAs help to reduce the cost of borrowing for borrowers with good credit ratings. This is because lenders are more willing to lend to borrowers with good credit ratings at lower interest rates.

- Protecting investors: CRAs help to protect investors from losses by providing independent assessments of the creditworthiness of companies and securities. This helps investors to make informed investment decisions.

CRAs play an important role in India’s financial system by helping to promote financial stability, transparency, and efficiency. They also help to reduce the cost of borrowing for borrowers with good credit ratings and to protect investors from losses.

The Factors Considered by Credit Rating Agencies for Assigning Ratings

Credit rating agencies (CRAs) consider a variety of factors when assigning credit ratings to borrowers. These factors can be broadly classified into two categories: quantitative and qualitative.

Quantitative factors include:

- Financial performance: CRAs look at a borrower’s financial statements to assess its profitability, liquidity, and solvency.

- Leverage: CRAs consider the amount of debt that a borrower has relative to its equity. Higher levels of leverage can increase the risk of default, so CRAs may assign lower ratings to borrowers with high leverage ratios.

- Cash flow: CRAs also look at a borrower’s cash flow to assess its ability to generate sufficient cash to meet its debt obligations.

Qualitative factors include:

- Management quality: CRAs assess the experience and competence of a borrower’s management team.

- Industry risk: CRAs consider the risk profile of the industry in which a borrower operates. Industries that are more cyclical or subject to greater competition may be considered to be riskier, and borrowers in these industries may be assigned lower ratings.

- Country risk: CRAs also consider the country risk of the country in which a borrower is domiciled. Countries with higher levels of political or economic instability may be considered to be riskier, and borrowers in these countries may be assigned lower ratings.

In addition to the above factors, CRAs may also consider other relevant factors, such as the borrower’s competitive position, market share, and environmental, social, and governance (ESG) performance.

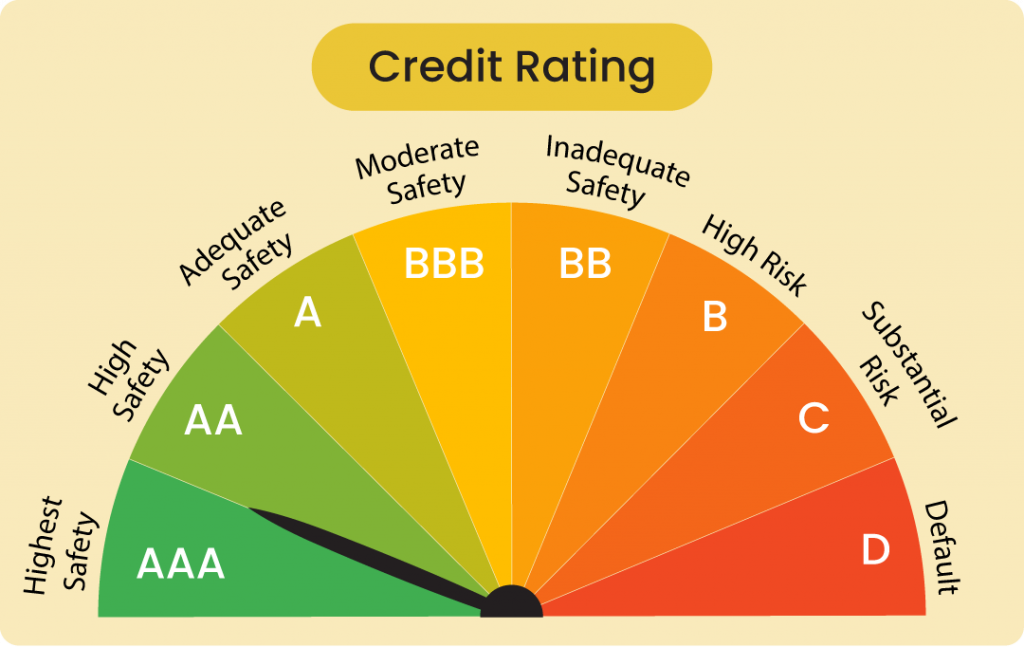

CRAs assign credit ratings on a scale, with higher ratings indicating a lower risk of default. The specific rating scales used by CRAs may vary, but they typically range from AAA (highest rating) to D (lowest rating).

It is important to note that credit ratings are not a guarantee of performance or repayment. However, they are a valuable tool that can be used by lenders, borrowers, investors, and regulators to assess the creditworthiness of borrowers and to make informed investment decisions.

