|

Getting your Trinity Audio player ready...

|

High Yield | AAA/Stable Rated | Minimum Investment: 10k Only

Power Finance Corporation Limited (PFC) offers non-convertible Debentures (NCDs), which are classified AAA/Stable by CRISIL, ICRA, and CARE, with rates of return between 7.45% and 7.55% every year and maturity of 3, 10, and 15 years.

Should you invest in Power Finance Corporation NCD?

Yes, you should plan on investing in PFC NCDs if you want a secure and stable investment. These NCDs assure secure and easy-redeemable investments at profitable interest rates, and they have high rates from major credit agencies.

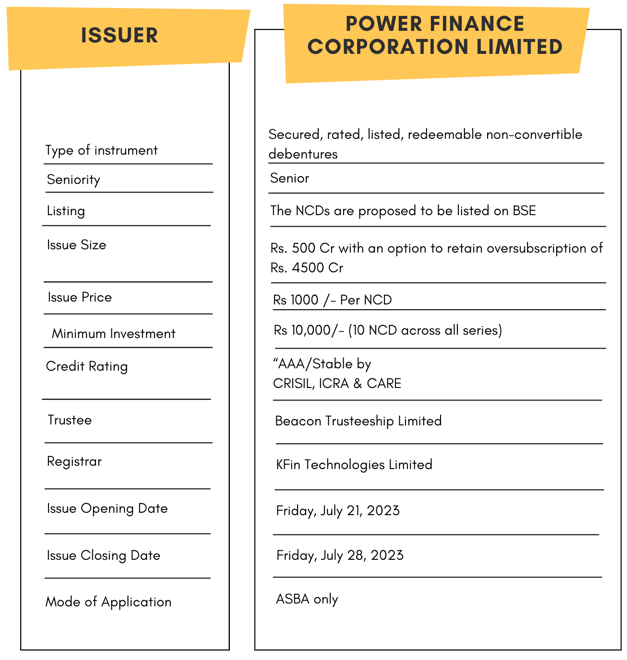

Bond overview

Power Finance Corporation Limited is issuing the Non-Convertible Debentures. These NCDs are AAA/Stable rated by CRISIL, ICRA and CARE. The NCDs are being issued in three series: coupon ranges from 7.45% to 7.55% p.a. and different tenures of 3, 10 & 15 years. The NCDs are secured and redeemable in nature.

