The term investing has become imperative, but for reasons, we never knew. Have we just been following the pattern or do we know what it is like to invest? The biggest myth of all is to “blindly invest”.

If that certainly makes you realize something, it isn’t about following a sheep but understanding why you need to invest in the first place. Simply put it’s not because others are investing but because you think you need to! With a clause that you are aware of “Why”?

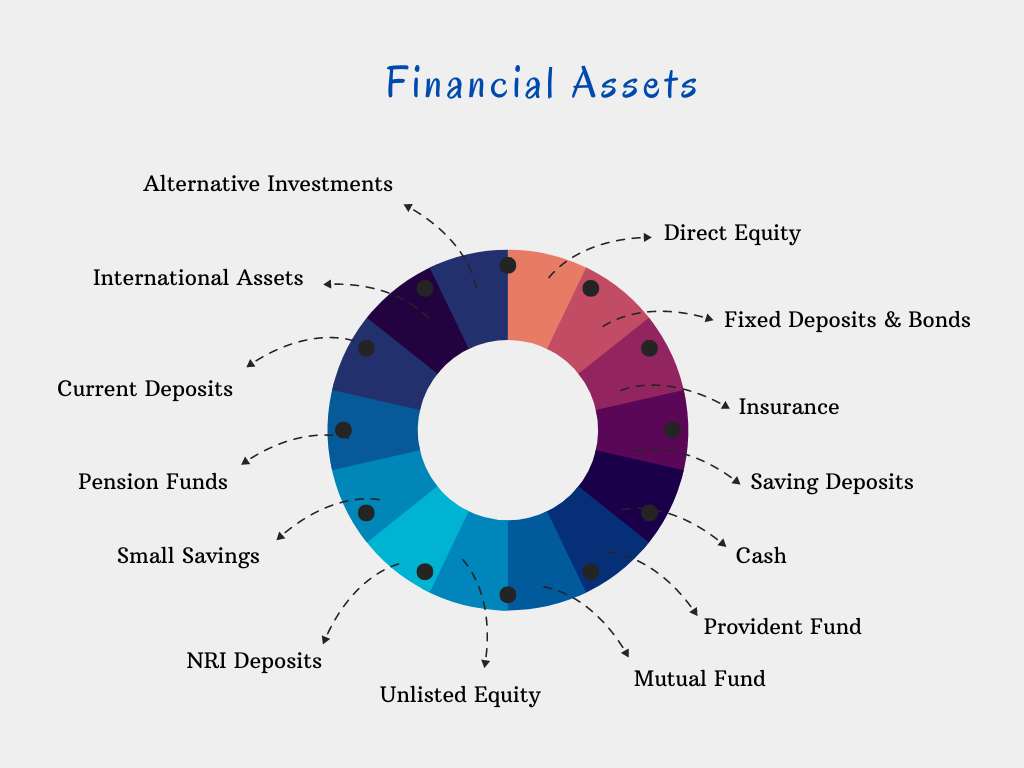

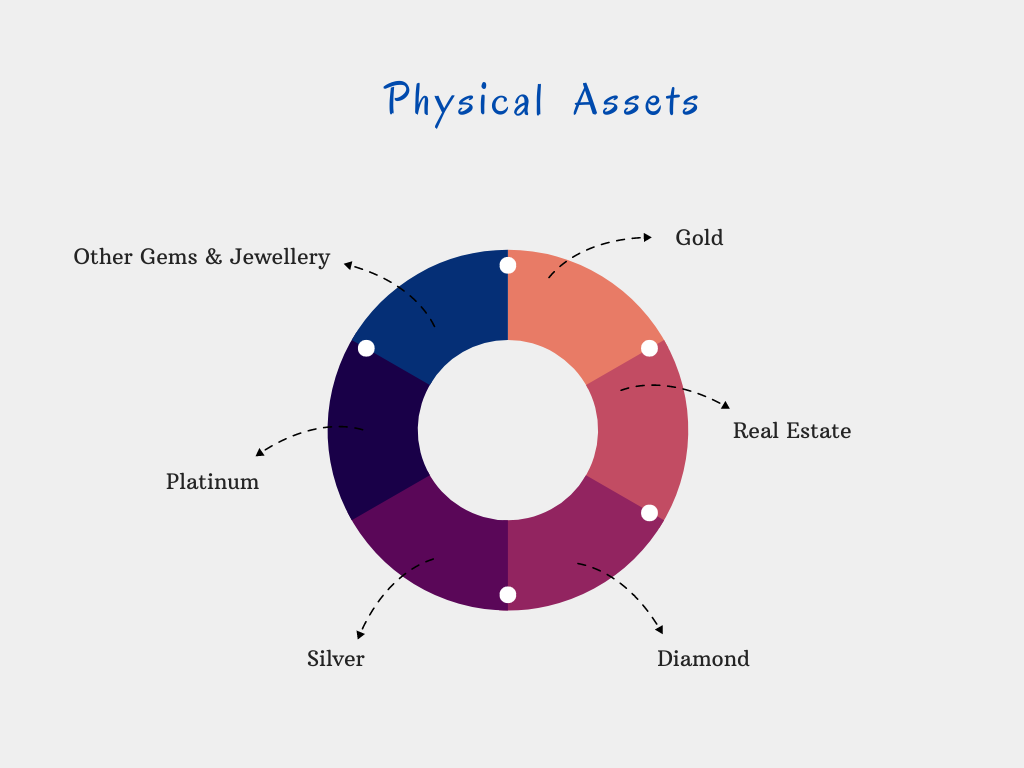

The most familiar thing that comes to our mind while investing is “The Stock Market”. But there are various assets associated with investing, falling under an umbrella of physical and financial assets. The Statista Research Department report shows that between 2015 and 2020, Indians held about “202.28 trillion worth rupees of physical and 262.92 trillion worth rupees of financial assets.” These are the investments people are making but why do you think it is so?

What is an investment?

Warren Buffet once said, “Invest by facts, not emotions”. With that being said,

“An investment is an unspent income that isn’t a saving but is an asset that makes higher returns for the future aspect.”

For instance, keeping your income in the bank is called saving, which is accumulated over time that one can use in the future for any purpose. On the other hand, using your income in opting for a site is an investment in an asset that will make more income for you in the future when the prices of the land shoot up and you happen to sell it.

In a broader sense, we invest time, money, and energy in building skills, which generates continued higher income until we are fit enough to work. Similarly, investing in an asset at the present will generate more income in return in the future.

What comes with investing?

We often hear the ancestors telling the millennials, whether they are up with the right financing. The thought process of the millennials would wrap around the fact that it is an underrated question because it’s a norm to hear it quite often or might be an inclusive question that strikes one’s mind or can even be an obligatory thing to a few others and that they are mostly clueless. One can leverage investing for the benefits it has to offer.

#1 With risks comes higher returns

