In recent years, bond investments have become increasingly popular, a trend observed over the past decade. Market turbulence and fluctuations have contributed to this rise, and even today’s market conditions can be unpredictable. As a result, investors are opting for diversified portfolios to secure regular fixed returns on their investments.

While bond investments have seen notable growth, investors often have questions about the relationship between bond prices and interest rates and why discrepancies may arise between them.

Let’s explore the fundamental relationship and correlation between interest rates and bond prices.

What is the bond price?

Bond price is face value of the bond while buying bond though you may either be discounted or higher pricing but the face value will be constant.

What is coupon rate or Interest rate?

Coupon rate is that the bond issuers pay interest on the bond’s face value, which is known as the coupon rate. In other words, it is the interest that is paid to the bond buyer regularly by the bond issuer. Bonds’ coupon rates are calculated using their face values.

For example, if the coupon rate on a bond is 5 % on a Rs.10000 bond, the coupon payment comes out to Rs. 500 per year.

Coupon rate = Annual Coupon rate / Par value of the bond or face value of the bond

- Par Value = Rs.10000

- Coupon Rate = 5%

- Annual Coupon = Rs. 100,00 x 5% = Rs.500

Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of Rs.250 each year for as long as the bond is still outstanding.

- Number of Periods (N) = 2

- Coupon Payment = Rs.500 / 2 = Rs.250

What is the difference between Coupon Rate and Yield to Maturity?

Bond prices and Interest rates are in inverse relationship

Interest rates and bond prices fluctuate in direct opposition to one another and have a direct impact on one another. Bond prices decline as market interest rates rise, and they increase when market interest rates decline (increase).

Interest rates increase and bond prices goes down

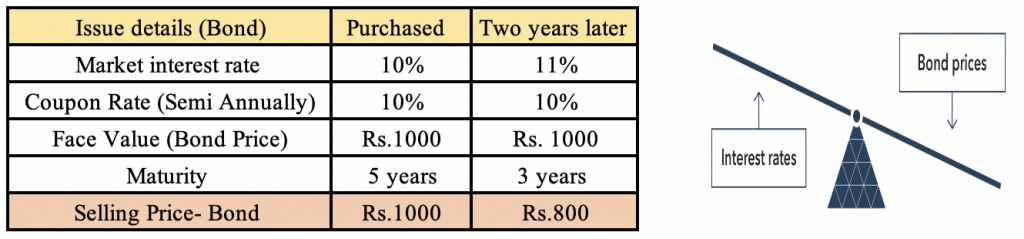

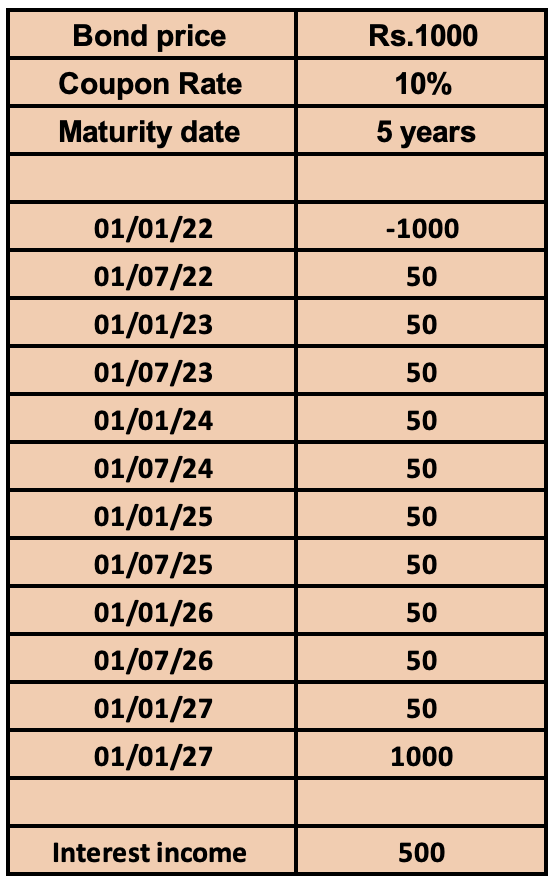

If a XYZ buys a bond in January 2022 from ABC company with face value (Bond Price) of Rs. 1000 with a coupon rate (interest rate) 10 % and maturity period 5 years (end with January 2027), payment duration semi-annually.

