|

Getting your Trinity Audio player ready...

|

Introduction: What are Listed and Unlisted Bonds?

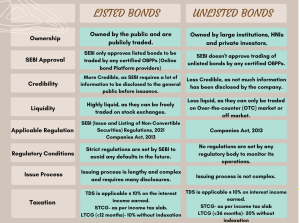

Listed bonds are a type of listed debt security that businesses use to solicit public debt. They are financial products that are traded on a recognised stock exchange like the Bombay Stock Exchange or the National Stock Exchange (NSE) (BSE). The public is given access to these bonds through the release of an offer document. SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021 governs them.

Meanwhile, unlisted bonds are debt securities that are not listed on any recognised stock exchange (NSE or BSE). These bonds are exchanged in the over-the-counter (OTC) market, which means that a broker or other middleman is involved in the transaction. Market-makers make it simple to buy and sell unlisted bonds on the OTC market. Unlisted bonds could be less liquid than listed bonds because they are not traded on an exchange.

Market Share of Listed and Unlisted Bonds

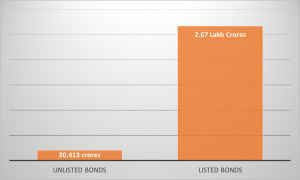

In H1FY23, Rs. 20,413 crores in unlisted bonds were issued as opposed to Rs. 53,176 crores during the same period last year.

In H1FY23, listed bonds raised more money than they did in the same period the previous year, reaching Rs. 2.67 lakh crore.

Listed vs Unlisted Bonds

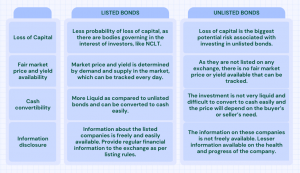

Risks Associated with Investing in Listed vs Unlisted Bonds

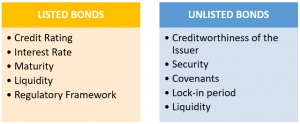

Points to be considered before investing in Listed and Unlisted Bonds-

Before investing in listed or unlisted bonds in India, there are a few points an investor should consider:

Listed Bonds:

- Credit Rating: Check the credit rating of the issuer of the bond to understand the creditworthiness of the issuer.

- Interest Rate: Check the interest rate offered on the bond and compare it with other similar bonds in the market.

- Maturity: Check the maturity period of the bond and ensure that it aligns with your investment horizon.

- Liquidity: Check the liquidity of the bond and the trading volume on the stock exchange.

- Regulatory Framework: Understand the regulatory framework governing the bond and the issuer’s compliance with it.

Unlisted Bonds:

- Creditworthiness of the Issuer: Check the creditworthiness of the issuer of the bond through their financial statements and credit ratings.

- Security: Check if the bond is secured by any assets of the issuer.

- Covenants: Check the covenants in the bond document that provide additional protection to the bondholders.

- Lock-in Period: Check if there is a lock-in period before the bond can be redeemed or sold.

- Liquidity: Check the availability of a secondary market to sell the bond if required.

- Tax Implications: Understand the tax implications of investing in an unlisted bond.

While the points to consider may differ for listed and unlisted bonds, investors should carefully evaluate the issuer’s creditworthiness, the security, the interest rate, the liquidity and the regulatory framework to make an informed investment decision.

Is My Investment Safe With Bonds? Q&A Session

Default Resolution Process

The resolution process for default in listed and unlisted bonds in India is slightly different. Here’s a brief overview:

Listed Bonds:

In the case of listed bonds, the resolution process is governed by SEBI regulations. The bondholders can approach the Debenture Trustee (DT) appointed by the company to take necessary action on their behalf. The DT can take legal action against the defaulting company or take measures to protect the interests of the bondholders. The company is required to disclose the default to the stock exchange and the bondholders.

Unlisted Bonds:

In the case of unlisted bonds, the resolution process is determined by the terms and conditions mentioned in the bond document. The bondholders can approach the company directly to seek a resolution. The company can choose to restructure the debt, offer a settlement or initiate legal proceedings to recover the money.

If the company fails to honor its commitment, the bondholders can initiate legal proceedings to recover the money. The process may involve approaching the Debt Recovery Tribunal (DRT) or initiating insolvency proceedings under the Insolvency and Bankruptcy Code (IBC).

In summary, while the resolution process for default in both listed and unlisted bonds involves legal action, the regulatory framework and process of approaching the Debenture Trustee or the company may differ.

Securities Exchange Board of India proposed in one of the consultation paper that any issuer who has previously issued listed securities cannot issue unlisted securities; instead, the subsequent issuance must likewise be listed.

Conclusion: An Overview of the Benefits of Investing in Both Types of Bonds

Investing in listed and unlisted bonds both have their own advantages and disadvantages. Here are some of the advantages of each:

Advantages of Listed Bonds:

- Liquidity: Listed bonds are traded on stock exchanges, which means that they are more liquid than unlisted bonds. Investors can buy or sell these bonds anytime during market hours, and the price is determined by the market demand and supply.

- Transparency: The price of listed bonds is publicly available on stock exchanges, and the issuers are required to disclose all material information to the stock exchange and the regulators. This transparency provides investors with greater confidence and assurance.

- Price Discovery: The trading of listed bonds on stock exchanges provides an efficient and transparent price discovery mechanism. This enables investors to make informed decisions based on the current market conditions.

Advantages of Unlisted Bonds:

- Higher Yields: Unlisted bonds often offer higher yields compared to listed bonds, as they are typically issued to a small group of institutional investors who negotiate the terms and conditions directly with the issuer.

- Flexibility: The terms and conditions of unlisted bonds can be customized to meet the specific needs of investors. This means that issuers can offer a wide range of maturities, payment frequencies, and other features to attract investors.

- Lower Costs: Unlisted bonds are issued directly to investors, which means that there are no intermediaries involved, such as brokers or underwriters. This can result in lower issuance costs, which can be passed on to investors in the form of higher yields.

It is important for investors to carefully consider their investment objectives, risk tolerance, and liquidity needs before deciding to invest in either listed or unlisted bonds. They should also conduct thorough research and analysis to ensure that they are investing in bonds that align with their investment goals and risk appetite.