High Yield | AA-/Positive Rated | Minimum Investment: 10k Only

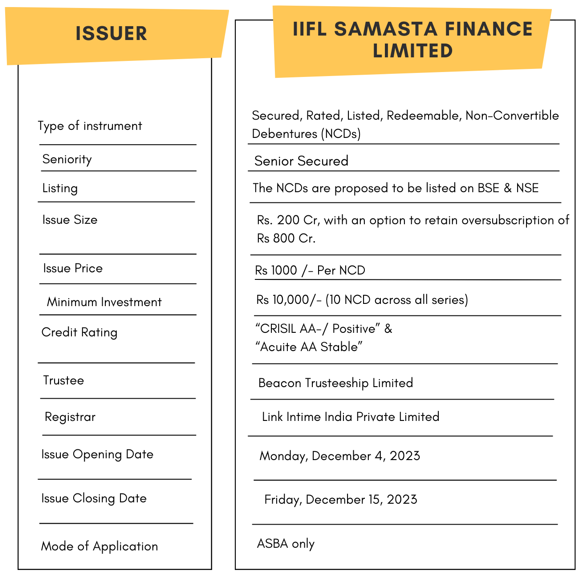

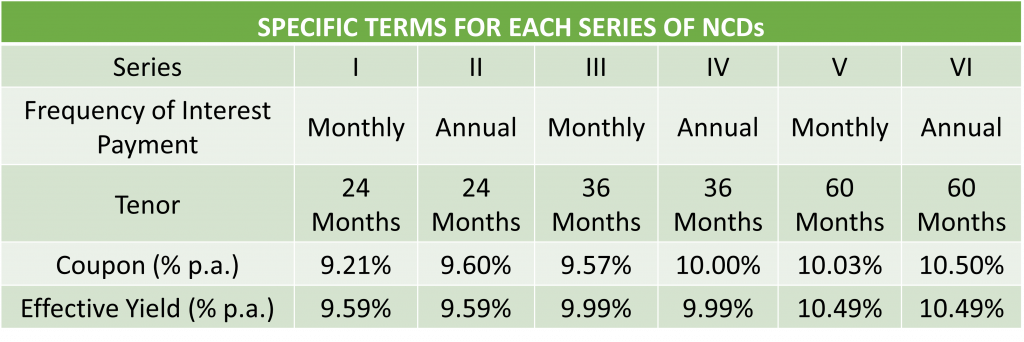

IIFL Samasta Finance Limited is issuing the Non-Convertible Debentures. These NCDs are CRISIL AA-/Positive and Acuite AA Stable rated. The NCDs are being issued in six series: coupon ranges from 9.21% to 10.5% p.a. and different tenures of 24 months, 36 months and 60 months. The NCDs are secured and redeemable in nature.

IIFL Samasta Finance Limited NCD IPO: Coupon rates and effective yield for each of the series

