|

Getting your Trinity Audio player ready...

|

High Yield | AA/Stable | Minimum Investment: 10k Only

Bond overview

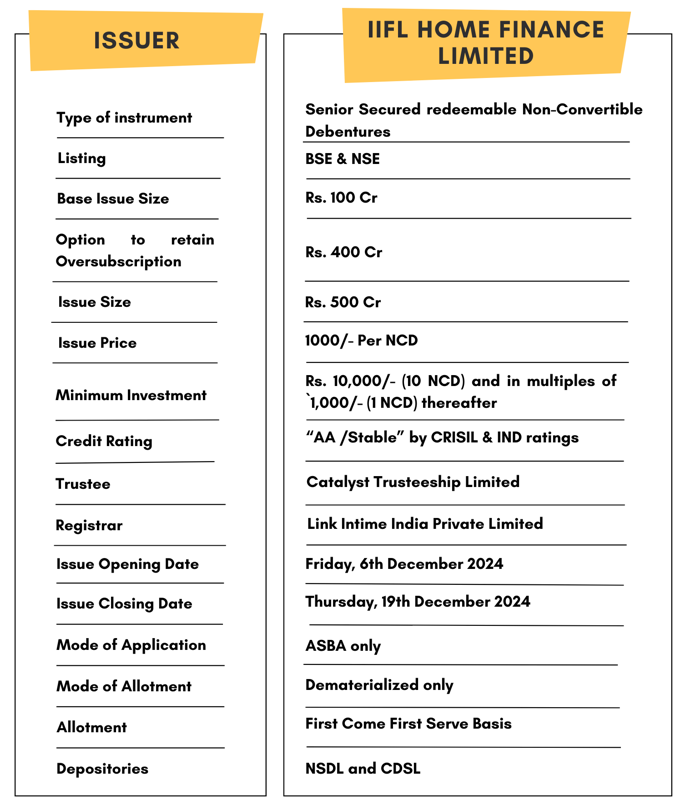

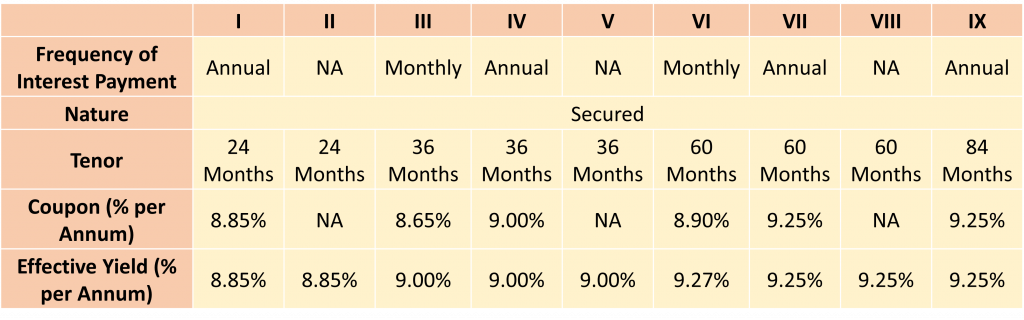

IIFL Home Finance Limited is issuing the Non-Convertible Debentures. These NCDs are “AA/Stable” rated by CRISIL and IND ratings. The NCDs are being issued in nine series: coupon ranges from 8.65% to 9.25% p.a. and different tenures of 24 months, 36 months, 60 months and 84 months. The NCDs are secured and redeemable in nature.

