|

Getting your Trinity Audio player ready...

|

For thousands of years, gold has served as a global symbol of wealth. Its significance as an emblem of fortune and prosperity is significantly rooted in Indian tradition. For those seeking a secure investment to protect themselves from inflation and market volatility, gold has always proven to be an attractive option.

Investors now have an additional investment tool that offers various advantages over physical gold. With the Indian government’s launch of sovereign gold bonds, each investor has three options for investing: Sovereign Gold Bonds, gold ETFs, and physical gold. Nonetheless, there are a lot of advantages to making investments in sovereign gold bonds over physical gold investments and gold ETFs.

Let’s find out how these gold bonds are compared to physical gold investments as you continue to read.

Key Takeaways

- With SGBs, you eliminate the risk of storage and theft.

- They offer an interest rate of 2.5% annually unlike the physical gold which doesn’t give any.

- SGBS have a lock-in period of 5 years.

- On holding till maturity, it attracts zero capital gain tax.

- Physical gold doesn’t have any purchase limit whereas the SGBs have a limit of 4 kgs for individuals and HUFs whereas trusts and entities have a limit of 20kg per fiscal year.

The options of owning gold

The lookout for gold-related investment options is fascinating for the intrinsic value it carries and there are few options available to stay invested.

1. Physical Gold

The traditional way of investing in gold is through jewellery, but there are certain charges involved in it, which doesn’t make it an investment option. On the other end, there are gold coins and bars, which are the purest forms available in various denominations meant for investment purposes. Storage can be a real concern with these forms.

2. Gold ETFs

This is a mutual fund unit that is associated with physical gold and can be easily bought on the stock exchanges and sold as well. This in turn tracks the price of the gold, where it can be easily transacted and liquidity is not at all a concern. It also solves the problem of storage concerns but of course, comes with brokerage and management fees.

3. Sovereign Gold Bonds

This is offered by the GOI and the returns are directly associated with the price of the gold, along with 2.5% returns, which are paid twice a year. Is the safest option backed by the government with absolutely no storage concerns. Additionally, you can get interest and tax exemptions on capital gains if they are held until maturity.

4. Digital Gold

These are digital forms of gold which can be bought at online platforms and stored in the vault. Storage concerns are not at all a matter and they provide convenience and make it easy to transact, which can be bought in smaller denominations. Storage and insurance can have additional costs.

5. Gold Futures and Options

Derivative instruments are where investors get to speculate on the prices of gold and are usually traded on commodity exchanges. It offers leverage and hedge options with the potential for higher returns. Higher returns come with high risk and exposure to potential losses.

Based on your preferences, you can take advantage of the investment.

What is a Sovereign Gold Bond?

Sovereign Gold Bonds (SGBs) are referred to as Debt Funds and were launched by the Government of India in November 2015 as a substitute for buying physical gold. These debt securities provide a set interest rate on the investment. They are multiple-gram gold securities that are issued by the government. Additionally, investors can make financial gains by selling them on the secondary market.

SGBs are documented as certificates, but they can also be transformed into a dematerialized state. Therefore, there is no chance of theft or extra expense for storage.

One can apply for SGBs by going to the following locations:

- Authorized stock exchanges

- Stock Holding Corporation of India Ltd. (SHCIL)

- Registered private and foreign banks

- Nationalized bank branches

- Designated post offices

Online applications for these bonds are also available on the websites of accredited commercial institutions.

The gold bonds have a 2.50% annual percentage rate of interest that is paid semi-annually based on the nominal value of the gold. The bond has an 8-year term, with a termination option accessible on the 5th, 6th, and 7th years of interest payments.

Individuals and Hindu-Undivided Families (HUFs) only have access to a maximum of 4 kilograms of gold, whereas trusts, along with other similar institutions, are confined to a maximum of 20 kilograms. When the gold bonds are owned together, the capital investment maximum is 4 kg and will only apply to the first applicant.

According to the 2006 Government Security Act, gold bonds are to be released as stocks. A holding certificate for this purpose would be provided to the investors. SGBs are more immune to default than ordinary gold investments because they are backed by the RBI.

Pros and Cons of Sovereign Gold Bonds

There are both advantages and disadvantages to investing in sovereign gold bonds.

Pros

Here are the pros of investing in SGBs.

- The bonds have an assured 2.5% interest rate that is paid out every two years for eight years. However, investors who seek early liquidation may choose premature withdrawal at current market values.

- Since there are no fees associated with buying gold jewelry or determining its purity, SGBs can be acquired for a price that is relatively close to the real market value of gold.

- Most lenders and lending organizations accept SGBs as collateral. The “loan to value” ratios set forth by the RBI are valid and equivalent to those that apply to loans secured by gold.

- As SGBs are dematerialized and free of the risks associated with storing or safeguarding gold, as well as concerns about the quality of the gold that is purchased, they represent a safe investment alternative in comparison with physical gold.

Cons

Here are the cons of investing in SGBs.

- When it comes to liquidity, SGBs have less liquidity than physical gold. They have a five-year lock-in period starting on the date of their coupon payments.

- There is a risk of capital loss if the withdrawal amount is less than the purchase value.

What are Physical Gold Investments?

Whenever it comes to physical investments, gold is among the most popular options. It is available for purchase as gold bars, coins, jewellery, and biscuits. Compared to buying some digital gold, buying or selling physical gold usually requires handling with high levels of security. One can easily get physical gold from the nearest jewellery stores. Hence, there is no risk associated with a counterparty, and no broker or middleman is engaged.

Gold coins with 24-carat purity and 999 quality can be purchased in 5 and 10-gram denominations. Usually, gold bars weigh 20 grams. These are readily available for purchase over the counter at jewellery stores throughout the nation.

