|

Getting your Trinity Audio player ready...

|

Current 10 year G-Sec Par Yield is 7.293% as on November 10, 2023

What are Government Securities?

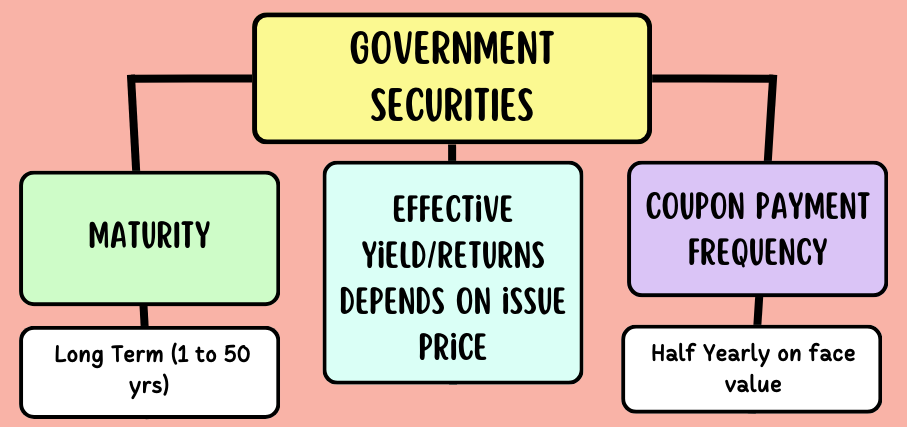

A ‘Government Security‘ (G-Sec) is a tradable financial instrument issued by either the central or state governments, representing an acknowledgment of their debt obligation. These securities come in two main categories:

- Short-Term: Often known as “Treasury Bills,” these have initial maturities of less than a year.

- Long-Term: Typically referred to as Government Bonds or Dated Securities, these have an original maturity of one year or more. Investors can conveniently access and purchase these government bonds online, streamlining the investment process and making it more accessible.

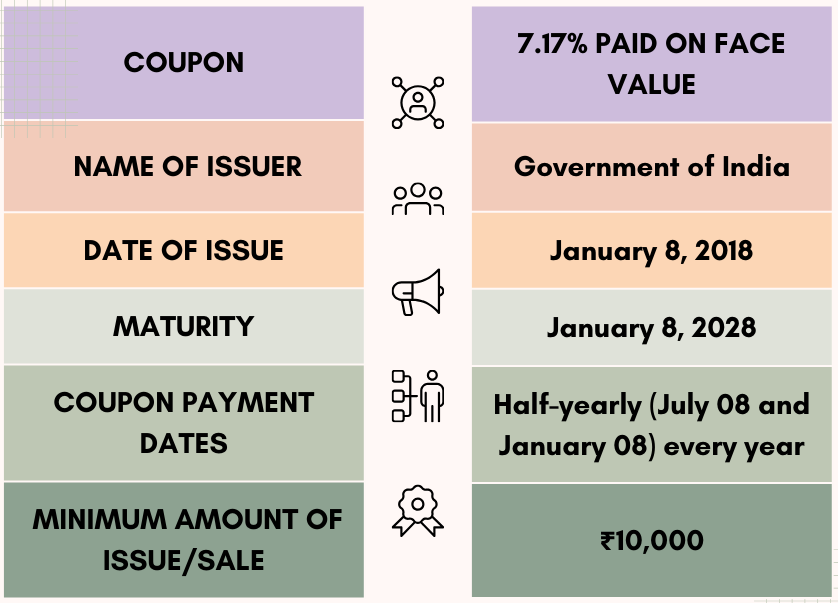

A typical dated fixed coupon G-nomenclature Security includes the following elements: coupon, issuer name, and maturity year. For instance, -7.17% GS 2028 translates to:

G-SEC HOLDINGS IN INDIA

The net issuance of dated securities in FY 2022-23 amounted to Rs. 11,05,759 Cr. Looking ahead, the budget for FY 2023-24 outlines ambitious plans with gross market borrowings set at ₹15,43,000 crore and net market borrowings projected at ₹11,80,911 crore. These figures underscore the fiscal strategy for the upcoming financial year, reflecting a dynamic approach to managing government securities in the evolving economic landscape.

