A small capital can be sufficient to embark on a business venture, but as the business grows substantially higher capital has to be infused in order to sustain growth and expansion. The funds can be infused by borrowing money from the bank as a loan with a certain percentage of interest, but it comes with its limitations and risks. Since the necessity of expansion and growth is on the cards, the business ought to infuse adequate funds. This led to the concept of seeking funds from individuals either as equity or debt.

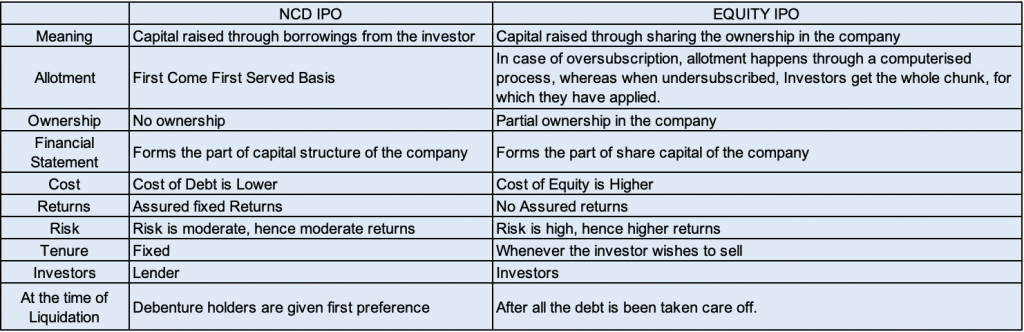

Equity means, a company is inviting investors to be shareholders of the company. While debt means, the company borrows money as a loan from investors at a predetermined rate.

What is an Equity IPO?

Through equity financing, the company asks investors to invest capital and become shareholders. It is also done by unlisted companies that require funds. Once the process is completed successfully, the company will be listed on the exchange and available for trading.

What is a Debt/NCD IPO?

Through this method, the company uses fixed-term instruments to raise money in the form of loans from the public at a predetermined rate of return through an upcoming NCD IPO. These are known as Non-Convertible Debentures as these cannot be converted into shares. They are of 2 types;

- Secured NCDs – This tranch of NCD is basically secured by the assets of the company. Therefore, in case the company is unable to pay back its borrowers, the assets could be liquidated and the amount derived by it could be utilised to pay back the company borrowers.

- Unsecured NCDs – These are not secured against the assets of the company. Hence, they are riskier and offer higher yields when compared with the secured NCDs, to compensate for the risk borne by the borrowers.

The maturity period of Non-Convertible debentures can range from 90 days to even 30 years. The rate of interest provided to the NCD holders is much higher when compared to the other convertible debentures or fixed deposits.

The maturity period of Non-Convertible debentures can range from 90 days to even 30 years. The rate of interest provided to the NCD holders is much higher when compared to the other convertible debentures or fixed deposits.