High Yield | A+/ Watch Negative | Minimum Investment: 10k Only

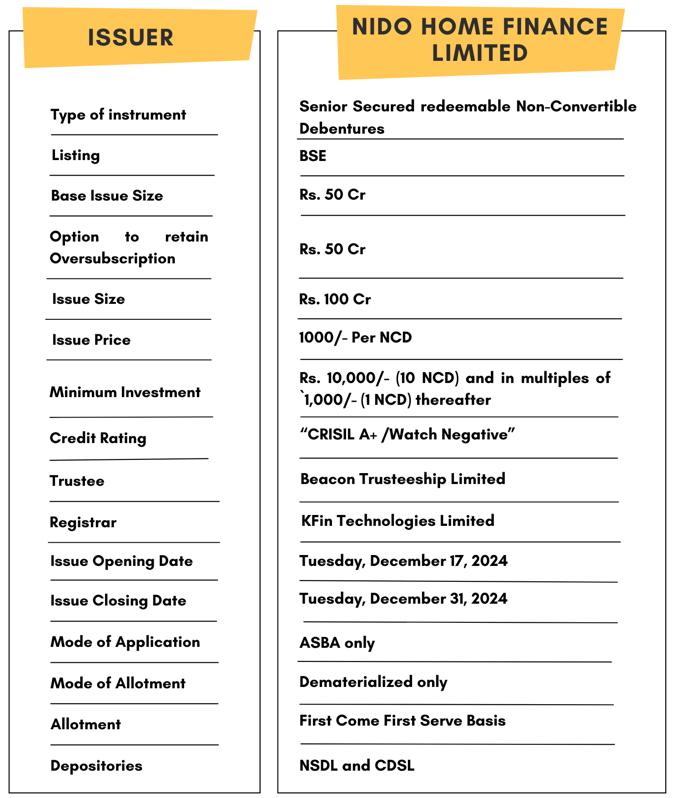

Bond overview

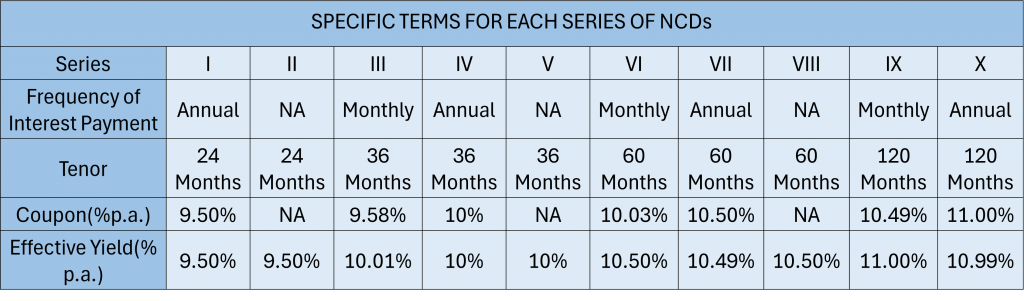

Nido Home Finance Limited is issuing the Non-Convertible Debentures. These NCDs are “A+/Watch Negative” rated by CRISIL. The NCDs are being issued in ten series: coupon ranges from 9.50% to 11% p.a. and different tenures of 24 months, 36 months, 60 months and 120 months. The NCDs are secured and redeemable in nature.

