|

Getting your Trinity Audio player ready...

|

The popularly known stock market, though it came into existence after the bond market, remains in people’s sanity for its attractive returns.

Since the inception of bonds, they have been slowly growing but investors’ interest in them has begun to spike.

There is no doubt that booming economies are the hotspots for growing investments and India is in one such spot – more attractive than China and an alternative to US stocks these days.

The announcement of bond inclusion in JP Morgan is alarming news. On the other hand, the stable Indian rupee is something an investor is attracted to.

Bond Funds Taking Attention

If you have been reading but aren’t aware of what bond funds are, you’ll get an idea here.

Bond funds are more like your mutual funds and they also get the name debt funds. These funds are a basket of bonds and debt securities, which is a pool managed by a fund manager.

It’s known that these bonds will mature at a predetermined time and earn a monthly interest rate. The bond fund manager is so interested in diversification and earnings that they rarely keep them till maturity but rather buy and sell frequently based on the conditions in the market.

These are the funds that the South Koreans are allured by in India, due to vibrant bond market scenarios and its attractive returns backed by the growth of India and its inclusion in the index.

They are interested in high-yield bond funds. With a higher yield, the prices of the bonds are lower as they are inversely related to each other and that’s what has become attractive to investors.

So far, they have invested in US bond funds, and they believe in increasing the investment in Indian bond funds. Their funds in Indian debt have grown to a massive $22.5 billion, which was $17.7 billion at the end of last year.

The interest is rising in the minds of retail investors, which earlier was limited to a few institutional investors. Japanese investor interest has also increased in this regard.

The difference between bond funds and bonds

Rupee’s Stable Performance

Among all the currencies in the emerging market, India has stood out as the top performer and strongly against the dollar, it is up by 0.4%. Adding to that, its volatility has just been lower.

Why does the stability of the rupee matter in deciding on any investment, especially for foreign inflows?

The depreciation of the currency can’t make much money for the investors when they have initially invested in the instrument at a higher currency value. After all, the result is to make more money and hence the currency value should either be stable or higher for foreign investors to see any investment as beneficial.

That’s why stability matters a lot! Currently, the Indian currency is stable!

Source: Bloomberg

While this has been one of the major factors in considering Indian bonds for foreign investors, the other thing to consider is that the inflation has lowered, there is fairly no risk in politics, and India follows its fiscal policy disciplinedly.

If you are interested in knowing how the Indian rupee has been stable so far, the significant reason is the “current account deficit” and includes other fundamentals of a strong economy. Let’s speak in terms of CAD, which is quantifiable, to understand its impact on currency stability.

A current account of the country is the sum of the goods and services exported and imported. If imports are greater than exports, it creates a deficit, namely the “current account deficit.”. This deficit means the country is paying more for imports, which is not from earnings but rather from external sources.

This creates a demand for other foreign currencies; basically, in India’s case, the US currency looks more attractive and gets the demand. Earlier, the deficit was 3.8%, but now it has dropped to 1%, therefore taking the demand back to Indian currency again.

One of the reasons for a stable currency is the lowered current account deficit!

How to leverage volatility?

The difference between bond and bond funds

You must be aware of how these instruments work, let’s focus on how both make a difference concerning investment choices.

The good side of bonds and bond fund investments

If you are invested in bonds, you certainly get a predictable income where the interest rates are fixed on any bonds in which you invest. Well, the noteworthy point is that, in case of any risk, the bondholder gets first precedence in claiming the assets over the equity holders.

Diversification of bonds with a stock portfolio lowers the risk of the portfolio at any given time as the stock and bond have no direct correlations.

While diversification is the good side of the investment even in bond funds, as it’s a portfolio of bonds with different maturities, it can lower the risk of your portfolio too. Also, when handled by a proficient fund manager, you are well-managed in terms of your portfolio.

When it comes to liquidity, bond funds get the upper hand as there are more buyers and sellers in the market.

The not-so-good side of the investments

One simple thing to understand in the bond market, which also holds good for bond funds, is that the bond price and the interest rates are inversely related, meaning when one goes up, the other declines.

Therefore, interest rate risk is the same for both instruments. In a situation where the interest rates are hiked by the RBI, the bond price will be lower and when you sell in the secondary market, what you receive is a lower return.

While bond funds are more liquid in the market, bonds are not, so you’ll have a bit of a hard time finding buyers and sellers. If we continue thinking further, when inflation rises in the economy, the returns from the bond may not beat the inflation rates if the interest rate is lower. So you should always keep the inflation rate and the interest rate in check!

The last risk to take care of in terms of the bond funds is the credit risk. Since you have a portfolio of bonds, if one or two default, your portfolio gets a hard hit by lowering the overall return, which isn’t the same in a portfolio of bonds and stocks.