Investing might have seemed easier after reading till here but they indeed are associated with the risk factors whether it is high or low, it depends on the type of instrument. And at this point, you might still think saving is your best choice but the fact that they hardly aid in, no or little increase in the money, still holds good. That which again brings our mind to think about investing, after all with the risk, they are always associated with higher returns than just keeping it unspent in the piggy bank. It’s completely your choice whether you want to take low, medium, or high risk and still be getting earnings depending on the interest an instrument has to offer.

#2 Investment can strike down inflation

The increase in prices of the goods might seem daunting as it lowers the purchasing power of an individual as the value of the money depreciates and is called inflation which occurs yearly and generally is an inevitable situation as the production cost or either the cost of the raw material is spiked such that it has to occur. If at all the interest rate of a savings account beats the inflation rate, it might still have been your right choice but sadly that’s not the case. An investment is said to be useful if the interest rate is equal to or beats the inflation rate. Investing in the right instrument can turn the table around and still be able to keep you up with inflation, which savings can not do but surely investing does.

How does inflation affect bond price?

#3 Compounding multiplies the investment

The interesting fact about keeping money for a longer time as an investment is that it multiplies. Behind this, there is a simple concept called compounding. What it essentially does is easy to understand. Let’s say you invest Rs 1000 and are receiving 6% interest on it annually for 5 years. In the first year, you make Rs 1060. Where Rs 60 is the gain. On keeping the principal and the gains invested, in the second year, you make Rs 1123.6. By keeping the earnings and the principal as it is, the new earnings were calculated for Rs 1060 and not for Rs 1000. Thus by keeping the principal and earnings remain invested in an instrument, by the end of the 5th year Rs 1338.21 is the money you would earn which otherwise would have been Rs 1300 only if the interest was on Rs 1000 alone. That’s the power of compounding Warren Buffet was talking about!