Coupon rates and effective yield for each of the series

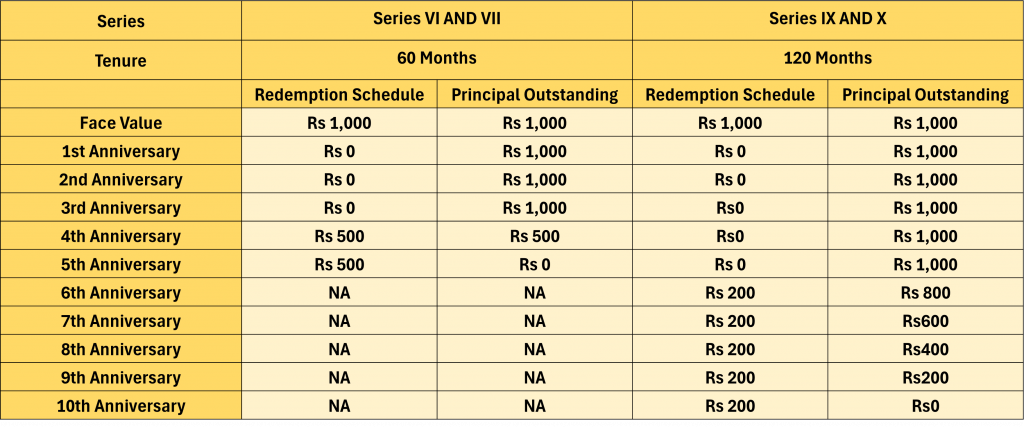

Redemption Payment Schedule

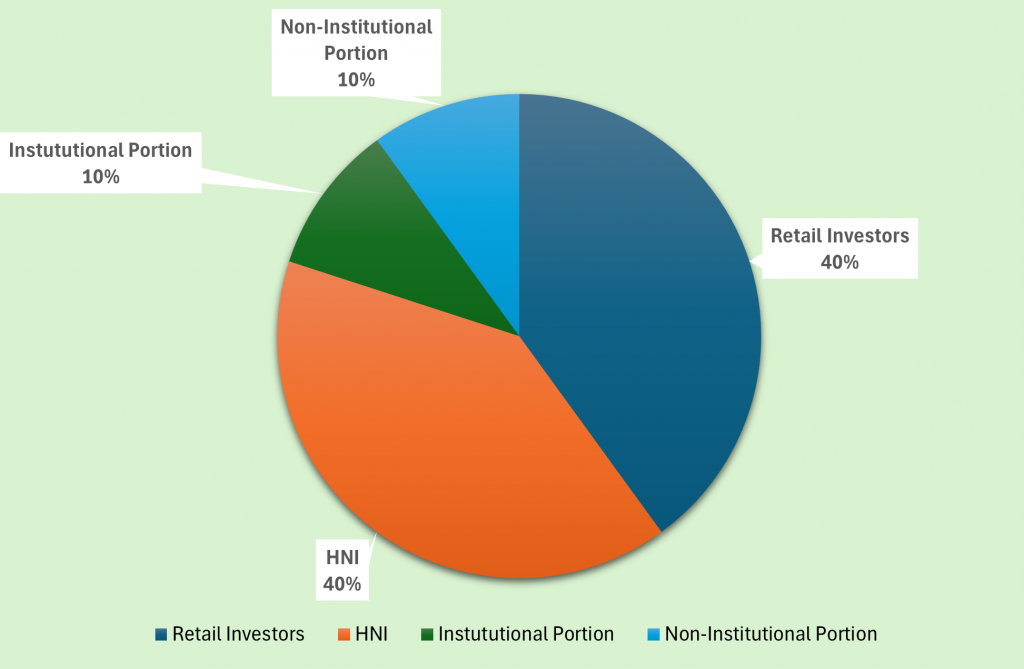

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Nido Home Finance Limited NCD-IPO.

Investment Process for Nido Home Finance Limited NCD IPO

You can invest in IPOs via GoldenPi in these easy steps.

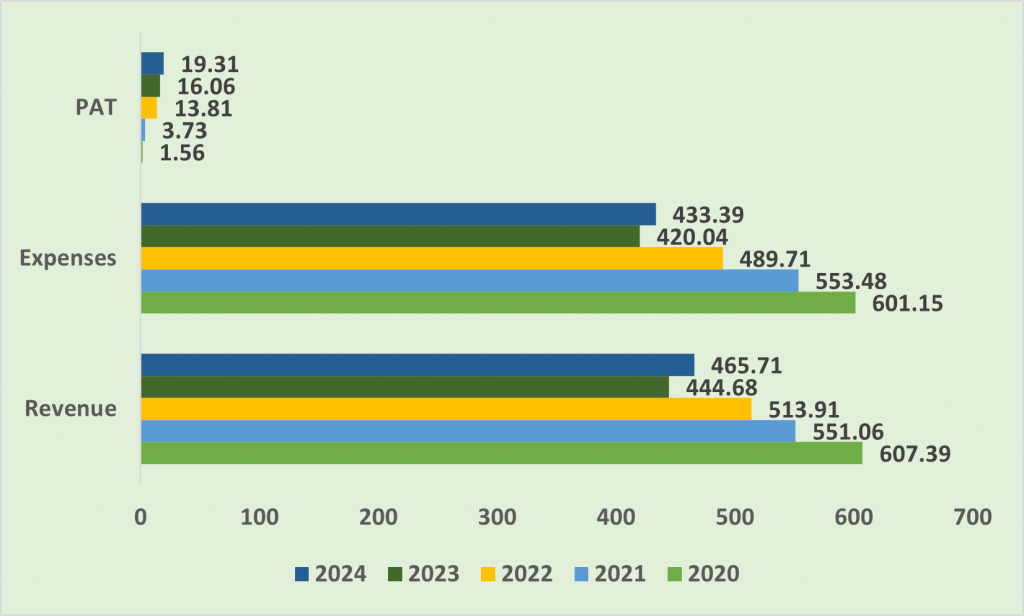

Financial Overview

Snapshot stating the Revenue, Expenses, and PAT (In crores)