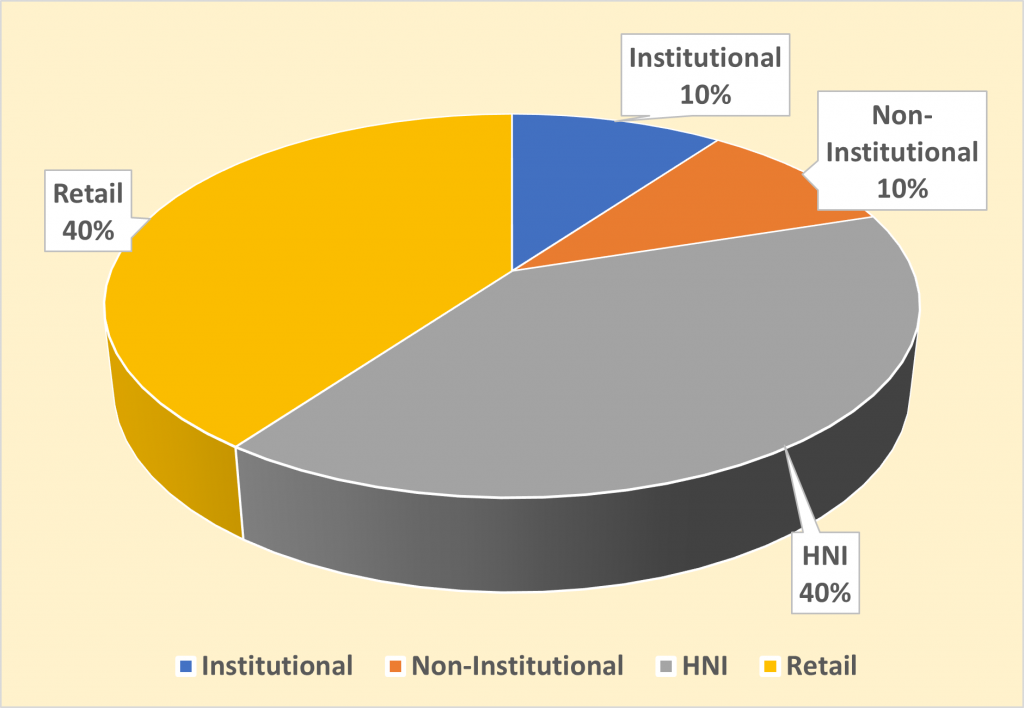

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for IIFL Samasta Finance Limited NCD-IPO.

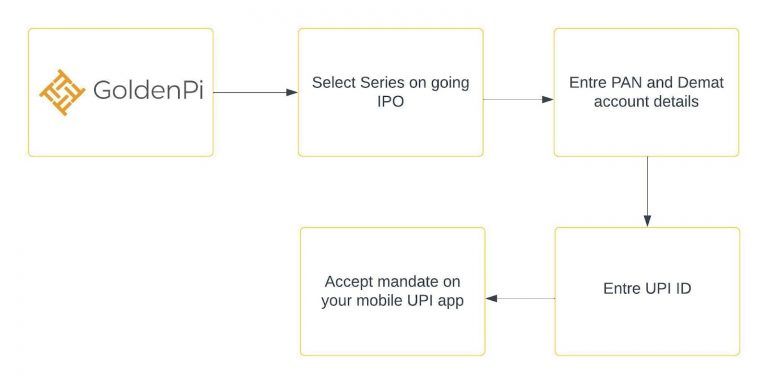

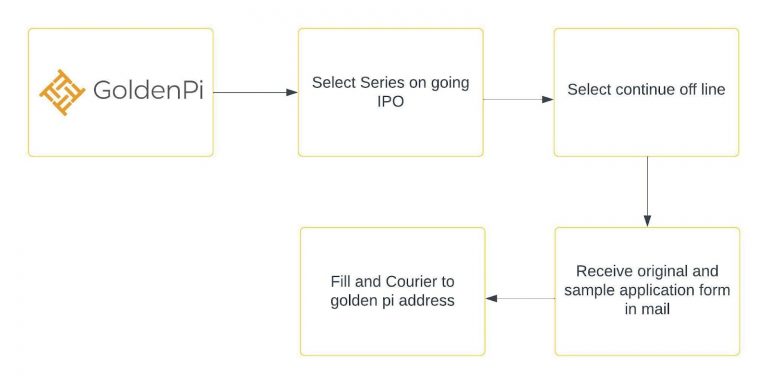

Investment Process for IIFL Samasta Finance Limited NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

