|

Getting your Trinity Audio player ready...

|

High Yield | AA-/Positive Rated | Minimum Investment: 10k Only

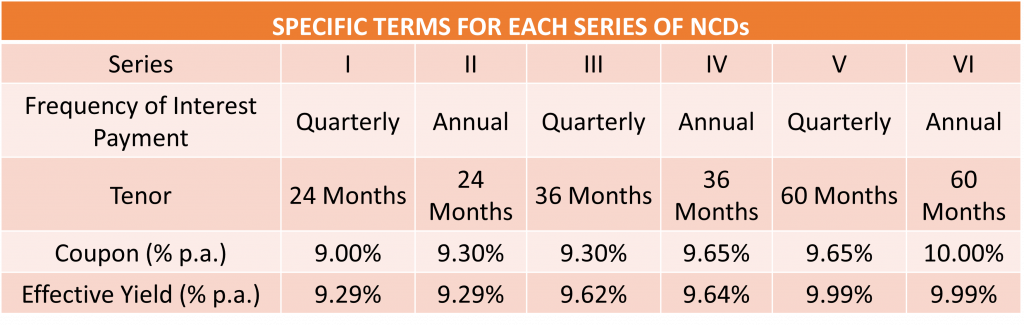

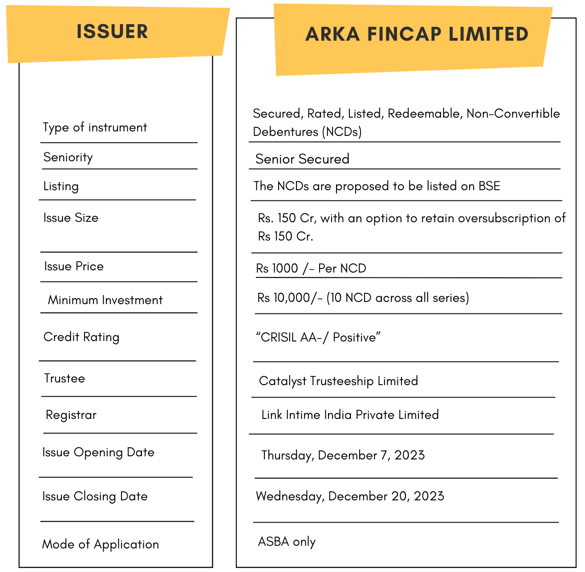

Arka Fincap Limited is issuing the Non-Convertible Debentures. These NCDs are AA-/Positive rated by CRISIL. The NCDs are being issued in six series: coupon ranges from 9.00% to 10.00% p.a. and different tenures of 24 months, 36 months and 60 months. The NCDs are secured and redeemable in nature.

Arka Fincap Limited NCD IPO: Coupon rates and effective yield for each of the series