Coupon rates and effective yield for each of the series

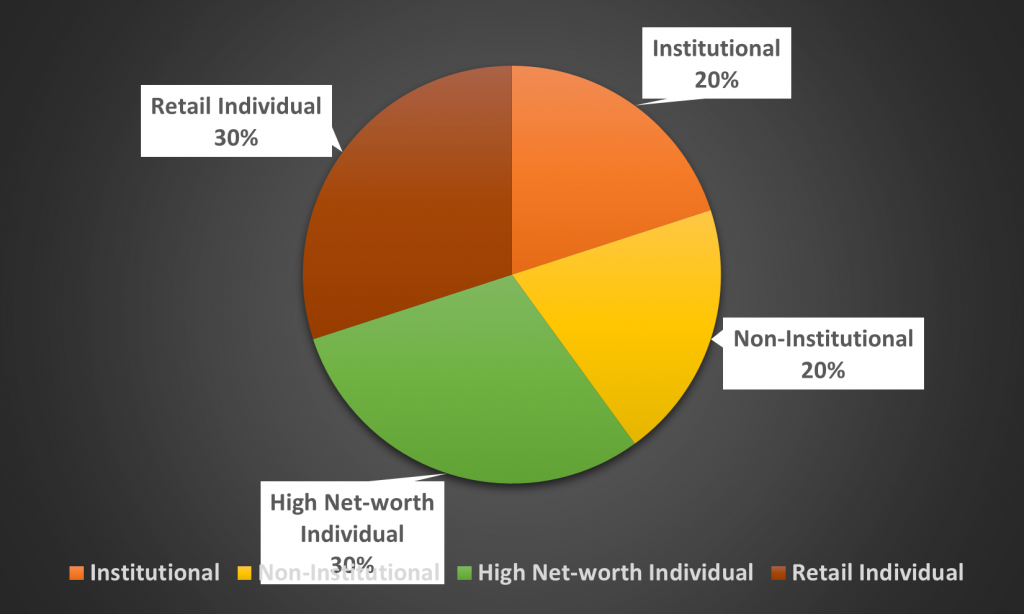

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for IIFL Home Finance Limited NCD-IPO.

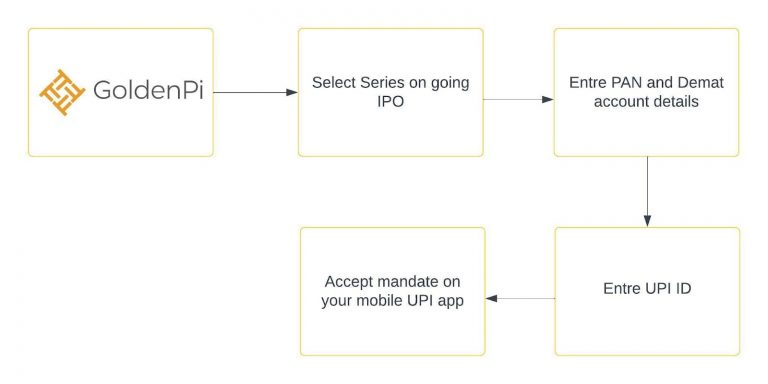

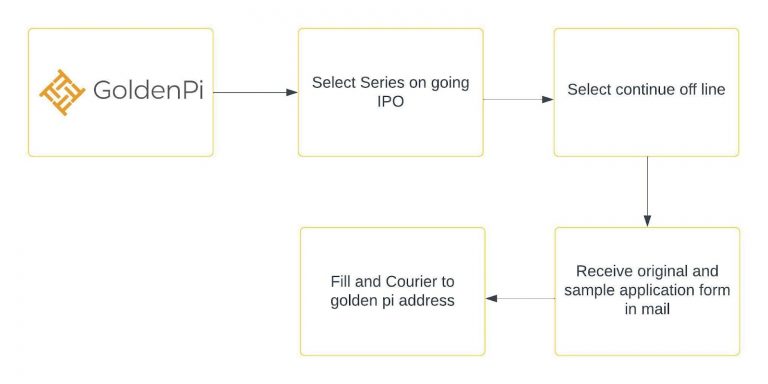

Investment Process for IIFL Home Finance Limited NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