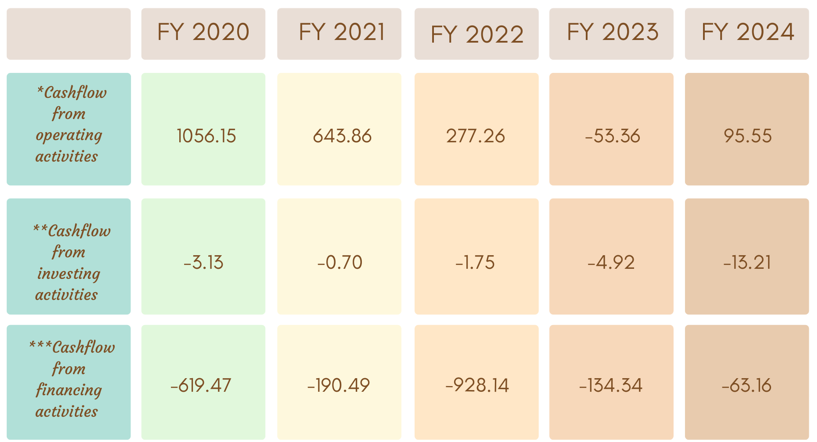

Cash flow for last few years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

Ratio Analysis

Issue analysis

Pros

- These NCDs are secured providing an additional layer of protection to your investment.

- The issuer is offering as high as 11% p.a. when compared with FD rates it is much higher.

- With a reduced net NPA of 1.19% in 2024, the company showcases a significant enhancement in asset quality, bolstering investor confidence.

Cons

- The company’s credit rating, previously stable at A+, has now shifted to A+ with a negative watch, suggesting possible financial uncertainties.

- The excessively high interest coverage ratio suggests potential challenges in the company’s ability to service interest payments over the long term

Liquidity

The group has liquidity of 1,795 Crores of which 1,125 Cr is in the form of bank balance, FDs and investment in mutual funds, 626 Cr in form of exchange margin and 44 Cr in the form of undrawn lines as on 22nd August, 2024.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Nido Home Finance Limited

Nido Home Finance Limited (Nido) is a housing finance company that is registered with National Housing Bank. It was established in FY2011 in accordance with the Group’s plan to establish a presence in the affordable housing market. In May 2023, the business changed its name to Nido Home Finance Limited (Formerly Edelweiss Housing Finance Limited) as part of the Group’s positioning effort. The business has adjusted its approach in recent years to concentrate on small-ticket home loans.

Strengths

- Adequate Capitalisation: The Edelweiss group, to which NHFL belongs, has demonstrated adequate capitalisation, supported by multiple rounds of capital raising. Since 2016, the group has raised ₹4,400 crore through stake sales in various businesses to global investors.

- Diversified Business Profile: The Edelweiss group has a diversified presence across lending, asset management, asset reconstruction, and insurance segments, which supports its earnings and business stability.

- Demonstrated Ability in Multiple Business Lines: The group has shown the ability to build a competitive presence in multiple lines of business, which is expected to support improvement in earnings.

Weakness

- Regulatory Concerns: The Reserve Bank of India (RBI) raised material supervisory concerns regarding ECL Finance Ltd (ECLF) and Edelweiss Asset Reconstruction Company Ltd (EARC), both part of the Edelweiss group. The RBI directed ECLF to cease structured transactions related to wholesale exposures and EARC to halt the acquisition of financial assets, which could impact the group’s business operations.

- Asset Quality Challenges: The group faces challenges in profitability and asset quality, particularly concerning its wholesale lending book. Although there has been some improvement, asset quality remains a key monitorable over the medium term.

- Rating Watch with Negative Implications: CRISIL Ratings has placed NHFL’s ratings on ‘Rating Watch with Negative Implications’ due to the aforementioned regulatory concerns and their potential impact on the group’s business and financial risk profiles.

Invest in Bond IPO online in just 5 minutes

Source- Prospectus December 5, 2024

Disclaimer- The information is published as on date 12/16/2024 based on information available on Prospectus December 5, 2024. The information may be subject to change in case of change in terms of prospectus or any other reason as the case maybe. Contents which are exclusively for educational information/knowledge sharing on capital market concepts and has no influence the investment/sale decisions of any investors