High Yield | AA+/Stable Rated | Minimum Investment: 10k Only

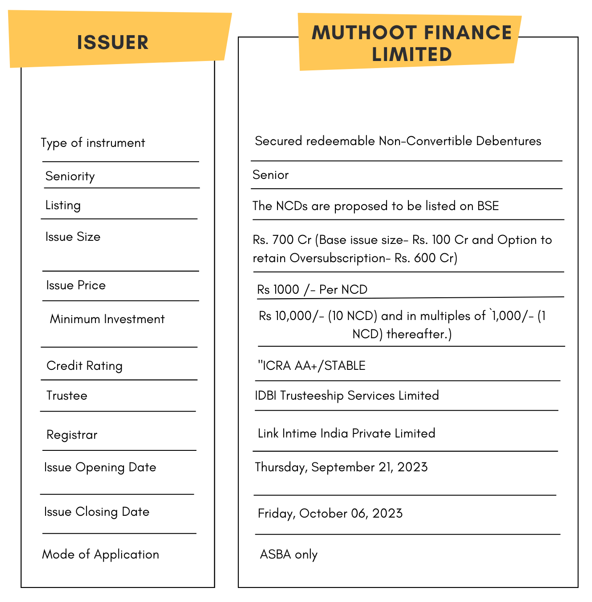

Muthoot Finance Ltd is issuing the 4th tranche of Non-Convertible Debentures. These NCDs are AA+/Stable by ICRA. The NCDs are being issued in seven series: yield ranges from 7.75% to 8.60% p.a. and different tenures of 24 months, 36 months and 60 months. The NCDs are secured and redeemable in nature.

Muthoot Finance Ltd NCD IPO: Coupon rates and effective yield for each of the series

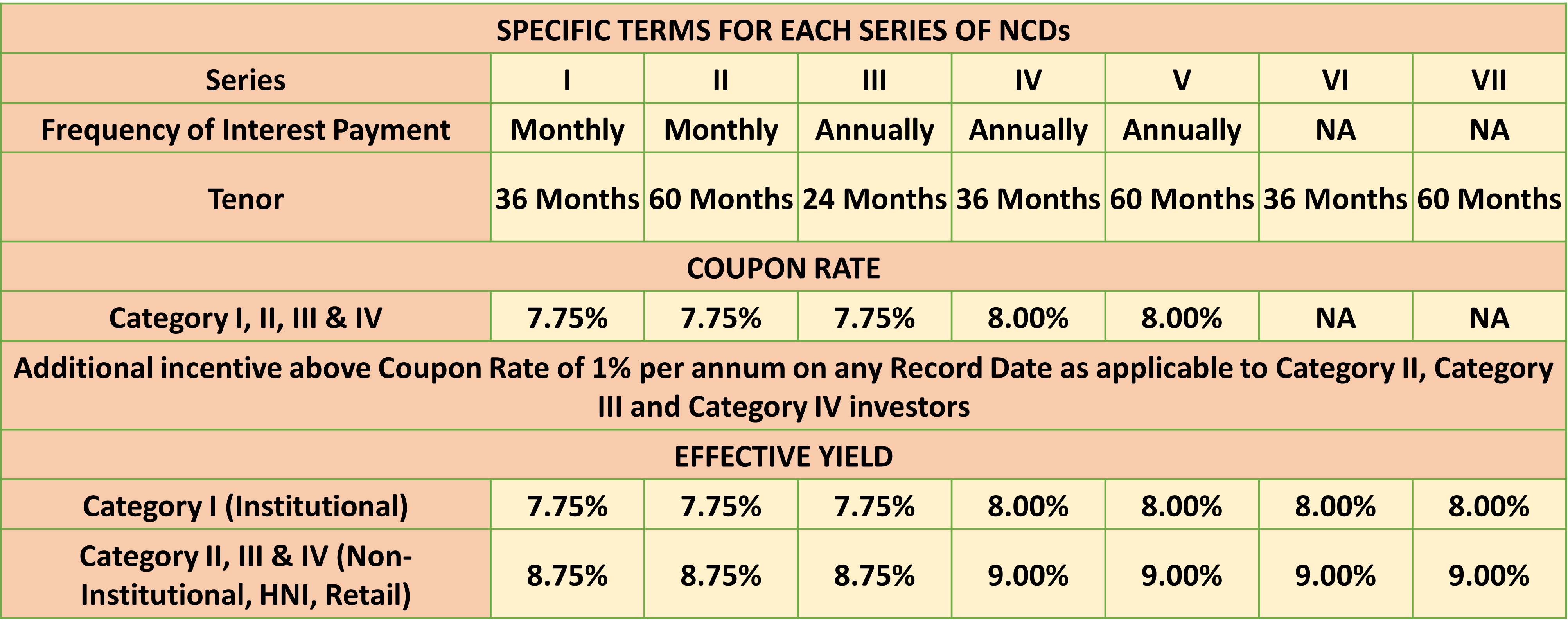

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Muthoot Finance Ltd NCD-IPO.

