|

Getting your Trinity Audio player ready...

|

Introduction: Understanding the Significance of Indian Bond Inclusion in Global Indices and Credit Rating Upgrade

In the ever-evolving landscape of global finance, the inclusion of Indian bonds in global indices and the prospect of a credit rating upgrade have taken center stage. These developments carry immense implications not only for India’s financial ecosystem but also for international investors and the broader global economy.

As we delve into the significance of Indian bonds making their mark in global indices and the potential credit rating upgrade, we embark on a journey to understand the transformational power of these financial milestones.

In this blog, we will explore the importance of bond inclusion in global indices, shedding light on how it amplifies India’s presence on the global stage. Additionally, we will delve into the far-reaching effects of a credit rating upgrade, examining how it can bolster investor confidence and drive economic growth.

Join us on this enlightening voyage as we decipher the intricate threads that weave together the worlds of global finance, Indian bonds, and credit rating upgrades. Let’s uncover the remarkable potential these developments hold for shaping the future of India’s economy and their profound impact on the international financial community.

The Benefits of Including Indian Bonds in Global Indices

The inclusion of Indian bonds in global indices is a game-changer that extends far beyond the borders of the nation. This pivotal move unlocks a treasure trove of benefits, creating a win-win scenario for India and the global investment community.

Let’s delve into the advantages of this monumental step:

Increase in Foreign Investment and Capital Inflows

Foreign portfolio investors (FPIs), sovereign wealth funds (SWFs), and emerging market funds are set to gain substantially from the inclusion of Indian bonds in global indices. Here’s how:

Global investment opportunities and capital inflows to India:

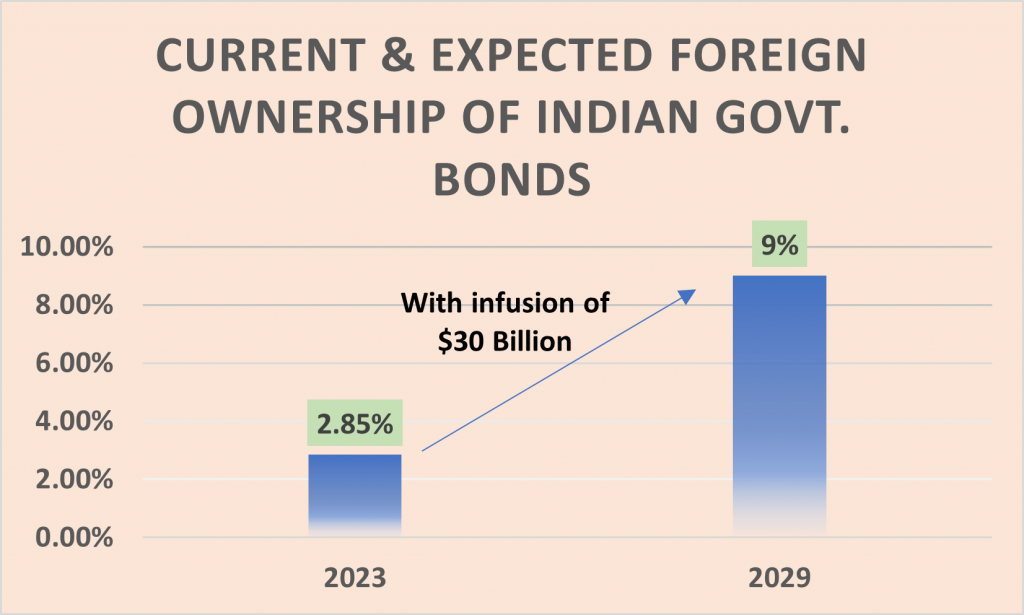

The inclusion of Indian bonds in global indices will provide foreign investors with access to a new and attractive market, diversifying their portfolios and reducing risk. This is expected to lead to a surge in capital inflows to India, worth nearly $30 billion, which will strengthen the country’s financial stability and economic growth.