Source- RBI

Advantages of Holding G-sec

- Security and Assurance:

Government securities are backed by the full faith and credit of the government, offering one of the safest investment options. Issued by the Reserve Bank of India, they provide a secure haven for investors.

- Attractive Yields amid Economic Shifts:

Given the reduced interest rates in fixed deposits and savings accounts due to the pandemic, government securities stand out with competitive yields, making them a valuable investment avenue.

- Convenient Entry and Exit:

Facilitated by the National Stock Exchange’s auction platform, purchasing and selling these bonds in the secondary market is seamless. The active secondary market ensures investors can easily liquidate their holdings.

- Steady Fixed-Income Returns:

With a predetermined interest rate, investors enjoy a reliable income stream until maturity. This fixed-income nature makes them particularly appealing for businesses seeking stability over an extended period.

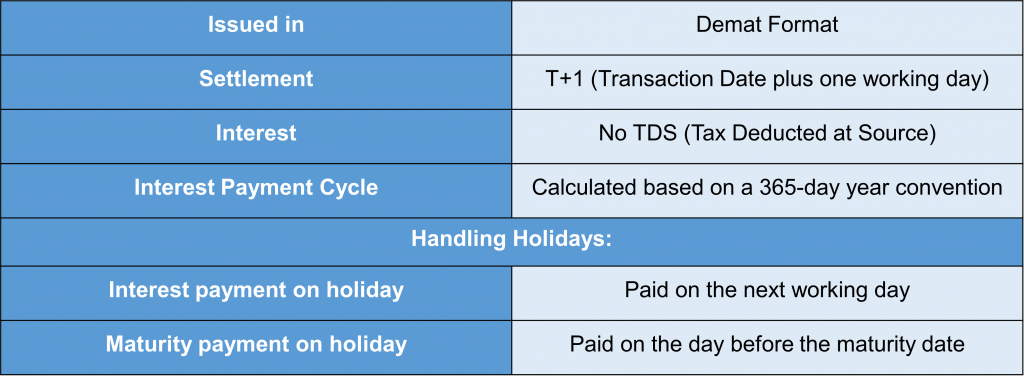

- Tax Advantage – No TDS:

Interest earned on government securities is not subject to Tax Deducted at Source (TDS), enhancing returns for investors.

- Versatile Collateral Option:

Government securities can serve as collateral for loans, providing an additional layer of financial flexibility for investors.

- Dematerialized Convenience:

Eliminating the need for physical documentation, these securities can be held in dematerialized form, streamlining online transactions and enhancing overall accessibility.”

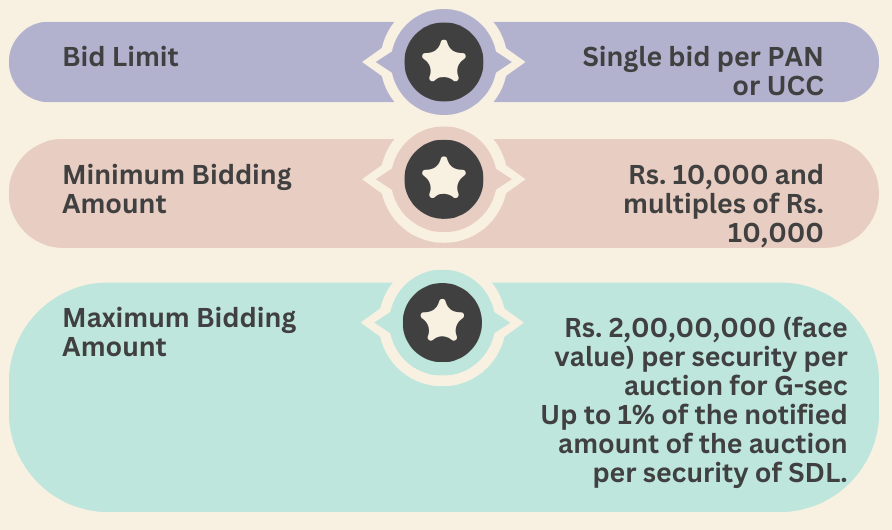

What are the limits for investors’ bidding amount?