Lastly, if debt funds are mutual funds, the fund manager needs some part of your money as they are managing your portfolio.

Beyond this, it’s up to your logic and opinion to find out what’s good for you in terms of making good returns.

Difference between listed and unlisted bonds

Let’s get back to Korea

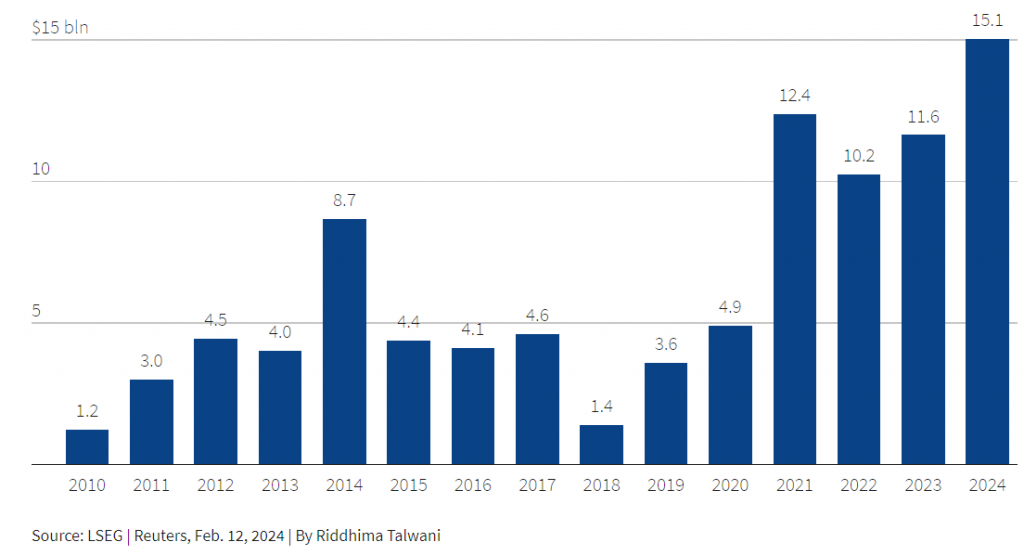

The US dollar bond issuance by South Korea has reached a record high in 2024, as you can see below.

Source: Reuters

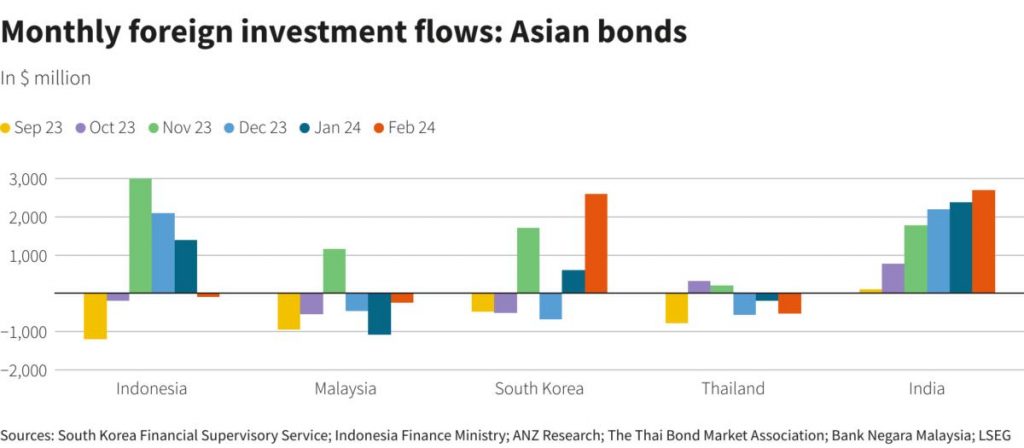

Now look at the foreign investment inflows on a monthly basis in Asian bonds, India is gradually picking up investors’ interest.

Source: Reuters

The overseas capital inflows in Indian bonds came to an investment of $2.7 billion, which is the highest ever since 2017 monthly inflows.

The inclusion news alone will lure an inflow of $30 billion, which will exceed the current foreign investment holding size of the Indian sovereign bonds. South Korea’s Mirae Asset Management’s global fixed income division head, Kim Jin Ha, has been managing the India Fund ever since 2013.

Here’s what he looks forward to:

- His preference to invest is in Indian rupee bonds issued by supranational corporations.

- 40% of the fund will be holding these securities, while the remaining will be taken by those debts that are issued by the country’s state companies. Also including the currency and the Treasury.

- He decided to increase the duration of holding the bond, considering the FED’s rate cut later this year.

- In the past 12 months, this fund has returned about 9.6%.

Now, just imagine how much more inflow can be seen after the inclusion.

Have you been thinking about investing in bonds lately? While foreign investors are attracted to keeping tabs on the growing economy, what are you waiting for? Check out Bonds!