The Reserve Bank of India has been the primary pillar in depicting and controlling inflation, which determines the overall economic flow of the country. The RBI’s Monetary Policy acts as a key determinant of factors such as inflation and price stability. The RBI’s decision making process always revolves around the events happening around the world. The recent incident is a prime example of how, as a result of the Russia-Ukraine conflict, the entire world has been experiencing economic fluctuations, including India. Therefore, India had to face the hike in the Consumer Price Index Inflation, which stood at 6.95% in March 2022.

According to the Economic concept of Monetarism, inflation could only be controlled through the money supply in the economy. Hence, in order to cool off inflation, the Indian government has planned to suck in liquidity by issuing new borrowing plans and making adjustments in the liquidity window of the RBI.

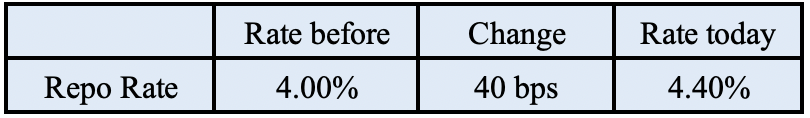

Simultaneously, the Monetary Policy Committee made a few changes in its Liquidity Adjustment Facility. These changes are stated below-

By making such adjustments in the policies, RBI is trying to suck out the excessive money in circulation. The bank also mentioned that they would be able to aspirate Rs 87000 crores from the economy.

By making such adjustments in the policies, RBI is trying to suck out the excessive money in circulation. The bank also mentioned that they would be able to aspirate Rs 87000 crores from the economy.

Inflation is a rise in the price of an economy over a period of time. It happens when there is an excessive supply of money in the economy. It also refers to the decline in purchasing power of currency over time.

Let’s understand Inflation with an example-

Three years ago, if we were able to buy one ltr of petrol for Rs. 79.89, so today with an increase of around 93% in the inflation rate, the same one ltr of petrol would cost an ordinary person Rs. 105, showing an increase of 32%.

How to beat market volatility through bonds?

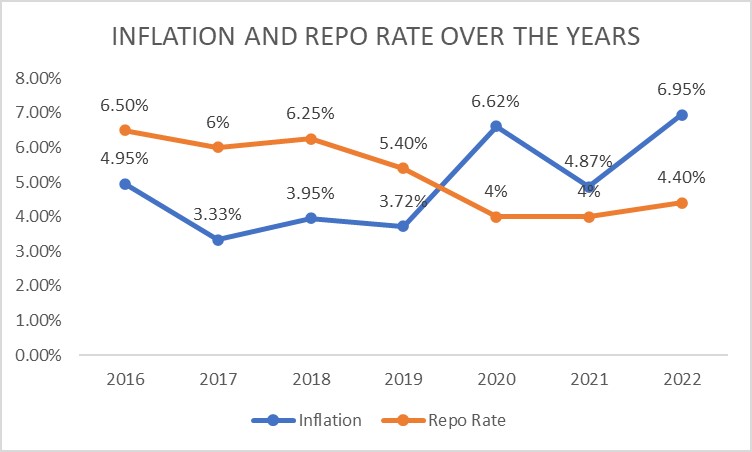

Repo Rate and Inflation Rate-

The repo rate and inflation have an inverse relationship. The Reserve Bank of India uses the repo rate to keep inflation under control. Inflation falls when the repo rate is raised. Inflation rises when the repo rate is reduced. Observation – A decrease in the repo rate would lead to an increase in the inflation rate next year. For instance, if the repo rate is decreased by 50bps from 2016 to 2017, the results could be seen in the year 2018 inflation rate, which would be on a hike.

Observation – A decrease in the repo rate would lead to an increase in the inflation rate next year. For instance, if the repo rate is decreased by 50bps from 2016 to 2017, the results could be seen in the year 2018 inflation rate, which would be on a hike.

Role of US behind Monetary Policy Committee increasing the interest rates-

Since the US Federal Reserve has begun raising interest rates and is expected to raise them by at least 50 basis points, the RBI must follow suit. If the RBI does not act, the spread between Indian and US sovereign bond yields will narrow, resulting in more foreign capital outflows. FPIs have currently extracted Rs. 14000 Cr from Indian debt since February 2022.

Impact on the Indian Economy-

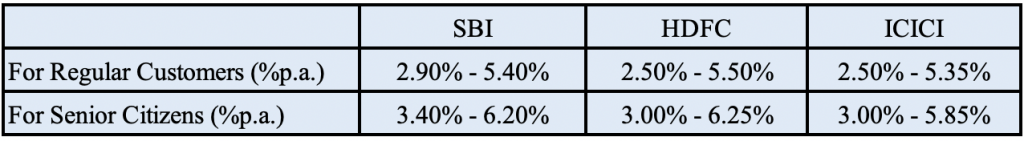

With the RBI’s move, interest rates on loans will begin to rise. It will have an effect on consumer demand for housing, consumer durables, and other non-essential items. With credit to large companies and industries just starting to recover, the rate hike may slow credit growth to the industry as well. However, in the long run, price stability will be critical in supporting demand. It will benefit investors in small savings schemes and fixed income.

-

Fixed deposit interest rate-

-

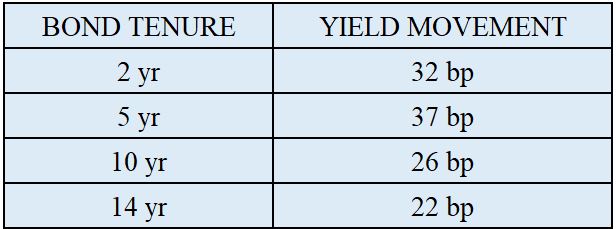

For Bond Market-

In response to the move made by RBI, the yields of the Indian Govt bonds have inched up. The movement could be seen in the following table-

As the bond yields and value hold an inverse relationship, hence with yields going up, the price would fall, which will eventually lead to mark-to-market losses for debt mutual funds

What’s a corporate bond? How to select one.

For Existing Investors-

Existing bond and debenture holders are suggested not to make rash decisions. It is recommended that the investment be held until maturity, i.e. HTM because the yield will be locked until maturity.

For New Investors-

For new investments, it is suggested that investors invest in short-term fixed income products with maturities ranging from 3 to 5 years which would stretch them to re-invest in other opportunities with investment proceeds derived from previous investments. It would help them to invest in higher yield instruments.

Explore high yield bonds