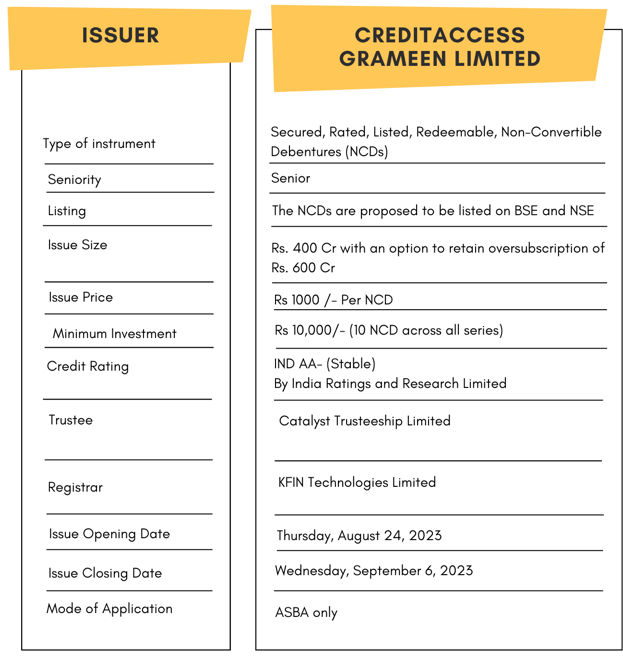

High Yield | AA- /Stable Rated | Minimum Investment: 10k Only

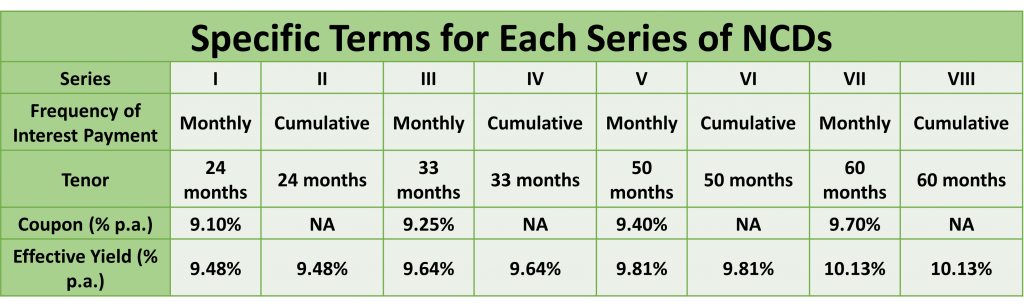

CreditAccess Grameen Limited is issuing the Non-Convertible Debentures. These NCDs are AA- Stable by IND. The NCDs are being issued in eight series: coupon ranges from 9.1% to 9.7% p.a. and different tenures of 24, 33, 50 and 60 months. The NCDs are secured and redeemable in nature.

CreditAccess Grameen Limited NCD IPO: Coupon rates and effective yield for each of the series

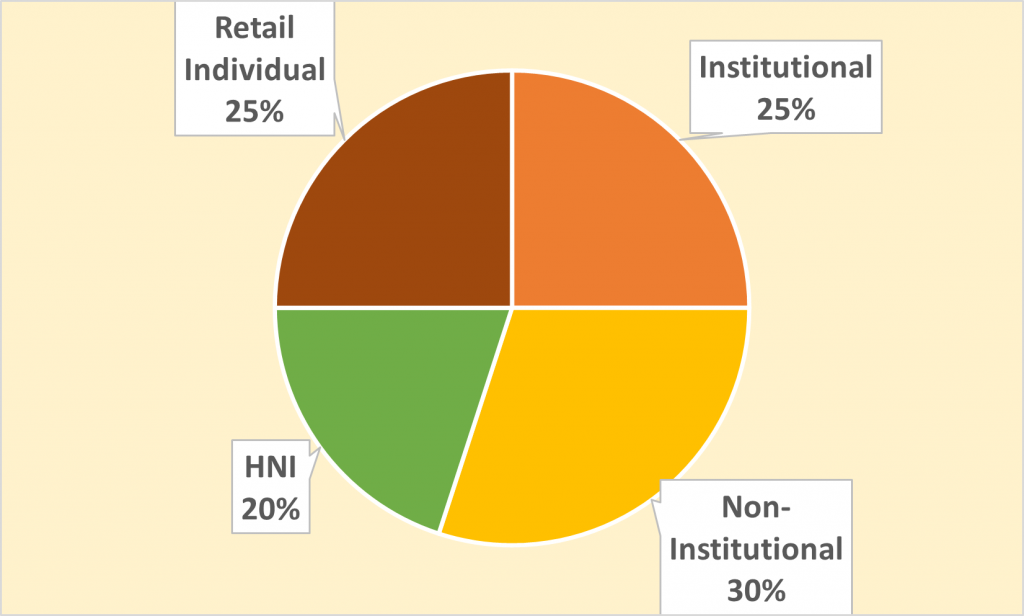

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Creditaccess Grameen Limited NCD-IPO.

