Environmental protection has unquestionably become a common understanding and development strategy of all countries around the globe. The environment is the basis and support of human life and survival, and the assurance of sustainable human growth. The modern human race is attempting to enter the postindustrial era and rebalance the environment at a later stage of development. To achieve reciprocal gains, sustainable world development, and to build a home on Earth for the peaceful coexistence of humanity and the environment, all nations must carry out their respective tasks and obligations in environmental governance.

Since the entire human race has been involved in disturbing nature from its natural functions, we have a responsibility to sustain and provide a better environment for future generations. We might be contributing to the growth environment fairly, but there is an opportunity to contribute further to prepare the world for future generations. Investing in “GREEN BOND” can be one of the significant contributions to the world. To grasp the full green bonds meaning, let us understand what is Green Bond and what its basics are.

How NRIs Can Invest in Indian Bonds?

What are Green Bonds?

Similar to a conventional bond, a “Green Bond” is a fixed-income financial product. The funds raised from investors for green bonds are only used to support initiatives that have a positive environmental impact, such as renewable energy projects, clean transportation projects, water management projects, etc. This is a key distinction between green bonds and conventional bonds. It encourages sustainability and works toward a number of goals, such as lowering pollution levels, enhancing energy efficiency, and lowering global warming.

History of Green bonds

The European Investment Bank first issued green bonds in 2007, which was approximately 15 years ago. The World Bank then started issuing green bonds in 2008 to support its financing initiatives for projects related to climate change. The significance of green bonds became increasingly apparent with the introduction and growth of ESG (Environment, Social, and Governance) and Sustainability Framework in the investing reporting framework.

As a result, the International Capital Market Association developed the Green Bonds Principles2 (GBP), which places an emphasis on transparency, disclosure, and integrity in the growth of the green bond market.

What are tax-free bonds?

Global Green bond market

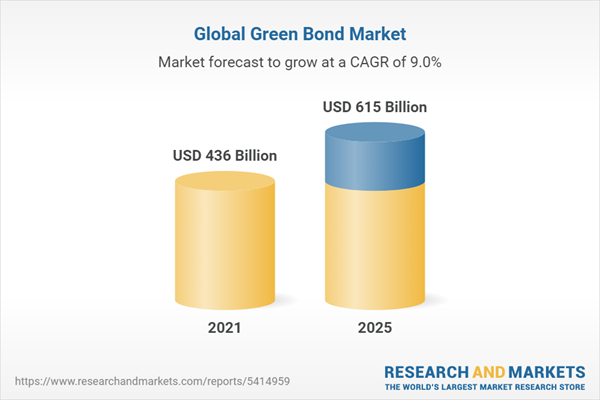

The Global Green Bond Market was valued at USD 436 billion in the year 2021.

What Are Infrastructure Bonds

Green Bonds Market in India

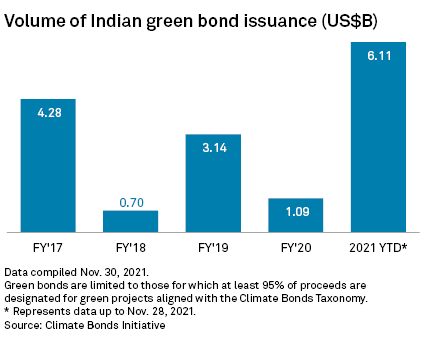

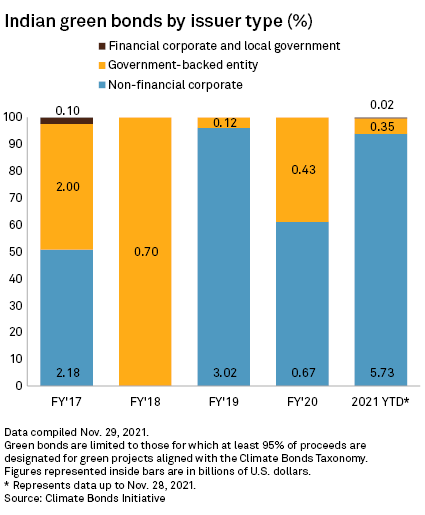

According to the Economic Survey 2019-20, the first half of 2019 saw transactions totalling $10.3 billion in green bonds, making India one of the Asian countries with the fastest-growing green bond markets. According to the U.K. based green bond tracking agency Climate Bonds Initiative, India issued $6.11 billion of green bonds in 11 months of 2021. As previously mentioned, green bonds are similar to regular bonds, except their proceeds are designated towards particular “green,” or climate-friendly, projects or assets.

According to officials with knowledge of the matter, India will issue at least 240 billion rupees ($3.3 billion) in sovereign green bonds as the nation transitions to a low-carbon economy.

India will need to invest $10.103 trillion by 2070 to achieve carbon neutrality, according to the CEEW-CEF. According to the think tank, developing carbon capture and storage technology and green hydrogen technology will cost an additional $1.494 trillion and $8.412 trillion, respectively, including both, to replace India’s coal-dependent power sector with renewable energy sources.