How much will you earn if you invest in G-sec?

Lets understand this with a simple example. Every bond has a par value i.e. Rs 100, but that bond can be issued at par, premium (price higher than par) or discount (price lower than par). The price of the G-sec would depend on the auction process.

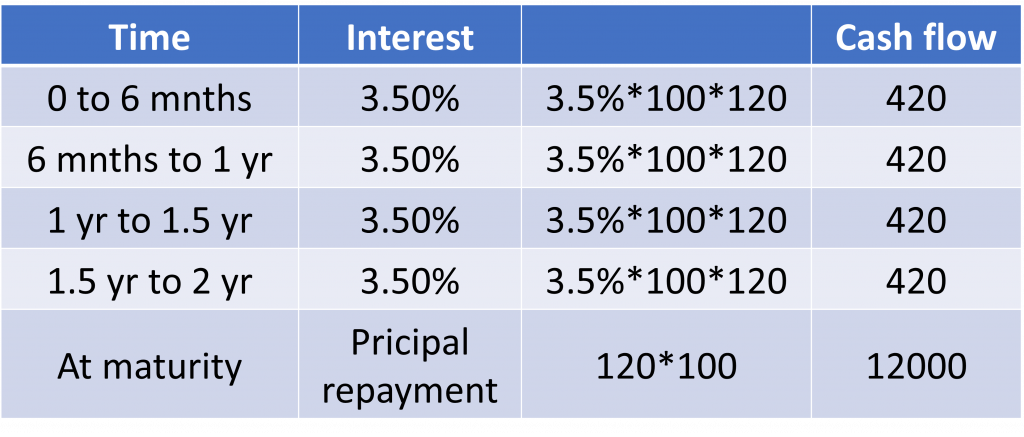

Now, let’s consider if an investor has invested in 700GS2024 at a discount price of Rs. 98. Assume, they have invested in 120 units. Lets see how the cashflow looks like-

So the total amount paid by the investor would be 98*120= Rs 11760

As the interest is paid on half yearly basis, the total amount earned is as follow-

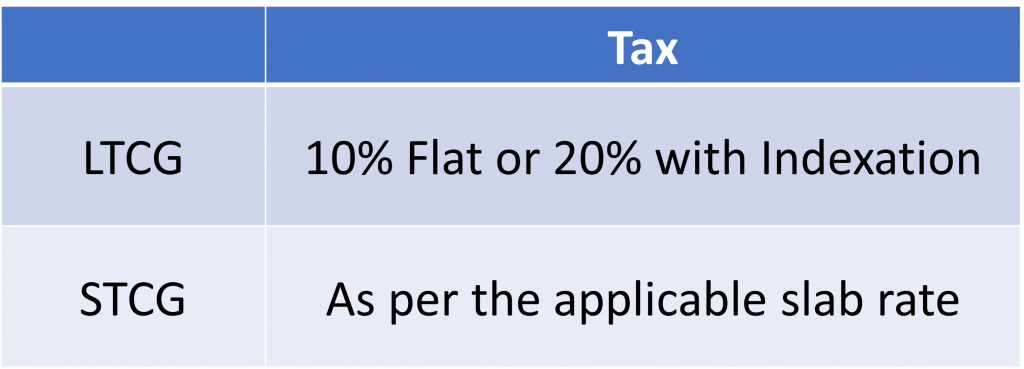

Taxation Process for G-sec

Most Government Securities are not tax free especially those floated for Infrastructure purpose, e.g. Rural Electrification Corporation Ltd. (RECL bonds) or Railway bonds. Interest income from bonds are considered as income from other sources, hence taxes have to be paid as per the income tax slab. Earnings more than Rs. 5000 for a year are considered taxable. There is no TDS charge over this. If there is any appreciation in the bond price, it is considered as capital gains and taxes over it is charged as follow-