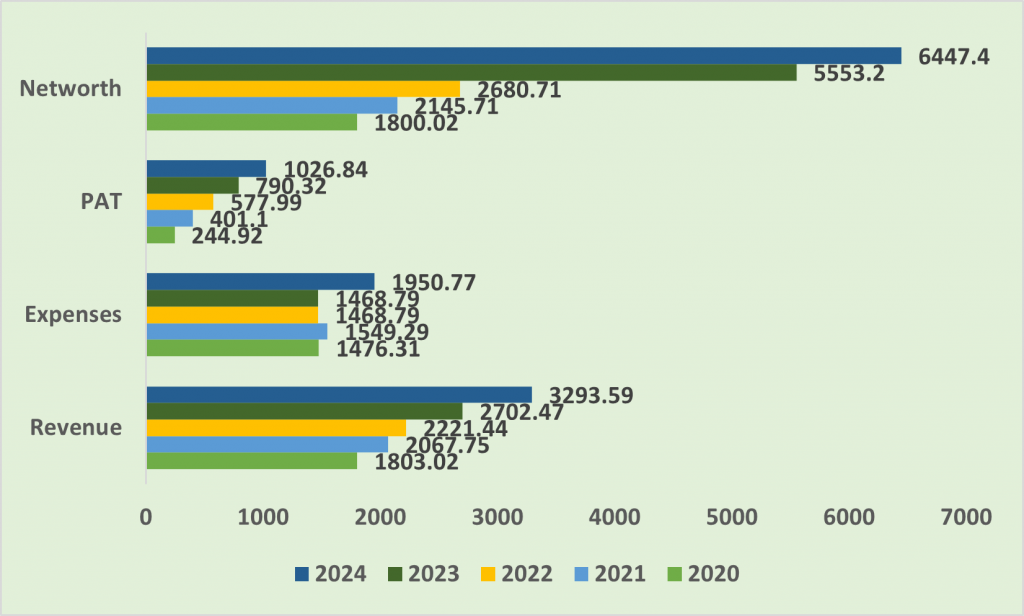

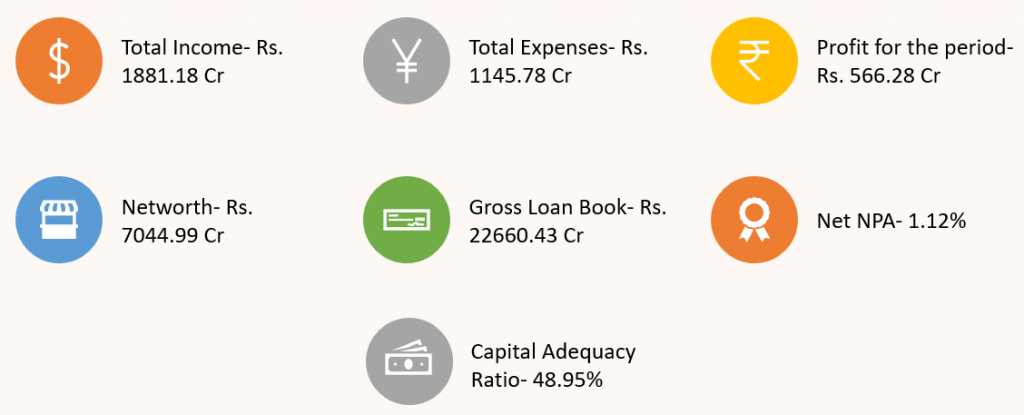

Financial Overview

Snapshot stating the Revenue, Expenses, Net Worth and PAT (In crores)

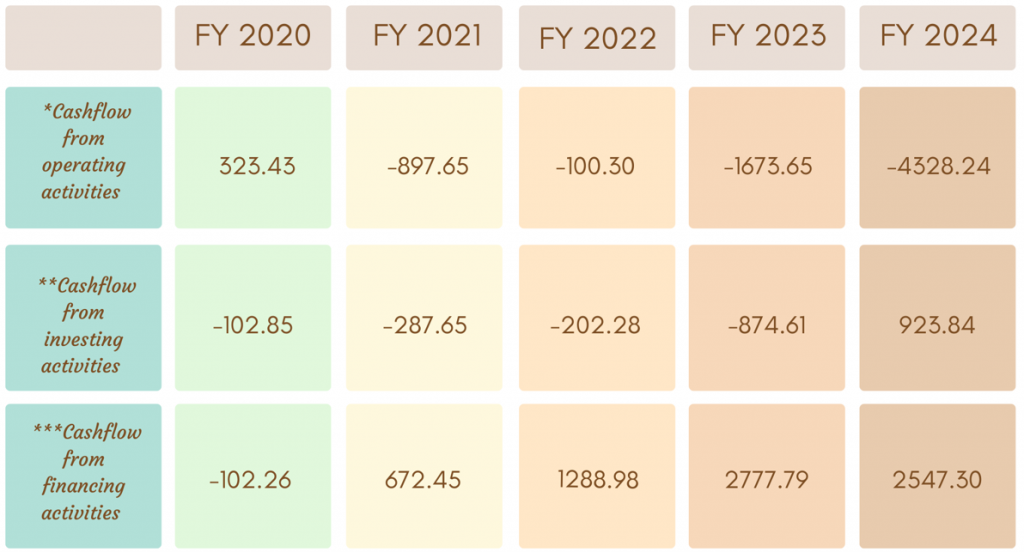

Cash flow for last few years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