The Different Credit Rating Categories and What They Indicate

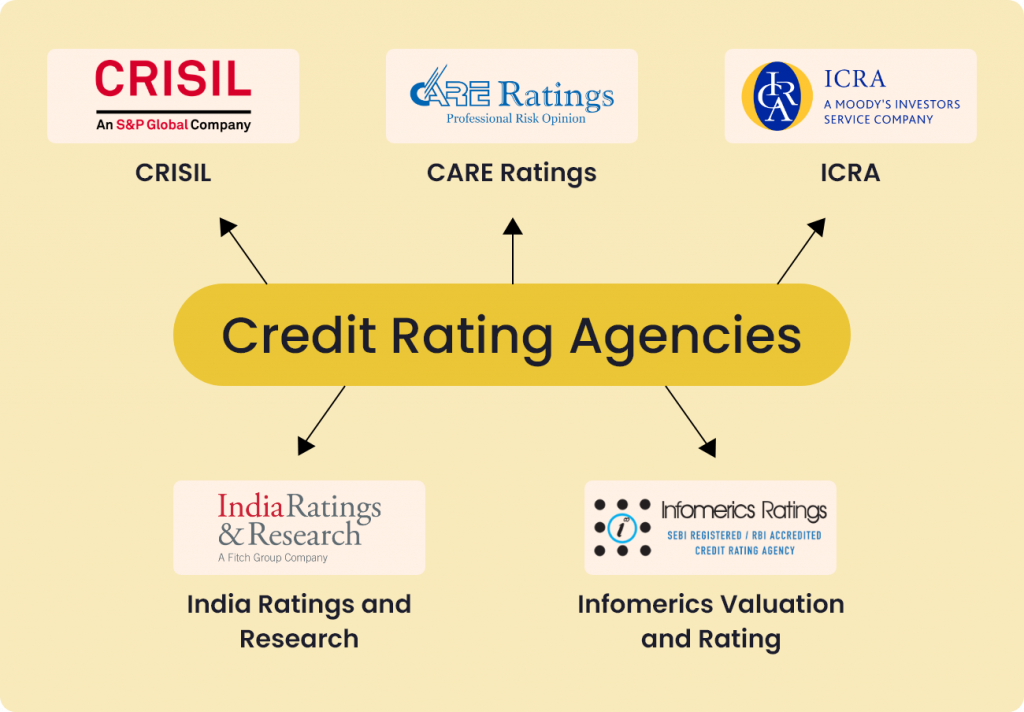

In India, there are seven CRAs that are registered with the Securities and Exchange Board of India (SEBI). These CRAs are:

CRAs use a variety of factors to assign credit ratings, including the borrower’s financial performance, leverage, cash flow, management quality, industry risk, and country risk.

Credit ratings are typically displayed on a scale, with higher ratings indicating a lower risk of default. The specific rating scales used by CRAs may vary, but they typically range from AAA (highest rating) to D (lowest rating).

Here are the different credit rating categories and what they indicate in India:

- AAA rating: This is the highest rating that can be assigned to a borrower. It indicates that the borrower has an extremely strong ability to meet its financial obligations.

- AA rating: This is a very high rating, indicating that the borrower has a very strong ability to meet its financial obligations.

- A rating: This is a high rating, indicating that the borrower has a strong ability to meet its financial obligations.

- BBB rating: This is a good rating, indicating that the borrower has a moderate ability to meet its financial obligations.

- BB rating: This is a speculative rating, indicating that the borrower has a below-average ability to meet its financial obligations.

- B rating: This is a speculative rating, indicating that the borrower has a high risk of default.

- C rating: This is a junk bond rating, indicating that the borrower is in default and has little to no chance of repayment.

- D rating: This is the lowest rating that can be assigned to a borrower. It indicates that the borrower is in default and has no chance of repayment.

It is important to note that credit ratings are not a guarantee of performance or repayment. However, they are a valuable tool that can be used by lenders, borrowers, investors, and regulators to assess the creditworthiness of borrowers and to make informed investment decisions.

Junk bonds are bonds that have a credit rating of BB or lower. They are considered to be high-risk investments, but they can offer investors the potential for high returns. Junk bonds are often used by companies that are in financial difficulty or that are operating in risky industries.

Investors who are considering investing in junk bonds should carefully consider their risk tolerance and investment objectives. Junk bonds are not suitable for all investors.

The Importance of Regularly Monitoring and Maintaining a Good Credit Rating in India

It is important to regularly monitor and maintain a good credit rating in India for a number of reasons:

- Access to credit: A good credit rating can help you to obtain loans and other forms of credit at lower interest rates and with better terms. This can save you money over the life of a loan and make it easier to borrow money in the future.

- Cost of insurance: Some insurance companies use credit ratings to set premiums for policies such as auto insurance and home insurance. Borrowers with good credit ratings may be eligible for lower insurance premiums.

- Employment opportunities: Some employers may check credit reports when making hiring decisions. A good credit rating can make you a more attractive candidate to potential employers.

- Other financial services: A good credit rating may also give you access to other financial services, such as credit cards and lines of credit.

Conclusion: Understanding the Dynamics of Credit Ratings is Crucial for Financial Well-being in India

Understanding the dynamics of credit ratings is crucial for financial well-being in India. Credit ratings are an assessment of the creditworthiness of a borrower, and they play an important role in determining the borrowing costs and access to capital for individuals and businesses.

Borrowers with good credit ratings can save money on interest and have better access to capital, while borrowers with bad credit ratings may have to pay higher interest rates and may have difficulty accessing capital. This can have a significant impact on a person’s or business’s financial well-being.

In India, credit ratings are also used by lenders, borrowers, investors, and regulators to promote financial stability, transparency, and efficiency. By understanding the factors that affect credit ratings and how to maintain a good credit rating, individuals and businesses can improve their financial well-being.

Here are some specific tips for how to understand the dynamics of credit ratings and improve your financial well-being in India:

- Get a copy of your credit report from each of the three major credit bureaus once a year. Review your credit report carefully for any errors or inaccuracies.

- Understand the factors that affect your credit rating, such as payment history, credit utilization, and length of credit history.

- Take steps to improve your credit rating, such as paying your bills on time, keeping your credit utilization low, and limiting the number of hard inquiries on your credit report.

- Be aware of the different types of credit ratings and how they are used by lenders, borrowers, investors, and regulators.

- Use your credit rating to your advantage by shopping around for the best interest rates and terms on loans and other forms of credit.

By taking the time to understand the dynamics of credit ratings, you can take control of your financial future and achieve your financial goals.