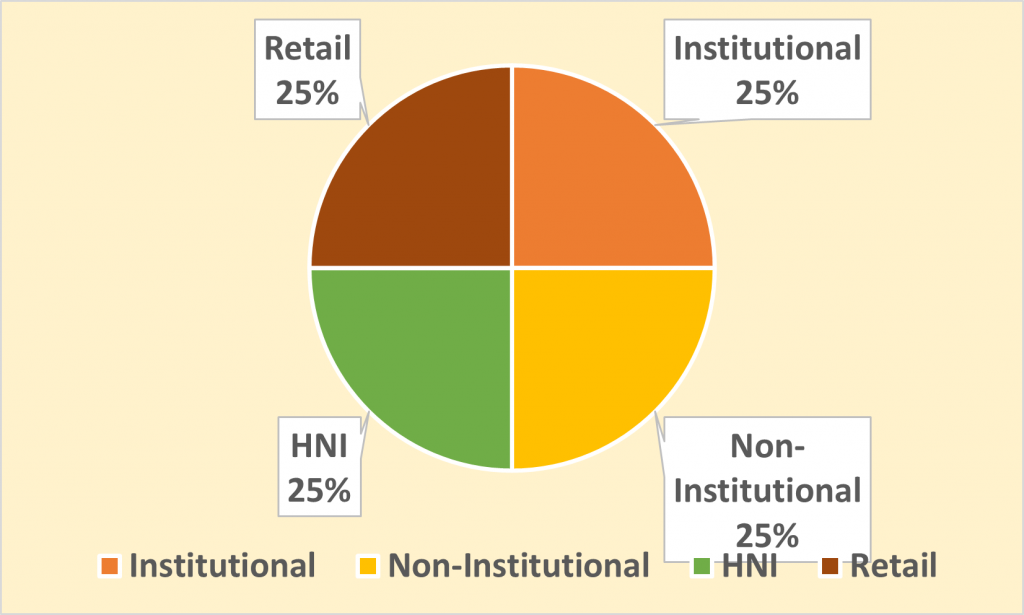

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Arka Fincap Limited NCD-IPO.

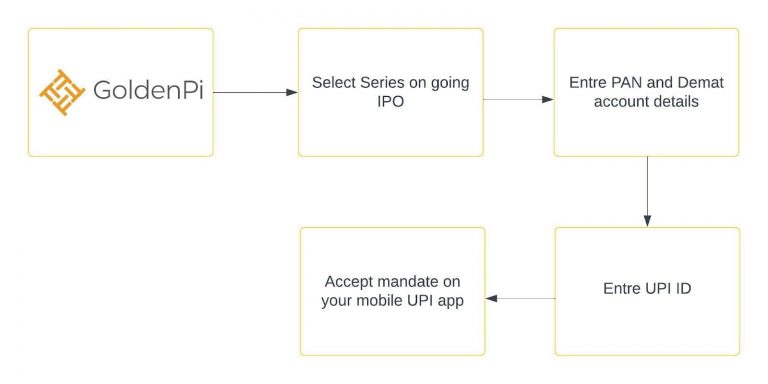

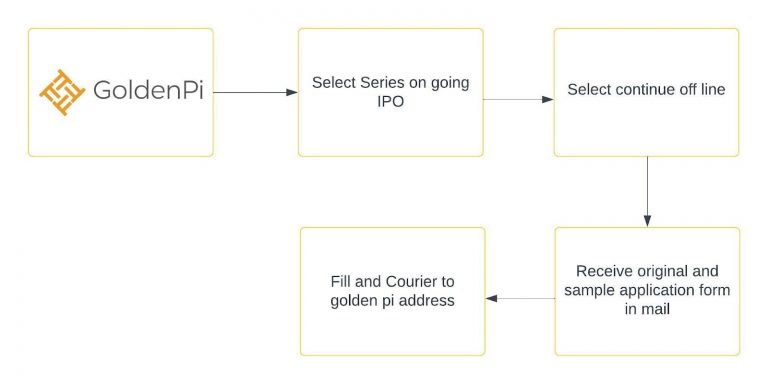

Investment Process for Arka Fincap Limited NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