“An interest earned on the interests that get added along with the principal amount is called compounding.”

#4 Investing assists in financial freedom

It’s a way towards retirement and security. What feels like you have achieved it? Hard cash in hand, handsome savings, and a couple of investments that don’t allow you to think of checking your balance twice or making full payments to your bills with satisfaction, or not being worried about having missed one of your salary payments? It’s a great feeling to have been backed up with proper financing and in attaining financial freedom during unprecedented times. Well with apt financial planning the financial goals are achievable.

#5 Saving taxable income deductions

Having to pay taxes on income is a reluctant action but is inescapable. Fortunately one may cut down on some deductions by investing. From the income tax act under section 80 C, up to 1.5 lakh rupees is the claimant in a year on various expenses and investments. What’s lost can be saved! Investing has a lot to offer with tax-relieving benefits and that’s just one of them to mention.

What’s your financial goal?

Though investing reap financial rewards, it comes down to what are your financial goals. It needs financial planning towards your goals to achieve all or one of the rewards it offers with a certain degree of discipline. The financial goal of each individual is different and it accordingly needs attention to achieve whether it is short or long-term. Hence it’s crucial to understand that by knowing the investment instruments, one can leverage them to reach the financial goals that you have set. Though the rewards seem alluring, trying to achieve them without defining a financial goal is like seeing the efforts go futile.

That’s about investing when your financial goal is aligned with it. Hence you need to know why you want to invest. With that being said, it takes us to understand the “When” and “How” of this chapter.

When to invest?

We’ve heard it all, that says, “Earlier is the best”. Yet times that might have put a stop, as to why I can not spend the money on my favorite Pizza instead?

The verdict does hold good but doesn’t mean you need to sacrifice the pizza! You’ll find the #1 reason to be interested in investing earlier.

#1 Money grows with time!

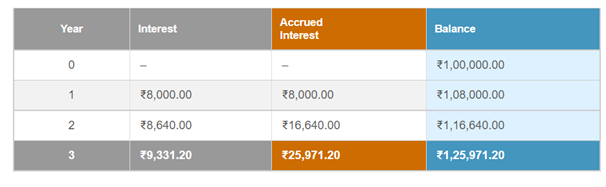

The earlier you invest, the longer it compounds and the later you invest, the lesser it compounds, and finally it comes down to having more money by the end of the time with the former part. For example, you invest 1,00,000 Rs in exchange for a return of 5 – 8% annually for about 5 years at the age of 25. And similarly, for about 3 years at the age of 27, let’s see how compounding will work in both cases.

In the first case,

Investment of 1,00,000 at the age 25 with 8% interest until 5 years will grow to Rs 1,46,932.81

In the second case,

Investment of 1,00,000 from the age of 27 until 3 years will grow to Rs 1,25, 971.20.

So we see there is a difference of Rs 20,962 with a late investment of 2 years. Thus it’s imperative to conclude that the earlier you invest, the more money you make sooner and be able to take up your retirement at the earliest as well.

How to invest?

By now if we understand why to invest and when to invest, the next thing in mind is “how to invest”. Well as said, investing comes with risks, if we invest all the money in one instrument, the chances are also highly probable that in the worst case we may lose it all.

Why should millennials consider investing in Bonds and Debentures

There are two things to keep in mind:

a. Invest in the right instrument

It’s a matter of hard-earned money that you are going to invest and it can’t go in vain just so easily. Hence you need to acquire the knowledge of the investment instruments before hopping onto investing blindly, also ensuring you know your financial goals before you dive in. There are various assets as mentioned earlier and you can consider investing as per your risk appetite and researching the right instrument is always the priority at hand.

b. Diversify your portfolio

Now that you are aware of the type of assets, investing in various assets balances the health of the portfolio even in the worst-case scenario as long as the portfolio is invested in the right type of instruments that meet your financial goals. More often the financial advisors go with the 60 / 40 rule by allocating 60% for the stocks and 40% for the bonds.

The biggest myth is to blindly invest and that’s a psychological trap we all fall into and one day realize that much is lost than have gained because of not knowing why to invest in the first place. If this has answered the rewards an investment reaps, then it’s time you align your financial goals to make complete sense of how your portfolio must look for it to make fruits for you!