As the title suggests, the RBI monetary policy is a policy formulated by the central bank, i.e. Reserve Bank of India or RBI, and relates to the monetary matters of the country, like regulating the supply of money, availability, and cost of credit in the economy. Its primary objective is to maintain price stability while keeping in mind the growth factor. As we all know, price stability is a necessary precondition for sustainable growth.

Recently the Reserve Bank of India has announced a couple of policies and most of us might still have many questions in mind. For example:

How are these policies going to affect the nation’s economy?

Will it help in the recovery of domestic economic activity?

Through this blog, we will try to give you a brief summary of the recent announcement and its overall impact.

On 10th February 2022, RBI’s Monetary Policy Committee(MPC) announced its monetary policy on an assessment of the current macroeconomic situation such as employment, inflation, productivity, interest rates, the foreign trade deficit.

First of all, let’s understand the 2 kinds of policies in the context of an economy:

- Monetary Policy

- Fiscal Policy

The primary difference between the two is that the Monetary policy is formulated by the central bank, i.e. Reserve Bank of India, whereas, a Fiscal Policy is formulated by the Government of the country.

A Fiscal Policy is the projection of earnings and expenditures made by the government to influence a country’s economy, whereas, Monetary Policy is a set of actions undertaken by RBI to control the overall money supply and achieve sustainable economic growth in the economy. The policy is set to maintain a very low rate of inflation or deflation so that the general level of prices does not show significant fluctuations. The policy is with regard to the use of monetary instruments under its control to achieve the goals.

These instruments are:

- Bank rates

- Repo rate

- Reverse repo rate and

- Marginal standing facility rate.

The Monetary Policy Committee(MPC) consists of 6 members, including the Governor of RBI, Deputy Governor of RBI and 4 others. Once every 6 months, the RBI publishes a Monetary Policy report.

In this article, we will try to understand the changes that have taken place because of the February 2022 Monetary Policy.

Let us have a look at the exciting new Highlights of Monetary Policy 2022

a. RBI plans to keep the following rates in its Monetary Policy unchanged

| Indicator | Current Rate |

| Repo rate | 4% |

| Reverse repo rate | 3.35% |

| Marginal Standing facility rate | 4.25% |

| Bank rate | 4.25% |

As per the bond market, it was expected that the RBI would make some changes in the prevailing indicators which would result in an increase in the interest rates, yields of the bonds can also move upward, leading to prices of such bonds going down.

But with no change in the RBI monetary policy and demand still staying the same in the bond market, prices of such bonds moved northward, and the interest rates moved downward.

Note- Interest rates share a parallel relationship with the yields of the bonds, whereas the yields of the bonds share an inverse relationship with the price of the bonds

What do these parameters mean?

- Repo rate: Repo rate is the rate at which banks borrow from RBI on a short-term basis against a repurchase agreement. Under this policy, banks are required to provide government securities aka G-secs as collateral and later buy them back after a pre-defined time.

- Reverse Repo Rate: Reverse Repo rate is the rate at which RBI takes money from banks and pays interest in return. The Reverse repo rate is always less than the repo rate.

- Marginal Standing Facility (MSF) Rate: MSF Rate is the interest rate at which the Central Bank lends money to commercial banks. Commercial banks avail loans at this rate when they are facing an acute shortage of liquidity. Banks availing of MSF Rate can use a maximum of 1% of SLR securities.

- Statutory Liquidity Ratio is a minimum percentage of deposits that a commercial bank maintains as a reserve before offering credit to customers. These could be maintained in the form of liquid cash, gold, or other securities.

- Bank Rate- Bank rate is the rate at which the banks can borrow money from the Reserve bank of India without providing any security.

b. To support the economy during the Covid-19 situation, RBI’s monetary policy committee decided to maintain the accommodative stance to revive and sustain growth on a durable basis.

An accommodative stance means that the central bank plans to keep the rates of the monetary instruments unchanged. This shows that RBI is willing to infuse money into the economy to boost economic growth. Taking loans becomes affordable in this stance.