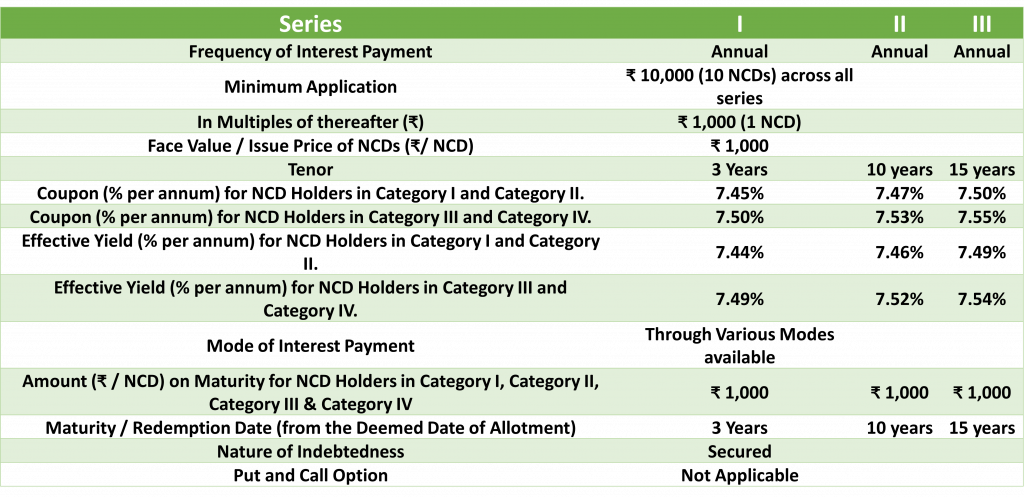

Coupon rates and effective yield for each of the series

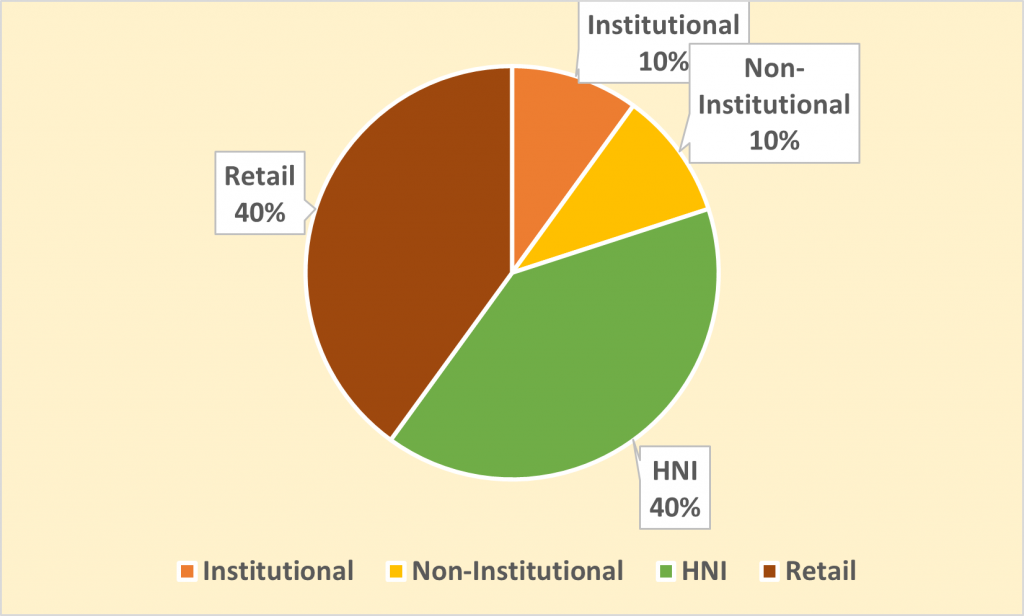

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for PFC NCD-IPO.

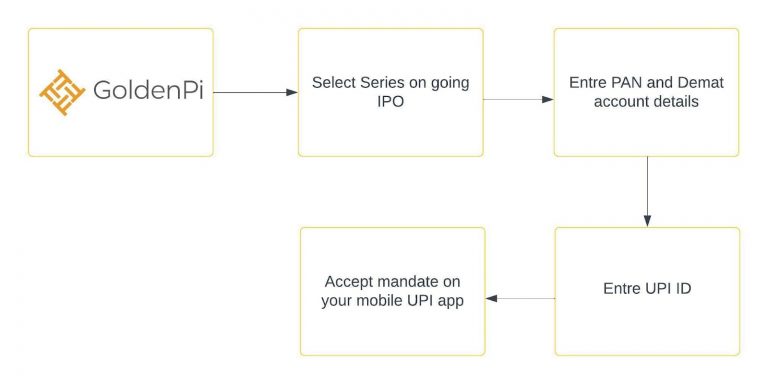

Investment Process for PFC NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

Issue analysis

Pros

- PFC has a AAA/Stable rating from CRISIL, which means that it is considered to be a very safe investment.

- These NCDs are senior secured in nature providing an additional layer of protection to your investment.

- An opportunity to invest in one of the leading NBFCs in India.

- An option to invest in short as well as long term tenures.

- Including AAA/Stable rated NCDs in an investment portfolio can diversify risk, especially for investors with a large exposure to equities or other high-risk assets.

Cons

- The interest rates on NCDs are typically lower than the returns on other types of investments, such as stocks or mutual funds.

- In a changing interest rate environment, the fixed interest rate on the NCD may become less attractive if market interest rates rise significantly.