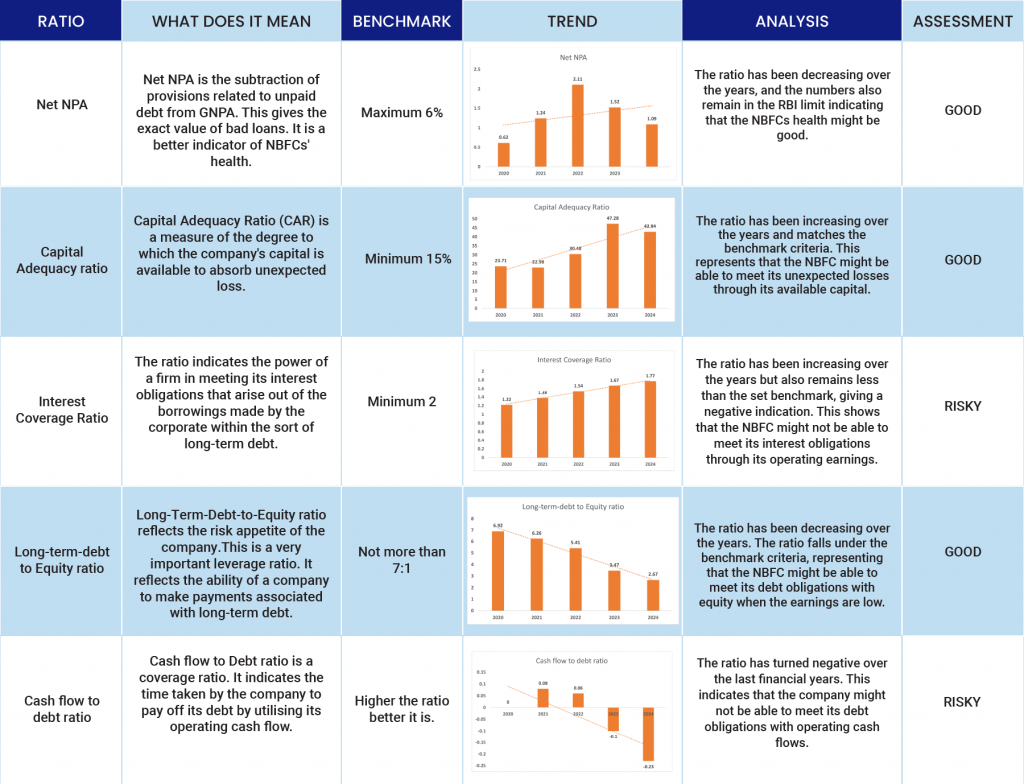

Ratio Analysis

Issue analysis

Pros

- These NCDs are secured providing an additional layer of protection to your investment.

- The issuer is offering as high as 9.27% p.a. when compared with FD rates it is much higher.

Cons

- Negative Cashflows

To get better returns than Bank FDs, invest in NCD-IPOs online.

Liquidity

The company has more than 4595 Crores in cash and cash equivalents, 354 Cr of unutilised cash credit limit and 713 Cr of undrawn sanctioned bank limits as on November 2024.

About IIFL Home Finance Limited

IIFL Home Finance Limited is a leading technology-driven and retail-focused housing finance company in India. The company primarily caters to first-time home buyers in the Economically Weaker Sections (EWS) and Low-Income Group (LIG). With a strong presence in Tier 1 to Tier 4 cities, IIFL Home Finance provides accessible housing finance solutions to salaried and self-employed customers.

As of June 30, 2024, the company has served over 4.1 lakh customers and has an Asset Under Management (AUM) of ₹37,089.39 crore as of September 30, 2024. IIFL offers a wide range of loan products, including housing loans, secured business loans, and affordable housing project loans

Q2FY25

Strengths

1️⃣ Focus on Affordable Housing

- Targets EWS and LIG segments with an average housing loan size of ₹0.15 crore.

- Promotes home ownership in underserved and underpenetrated markets across Tier 2 to Tier 4 cities.

2️⃣ Impressive Financial Performance

- AUM stands at ₹37,089.39 crore (September 2024), showcasing consistent growth.

- Net Profit for FY24: ₹1,026.84 crore, a 29.92% increase from FY23.

3️⃣ Strong Digital Infrastructure

- Fully digitized loan lifecycle, from origination to closure, ensuring efficiency and enhanced customer experience.

4️⃣ Extensive Market Reach

- Operates through 387 branches across 18 states and 2 union territories, ensuring deep market penetration.

5️⃣ Low Non-Performing Assets (NPA)

- Gross NPA: 1.63% (Q2 FY25), reflecting robust credit appraisal and risk management practices.

6️⃣ Strong Leadership and Governance

- Managed by seasoned executives, including CEO Monu Ratra, driving strategic growth and operational excellence.

7️⃣ Innovative Financing Solutions

- Offers secured business loans for working capital and affordable housing project loans for developers, expanding its product portfolio.

8️⃣ Advanced Risk Management

- Maintains a robust credit appraisal process complemented by an in-house collection team, ensuring acceptable risk levels.

Weakness

1️⃣ Resource Concentration with Higher Costs

- As of June 30, 2024, 75% of on-book borrowings were from banks and financial institutions, including term loans (46%), refinance (17%), short-term borrowings (2%), external borrowings (9%), and others (1%).

Invest in Bond IPO online in just 5 minutes

Source- Trance I Prospectus November 27, 2024

Disclaimer- The information is published as on date 13/03/2024 based on information available on Trance I Prospectus November 27, 2024. The information may be subject to change in case of change in terms of prospectus or any other reason as the case maybe. Contents which are exclusively for educational information/knowledge sharing on capital market concepts and has no influence the investment/sale decisions of any investors