In an economy adopting an accommodative stance like India, RBI plans to infuse as much capital as possible, until the inflation is under a set target. This would eventually lead to low lending rates, through which corporates, MSME’s and other incorporations would be able to take more loans from the banks. It can lead to the utilization of more resources which would fuel the growth of the nation in the near future.

c. With RBI infusing money into the economy (as read in the b point), inflation also goes up. Therefore, the Monetary Policy Committee is projecting to retain the inflation for 2021-22 at 5.3% (Q4- 5.7%). It also assumes a normal monsoon in 2022.

A normal monsoon means an appropriate amount of rainfall which would improve the condition of farmers, their income would increase. It also indicates that a good supply of food and its related commodities would be maintained, hence making the prices fair and affordable for the public. Thereby maintaining the rural demand and consumption. Whereas lack of supply with more demand would lead to prices shooting up. This will enhance India’s food production and GDP growth.

Expecting a normal monsoon in 2022, MPC projects a Consumer Price Index (CPI) inflation of 4.5% in 2022-23 (Q1- 4.9%, Q2- 5%, Q3- 4% and Q4- 4.2%). These decisions align to achieve the medium-term target for consumer price index (CPI) inflation of 4 percent within a band of +/- 2 percent, while supporting growth.

| Consumer Price Index- Consumer Price Index or CPI is an index measuring retail inflation in the economy by collecting the change in prices of most common goods and services. |

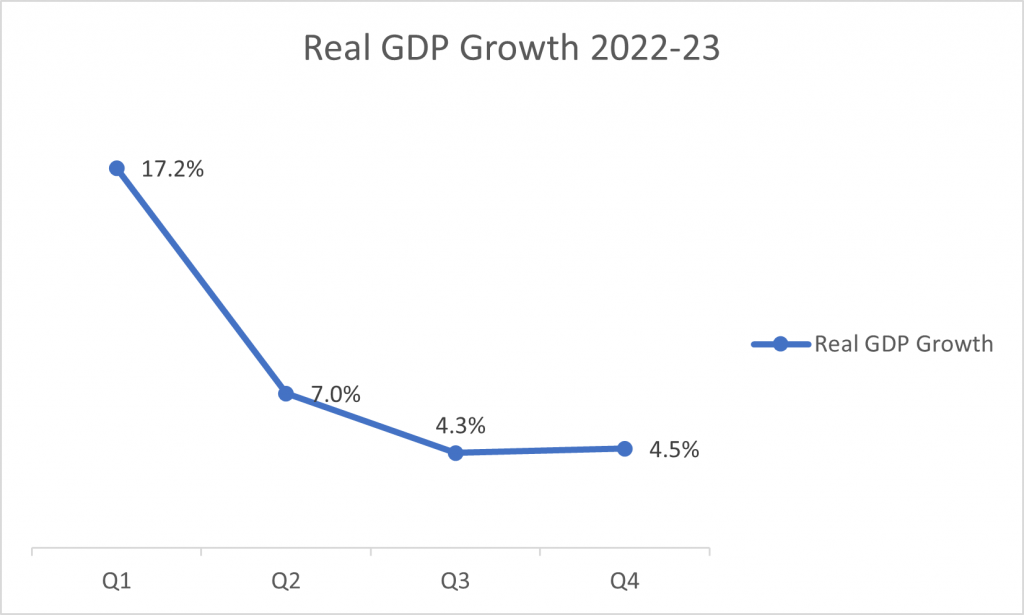

The increase in the capital expenditure announced in the Union Budget 2022-23, boosting the infrastructure, will lead to an increase in the aggregate demand in the economy. Furthermore, due to more demand, the economy would grow. MPC projected a real GDP growth at-7.8%

| FY 2022-23 | Q1 | Q2 | Q3 | Q4 | |

| Real GDP Growth | 7.8% | 17.2% | 7% | 4.3% | 4.5% |

Gross Domestic Product is a monetary measure of the market value of the Final goods (goods and services produced minus the value of goods and services used to produce the product) in a specific time period by country.