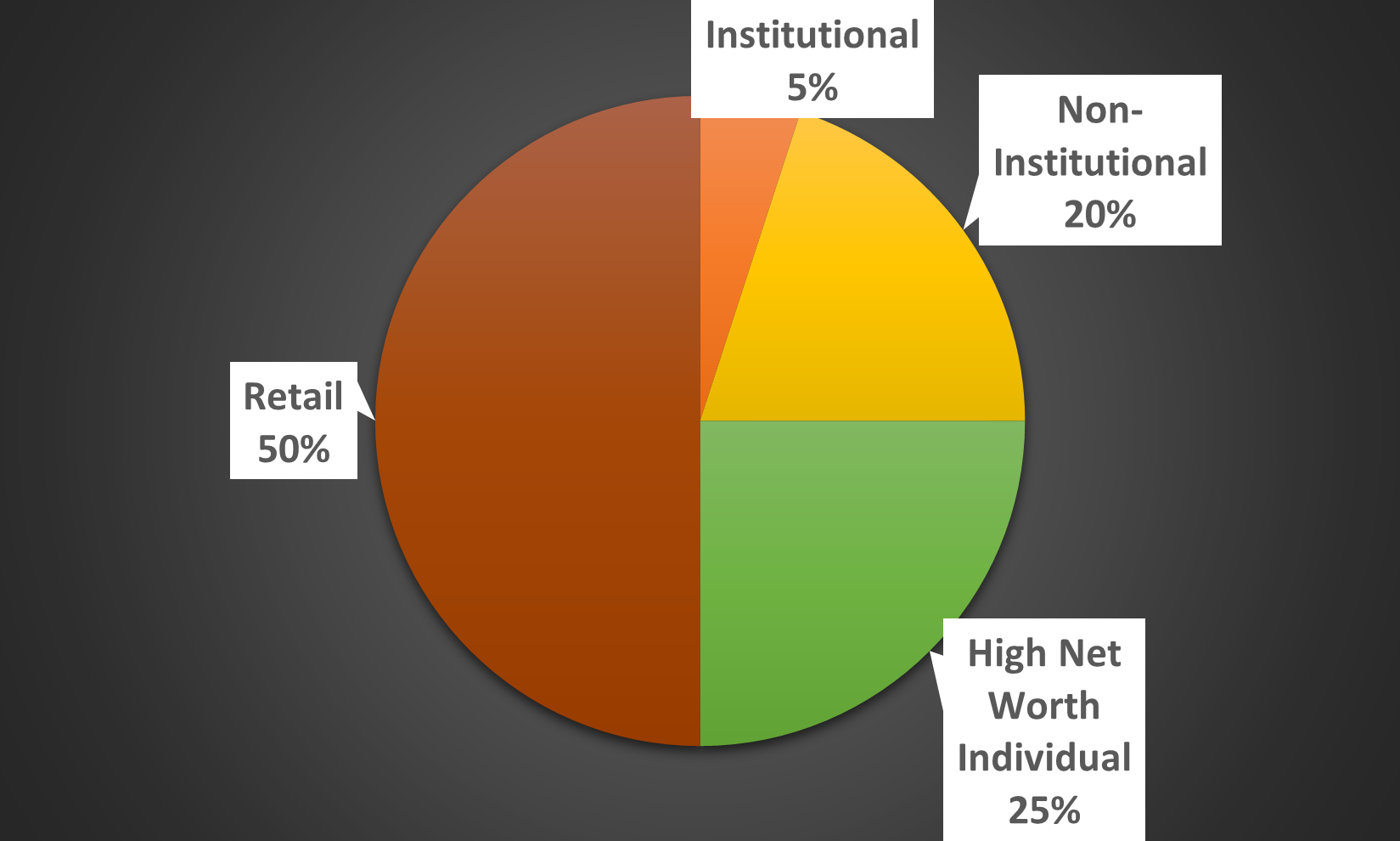

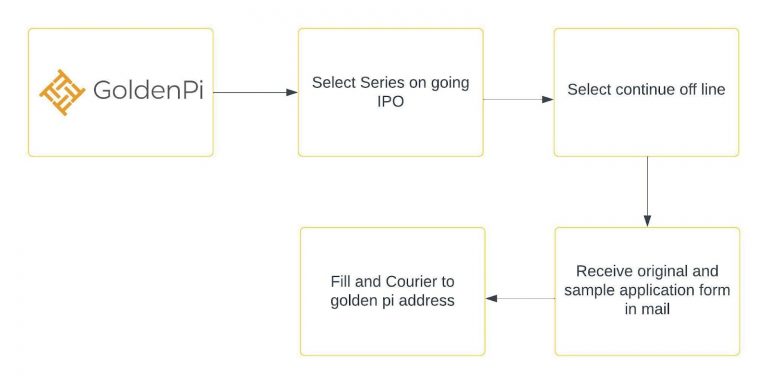

Investment Process for Muthoot Finance Ltd NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