A few jewellers also offer their jewellery for sale online, with doorstep delivery included. Gold coins and bars can also be purchased online on sites like Amazon, Flipkart, Snapdeal, and others, known as digital gold.

Physical gold purchases have no upper limit. Nevertheless, the minimum investment for physical gold is a bit more because gold biscuits require a minimum of 10 grams. You are always advised to keep actual documentation of every gold purchase you make. It is going to help you out with your income tax returns.

One of the greatest things about making investments in gold is the fact that it doesn’t need any upkeep, and you can easily store it for generations to come in a safe place.

Pros and Cons of Physical Gold Investments

There are both advantages and disadvantages to investing in physical gold investments.

Pros

Here are the pros of investing in physical gold.

- Depending on the type of purchase one is searching for, gold coins, bars, and jewellery are typically easily accessible over the counter at jewellery stores, banks, and internet platforms.

- When it comes to safe and highly liquid investments, physical gold has a distinct advantage over SGBs.

- Inflation can cause gold’s value to rise, protecting investors against the decreasing value of money.

- Investing in gold helps to diversify portfolios and lessen dependency on a particular asset type.

Cons

Here are the cons of investing in physical gold.

- Over time, gold might not always perform better than other assets.

- Appropriate gold storage may require additional costs, such as renting or buying a security deposit box. If significant gold assets are covered by insurance, the overall cost may also go up.

Sovereign Gold Bonds vs. Physical Gold Investments

Here is a detailed comparison between sovereign gold bonds and physical gold investments.

| Sovereign Gold Bonds | Physical Gold Investments |

|---|---|

| Following the five-year lock-in period, bonds can be traded on the stock exchange. | Physical gold is readily available for purchase from any banking institution or jeweller. They can be exchanged with a jeweller at any location around the world. |

| Sovereign Gold Bonds are gold-backed government securities. | The purity of physical gold is likely to or might not be 99.5%. |

| There is a five-year lock-in period on the investment. | There is no lock-in period. |

| The issue rate is determined by the government. | There is variation in the real price of gold. |

| Gold bonds are sold in denominations. A gram is equivalent to one unit. One gram of gold is the least investment, and four kilograms of gold is the maximum amount per investor. | Gold biscuits or coins are offered in conventional denominations of 10 grams. Hence, purchasing physical gold involves a large financial investment. |

| There is no capital gains tax on redemption. Additionally, indexation benefits are associated with long-term financial gains. But just like with physical gold, the capital gains on an early redemption are subject to taxes. | If an investor holds a gold investment for no more than three years, the capital gains are subject to taxation, given their income tax slab rates. Gains from an investment with a holding period longer than three years are subject to 20% taxation with an indexation advantage. |

| There are no storage expenses or theft risks associated with a sovereign gold bond. | There are storage expenses and theft risks associated with physical gold. |

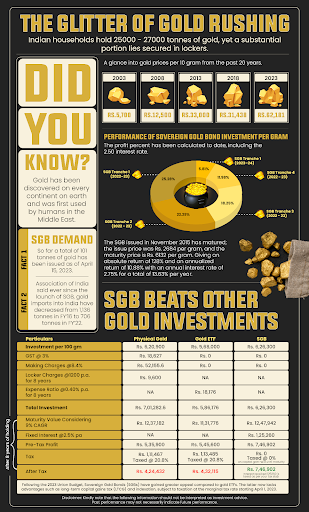

Physical gold vs SGB vs ETF

Making Investments Easy with GoldenPi

Gold is among the safest forms of investment in India. Due to its significance in Indian society, people often invest a good amount of money in gold for several reasons. To make gold investments easy and accessible to all, the Government of India launched sovereign gold bonds backed by the RBI. These bonds allow investors to invest even a small amount of money in gold.

GoldenPi provides investors with a platform to compare various sovereign gold bonds available in the market and use a sovereign gold bond calculator to get an estimate of the return on their investment.

Start secure and informed investing with GoldenPi today!

FAQs About Sovereign Gold Bonds and Physical Gold Investments

1. How much gold should I buy in SGB?

Individual and HUF investors may invest anywhere from one gram of gold to as much as 4 kg. Investments in gold worth up to 20 kg are permitted for trusts and other government-designated organizations. SGBs are issued with a duration of 8-year maturity.

2. Is physical gold tax-free?

No, physical gold is not tax-free. The Indian Income Tax Act specifies that selling physical gold is subject to a 20% tax and a 4% long-term capital gains (LTCG) fee. As a result, the total tax rate on gold is 20.8%.

3. Which is better to invest in, a gold ETF or a sovereign gold bond?

Mutual funds called gold exchange-traded funds (ETFs) can be traded on the stock exchange. They are highly tradable, and the price is determined by the supply and demand for gold. Gold ETFs don’t provide any interest-based passive income. Sovereign gold bonds, on the other hand, can also be traded on the stock exchange after a five-year lock-in term. They pay out interest to investors, providing an additional source of earnings. Gold bonds are a good option for investors who want more income, while gold exchange-traded funds (ETFs) are a good choice for those who want liquidity.

4. Why should I buy SGB rather than physical gold?

Since SGBs are digital copies of gold that are traded through demat accounts, they are not prone to theft or robbery, in comparison to physical gold. Also, SGBs offer a 2.5% annual return rate, which gives them an advantage over physical gold investments.

5. How are the prices of SGBs determined?

The price of SGBs is determined by the average closing price of 999-purity gold over the previous three working days of the week prior to the end of the subscription term, as provided by the India Bullion and Jewelers Association (IBJA).