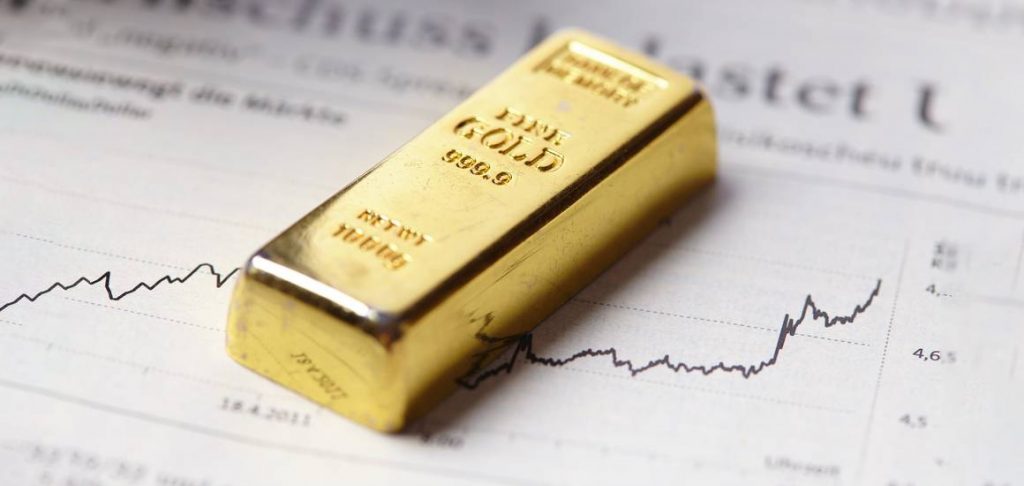

Currently, the second most popular use of Gold worldwide, which accounts for 20% of the world’s physical Gold is investment. Indians have traditionally loved physical gold, but the Reserve Bank of India’s Sovereign Gold Bonds scheme, which was introduced in 2015, has also drawn a sizable number of investors.

Sovereign Gold Bonds are government-backed investments that are valued in grams of gold. It provides investors with a viable alternative to physical gold. With the help of these bonds, investors can trade gold without having to hold any physical bullion.

This next-best Gold scheme of Sovereign Gold Bonds is a great alternative with high liquidity and tradability that an investor can consider.

Key Takeaways

- After 5 years of holding SGBs, they are also eligible for premature withdrawal on coupon payment dates.

- The SGBs in demat form are eligible to be traded on the stock exchange.

- On maturity, SGBs are redeemable at the gold price of the current market.

- The capital gains are tax-free when redeemed during maturity

- It avoids risks and storage costs associated with physical gold.

- The greater liquidity comes with active participants of retail and institutional investors in Sovereign Gold Bonds.

Sovereign Gold Bond Liquidity

The simplicity with which any asset can swiftly be turned into cash without suffering a large loss in value is known as liquidity. Currently, investing in digital gold has several advantages over investing in physical gold, including high liquidity, no storage costs, and ease of sale. Another significant aspect is that since its launch in 2015, the Sovereign Gold Bond has had double-digit gains (average annualized growth of 11%).

Investing in Sovereign Gold Bonds is particularly beneficial because, although there is an initial five-year lock-in period and an eight-year maturation period, bondholders receive 2.5 percent annual returns and capital gains at maturity are tax-free.

How to Liquidate a Sovereign Gold Bond?

The bond can be redeemed or cashed prematurely after the fifth year following the date of issuance on coupon payment dates, even though the bond has an eight-year term. If the bond has been kept in demat form, it can be traded on an exchange. It can additionally be transferred to another investor who is eligible.

Benefits of Sovereign Gold Bond Liquidity

Sovereign Gold Bonds offer several liquidity benefits to their investors. Here are a few of them.

Fixed Withdrawal Amount

Sovereign Gold Bonds offer a consistent redemption process, in comparison to gold exchange-traded funds or physical gold, since the selling price is determined by the current condition of the market. Investors know they will get the current price for gold if they hold their investments to maturity.

Tax Benefits

Profits earned from Sovereign Gold Bonds that are held till maturity are tax-free. This improves effective liquidity by giving a transparent post-tax return.

Easy Trading

Compared to physical gold, which needs to be purchased from a jeweler or dealer, Sovereign Gold Bonds can be purchased or traded on stock exchanges, providing them with an established means of liquidity.

Diversification of Investors

Sovereign Gold Bonds are attractive to both individual and institutional investors. Due to the wide range of liquidity preferences expressed by this investor base, it may be simpler to find who is buying or selling at any given point in time.