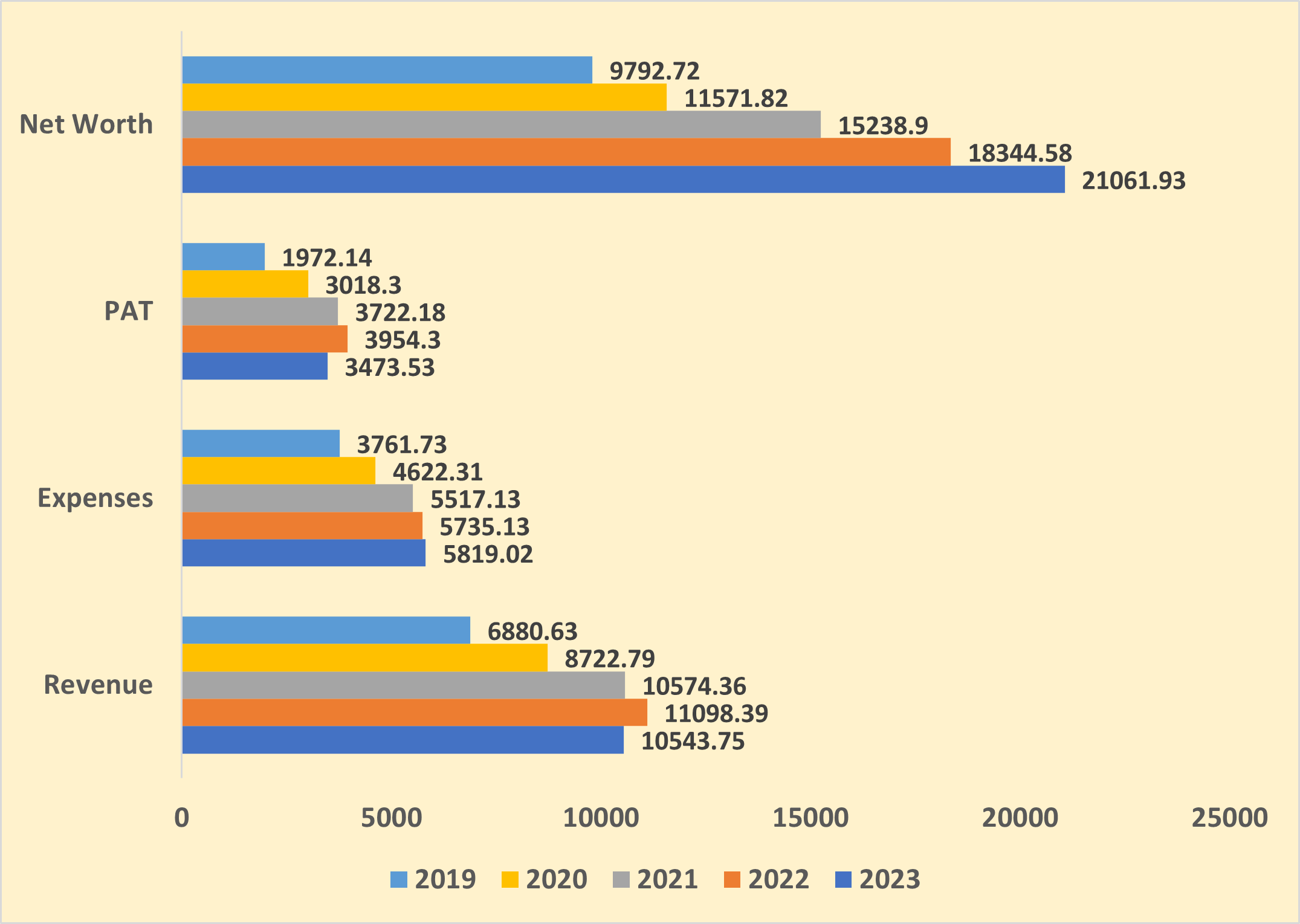

Financial Overview

Snapshot stating the Revenue, Expenses, Net Worth and PAT

(Amount in Rs. Cr)