Enhanced Market Visibility and Reputation for India’s Bond Market

The inclusion of Indian bonds in global indices is akin to rolling out the red carpet for international investors. Here’s why:

Bond market development and improved market infrastructure:

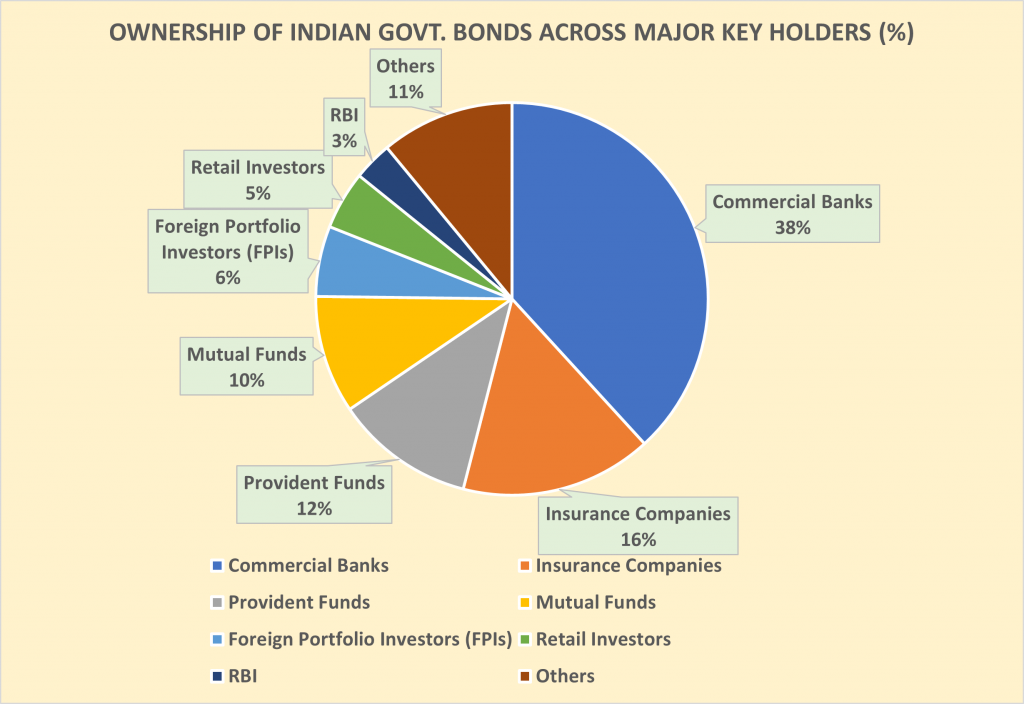

India’s bond market is expected to experience significant growth due to international recognition and inclusion in global indices. With a market cap of over $1.2 trillion, nearly triple of Indonesia’s and almost similar to Brazil’s. India’s bond market is the third largest among Emerging Markets (EMs). FPI ownership of India G-Secs is <2% (3% FPI holdings in FARs), significantly lower than EM peers. The country’s financial infrastructure is being hailed for enhanced facilities and regulations, attracting foreign investors and ensuring a transparent investment environment.

The passive inflow is likely to boost India’s profile on the world stage and further strengthen local fundamentals. The RBI could also conduct sterilization operations during this inclusion period, potentially opening avenues for long-term debt capital to fund India’s infrastructure and development needs.

Potential Reduction in Borrowing Costs for the Indian Government and Corporates

A stronger bond market brings down the cost of borrowing, and this is particularly significant for India:

Bond yields and access to cheaper funding sources:

India’s inclusion in global indices often leads to increased demand for Indian bonds, driving up their prices and pushing yields lower. This results in reduced borrowing costs for both the government and corporations. Greater foreign inflows next year will result in increased demand for Indian government bonds. The Centre could borrow a smaller amount in 2024-25, compared to Rs 15.43 lakh crore this year as the fiscal deficit target could be around 5.5% of GDP. This could result in the demand exceeding the supply by up to Rs 90,000 crore. As a natural consequence to it, lower bond yields are expected, with the 10-year government bond yield expected to fall to 7% by the end of 2023-24 and potentially breach 7% next financial year. As borrowing costs decline, India can tap into cheaper funding sources, fostering economic growth and development. This reduction in financing expenses benefits both public and private sectors, facilitating investment in critical infrastructure and projects.

Financial data:

- 10-year government bond yield as of November 21, 2023: 7.269%

- Expected 10-year government bond yield by the end of 2023-24: 7% or lower

- Expected 10-year government bond yield in 2024-25: 6.70%

“Based on our careful monitoring of how the Reserve Bank of India (RBI) handles domestic inflation, we at GoldenPi would like to suggest considering the following projections for the yield on 10-year government bonds.