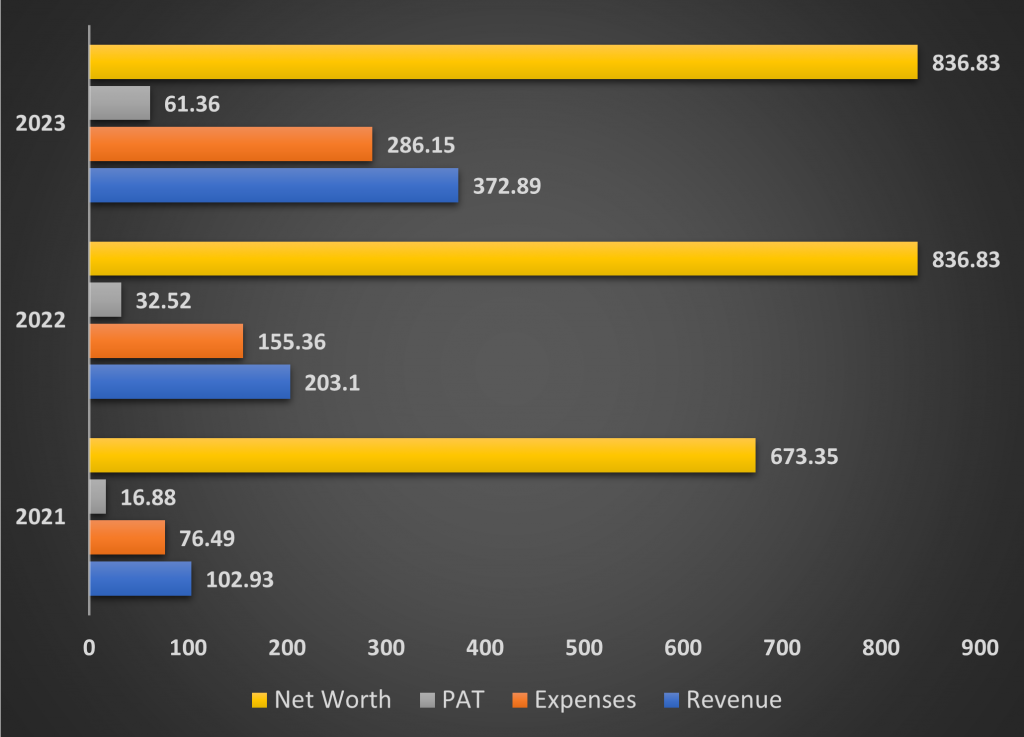

Financial Overview

Snapshot stating the Revenue, Expenses, Net Worth and PAT (In crores)

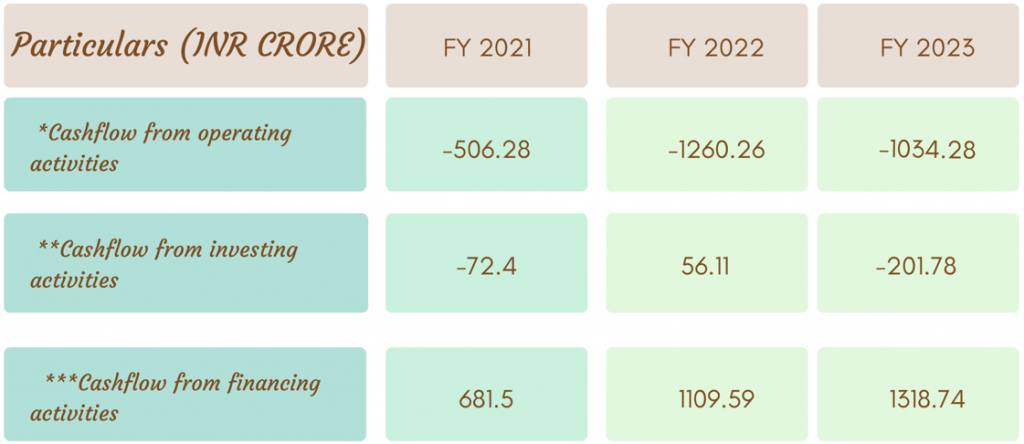

Cash flow for last few years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

