Bonds are fixed-income assets that reflect a loan made by an investor to a borrower, usually a business or the government.

It is becoming increasingly important for everyone to save in order to fulfill their dreams or carry out their desired activities. Until recently, most of us relied heavily on traditional financial instruments such as fixed deposits, PPF, bank savings, life insurance and so on. Few of us may have recently invested in bonds for a regular fixed income, while others may have invested in equity or cryptocurrencies for a quick return at high risk.

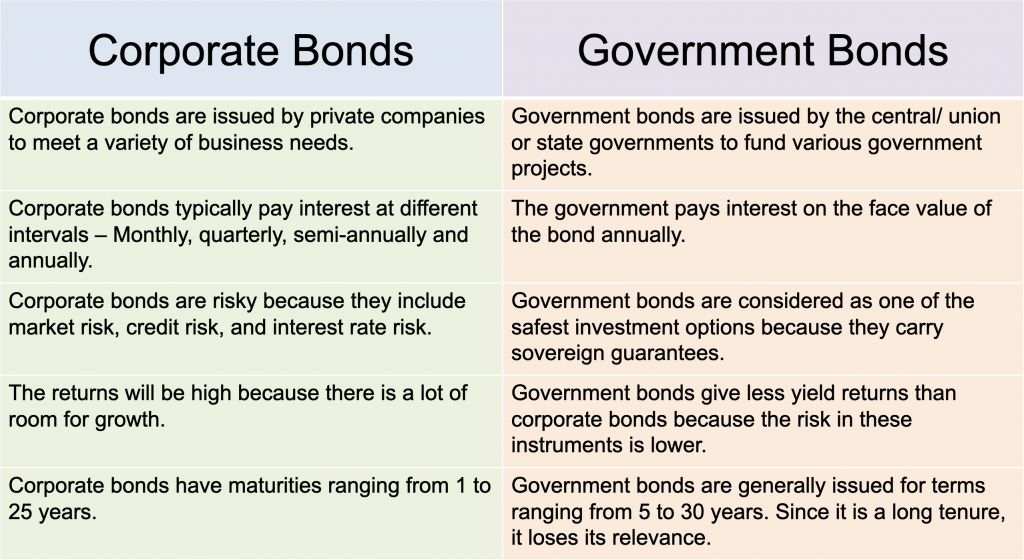

Though few of us may have invested in bonds, there is still considerable confusion about the fundamental differences between the various types of bonds that exist or are issued in the market. There are two types of bonds that dominate the market: “Government bonds“ and “Corporate bonds”. Although they appear to be identical, they actually have significant differences.

This article would appraise the fundamental difference between government and corporate bonds as well as why they are being issued in the market, their features, etc.

What are Government Bonds?

Government bonds or G-sec are issued by the Government of India, either the Central Government or the State Government. When the government faces a liquidity crisis, such bonds are issued to fund infrastructure development. These bonds are primarily intended for long-term holding. A government bond’s interest rate is a coupon rate that can be fixed or floating on a biannual basis. Furthermore, because the government has very little chance of defaulting on interest or principal payments, these bonds are regarded as the safest form of investment.

What are Corporate Bonds?

Corporate bonds are debt securities issued by corporations, which can be private or public. To raise funds for a variety of purposes such as establishing a new plant, purchasing equipment, or expanding the business. When a person purchases a corporate bond, he or she is lending money to the issuer in exchange for periodic interest payments on the principal at maturity. Though the individual investor lends money. he/she will not be considered a stakeholder or having ownership rights like an equity stock holder.

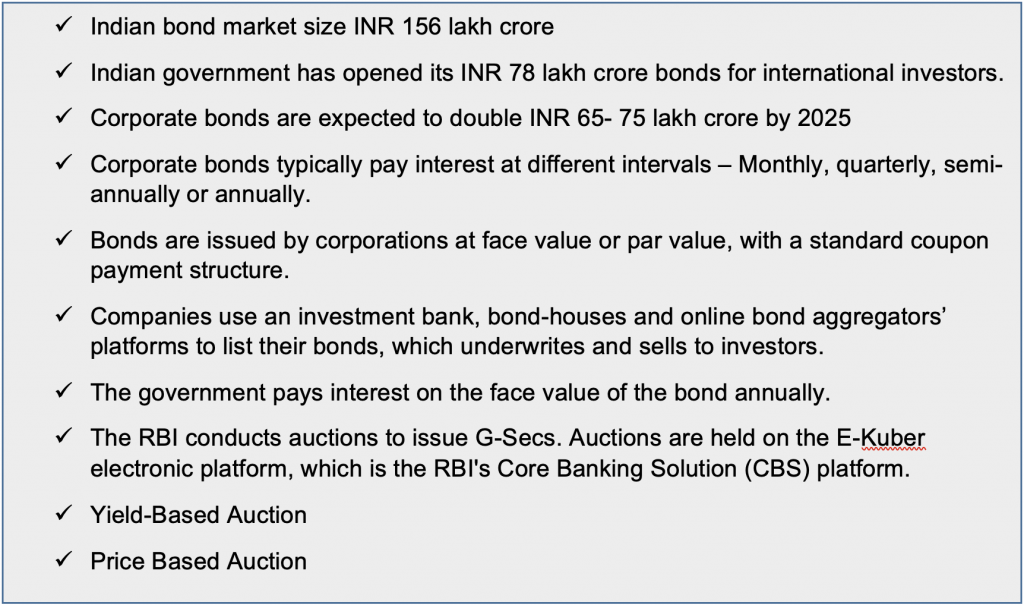

Bond Market Size in India

The Indian bond market size is estimated at INR 156 lakh crore ( US $ 2 trillion ) and recently the Indian government has opened its INR 78 lakh crore ( US $1 trillion) government bond market to international investors. The Indian government has also announced that it has planned to borrow INR.14.31 lakh crore for the current fiscal year (2022-23).