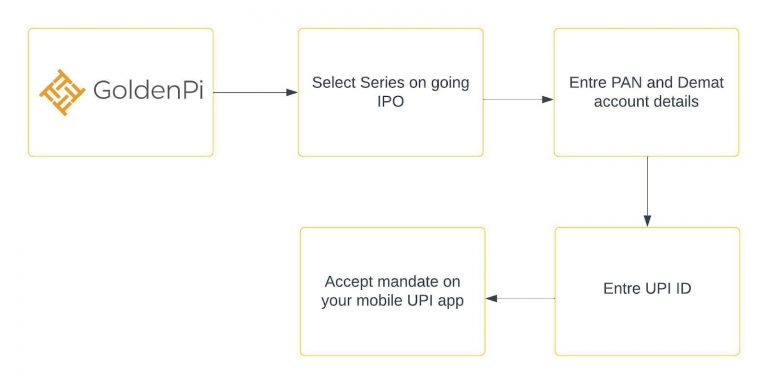

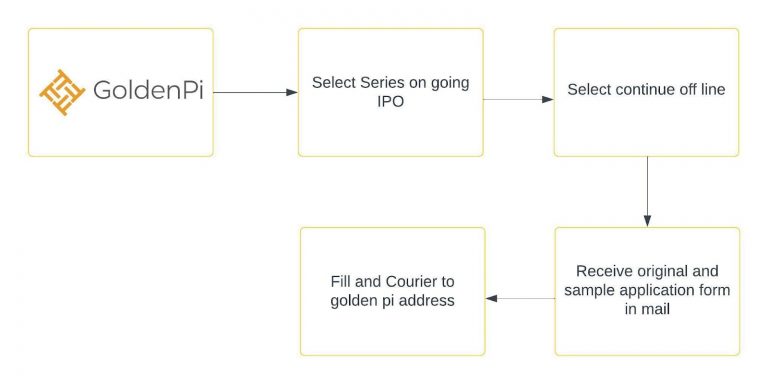

Investment Process for Creditaccess Grameen Limited NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

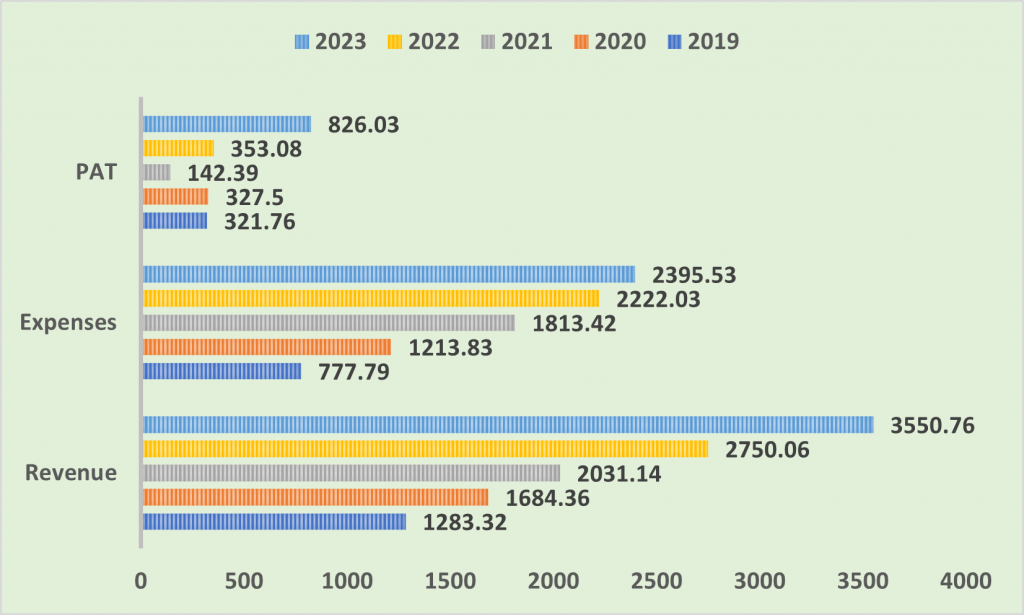

Financial Overview

Snapshot stating the Revenue, Expenses, and PAT

(Amount in Rs. Cr)