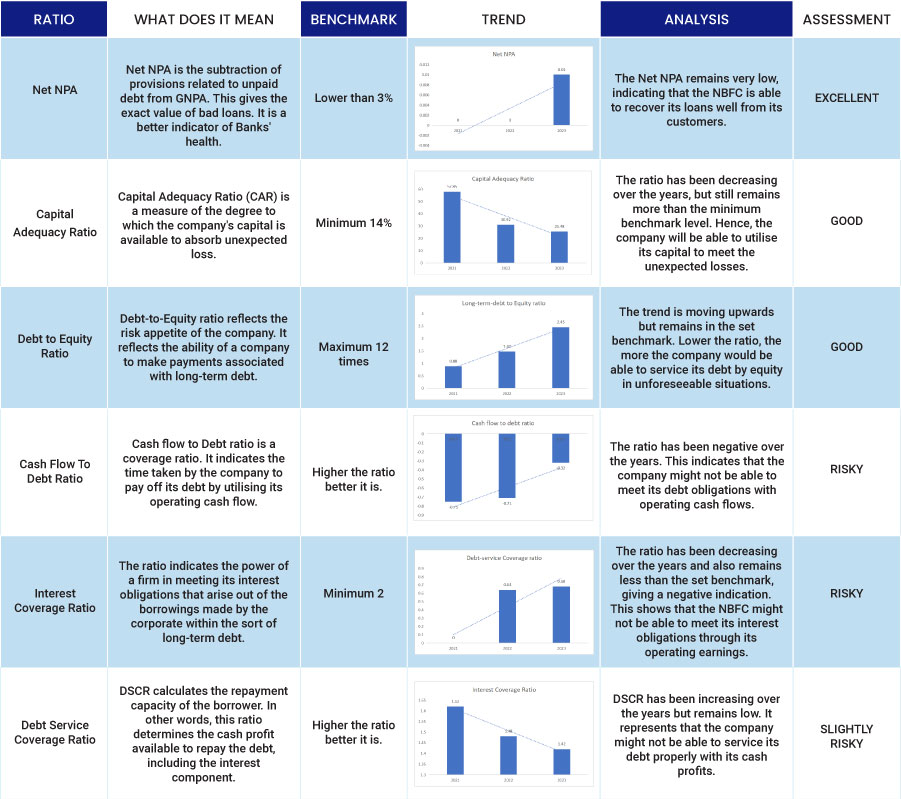

Ratio Analysis

Issue analysis

Pros

- The NCD is AA- rated security with a positive outlook.

- The coupon rate is between 9% to 10% which is much higher than FDs.

Cons

- Company commenced its operations in April 2019, therefore they are still in the very initial stages of operations.

Liquidity

With around Rs. 586 cr in cash and cash equivalents (Rs. 119 cr), Rs. 291 cr in liquid investments, and Rs. 176 cr in unused bank lines, the company has sufficient liquidity.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Arka Fincap Limited

Arka Fincap Limited is a systemically important non-banking finance company (NBFC) with a customer-focused approach and digital capabilities. It is a step-down subsidiary of KOEL and is marketed by the Kirloskar group. They serve corporates, developers, MSMEs, and SMEs both secured and unsecured finance options. Arka is an RBI-licensed business that was established in 2018. At now, Arka operates in 17 cities in India’s West, South, and North regions, employing more than 300 people across all of its branches.

Strengths

- Strong Parentage: Arka Fincap benefits from the strong backing of its parent company, KOEL, a large and diversified conglomerate with significant financial strength.

- Satisfactory Financial Performance: Arka Fincap has demonstrated a consistent track record of profitable operations, with a healthy asset quality and adequate capital adequacy.

- Diversified Portfolio: The company maintains a diversified loan portfolio across various industries and geographies, mitigating concentration risks.

- Experienced Management: Arka Fincap is steered by a seasoned team with extensive experience in the financial services sector, ensuring sound risk management practices.

Weakness

- Limited Market Reach: The company’s operations are currently concentrated in a few geographies, potentially limiting its overall growth potential.

- Competitive Landscape: Arka Fincap faces intense competition from established players in the market, which could impact its profitability and market share.

- Dependence on Wholesale Funding: The company relies significantly on wholesale funding sources, making it susceptible to fluctuations in interest rates and liquidity risks.

Invest in Bond IPO online in just 5 minutes

Disclaimer: Investments in debt securities are subject to risks. Read all the offer related documents carefully.