|

Getting your Trinity Audio player ready...

|

High Yield | BBB+/Stable Rated | Minimum Investment: 10k Only

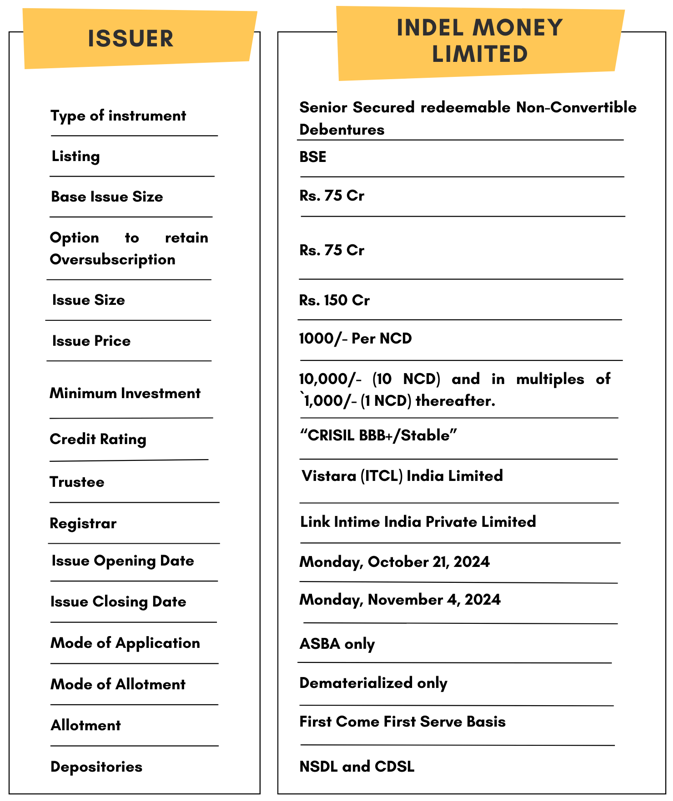

Bond overview

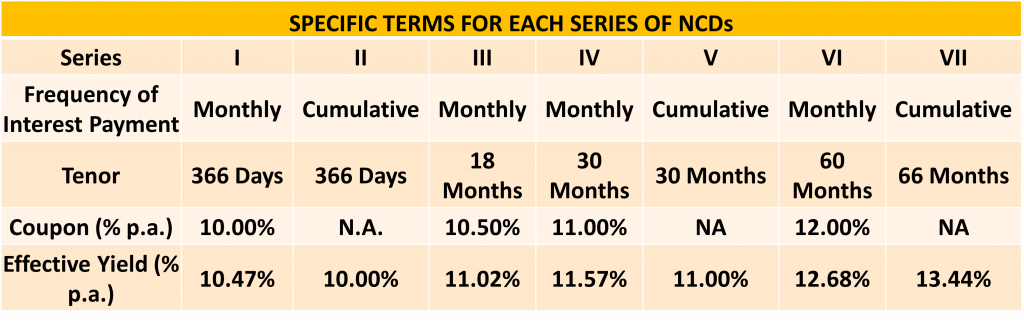

Indel Money Limited is issuing the Non-Convertible Debentures. These NCDs are BBB+/Stable rated by CRISIL. The NCDs are being issued in seven series: coupon ranges from 9% to 11.5% p.a. and different tenures of 366 days, 18 months, 30 months, 60 months and 66 months . The NCDs are secured and redeemable in nature.

Coupon rates and effective yield for each of the series

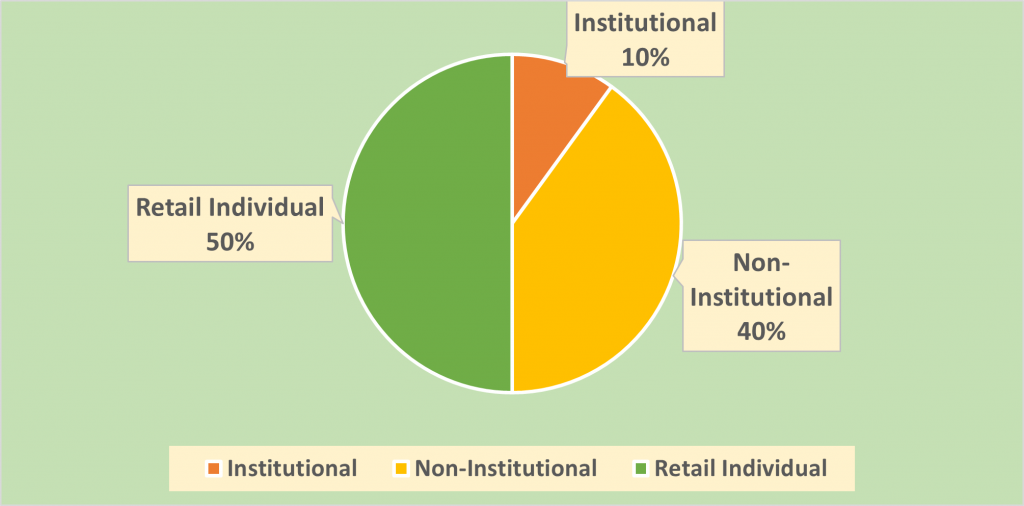

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Indel Money Limited NCD-IPO.

