A High Net-worth Individual (HNI) in India is one who has an investable surplus of 5 crores annually. According to Capgemini’s World Wealth Report, India’s HNI population grew at the fastest rate of 20% between 2017 and 2018, and the cumulative wealth stood at 877 billion dollars in 2018. And, today we’re moving towards a milestone of having a million millionaires. If you belong to this exclusive group of HNIs and are wondering how to grow your wealth in a low-risk and stable manner, without heavy tax-cuts, there are few solutions for you.

While traditionally, HNIs have been active in investing across residential and commercial real estate investments, mutual funds and gold bonds, they continue to find some level of difficulty in accessing and investing in the Bond Market. This fixed-income investment segment offers a range of low-risk financial instruments – from tax-free bonds to PSU Bonds, capital gain bonds, and corporate bonds that can offer HNIs the benefits they are looking for. Bonds can prove to be immensely enriching investment options for HNIs, offering benefits ranging from tax-free income, substantial capital gains in a rising interest economy to earning predictable fixed returns to offset their exposure in other risky asset classes.

So, if you are an HNI, here’s a simple guide to how you can invest in bonds:

STEP 1. – Select the Bond/s that you want to invest in

The first step involves browsing through the latest bonds available in the market. You can choose corporate bonds, public-sector bonds, corporate fixed deposits or tax-saving bonds based on your financial goals. GoldenPi offers a one-stop solution where you can browse through the latest bonds available in the secondary market. You could also check out the National Stock Exchange (NSE) to get information related to government bonds.

STEP 2. – Documentation

HNI investors can buy bonds from the primary market (IPO Issuance) or the secondary market. The documents required for investments varies based on this criterion.

IPO:

a. If you’re investing in a bond IPO, then you just need to fill up the Sample IPO form. GoldenPi will send this form to you. GoldenPi will also get the form picked up from your place via its delivery partners

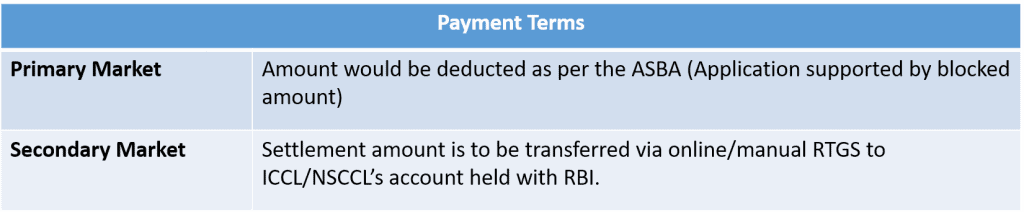

For an IPO application, no payment is required. This is as per the latest ASBA norm. As per this norm, once you apply for an IPO with your form, your application amount (mentioned in your form) gets blocked in your Bank Account. Once you get allotment successfully, the corresponding amount gets deducted from your account. The bonds units get credited to your Demat account.

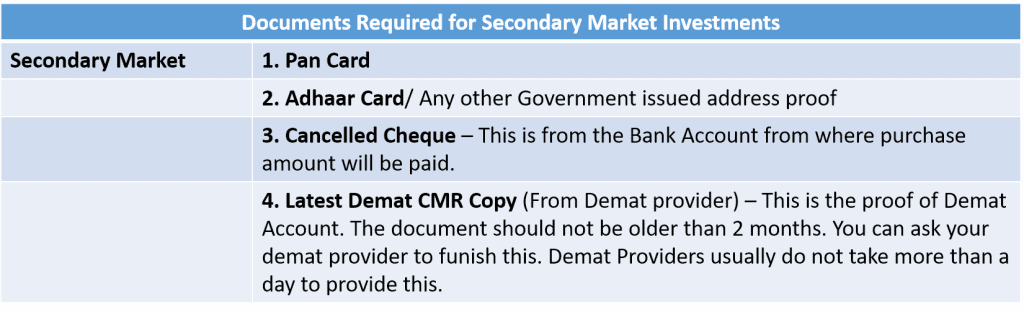

b. For secondary market investments, investors need to complete all KYC formalities which include submitting address proof, pan card, canceled cheque, and CMR Demat copy. Once KYC is completed, you will be eligible for bond transactions.

The following are the documents that are required:

If you are investing in Bonds via GoldenPi, rest assured that all your documentation, physical document pickup and processing will be done by our dedicated KYC desk.

STEP 3. – Receiving the Bond Units in Demat Account

a. IPO:

On successful allotment, the bond units will automatically be transferred to your Demat account. The application amount for the units allotted will get debited from your Bank Account.

b. Second Market Purchase:

For the purchase of bonds from the secondary market, Sample Deal Sheet or consideration sheet is generated with all the details of the transaction (buyer details, seller details, price, yield, etc). You’ll have to sign and send a scanned copy to us to complete the purchase process. Then you have to remit the purchase amount for the bond to ICCL/NSCCL or directly. You can use manual or online RTGS payment to remit the money. (ICCL/NSCCL are the counterparty settlement bodies in India.)

The bond units will be transferred by ICCL/NSCCL to your Demat account on the same day.

To sum up:

*RBI – Reserve Bank of India

You can invest in bonds via GoldenPi

As India’s first online platform for bonds and debentures, we at GoldenPi have simplified the entire bond investment process for you. From selecting the top bonds in the market to completing the transaction process for you, we follow a completely transparent and smooth process, making investments in bonds easy and effortless.

Reach out to us to start investing in bonds.