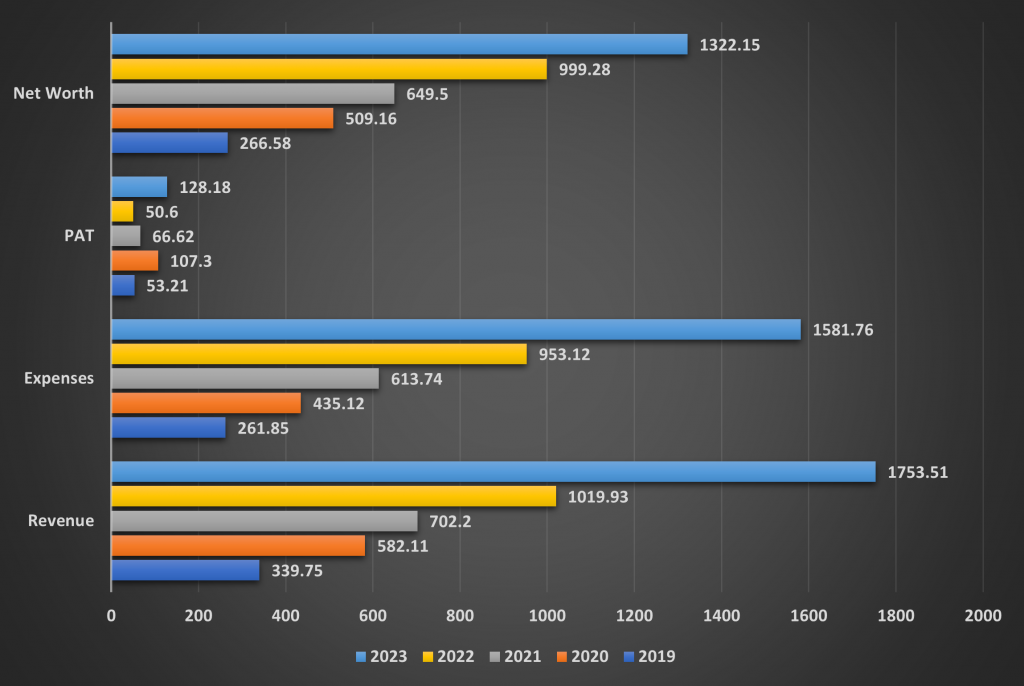

Financial Overview

Snapshot stating the Revenue, Expenses, Net Worth and PAT (In crores)

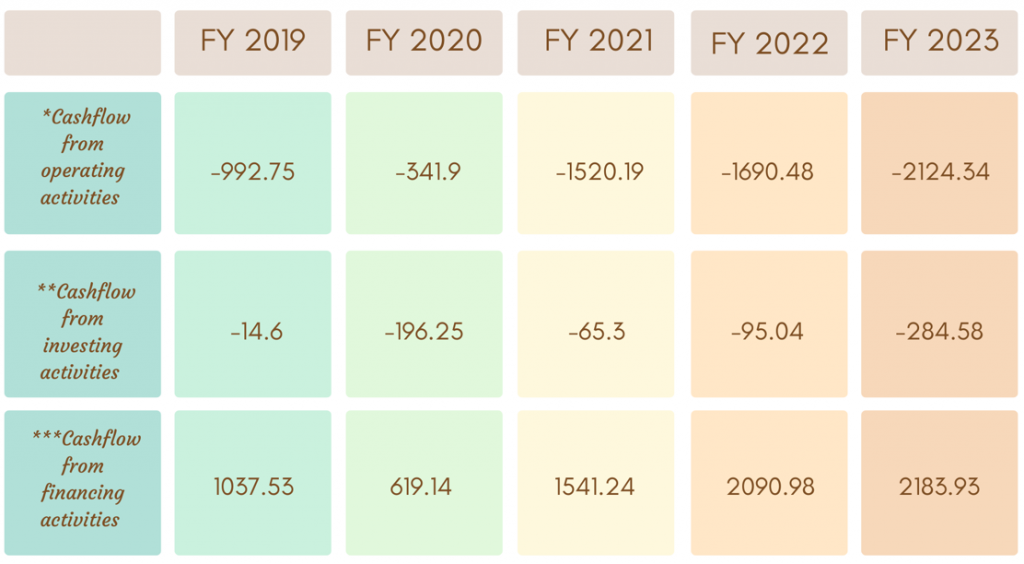

Cash flow for last few years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

