Finance Minister Nirmala Sitharaman, unveiled the Union Budget of FY 2023-24 on 1st February 2023. The budget outlines the government’s fiscal and economic policies for the upcoming financial year. It lays out the government’s plans for revenue generation and expenditure, as well as its strategies for promoting economic growth and development. The budget also reveals the government’s priorities in terms of taxation, subsidies, investments and other measures to support businesses and individuals.

The budget emphasized on “Amrit Kaal,” a period of time that is said to be extremely auspicious for starting any new endeavor. In 25 years, India will transition from being India@75 to being India@100. The Indian economy will be guided by Amrit Kaal’s design in the next few years.

Focus of Amrit Kaal

An empowered and inclusive economy is the vision of Amrit Kaal that will be accomplished through-

Stated below are three factors which are primary economic agendas for accomplishing this goal-

One of the key highlights of the Budget

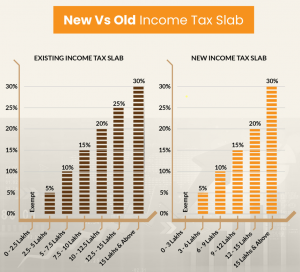

TAX PROPOSAL

This budget can be called one of the most awaited budgets among salaried people for their taxation. The government has altered slightly from its previous regime which might benefit lots of young salaried people.

- The new regime has enhanced the income tax rebate from Rs 5 lakh to Rs 7 lakh.

- Under the new regime, the highest surcharge rate on revenue over 5 crore rupees will drop from 37% to 25%.

- The salaried class and retirees who earn at least Rs. 15.5 lakh will gain by Rs. 52,500 from the extended standard deduction benefits.

- Increasing the non-government salaried employee tax exemption threshold to Rs. 25 lakh for leave encashment on retirement.

- The default tax system will be the new one. However, citizens can still choose to benefit from the old tax system.

The Union Budget 2023-2024

The finance minister presented the budget classified into seven priorities and serve as “Saptrishi”, the compass of Amrit Kaal. The following are the seven priorities.

PRIORITY 1- INCLUSIVE DEVELOPMENT- “Sabka Saath Sabka Vikas”

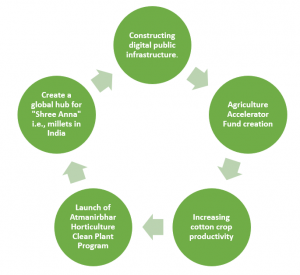

Agriculture and Cooperation

Constructing digital public infrastructure

This will make it possible to develop solutions for crop planning and health that are inclusive of farmers, increase access to agricultural inputs, loans, and insurance, and promote the Agri-tech sector start-ups.

Agriculture Accelerator Fund creation

This seeks to provide innovative and reasonably priced solutions for problems encountered by farmers. It will also inspire young entrepreneurs in rural areas to launch Agri-startups.

Increasing cotton crop productivity

Farmers, the government and business will work together to produce extra-long staple cotton using a cluster-based and value chain approach.

Launch of Atmanirbhar Horticulture Clean Plant Program

It’s to increase the supply of high-value horticulture crops with disease-free, high-quality planting material at estimated cost of Rs. 2,200 crores.

Create a global hub for “Shree Anna” in India

The Center government will assist the Indian Institute of Millet Research (IIMR) in Hyderabad in its efforts to serve as a global center of excellence for the exchange of cutting-edge research, innovations, and best practices.

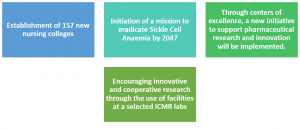

Health

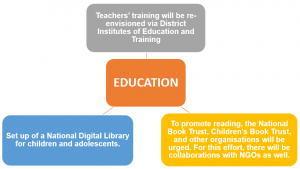

Education

PRIORITY 2- REACHING THE LAST MILE

- Launch of the Pradhan Mantri PVTG Development Mission to improve the socioeconomic circumstances of the particularly vulnerable tribal groups (PVTGs). Budget of Rs.15000 crore is allocated for 3 years in this mission.

- Recruitment of 38,800 teachers to serve 5 lakhs indigenous (tribal) students enrolled in the 740 Eklavya Model Residential Schools.

- Financial assistance of Rs. 5300 cr will be given to drought prone areas of Karnataka.

- One lakh old inscriptions will be digitally preserved as part of the Bharat Shared Repository of Inscriptions, which will be established in a museum of digital epigraphy.

PRIORITY 3- INFRASTRUCTURE & INVESTMENT

Investments in Infrastructure have a multiplier impact on growth and employment.

- Increase in Capital Investment Outlay by 33% to Rs. 10 lakh crores, which is 3.3% of GDP.

- The Center has budgeted 13.7 lakh crore for “Effective Capital Expenditure”,which equates to 4.5% of GDP.

- Continuation of 50 year interest free loan to states governmentsto incentivise infrastructure investment costing for Rs. 1.3 lakh crore.

- Allocation of 2.4 lakh crore to railways.

- A total of Rs. 75,000 crore, including Rs. 15,000 crore from private sources, would be invested in 100 transportation infrastructure projects, which will be completed in order of priority.

- Cities will be incentivized to improve their credit worthiness for municipal bondsthrough changes to the regulation of property taxes and the ring-fencing of user fees on urban infrastructure.

PRIORITY 4- UNLEASHING THE POTENTIAL

- Three centers of excellence for artificial intelligence will be established in prestigious educational institutions under the motto “Make AI in India and Make AI work for India”.

