It has become one of the constant searches among the people at the time of the arrival of every fiscal year that is, how can save a tax and what are the available options. Even though there are enormous investment opportunities that could save a significant amount from taxes, everyone is casting around the possibilities pertaining to government-issued options. The government has multitudes of options nevertheless, there are two standout options that could reduce a considerable amount of tax for investors which are tax-free bonds and tax-saving bonds. However, these are two investment concepts that are frequently used interchangeably. These are two distinct investment possibilities, and the tax treatment of buying these bonds also differs.

Let us understand what they are and how they differ from each other.

What are tax-saving bonds?

Tax saving bonds are one of the financial instruments offered by the government to support people to save tax under the Income Tax Act. But the interest generated from these bonds are taxable under the income tax act. Tax Saving Bonds come with a minimum lock-in period of 5 years.

Tax saving bonds have tax exemption under section 80CCF of the income tax where an individual can enjoy tax reductions up to Rs.20000 on these bonds owned by them. This deduction is excluded from Rs, 2.5 lakh provided under 80C of the act.

Let us take for example ABC a 25-year-old whose earnings are Rs. 5.5 lakh per annum which comes under the tax slab of 10 %. If ABC buys a bond worth Rs.40000 with a lock-in period of 5 years. Now ABC become eligible for a tax reduction of Rs.20000 under the 8CCF Income Tax act.

Now ABC’s actual taxable income is – 2.5 lakh without saving bonds investment.

Since ABC has invested in Tax saving bonds – Rs.2.5 Lakh – Rs.20000 = Rs. 2.3 lakh. It can help ABC to save money year after year.

Capital Gains exemption bonds under Section 54EC

Your long-term capital gains from assets other than shares and securities are eligible to be reinvested under Section 54EC in certain Section 54EC bonds issued by infrastructure companies. Your entire capital gain becomes tax-free in your hands if it is invested wholly in these Section 54EC bonds. However, it is important to keep in mind that these Section 54EC bond transactions are subject to a 3-year lock-in, and any violation of this lock-in would result in the loss of any claimed capital gains tax exemption. Within six months of the creation of capital gains, this investment in Section 54EC bonds must be made.

The NHAI, PFC, REC, and IRFC are the issuers of the bonds that are mentioned in Section54EC.

Each bond costs 10,000 rupees, hence these bonds can only be purchased in multiples of 10,000 rupees, with a maximum purchase of 500 units. You may invest a total of Rs. 50 lakhs in these bonds.

These bonds offer a 5% annual interest rate.

However, based on the taxpayer’s tax bracket, income tax is due on the accumulated interest.

What are tax-free bonds?

Tax-free bonds are financial securities issued by the government of India to raise funds for a particular purpose. It can be for the construction of roads or any other infrastructure.

These bonds are absolute tax exempted under Section 10 of the Income Tax Act of India, 1961. The income generated through these bonds is only exempt from tax, however, the invested amount cannot be under come to the tax exemption (under 80C).

These bonds are also considered as one of low-risk bonds.

Examples of tax-free bonds – the National Highway Authority of India, NTPC Limited, Indian Railways, Rural Electrification Corporation, Housing and Urban Development Corporation, Indian Renewable Energy Development Agency, Rural Electrification Limited, and Power Finance Corporation.

What are Tax-Free Bonds?

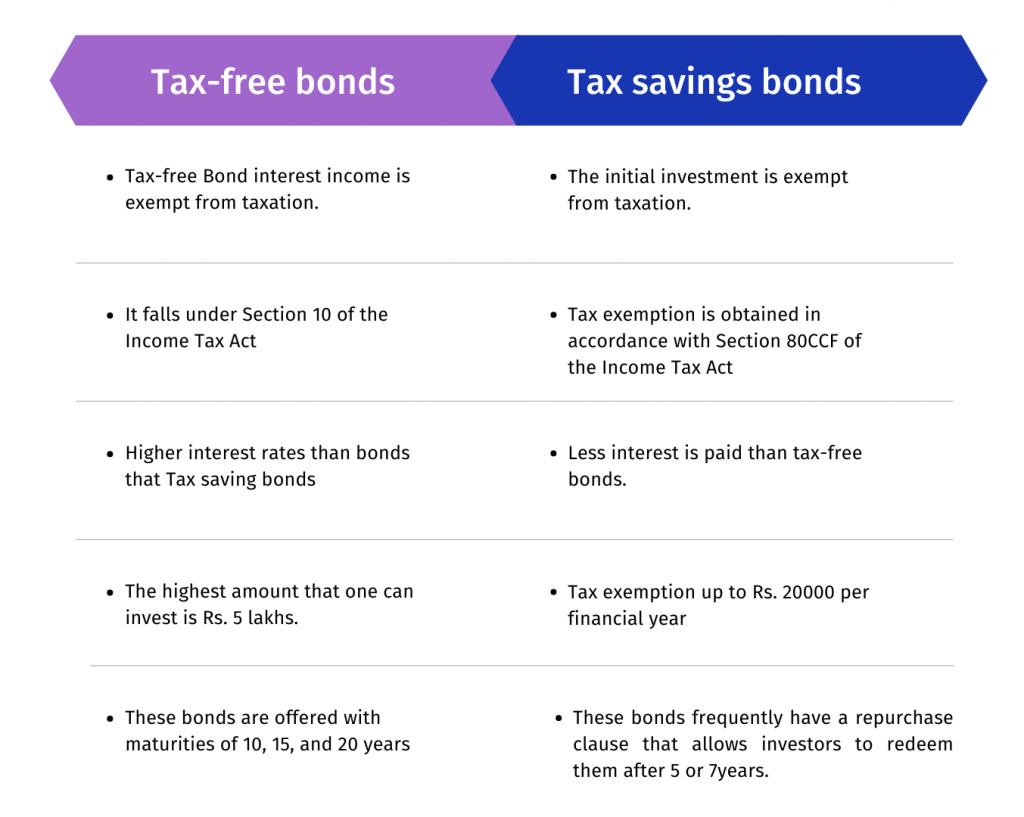

The difference between Tax-free bonds and Tax saving bonds

So, while tax-free bonds offer tax-free interest, tax-saving bonds offer you special exemptions for investment! Both are equally good for the investors and it depends on each individual investor where they like to park their investments to have tax exemptions.

Tax-Free Bond vs Fixed Deposit

Frequently asked questions

1. Who issues Tax-free bonds?

Public sector companies including NHAI, NTPC, HUDCO, REC, REL, IREDA, PFC, IRFC, and NABARD issue tax-free bonds.

2. What is the tenure of the tax-free bonds?

These bonds are long-term investments because of their typical maturities of 10, 15, or 20 years. You will receive the original investment amount upon maturity. The interest, however, will be yearly directly transferred to your bank account.

3. What is the tax impact?

You won’t pay taxes on the interest income you earn from these bonds. Therefore, the idea of TDS, or tax deducted at source, does not exist.

4. How do I buy tax-free bonds?

Bonds issued by the company may be acquired from them (primary market).

Such products are not now available in the primary market. So, the sole choice is to purchase them through the secondary market at the Bombay Stock Exchange or the National Stock Exchange (NSE) (BSE).