In accordance with the Paris Agreement, India’s Intended Nationally Determined Contribution (INDC) for the years 2021 to 2030 urges a 33% to 35% reduction in GDP emissions from 2005 levels, a 40% increase in installed capacity for non-fossil fuel-based energy sources, and the establishment of 2.5 to 3 billion tonnes of carbon dioxide equivalent in forest cover.

The country’s first green infrastructure bonds were successfully issued in 2015 by YES BANK, the fourth-largest private sector bank in India, raising INR 1,000 crores ($14,92,53,731) from the sale. The money received is being utilised by YES BANK to fund renewable energy infrastructure projects, including modest hydropower, solar, wind, and biomass projects.

Types of Green Bonds

An organisation-guaranteed bond, also known as a general obligation bond, bases its creditworthiness on the issuing organisation rather than merely the financed asset, in this case, the solar farm. The farm is recorded on the issuer’s books, and all of the issuer’s cash flow, not only that from the farm, is used to repay the lenders. The government, public institutions, or private companies may issue these bonds. Some of these bonds are also convertible, meaning the lenders have the option to convert them into equity at a later time.

Asset-backed bonds’ creditworthiness is only dependent on the projected profits from the solar farm; other cash flows of the issuer are not taken into account. The solar farm asset is moved into a different organisation, also referred to as a special purpose entity (SPE) or special purpose vehicle (SPV). This asset is everything that this entity has. Only money made from the sale of this farm will be used to pay back the loans.

A hybrid bond, often referred to as a covered bond, is a dual-recourse bond that can be set up in one of two ways. In the first approach, the farm is recorded on the issuer’s books, and in the event of a payment default, the lender will come into possession of the farm. If the farm’s value is insufficient to satisfy the debt, the lender will also be entitled to claim other assets of the issuer. In a second approach, the farm is an SPE, and when it defaults, the lender receives ownership of the SPE’s assets. Similar to the first approach, if the assets’ value is insufficient, the lender may file a claim against the issuer’s other assets as well.

How to Build a Monthly Pension Using Bonds

Regulation to Issue Green Bonds in India

A “green debt security” is one that complies with the SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021. Any debt security issued to raise money for projects or assets falling under any of the following categories is referred to as green debt security.

- Renewable and sustainable energy sources, such as wind, solar, bioenergy, and other clean energy sources.

- Clean transportation, such as public transportation and mass transit.

- Sustainable water management practices, such as recycling water and/or providing clean water for drinking.

- Adaptation to climate change.

- Energy efficiency, including green and energy-efficient construction, etc.

- Effective trash disposal, including recycling, waste-to-energy, and other practices.

- Sustainable land use, such as reforestation, sustainable agriculture, forestry, etc.

- Biodiversity conservation, as well as any other category that SEBI may notify.

Benefits of Investing in Green Bonds

- Green bonds offer a means for investors to support environmental concerns.

- Retail investors might find it too expensive to purchase a green bond. There are still green bonds that make it simple to invest in green bond baskets.

- People who are more conscious of and motivated to take action to combat climate change are drawn to the green aspect.

- Higher demand for green bonds results in a decrease in interest rates, which reduces company spending. These savings are either distributed as a dividend to investors or utilised to reduce the cost of borrowing, which boosts profitability.

- A few issuers additionally utilise the funds to take action to cut carbon emissions and restore water ecosystems and biomes.

- The credit rating of these bonds typically matches that of other financial instruments issued by the same company.

How Can One Diversify Their Portfolio With NBFC Bonds?

Are green bonds tax-exempt?

No, there will be no tax exemption for green bonds. Typically, nations that issue green bonds make sure that any income from these investments is tax-free. A lower borrowing cost will result from this. According to the official cited above, India won’t provide any such perks.

What are the Tax Implications of Investing in NBFC Bonds?

Closing thoughts

It has become imperative that each one of us has the responsibility for the development and protection of the environment going forward. The green bond can be one of the significant opportunities to be part of saving the world’s communities, which would enhance the longevity of the world’s existence. Let us do it.

Investment Strategies in the Bond Market

Green Bonds FAQs

What are green bonds?

A green bond is like a regular bond, which raises money for eco-friendly projects like solar power, clean transport, or water management. These products may be ideal for investors supporting the fight against environmental degradation.

Are green bonds tax-exempt in 2026?

No, green bonds are not tax-exempt in India, even in 2026. The interest earned through green bonds is taxable, unlike other non-taxable bonds. But their focus on a greener environment has helped keep them in demand among investors.

Are green bonds tax-free in India?

Green bonds aren’t tax-free, as the income from them is taxed in India, with no special exemptions. While some countries offer tax-free income from green bonds to reduce borrowing costs, India does not provide these perks.

Why invest in green bonds?

Investing in green bonds lets you support environmental concerns like reducing pollution and enhancing energy efficiency while earning steady returns like regular bonds. Conscious investors find green bond baskets accessible, as lower rates boost profits, and it’s an impactful choice.

What are green bonds in India in 2026?

In India, green bonds have been funding climate-friendly projects like wind farms and green buildings with banks like YES Bank since 2015. In 2026, they will target low-carbon emission cuts and non-fossil energy, as per SEBI regulations.

Latest Updated:13-02-2026