No Security or Storage Issues

Sovereign Gold Bonds lower the necessity for storage space and the risks related to gold’s genuineness, hence eliminating possible liquidity bottlenecks associated with physical gold.

How to Invest in a Sovereign Gold Bond?

To invest in sovereign gold bonds, investors generally have to follow the given steps.

- First, review the eligibility conditions established by the Reserve Bank of India for Sovereign Gold Bonds. Sovereign Gold Bonds can be purchased by individuals, trusts, universities, charity organizations, and Hindu Undivided Families (HUFs).

- Maintain tabs on the Reserve Bank of India’s release schedule. They release numerous tranches during the year, and you can invest at any moment.

- Some options include authorized commercial banks, post offices, the Stock Holding Corporation of India, and the Stock Exchange.

- If you want to apply for Sovereign Gold Bonds, choose an authorized distributor and complete your KYC documentation. You need to provide proof of identity, proof of address, and numerous other documents during KYC.

- Apply online by logging into your account using a channel that has been approved for online transactions. You can also buy offline and receive Sovereign Gold Bonds from that account.

- Choose how much money you wish to invest in Sovereign Gold Bonds. Usually, one gram of gold is the minimum purchase quantity for Sovereign Gold Bonds.

- Pay for your membership to Sovereign Gold Bonds using a variety of online options, such as Internet banking, NEFT, UPI, debit cards, etc.

- Following the successful processing of the application and making a payment, you will receive a confirmation via email with the subject Sovereign Gold Bonds Receipt.

- The RBI will distribute the Sovereign Gold Bonds in line with the applications it receives when the purchase period for the relevant tranche ends. RBI will credit your demat account with the Sovereign Gold Bond units if the application is approved.

- Since the Sovereign Gold Bond is tradeable on the stock exchange, you can also begin trading with it.

- Keep in mind that selling sovereign gold bonds at maturity does not incur capital gains tax.

Investing in Sovereign Gold Bonds on GoldenPi

GoldenPi offers simple and easy steps for investing in Sovereign Gold Bonds. The following steps can be followed:

- Log in or sign up on GoldenPi.

- Go to the Sovereign Gold Bond section.

- Read about the terms and conditions for gold bonds.

- Complete your KYC.

- Enter the amount (in grams) you want to invest.

- Make payments to invest.

Making Sovereign Gold Bond Investments Easy with GoldenPi

As gold is one of the most loved metal investments for Indians, making it digitally available for every investor at the smallest amount of investment of as little as one gram of gold, the government of India took a very positive step. The Sovereign Gold Bond rate of investment in the market has also drastically increased due to its backing by the RBI, high liquidity, good returns, and safety.

To make Sovereign Gold Bond investments easy, GoldenPi has a simplified section where you can make these investments in just a few steps. You can get notified of the bond openings and get detailed information about your investments and returns.

Start investing now, sign up on GoldenPi!

FAQs About Investing in Sovereign Gold Bond

1. How do I withdraw my sovereign gold bond before maturity?

The request for an earlier redemption can be fulfilled only if the completed forms have been received no later than ten working days prior to the coupon payment deadline. The bank account will be credited with the redemption earnings.

2. Is Sovereign Gold Bond better than FD?

If held until maturity, capital gains in Sovereign Gold Bonds are tax-free; however, interest generated is not. Interest on federal deposit accounts (FDs) is taxed according to the relevant income tax slabs. On the other hand, you can deduct up to Rs 1.5 lakh from your taxable earnings if you invest in tax-saving FDs.

3. Can I convert Sovereign Gold Bonds to physical gold?

No, sovereign gold bonds cannot be exchanged for physical gold. Sovereign Gold Bonds have been designed primarily as long-term investments. Sovereign Gold Bonds cannot be converted into physical gold; nonetheless, they are listed on the market and may be traded if they can be found in demat format. Sovereign Gold Bonds are exclusively offered in either a paper or digital format.

4. Can I convert SGB to demat?

Only the banks that issue the bonds allow for the inclusion of Sovereign Gold Bonds in the demat account. In order to demat the SGB on their part, the client must visit the issuing bank with their DP ID (CML).

5. Can we show Sovereign Gold Bonds in 80C?

Under Section 80C of the Income Tax Act, there are no tax benefits associated with an investment in Sovereign Gold Bonds (SGBs).

6. How do Sovereign Gold Bonds offer liquidity to investors?

SGBs are highly liquid as they offer premature withdrawal after 5 years, also allowing an investor to trade on exchanges if it is held in demat form.