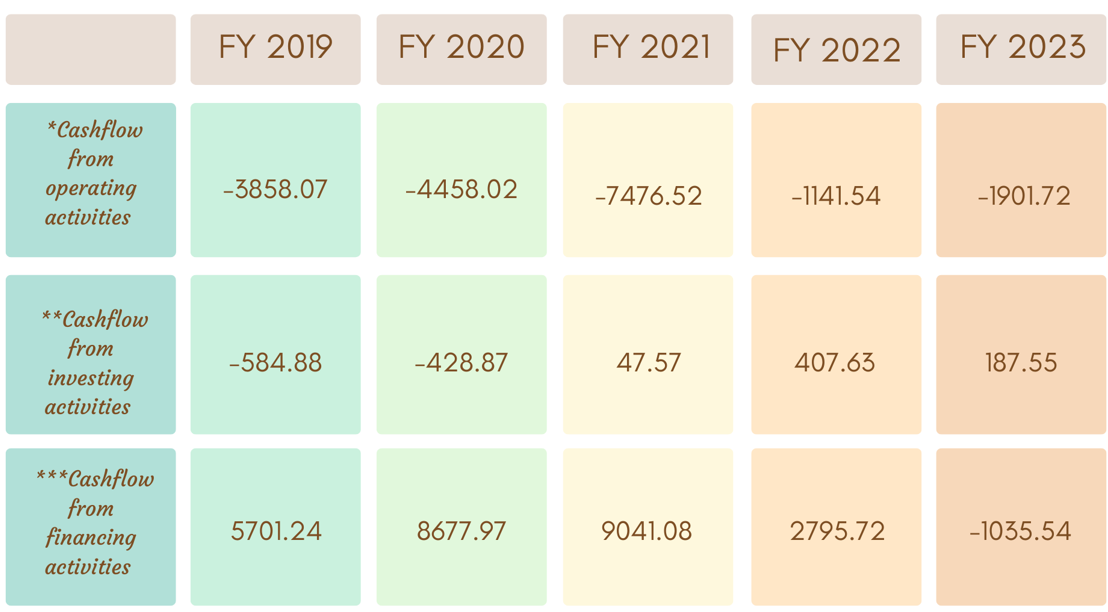

Cash flow for last 5 years

(Amount in Rs. Cr)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

What is NCD?

An item of debt that’s unable to be transformed into equity shares of the issuing business is called a non-convertible debenture (NCD). This implies that the investor will struggle to turn their investment into equity in the business.

Usually, these have a set tenure and a fixed rate of return. Because they have a lower default risk than other debt instruments, they are regarded as a safe investment option. Individuals, Indian incorporated bodies, dealers, banks, and other entities can assist with these.

Companies issue them to raise money from the public. On the stock exchange, investors can purchase and sell NCDs, or they can hold them until maturity to receive both the principal and accrued interest.

Individuals, Indian incorporated bodies, dealers, banks, and other entities can assist with these.

NCD VS FD

| NCD | FD |

|---|---|

| They give customers the choice between a fixed and floating rate of interest while purchasing | Fixed-rate of interest throughout the investment period |

| Maturity is specified, ranging from a few months to several years. | Investors can choose whatever suits them, either a short-term or long-term investment. |

| Muthooth Financing NCD is AA+ certified and has a low risk and higher return. | Investment bank = ensures the returns here; low risk, low return. |