According to a CRISIL report, the Indian corporate bond market is expected to double to INR.65 to 70 lakh crore by the fiscal year 2025, since the demand for corporate bonds is growing consistently.

Difference between Government bonds and Corporate bonds

What are Corporate Bonds? How to invest in corporate bonds in India?

How corporate bonds are issued or sold?

- Bonds are issued by corporations at face value or par value, with a standard coupon payment structure.

- Companies use an investment bank, bond-houses and online bond aggregators’ platforms to list their bonds, which underwrites and sells to investors.

- Until maturity, these bonds make regular interest payments. The interest payment can be fixed or variable, depending on a market indicator.

- Investors can redeem their bonds at face value when they reach maturity.

- These bonds may include a call provision that allows for early repayment if interest rates change dramatically.

- When the company becomes profitable, it will redeem the old bonds and issue new ones.

- Company bonds can be traded on the secondary market by investors. The bond price in the secondary market is determined by the number of interest payments still due before the bond’s maturity date. In this case, the investor may receive less than the bond’s face value.

How Government bonds are issued or sold?

- The RBI conducts auctions to issue G-Secs. Auctions are held on the E-Kuber electronic platform, which is the RBI’s Core Banking Solution (CBS) platform. Members of this electronic platform include commercial banks, scheduled UCBs, Primary Dealers, insurance companies, and provident funds that have funds accounts (current accounts) and securities accounts (Subsidiary General Ledger accounts (SGL)) with the RBI. Through this electronic platform, all E-Kuber members can place bids in the auction.

- Yield-Based Auction.

- Price Based Auction.

- Depending upon the method of allocation to successful bidders, the auction may be conducted on a Uniform Price basis or Multiple Price bases.

- Competitive Bidding.

- Non-Competitive Bidding (NCB).

- Government bonds are being sold through bond houses and online bond aggregators.

Benefits of investing in corporate bonds

- Higher interest: When compared to government bonds, corporate bonds typically have a higher interest rate. If anyone wants to earn more money, this is a good investment.

- Moderate risk: Corporate bonds have moderate risk but will not be largely affected by inflation.

- Corporate bonds are typically used as short-term investments. It will most likely see an immediate return on the investment.

Benefits of investing in Government bonds

- Government bonds always ensure assured returns to the investors and have always been risk-free.

- Government bonds always come with sovereign guarantees.

- Tax benefits: few of the government bonds provide tax benefits. Eg- the National Highway Authority of India(NHAI)and Rural Electrification Corporation Limited(RECL) are exempted from tax as well as TDS.

A couple of our blogs on Government and corporate bonds risk will help you to better understand risk.

Examples:

Corporate bonds

- Indiabulls Housing Finance Limited REC 54EC Bond

- Muthoot Finance Limited

- Navi Fintech

- Edelweiss Housing Finance Ltd

- UGRO Capital Limited

Government bonds

- UP Power Corporation Ltd

- REC 54EC Bond

- NHAI 54EC Bond

What is the Difference between Equity IPO and NCD IPO?

Key Highlights

Why should millennials consider investing in Bonds and Debentures

Frequently Asked Questions:

How Yield-Based Auction is conducted?

When a new G-Sec is issued, a yield-based auction is usually held. Investors bid in terms of yield to two decimal places (e.g., 8.30%, 8.60 %, etc.). Bids are arranged in ascending order, and the cut-off yield is the yield corresponding to the auction’s notified amount. The cut-off yield is then set as the security’s coupon rate. Those who bid at or below the cut-off yield are considered successful bidders. Bids that exceed the cut-off yield will be rejected.

How Price Based Auction is conducted?

When the Government of India re-issues previously issued securities, a price-based auction is held. Bidders quote in terms of price per Rs. 102.00, Rs.101.00, Rs.100.00, Rs.99.00, etc., per Rs.100/-). Bids are arranged in descending order of price offered, with successful bidders bidding at or above the cut-off price. Bids that are less than the cut-off price are rejected.

What is Competitive Bidding?

An investor bids at a specific value/yield in competitive bidding and is assigned securities if indeed the price/yield quoted is well within the cut-off price/yield. Well-informed institutional investors such as banks, financial institutions, PDs, mutual funds, and insurance companies submit competitive bids. The minimum bid amount in dated securities is Rs. 10,000 and in multiples of Rs. 10,000, and the minimum bid amount in T-Bills is Rs.10,000 and in multiples of Rs.10,000 thereafter. Multiple bidding is also permitted, which means that an investor may submit multiple bids at various price/yield levels.

What is Non-Competitive Bidding (NCB)?

Non-competitive bidding means that the bidder can participate in auctions of dated government securities without quoting the yield or price in the bid. As a result, he/she will not have to worry about whether his /her bid is correct or incorrect; as long as he/she bids in accordance with the scheme, he will be allotted securities in full or in part.

Corporate bonds vs. government bonds: which is best?

Government bonds are secure since they provide guaranteed returns but have a lower rate of return. Corporate bonds have a greater rate of return but are more risky, depending on the company that issues them.

What is a corporate bond?

A corporate bond is a debt product issued by a company to obtain cash, with a higher rate of returns, and is riskier than government bonds. It pays fixed interest and repays the principal when it matures.

How are Government bonds issued and sold in India?

The Reserve Bank of India (RBI) releases government bonds through auctions, which are then sold to investors through major dealers, banks, and stock exchanges.