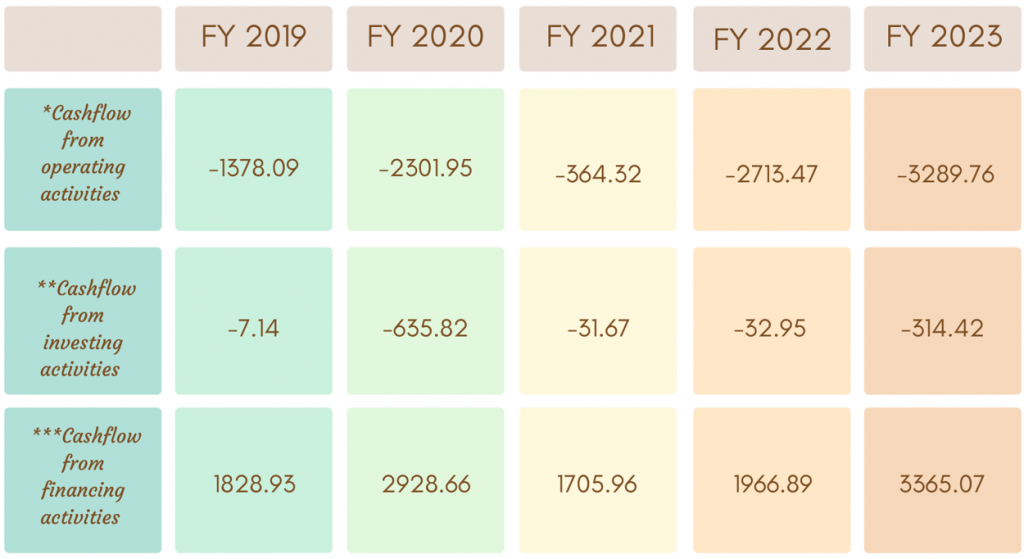

Cash flow for last 5 years

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

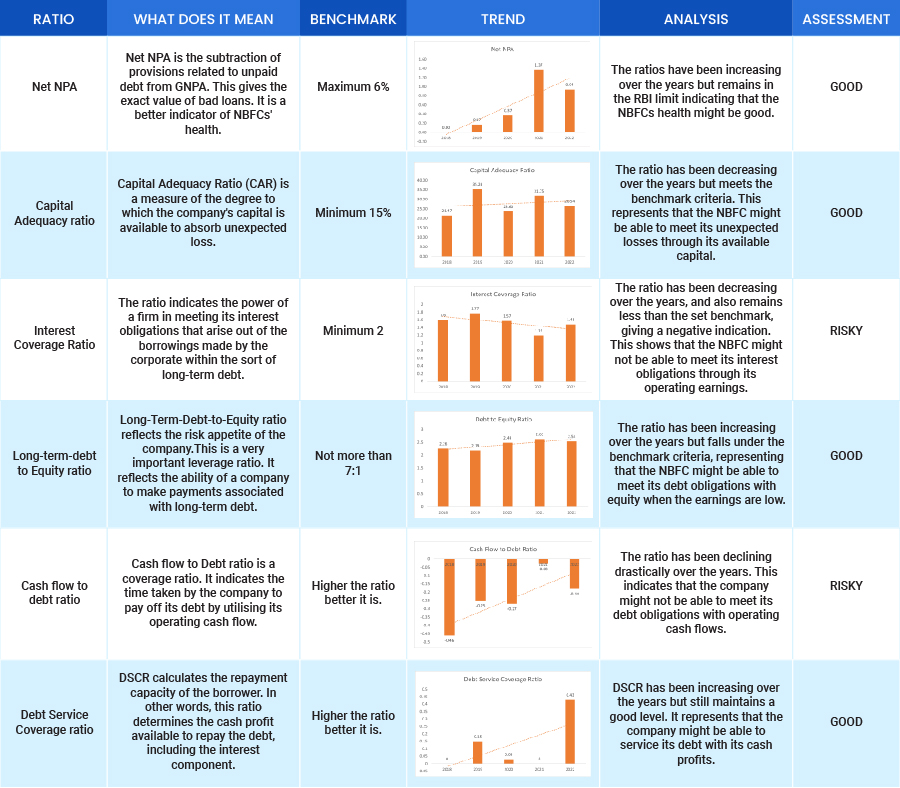

Ratio Analysis

Issue analysis

Pros

- The NCD is AA- rated security with a stable outlook.

- The coupon rate is between 9.1% to 9.7% which is much higher than FDs.

Cons

- Interest Coverage ratio has been decreasing indicating that the company might not be able to service its interest payments with its operating income.

- Cash flow to debt is falling drastically stating that the NBFC might not be able to service its debt obligations with its operating cash flows.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Creditaccess Grameen Limited

Founded in 1993, Creditaccess Grameen Limited was an NGO that was later transformed into a NBFC in 2007-08 under the guidance of Mrs. Vinatha M Reddy. In FY2014, Creditaccess India acquired a majority stake of about 74% in this company. Headquartered in Bangalore, the company is considered as the largest NBFC- MFI (Micro Finance Institutions) in India. The company is popularly known as “Grameen Koota” which means “rural group” in Kannada.

Business Verticals-

| Micro Finance | Retail Finance |

| Income Generation Loan | Grameen Vikas Loan |

| Home Improvement Loan | Gruha Vikas Loan |

| Family Welfare Loan | Grameen Savaari Loan |

| Emergency Loan | Grameen Suvidha Loan |

| Unnati Loan |

Strengths

- Largest NBFC in Microfinance institution with rural borrowers accounting for almost 85% of its total customer base.

- Liquidity position the company stands strong as it has been backed by the healthy monthly collections observed in the last few months.

- Low GNPA rates (3.1% as on FY2022) backed by adequate provisioning cover reflects effective risk management of the company.

- The portfolio of Creditaccess Grameen is expected to grow by 25% on a year on year basis in FY2023

Weakness

- Regionally concentrated, 70% of the total loan portfolio was from Karnataka, Maharashtra and Tamil Nadu.