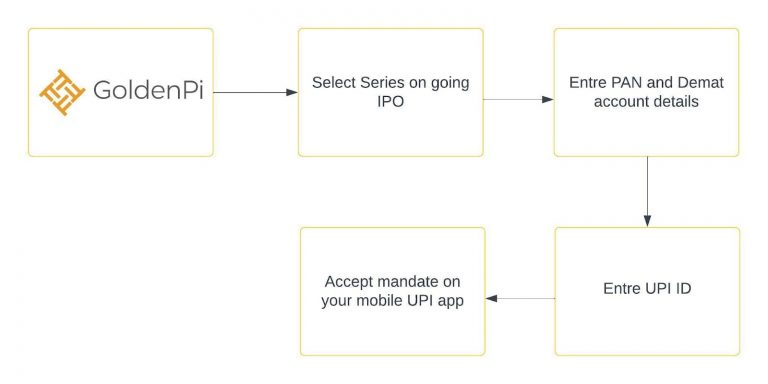

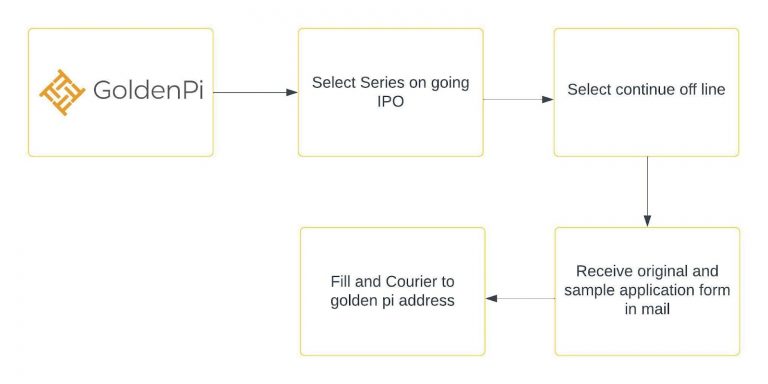

Investment Process for Indel Money Limited NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