XYZ will receive Rs.50 once every six months as interest against the bond price for the next five years.

The cash flow.

After the two year of the bond purchase, the same company issues the same bond with a higher interest rate (coupon rate).

Bond price –Rs. 1000

Interest Rate – 11%

Maturity – 5 years

Payment mode – Semi-annually

Now the XYZ wants to sell the bond in the market but the buyer won’t buy the bond at the face value (bond price at the time of purchase in January 2022) since the same bond has the higher interest rate currently. Therefore, the seller has to sell the bond at a lesser price than the purchase price.

What is the difference between Corporate and Governments Bonds?

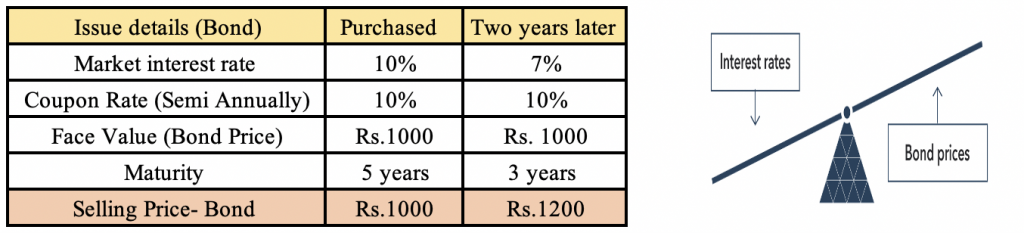

Interest rates decrease and bond prices goes down

If a XYZ buys a bond in January 2022 from ABC company with face value (Bond Price) of Rs. 1000 with a coupon rate (interest rate) 10 % and maturity period 5 years (end with January 2027), payment duration semi-annually.

XYZ will receive Rs.50 once every six months as interest against the bond price for the next five years.

After the two year of the bond purchase, the same company issues the same bond with a higher interest rate (coupon rate).

Bond price –Rs. 1000

Interest Rate – 9%

Maturity – 5 years

Payment mode – Semi-annually

Now the XYZ wants to sell the bond in the market but the buyer has to pay a higher price than the face value (bond price at the time of purchase in January 2022). Since the previous issue was issued at a higher interest rate than the current one. The buyer has to pay higher.

The cause for the impact on bond Price and Interest rate variation.

Inflation is one of the main factors influencing how bond prices and interest rates change. The economy as a whole experiences constant price increases due to inflation. Bond prices will therefore be more affected by inflation.

Example: XYZ company may issue bonds with following before the inflation.

Bond price – Rs.1000

Interest rate (coupon rate): 10%

Maturity – 5 years

The same company may issue the same bond with the following during inflation.

Bond price – Rs.1000

Interest rate (coupon rate): 15%

Maturity – 5 years.

Therefore, bond prices and interest rates are inversely correlated. Investors can choose bonds based on their investment plan.

How to analyse the credit worthiness of corporate bonds?

FAQ’s on What is the relationship between bond prices and interest rates?

1. How are bond prices and interest rates related?

As per industry understanding, bond prices and interest rates move in opposite directions (inversely related). When interest rates increase, bond prices usually come down, and vice versa. This happens because new bonds with higher coupon rates make the existing bonds less appealing. Thus, their prices fall in the secondary market.

2. How does a rate change affect your bond holdings?

Changes in interest rates only influence the “market price of bonds” prevailing in the secondary market. If you hold the bond to maturity, you continue receiving fixed interest and principal at maturity, as per the bond terms.

Latest Updated: 23-02-2026