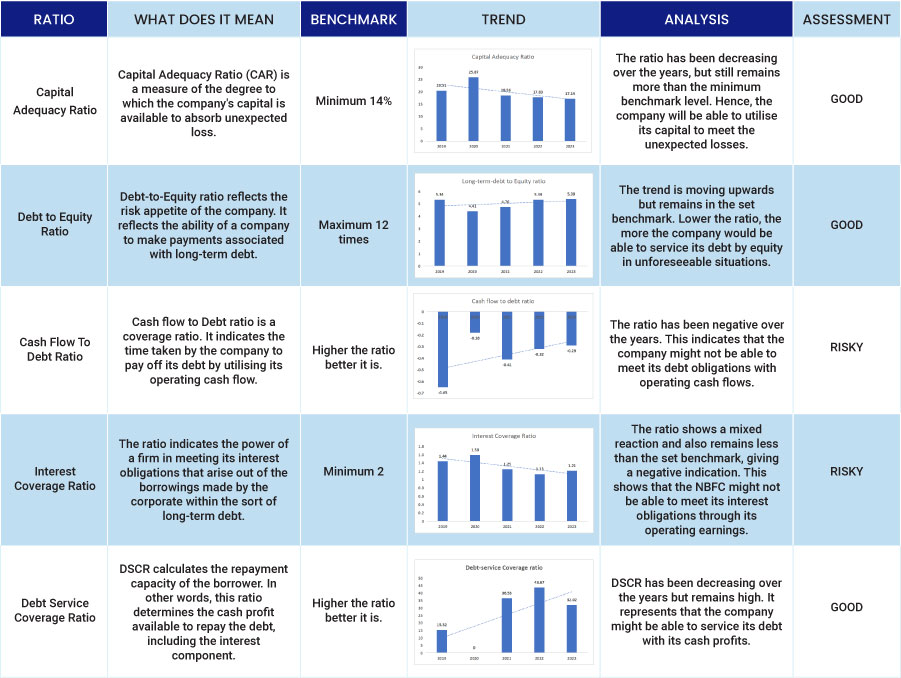

Ratio Analysis

Issue analysis

Pros

- The NCD is AA- rated security with a positive outlook.

- The coupon rate is between 9.21% to 10.50% which is much higher than FDs.

Cons

- Net NPA has been very close to the limit set by the authorities

To get better returns than Bank FDs, invest in NCD-IPOs online.

About IIFL Samasta Finance Limited

IIFL Samasta Finance Limited is a leading non-banking financial company (NBFC) in India, providing a diverse range of financial products and services to individuals and businesses in underserved and unserved regions. Founded in 2008, the company has a strong presence in rural and semi-urban areas, catering to the needs of financially excluded communities.

IIFL Samasta Finance offers a variety of loan products, including microloans, microfinance, small business loans, mortgage loans, and agri loans. The company also provides other financial services, such as savings accounts, insurance, and wealth management.

Strengths

- Robust business foundation: IIFL Samasta Finance Limited has established a strong business foundation with a diversified product portfolio and a well-established presence in underserved regions.

- Diversified asset portfolio: IIFL Samasta Finance boasts a diversified asset portfolio, catering to both retail and wholesale segments, contributing to risk mitigation and overall stability.

- Effective risk management practices: IIFL Samasta Finance implements rigorous risk management practices, enabling it to maintain healthy asset quality and profitability.

- Demonstrated growth trajectory: IIFL Samasta Finance has exhibited a steady growth trajectory, marked by consistent expansion in both assets and revenue.

Weakness

- Heavy dependence on wholesale funding: IIFL Samasta Finance relies heavily on wholesale funding sources, which could increase its borrowing costs and expose it to interest rate fluctuations.

- Concentration in rural and semi-urban areas: IIFL Samasta Finance has a significant exposure to rural and semi-urban areas, where economic conditions may be more volatile.

- Limited experience in certain segments: IIFL Samasta Finance has limited experience in certain segments, such as infrastructure lending and microfinance, which could pose some challenges in managing credit risk.

Invest in Bond IPO online in just 5 minutes

Disclaimer: Investments in debt securities are subject to risks. Read all the offer related documents carefully.