- In engineering institutions, 100 labs will be set up to develop applications using 5G services.

- A budget of Rs. 7,000 crores would be used to launch Phase 3 of the E-Courts project.

- Vivad se Vishwas I– Relief for MSMEs affected during Covid period – Less stringent contract execution for MSMEs

- Vivad se Vishwas II– Settling Contractual Disputes – Easier and standardised settlement of contractual disputes of Govt and Govt Undertakings

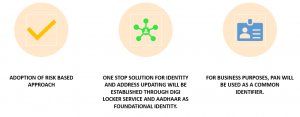

Simplification of KYC Process-

The government will aim to simply the KYC process by adopting a risked based approach rather than a one size fits all approach.

PRIORITY 5- GREEN GROWTH

- Budget allocates Rs. 35,000 crores for high-priority capital investments in energy security, net zero goals and energy transition.

- Outlay of Rs. 20,700 crores for Renewable Energy plan in Ladakh.

- PM- PRANAM will be introduced to encourage the use of alternative fertilisers’ responsibly and in moderation throughout the States and Union Territories.

- Under the GOBARdhan programme, 500 new “waste to wealth” plants will be built to advance the circular economy.

- The central government will assist 1 crore farmers in switching to natural farming. For this, 10,000 Bio-Input Resource Centers would be established.

- Amrit Dharohar will be implemented for optimal usage of wetlands.

- MISHTI will be taken up for Mangrove plantation along the coastline.

PRIORITY 6- AMRIT PEEDHI- Youth Power

- Within the following three years, as part of the Pradhan Mantri Kaushal Vikas Yojana 4.0will be introduced to train thousands of youngsters. The programme will also encompass cutting-edge training in coding, artificial intelligence, robotics, mechatronics, IOT, 3D printing, drones, and other soft skills.

- Creation of a single Skill India Digital platformto enable demand-based formal skilling, connect with businesses, especially MSMEs, and make access to entrepreneurship programmes easier.

- Stipend supportto be provided to 47 lakh youth in 3 years.

- 50 places to be selected to develop a complete package for domestic and foreign tourists. The central government will take the necessary measures to boost tourism sector.

- Set-up of Unity malls in states for promotion and sale of their own One District One Product.

PRIORITY 7- FINANCIAL SECTOR

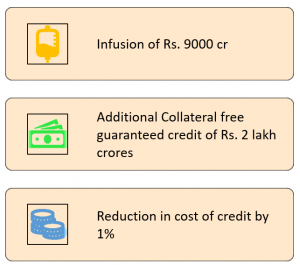

Credit guarantee for MSME –

- National financial information registry will be established to encourage the effective flow of credit, financial inclusion, and financial stability.

- A Central data processing center would be established to expedite the handling of administrative tasks under the Companies Act.

- Initiative will be taken to promote business activities in GIFT IFSC.

- Certain changes to the Banking Regulation Act, the Banking Companies Act, and the Reserve Bank of India Act are suggested in order to improve bank governance and strengthen investor protection.

- SEBI will have the authority to establish, control, uphold, and enforce norms and standards for education in the National Institute of Securities Markets (NISM)and to acknowledge award of degrees, diplomas, and certificates in order to increase the capacity of functionaries and professionals in the securities market.

- New savings scheme for women with a tenure of 2 years to offer 7.5% interest rate with partial withdrawal

- For Senior Citizens– The maximum deposit amount for senior citizens will range from 15 lakh to 30 lakh. The investment cap for modest savings programmes like Senior Citizen Savings Schemes (SCSS) was raised from Rs 15 lakh to Rs 30 lakh.

- Investment cap for a single account under the Monthly Income Scheme (MIS)increased from Rs 4.5 lakh to Rs 9 lakh. The ceiling for joint accounts has increased from Rs. 9 lakh to Rs. 15 lakh.

- Fifty-year interest free loan to states– Within 2023–2024, states must use their fifty-year loans for capital projects. The majority of this will be up to the states’ discretion, but some of it will depend on them raising their real capital spending.

Key factors of the union budget

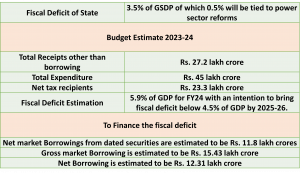

FISCAL DEFICIT

WHAT HAS BECOME CHEAPER AND COSTLIER?

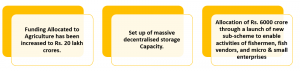

FUND ALLOCATED TO MINISTRY

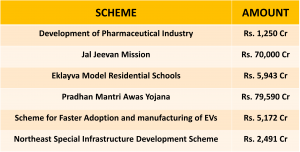

FUNDS ALLOCATED TO MAJOR SCHEMES

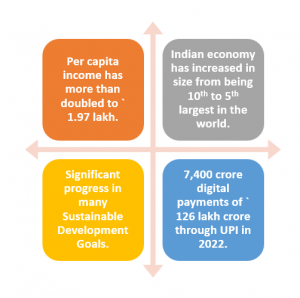

ACHIEVEMENTS SINCE 2014

EFFICIENT IMPLEMENTATION OF SCHEMES

FAQs About Union Budget

Q- What exactly is a union budget?

The Union Budget, also known as the annual financial statement, is a statement of the government’s estimated receipts and expenditures for that specific year, as per the Constitution of India’s Article 112.