Financial Overview

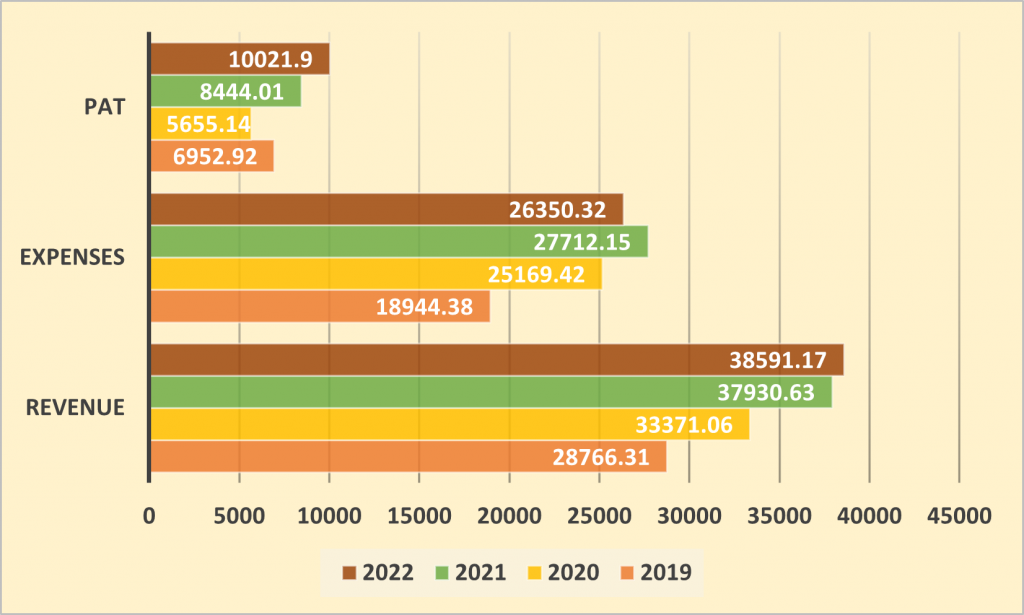

Snapshot stating the Revenue, Expenses, and PAT (In crores)