For the period of 2023-2024, we anticipate that the yield on 10-year government bonds will be at or around 7%, taking into account the RBI’s management of inflation.

Furthermore, based on our analysis, we anticipate that by July 2024, when inflation is expected to be under control, the RBI will likely begin lowering the repo rate. This, in turn, is projected to have an impact on the 10-year government bond yields for 2024-2025.

Considering these factors, we expect that the 10-year government bond yield for 2024-2025 will be in the range of 6.7% to 6.75%. It is important to note that these projections are subject to change based on various economic factors and RBI’s policies.”

Strengthening Rupee, Stock Market Boost, and RBI’s Role

The inclusion of Indian bonds in global indices is expected to strengthen the Indian rupee and boost the stock market. This is because it will lead to a big dollar inflow due to buying of government securities. This will lower India’s risk premia/cost of funding, enhance the liquidity and ownership base of G-Secs, and help India finance its fiscal and CAD.

Most of the corporate bonds yields are benchmarked to the yields on government bonds. Therefore, yields will decline pan India, across industries. The decline in the cost of capital will translate into higher profits for the corporate sector, which, in turn, will boost stock prices enabling the stock market to scale higher levels.

The RBI will continue to play a crucial role by accumulating dollars passively to absorb any heavy flows, given its focus on ensuring a more stable currency on top of internationalisation efforts.

Even though the RBI is expected to step in and keep the rupee from appreciating wildly, the external balance will nonetheless improve. The large inflows will likely keep the Balance of Payments “in strong surplus” even though the current account deficit may widen.

The Interplay between Bond Inclusion and Credit Rating Upgrade for India’s Economic Growth

The relationship between bond inclusion in global indices and credit rating upgrades is a dynamic one, with each element reinforcing the other to fuel India’s economic growth. Let’s explore this intricate interplay:

Credibility Boost through a Potential Credit Rating Upgrade for India’s Economy

A credit rating upgrade holds the power to transform India’s standing in the global financial arena. Here’s how it impacts the nation’s economic growth:

Improved investor perception and enhanced credibility among international investors:

A higher sovereign credit rating signifies lower credit risk and fosters improved investor perception. This leads to increased foreign investment and capital inflows, which stimulate economic growth and development. India becomes a more attractive destination for foreign investors, opening doors to a wider range of investment opportunities, further bolstering economic growth prospects.

The fact that India has a high government debt and interest/revenue ratios is a weakness in its credit profile. However, the inclusion of Indian bonds in global indices is expected to help lower India’s funding costs, which would have a significant positive impact on the country’s creditworthiness.

Bond Inclusion Acting as a Catalyst for Higher Credit Ratings

The inclusion of Indian bonds in global indices isn’t just a symbolic move; it has tangible benefits that can lead to higher credit ratings:

Fiscal discipline improvement and potential upgrades by CRAs:

The inclusion of Indian bonds in global indices is expected to lead to increased scrutiny of India’s fiscal policies and financial health by foreign investors. This scrutiny will act as a check on fiscal discipline, encouraging responsible economic management. If India is able to demonstrate its commitment to sound economic policies and responsible debt management, credit rating agencies may take notice and upgrade India’s sovereign credit rating. This would attract even more foreign investment and accelerate economic growth.

Positive Feedback Loop: Credit Rating Upgrade Reinforcing Bond Inclusion and Vice Versa

The relationship between credit rating upgrades and bond inclusion is not linear; it’s a dynamic feedback loop.

Mutually reinforcing benefits, increased investor confidence, and upward spiral of economic growth:

The inclusion of Indian bonds in global indices and a credit rating upgrade are mutually reinforcing developments that can lead to an upward spiral of economic growth.

A credit rating upgrade resulting from responsible economic policies and fiscal discipline can further boost India’s appeal to global investors. This, in turn, increases demand for Indian bonds, reinforcing their inclusion in global indices.

With every step up the credit rating ladder, India garners more investor confidence. This heightened confidence fuels economic growth as foreign investments pour into the country, fostering job creation, infrastructure development, and overall prosperity.

The positive feedback loop created by credit rating upgrades and bond inclusion sets the stage for an upward spiral of economic growth. As India’s creditworthiness and appeal to global investors increase, the nation’s economic potential soars to new heights.