- Real GDP is the market value of goods and services produced in an economy adjusted for inflation to reflect changes in real output.

- Nominal GDP is the market value of goods and services produced in an economy at its current price.

To read more about this, please refer to the previous article – BUDGET 2022: WHAT DOES IT MEAN FOR THE BOND MARKET AND ITS INVESTORS?

d. Global Central banks of developed nations accelerated their fight against inflation. These banks have tightened liquidity, i.e. increasing the interest rates, hence, making loans expensive and difficult to take. This can lead to less money sloshing in the economy, affecting the global demand. With less money in hand, demand goes down, thereby affecting the exports done by India. Fewer exports mean less income. These supply chain disruptors create inflationary pressure. Also, because of monetary policy, normalization in developed nations creates instability in financial markets. Considering this one of the major reasons, MPC concludes that the ongoing domestic recovery is still incomplete and needs continued policy support.

| Global Central Banks increase interest rates→ Loans become expensive→ low money supply in the economy→ demand moves downward in the specific country→ Fewer exports for India→ Lower Income for India |

Furthermore, the northward push in the yield curve of bonds cannot be afforded by the RBI. Hence, RBI should intervene and comfort the market forces, like they did last year by purchasing G-secs through Open Market Operations to cap yield. In order to control money supply, the RBI buys and sells government securities in the open market. When the RBI sells government securities, the liquidity is sucked from the market, and therefore the exact opposite happens when RBI buys securities. The latter is done to control inflation. The objective of OMOs is to keep a check on temporary liquidity mismatches in the market, owing to foreign capital flow.

- As stated in the Budget 2022-23, the increment in the capital expenditure for the development of infrastructure in the economy, have increased the total amount that the government will borrow to make such developments.

To facilitate its high borrowing program, RBI has made some changes to its Liquidity management framework.

- Variable-rate repo for different tenures will be conducted as and when required, with the Cash Reserve ratio maintenance cycle.

- The main liquidity management tool will be considered as the 14-day tenor , variable rate repo, and reverse rate repo. They will also be conducted within the Cash Reserve Ratio maintenance cycle.

The Reserve Bank of India (RBI) aims to reduce banks’ dependence on the overnight liquidity window and instead look at a 14-day auction to manage liquidity operations.

| A reverse repo is the rate at which RBI borrows money from banks. This is partly done at a fixed rate, and some of it is at a variable rate.

Cash Reserve Ratio is the share of banks total deposits that are being maintained as reserves by the Reserve Bank of India in the form of liquid cash. |

e. An Increase in Crude oil prices also serves as a big concern for the bond market. With the increase in the Crude Oil price, import inflation would also increase. An increase in inflation would lead to an increase in Fiscal deficit. Henceforth, to fill up the gap created by the Fiscal deficit, more borrowings would be required. With more borrowings, the yields on the bonds would also move northwards.

| Increase in Crude Oil Price→ Increase in Import price→ increase in inflation→ Increase in Fiscal deficit→ More bond issuance → More supply in market → Price of existing bonds drop → Yields of existing bonds increase → New bonds issued will bear higher coupon rates to match high yields in the market. |

Trends seen in the Bond market due to the RBI Policy-

- Projected Inflation is much lower than the estimated. As the Inflation and repo rate has come down, the yield curve has also shifted down.

- Due to no change in the RBI’s monetary policy and them still sticking to the accommodative monetary policy, Yields on G-secs have also shown a downward movement.

Summary:

To sum it all, the key policy rates will remain unchanged to maintain the supply of money in the economy, and also to revive and sustain growth, retaining its accommodative policy stance and supporting the “uneven economic recovery” in the wake of the Covid pandemic. There is no change in the rates of the monetary instruments. Believing in keeping inflation in an appropriate range, RBI will infuse money as much as possible to facilitate growth and capital expenditure. Higher bond yields not only put pressure on interest rates but also lead to a rise in lending rates.

Let us all believe in our strengths and be optimistic about what is yet to come.