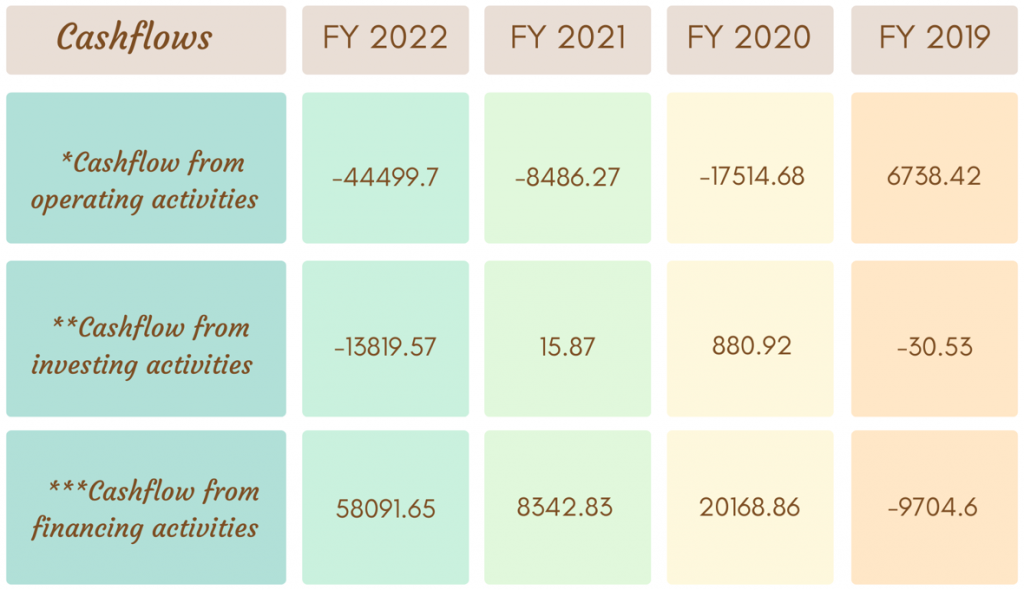

Cash flow for last 5 years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

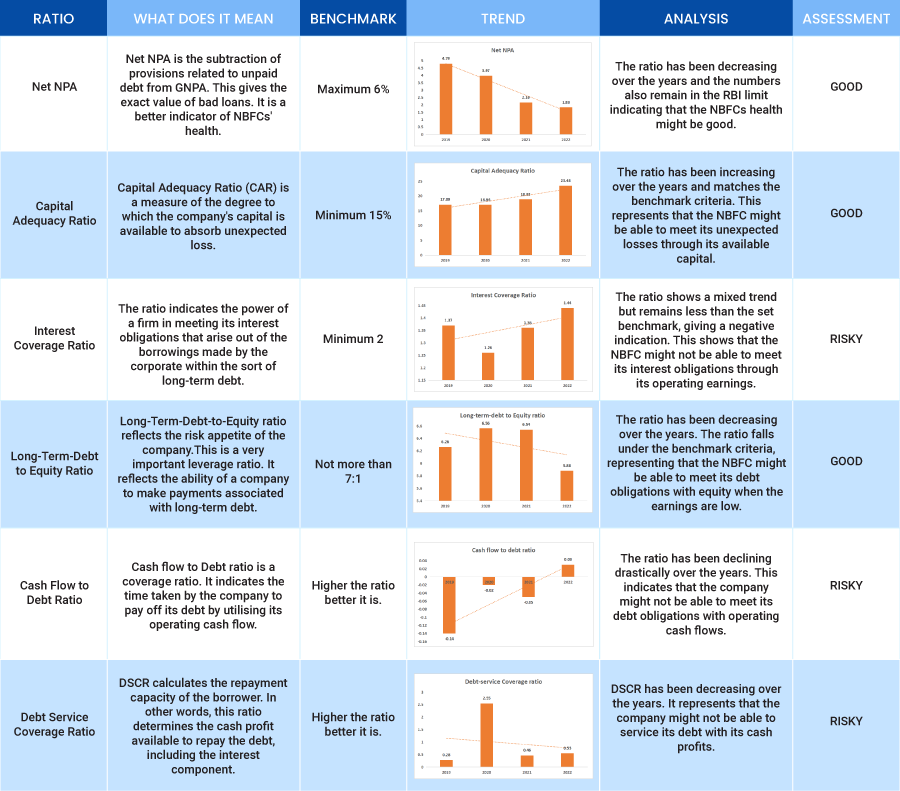

Ratio Analysis

To get better returns than Bank FDs, invest in NCD-IPOs online.

About PFC

Power Finance Corporation Limited (“PFC”), a Schedule-A Maharatna Central Public Sector Enterprise (“CPSE”) that specialises in the power industry, was founded in 1986 and is one of India’s top public financial institutions. According to the Companies Act of 2013, PFC is a publicly traded Government of India (“GoI”) business and a public financial institution. The Company is listed with the RBI as an NBFC that does not accept deposits.

PFC Group is the leading financial institution in India in the power sector-

- According to Public Enterprises, PFC is one of the Top 10 Profit-Making CPSEs in FY 2021–2022.

- Survey 2021–22, a document released by the Ministry of Finance’s Department of Public Enterprises.

- In October 2021, PFC received Maharatna Status, the highest honor bestowed upon a CPSE.

- According to Forbes Global 2021, PFC is rated 365th in the world in terms of the amount of its balance sheet assets.

- In the Fortune 500 India 2022, PFC is placed number 34.

- In FY 2021–2022, PFC produced its highest-ever net profit of Rs. 10,022 crores.

- Of all Central Public Sector Enterprises (CPSEs), the largest consolidated balance sheet size.

Strengths

- PFC offers its clients in the power sector a wide range of financial products, as well as related consultancy and other services.

- For more than three decades, PFC has played a crucial strategic role in GoI programmes aimed at promoting and developing India’s power sector.

- The ability to generate capital through public issues has been used to support the expectation that capitalization will remain adequate throughout the medium term.

- A sufficient mix of borrowings, with 57% coming from bonds, 20% from term loans, and 1% from other sources.

Weakness

- PFC’s asset quality is still intrinsically susceptible to borrowers with low credit risk profiles. The company only serves the power sector, with government sector power utilities accounting for 88% of its total loan book as of September 30, 2022.

Invest in Bond IPO online in just 5 minutes

Source: Shelf Prospectus and Tranche I Prospectus both dated July 17, 2023

Disclaimer: Invest only after referring to Shelf Prospectus and Tranche I Prospectus both dated July 17, 2023

| Details | Maximum yield | Overall Issue Size | Credit Rating | Start Date | Closing Date | For more details |

|---|---|---|---|---|---|---|

| Power Finance Corporation NCD IPO January 2021 | 7.15% | 5000 cr | ICRA, CRISIL, CARE AAA | January 15, 2021 | January 29, 2021 | More Details |

Key Takeaways

- CRISIL, ICRA, and CARE, all rated AAA/Stable, ensure a secure investment.

- New interest rates are between 7.45% and 7.55% per year.

- Available for a period of three, ten, and fifteen years.

- These come under senior secured debentures, giving an extra security level.

- PFC is a Maharatna CPSE and one of India’s largest public financial institutions in power.

- It works best for investors who are trying to divide risk across their holdings.

- Potential disadvantages include lower returns when it comes to equities or mutual funds, as well as set interest rates, which may be less appealing as market rates increase.

- PFC has an outstanding financial profile, with significant revenues and a huge balance sheet.

FAQs

1. What are the interest rates and terms for PFC NCDs?

PFC NCDs have an ROI ranging from 7.45% to 7.55% per year and mature at 3, 10, and 15 years.

2. What are the ratings on Power Finance Corporation ncd?

CRISIL, ICRA, and CARE rated PFC NCD AAA/Stable, advise that they are very secure investments.

3. How secure are PFC NCDs?

These NCDs are highly secured and also add an extra layer of security to each of your investments.