|

Getting your Trinity Audio player ready...

|

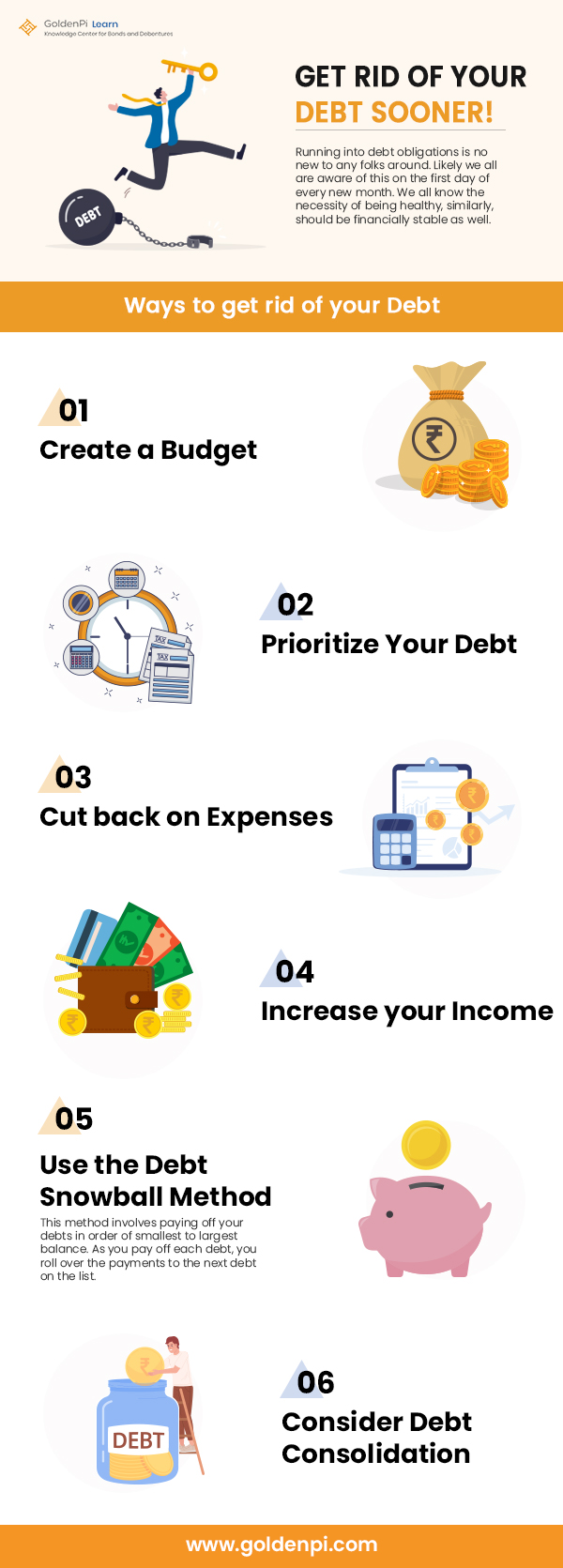

Running into debt obligations is no new to any folks around. Likely we all are aware of this on the first day of every new month. We all know the necessity of being healthy, similarly, should be financially stable as well.

If your health report knocks your consciousness, sometimes you need to check the credit report to shed light on the financial aspect of your life. Well, regardless of whether you check it or not, lenders when the time comes will definitely ring the bell to you.

Well, are you in a drastic dilemma that’s questioning you of a thought, “How to get rid of debts?” Let’s figure it out!

Clarity arrives when you Budget

Do you know it all comes down to managing your bank account? Though it might come out as obvious, we don’t intend to take a look to sort it out.

Now it comes down to how good you are at budgeting the money lying in your bank account. Have you thought of it or have to? If not, it’s time to segregate it into baskets appropriately.

What are these baskets after all?

Essentials for saying “Expenses”, requirements for saying “Wants”, and quintessential for saying “Savings”

There are no days that go without traveling, eating, or having a place to live. They are your definite expenses which need your money to be put into. And it takes a set budget of money from your pocket that you can’t escape. So, without thinking it occupies 50% of your budget.

Wants always remain wants; coming out of desires. A desire to explore a new restaurant, a desire to travel to a new place that was never explored, a desire to wear fancy apparel, a desire to live in a modern house. And they are never-ending, isn’t it?

Just living with expenses all the time might not serve the purpose, after all, we are humans with emotions and tend to cling to desires. Let’s allocate 30% of your money for it. Note that at times you might have to sacrifice it by settling for a lesser percentage sometimes.

And the last basket comes down to savings. Of course, you can’t blow all the money that you receive and later realize that you have none left for the times when it’s an emergency, a sudden plan, or in the worst scenario of losing your job. Ensuring to give at least 20% of the money for that is quite essential. If it’s more than 20% it is also good to go!

But how does it help to clear your debts though?