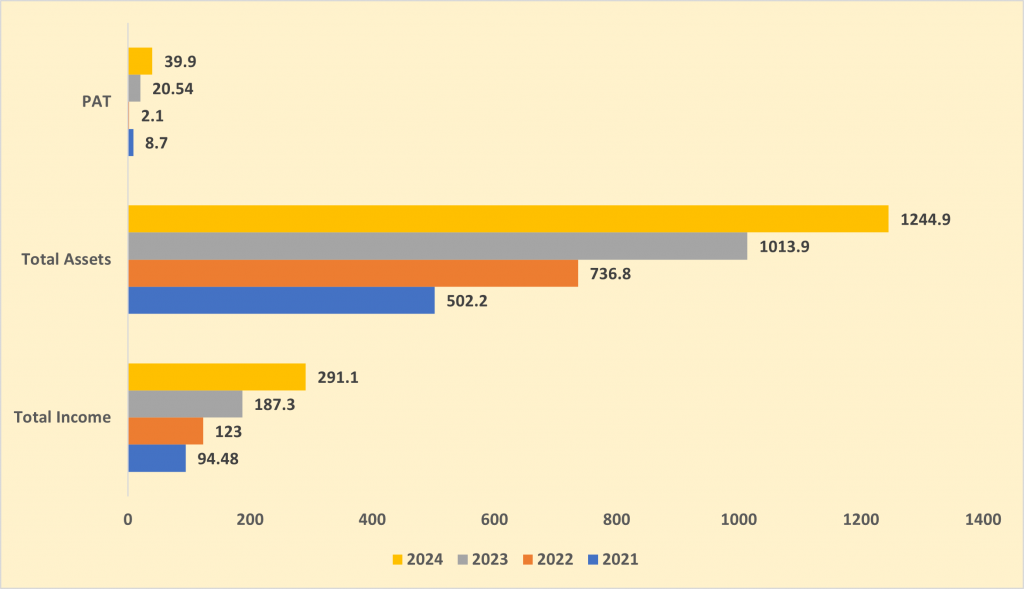

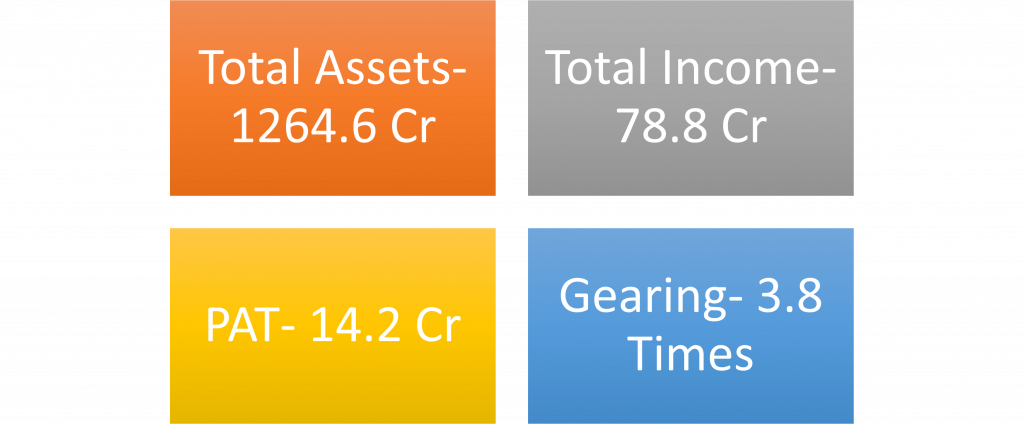

Financial Overview

Snapshot stating the Revenue, Expenses, Net Worth and PAT (In crores)

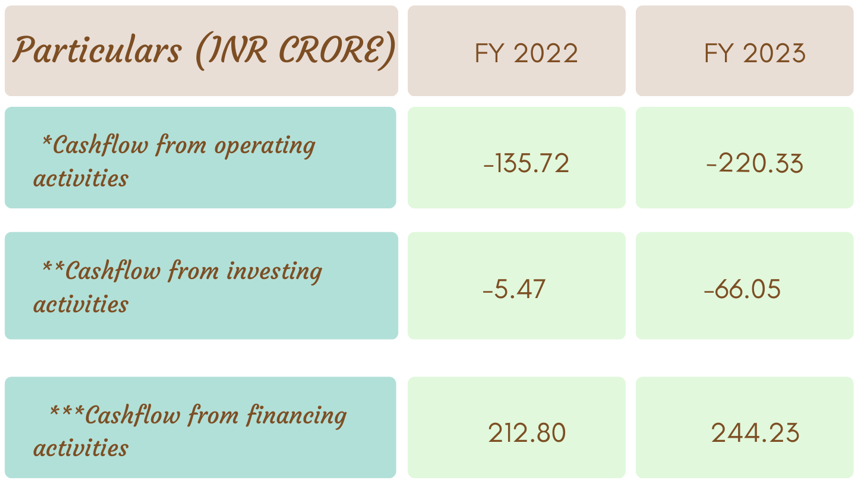

Cash flow for last few years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

Issue analysis

Pros

- These are senior secured securities.

- The issuer is offering high coupon rates, when compared with FD rates.

Cons

- Earnings are lower than that of large gold loan financiers.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Indel Money Limited

Indel Money Limited, established in 1986 and rebranded in 2013, is a non-deposit-taking NBFC primarily focused on gold loan financing. Acquired by its current promoters in 2012, the company has expanded its offerings to include business loans, loans against property, and vehicle loans. With a strong management team led by industry veterans and consistent capital infusion, Indel Money has demonstrated solid asset quality and a growing asset base, reaching ₹1,788 crore in assets under management as of June 2024. The company has maintained a CRISIL BBB+/Stable rating, reflecting its financial stability and robust growth

Q1 Fiscal 2025

Strengths

- Experienced Management: Promoters and senior management have extensive experience in the gold financing business, ensuring strong leadership.

- Adequate Capitalisation: Regular capital infusion and healthy net worth (₹236 crore as of June 2024) support operational growth.

- Strong Asset Quality: 90+ days past due (dpd) at 1.5% in June 2024, showcasing sound portfolio management.

- Steady Growth: 16% year-to-date growth in assets under management (AUM), reaching ₹1,788 crore by June 2024.

Weakness

- Average Profitability: Despite improvements, earnings remain lower compared to larger competitors with a RoMA of 2.4% in fiscal 2024.

- Geographical Concentration: Operations heavily concentrated in Southern India, increasing regional risks.

- High Operating Costs: Expansion into new states has led to elevated operating expenses, impacting profitability.

Invest in Bond IPO online in just 5 minutes

Source- Prospectus October 8, 2024

Disclaimer- The information is published as on date 24/10/2024 based on information available on Prospectus October 8, 2024. The information may be subject to change in case of change in terms of prospectus or any other reason as the case maybe. Contents which are exclusively for educational information/knowledge sharing on capital market concepts and has no influence the investment/sale decisions of any investors