Current Position of India

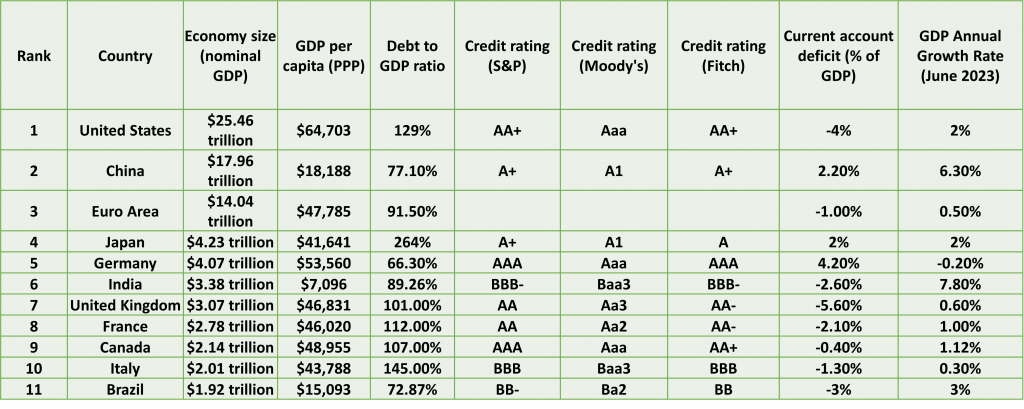

Based on the data mentioned in the attached table, India’s credit rating is BBB- from S&P, Baa3 from Moody’s, and BBB- from Fitch. This is the same as Brazil and Italy, and one notch lower than China.

India has a number of grounds on which it can look for a credit rating upgrade. These include:

- Strong economic growth: India is currently the fastest growing major economy in the world, with GDP growth of 7.8% in June 2023. This is significantly higher than the growth rates of other countries with similar credit ratings, such as China (6.3%) and Italy (0.3%).

- Low debt-to-GDP ratio: India’s debt-to-GDP ratio of 89.26% is lower than the debt-to-GDP ratios of other countries with similar credit ratings, such as Italy (145.00%) and Japan (264.00%).

- Large and growing middle class: India has a large and growing middle class, which is expected to reach 600 million people by 2030. This is a major source of economic growth and stability.

- Favorable demographics: India has a young and growing population, with a median age of 28.4 years. This is a major advantage over other countries with aging populations, such as Japan and Germany.

However, there are also a number of challenges that India needs to address in order to achieve a credit rating upgrade. These include:

- High inflation: India’s inflation rate has been above the RBI’s target range of 4% for several months. This is a major concern for the RBI and for investors.

- Weak fiscal position: India’s fiscal deficit has been widening in recent years. This is due to a combination of factors, including lower tax revenues and higher spending.

- Uneven growth: India’s economic growth has been uneven, with the formal sector growing much faster than the informal sector. This is a major challenge for the government, as it needs to create more jobs in the formal sector.

Overall, India has a number of grounds on which it can look for a credit rating upgrade. However, it also needs to address a number of challenges, such as high inflation and a weak fiscal position.

In addition to the above, India can also look for a credit rating upgrade by:

- Improving the quality of its infrastructure: India’s infrastructure is still lagging behind other countries with similar credit ratings. Investing in infrastructure would improve India’s competitiveness and make it more attractive to foreign investors.

- Reducing its reliance on fossil fuels: India is currently heavily reliant on fossil fuels, which makes it vulnerable to energy price shocks. Reducing its reliance on fossil fuels would improve India’s energy security and make it more sustainable.

- Improving its education system: India’s education system is still underdeveloped, which is a major constraint on economic growth. Improving the education system would create a more skilled workforce and make India more competitive in the global economy.

By addressing these challenges, India can improve its credit rating and attract more foreign investment. This would boost economic growth and create more jobs.

In summary, India’s potential for a credit rating upgrade can be grounded in its ability to manage its debt-to-GDP ratio, sustain high economic growth, maintain a manageable current account deficit, and achieve improvements in per capita income. To enhance its creditworthiness, India should focus on fiscal discipline, structural reforms, and inclusive economic growth, ultimately aligning itself more closely with countries holding higher credit ratings.