NO TDS

KYC Process

- Photo

- Scanned copy of PAN Card

- Scanned copy of Voter ID/ Adhaar Card/ Driving License

- Canceled cheque/ Bank Statement/ Passbook Copy

- Demat Copy- CMR or CML or eCAS Statement of CDSL or NSDL

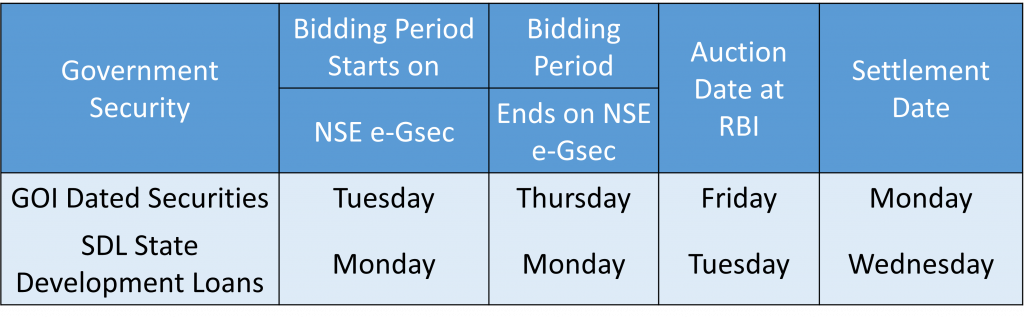

Bidding Period of NSE

The following table lists the specific days on which the NSE conducts the G-sec and SDL bidding:

Difference Between G-Sec, Strips and Treasury Bills

| Features | Government Securities | Strips | Treasury Bills |

| Nature of Instrument | Long-term debt instruments issued by the government with fixed or floating interest rates. | Zero-coupon securities created by separating the interest and principal components of a government security. | Short-term money market instruments issued by the government. |

| Maturity Period | Generally, medium to long-term maturity, ranging from 5 to 50 years. | Maturity period depends on the residual maturity of the underlying security from which Strips are created. | Short-term, with maturities ranging from 91 days to 364 days. |

| Interest Payments | Pay regular interest payments (semi-annually) | Zero-coupon bonds do not pay periodic interest; instead, they are issued at a discount and redeemed at face value. | Treasury Bills do not pay periodic interest; they are issued at a discount and redeemed at face value. |

| Yield | Yield is calculated based on the market price of the security and the remaining interest payments | Yield is calculated based on the difference between the purchase price and the redemption value | Yield is calculated based on the discount rate at which the treasury bill is sold |

| Liquidity | Relatively high liquidity | Lower liquidity than government securities | High liquidity |

| Trading in the Secondary Market | Traded in the secondary market, providing liquidity to investors. | Strips can be traded individually in the secondary market. | Treasury Bills can be traded in the secondary market. |

| Face Value Redemption | Redeemed at face value upon maturity. | Redeemed at face value upon maturity. | Redeemed at face value upon maturity. |

| Risk and Returns | Generally considered low-risk investments with stable returns. | Lower risk due to the guaranteed redemption value; returns depend on the purchase price. | Considered low-risk due to government backing; returns are typically lower compared to longer-term securities. |

| Issuing Authority | Issued by the Reserve Bank of India (RBI) on behalf of the Government of India. | Created by primary dealers in consultation with the RBI. | Issued by the RBI on behalf of the Government of India. |

| Primary Market Auctions | Initially issued through auctions in the primary market. | Not issued through auctions; created by primary dealers. | Initially issued through auctions in the primary market. |

| Denomination | Generally available in multiples of INR 10,000 or INR 100,000. | Denominated in smaller units, facilitating retail participation. | Usually issued in multiples of INR 25,000. |

Some Important facts before you invest into Government Securities