Well, your savings part of 20% is where you’ll take your money to pay off the debts. If you remember, sometimes expenses can be sacrificed, it’s for this reason that you can add some to the savings to clear the extra debt that’s over your head.

The percentage explained is as per the 50/30/20 budget rule. You can ensure to make changes in the percentage while keeping the precedence as is with the degree of its value.

Why did managing the budget matter here? Because it’s a conscious act of segregation that keeps in check where all your money flows.

If that alone could fade your debts, you wouldn’t be here. Once you know how to manage that might still take away a part of the burden. Now let’s look into how to manage.

By when will your investment get doubled?

Higher-interest Debts come first

Okay, now that you understand how to track your expenses and split your money to ensure you have enough to make payments toward your debt, the next question is to know which debt you pay first. Should you clear the smaller debt so that you have one less thing to worry about or should you try to pay off the biggest one first?

Understanding that you need to make the minimum payment so that you don’t incur any additional interest than the terms you agreed to is of prime importance.

Imagine you have three different debts that you make monthly payments toward. These might be the new flat you moved into, a car that you recently bought, and that new latest iPhone which you had to buy, because why not?

The first thing to do is to be aware of the minimum payment that you need to make toward all three EMIs. Calculate how much each of these costs you and sum it to understand the minimum amount of money that you require. This is for the short term.

However, for the long-term goal of being debt-free, you need to employ a more strategic approach often referred to as the ‘avalanche method,’ which will help you save money on interest in the long run and speed up the debt repayment process

Here’s how you do it.

- Jot down your debts and their interest rates, high to low.

- Pay the minimum on all to dodge penalties or extra interest.

- Have some extra money? Use it to tackle the highest-interest debt and reduce overall costs.

- Once the top-interest debt is settled, proceed to the next one, and keep going until you’re debt-free!

Clear more than minimum

This must be the most obvious point in this blog which we all are aware of, however, when it comes to applying it in real scenarios, we tend to ignore it as it can be challenging to follow.

Say you got a raise. That’s awesome, continue hustling! You definitely deserved it. But before you start splurging on that Gucci boots or that Prada handbag, just think what’s actually the best use of your newfound extra cash?

It’s great that you are keeping up with those monthly payments per the terms and doing fine. But you could actually escape the shackles of debt sooner if you toss your excess cash toward the repayment. There’s of course a limit on how much you can pay out in one shot per year, but reaching that significantly reduces the burden as the principal shrinks and a huge chunk of the monthly payment reduces!

Bear in mind that every bit matters. Even if you can only manage a modest amount above the minimum, you’re still moving forward. Stay dedicated, and watch your debts diminish quicker than you ever imagined.

You decide, would you prefer short-term pampering or early freedom? The choice is yours.

Why do you pay taxes by the way?

Refinancing the Debt with a Consolidation Plan

Losing track of all the debts can be a tricky problem to handle.

If only there were a solution wherein all those debts were wrapped into one tidy package, easier to manage and possibly with a lower interest rate. Sounds like a dream, right?

Well, don’t be shocked to know that you can actually consider such a plan.

Get started by scouting options like personal loans, home equity loans, or swapping high-interest credit card balances for low-interest ones. Shop around, and compare rates, terms, and fees to lock in the best deal. Keep in mind, consolidation isn’t a debt-disappearing act, but it sure streamlines repayment and might save you a pretty penny.

Watch out, though! Don’t let the “freedom” of consolidation trick you into piling on more debt. Stick to your budget and keep your focus on a debt-free future.

How does the psychology of investors work?

Hustle to get a Little Extra

While in debt, everyone only thinks of one thing ;“If only I had extra money” .

It’s time to hustle and grab those extra bucks! Not only does it help you reduce your debt faster, but it also gives you a sense of accomplishment and self-reliance.

You can always explore debt instruments like bonds, CFDs, and NCD IPOs to get a steady return. You can invest as low as 10,000 Rs. Once you start investing after a proper research on the particular asset, you can channelise the returns to clear your debts.

The possibilities of earning a little extra apart from your active income are endless!

Remember, every bit of money you earn from your side hustles can be channeled toward reducing your debt. As you witness your outstanding balance shrink, you’ll feel a sense of achievement and renewed motivation.

So, gear up and hustle to earn that extra cash. Your journey toward a debt-free life just got a little shorter and much more exciting!

Wrapping Up

The journey toward a debt-free life might seem daunting at first, but with a bit of determination, strategic thinking, and a healthy dose of hustle, you’ll find yourself reaching that finish line sooner than you thought was possible.

As you continue to chip away at your debts, stay focused on your ultimate goal: financial freedom. Embrace the sense of accomplishment that comes with each debt paid off and let it fuel your determination.

So, take a deep breath, roll up your sleeves, and dive into the world of savvy money management. With persistence and dedication, you’ll soon bid farewell to debt and embrace financial success.

See you on the other side!