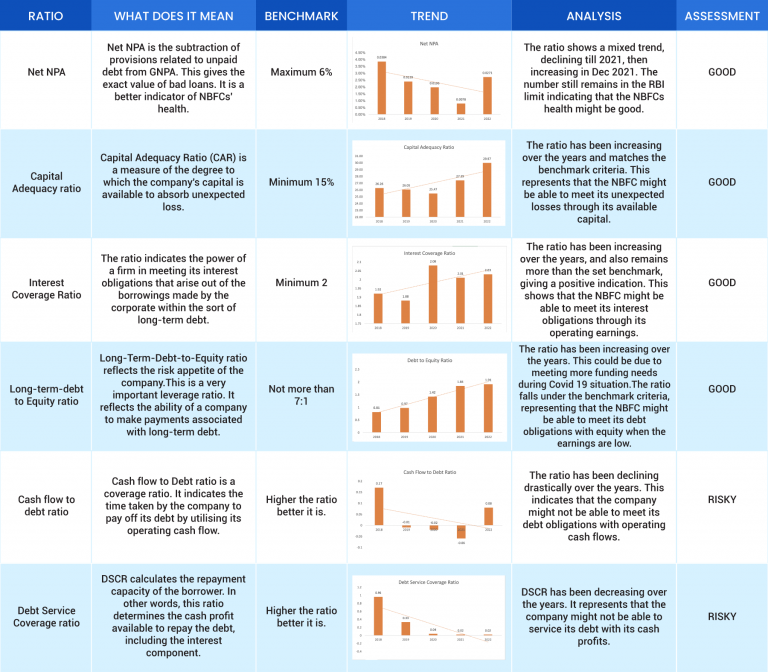

Ratio Analysis

Issue analysis

Pros

- Attractive interest rates: Muthoot Finance is offering attractive interest rates on its new NCD issue, ranging from 7.75% to 8.00%, depending on the tenor of the NCDs. This is higher than the interest rates offered by most banks on their fixed deposits.

- Good credit rating: Muthoot Finance has a good credit rating of AA+ from ICRA, which indicates that it is a relatively low-risk borrower. This means that investors are likely to receive their interest payments and principal on time.

- Secured investment: Muthoot Finance’s NCDs are secured by the company’s assets. This means that if the company defaults on its debt obligations, investors will have a claim on the company’s assets to recover their investment.

- Liquid investment: Muthoot Finance’s NCDs are listed on the stock exchanges, which means that they can be easily traded and sold if needed.

Cons

- Interest rate risk: If interest rates rise in the future, the value of Muthoot Finance’s NCDs may fall. This is because investors will be able to buy new NCDs with higher interest rates.

- Credit risk: Although Muthoot Finance has a good credit rating, there is always the risk that the company could default on its debt obligations. This risk is higher for longer-term NCDs.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Muthoot Finance Ltd.

Founded in 1939, Muthoot Finance Ltd. is the largest gold loan NBFC in India. It is registered as “Systemically Important Non-Deposit -Taking Non-Banking Financial Company” with RBI. The company is headquartered in Kochi, Kerala and also have presence in the UK, the US and the United Arab Emirates.

Business Verticals-

- Foreign Exchange Services

- Money Transfers

- Wealth Management Services

- Travel and tourism services

- Sells gold coins

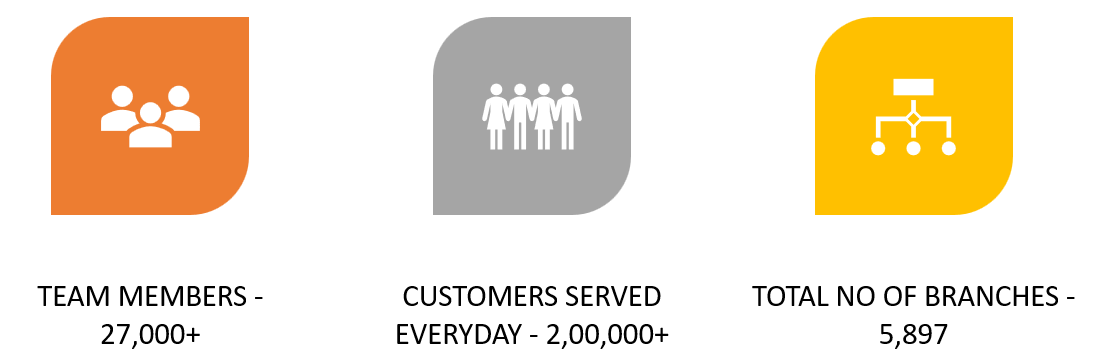

As on June 30, 2023

Strengths

- Strong Gold loan business. The total Loan portfolio of the company includes 99% of the gold loan.

- Healthy earnings profile.

- Capitalisation to remain healthy over medium term

Weakness

- Geographically restricted, MFL’s operations are largely concentrated in South India.

- Covid-19 disrupted the performance of non-gold segments.

Invest in Bond IPO online in just 5 minutes

Disclaimer: Investments in debt securities are subject to risks. Read all the offer related documents carefully.

FAQ

Is Muthoot Finance NCD safe?

Ans: With a strong credit rating, Muthoot is the most reputable financial services brand in India. The Investment Information Credit Rating Agency (ICRA) has given it an AA+ rating, meaning that there is little risk associated with investing in it.

Is NCD better than FD?

Ans: You will make more money in NCD than in bank offers because the corporation provides NCD returns, whereas the bank guarantees FD returns. When the rate of return between FD and NCD is assessed, this becomes clear.