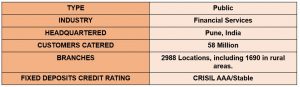

ABOUT THE COMPANY

A non-banking financial institution registered with the RBI, Bajaj Finance Ltd. accepts deposits. BFL was founded in 1987 and is a subsidiary of the Bajaj Group’s financial services division, Bajaj Finserv (52.8%). BFL offers a wide range of products, including loans for vehicles (two- and three-wheelers made by Bajaj Auto), consumer durables, personal loans, mortgage loans, loans for small enterprises, loans against securities, commercial finance, and rural finance. BFL is India’s top provider of financing for two-wheelers and consumer goods.

WHAT ARE CORPORATE FIXED DEPOSITS?

Company Fixed Deposits (corporate FDs) are term deposits kept for a set amount of time at a set interest rate. Financial institutions, both banking and non-banking, provide Company Fixed Deposits (NBFCs). A few months to a few years are the possible maturities for different corporate fixed deposits.

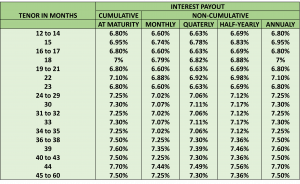

INTEREST RATE OFFERED BY BAJAJ FINANCE LTD CFD

Rate of interest per annum valid up to Rs. 5 Crores per deposit-

Senior Citizens get an additional rate benefit of 0.25% p.a.

FIXED DEPOSIT RELATED GUIDELINES BY BFL

- Minimum amount for opening a Fixed deposit with BFL is Rs. 15,000.

- Depositors falling under the special category of senior citizens (person more than 60 yrs of age) will be eligible for an additional interest rate of 0.25% p.a. Per deposit for an amount up to Rs. 5 Crores.

- Interest rates may vary on deposits of more than 5 crores and will be decided on a case to case basis but within the rate cap as specified by the Reserve Bank of India.

- In case of online applications, deposits will be booked upon the receipt of the funds and hence will be booked within 5 days from the date of application.

- Interest payable would be calculated from-

- The date of application made through BFL portal

- The date of receipt of funds by BFL

- The date of realization of amount by BFL

- Upon maturity the repayment of deposit will be made through RTGS or NEFT or account payee cheque unless it receives any request for renewal within the prescribed period before the date of maturity.

- The request for renewal shall reach the company at least 24 hrs before the maturity date of deposit either in physical format or through online portal.

- Renewal of deposits will be subject to the rate of interest and other terms & conditions prevailing at the time of renewal.

- In case the depositor has opted for renewal of deposit through deposit application form and wishes to cancel the renewal request shall submit the request to the company in written format at least 3 business days prior to the maturity of deposit.

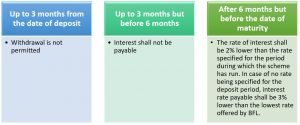

PREMATURE WITHDRAWAL

Investors that meet certain requirements and are subject to the regulations of the Reserve Bank of India can ask for premature withdrawal. Please note that the below mentioned conditions are to be followed in case of premature withdrawal-

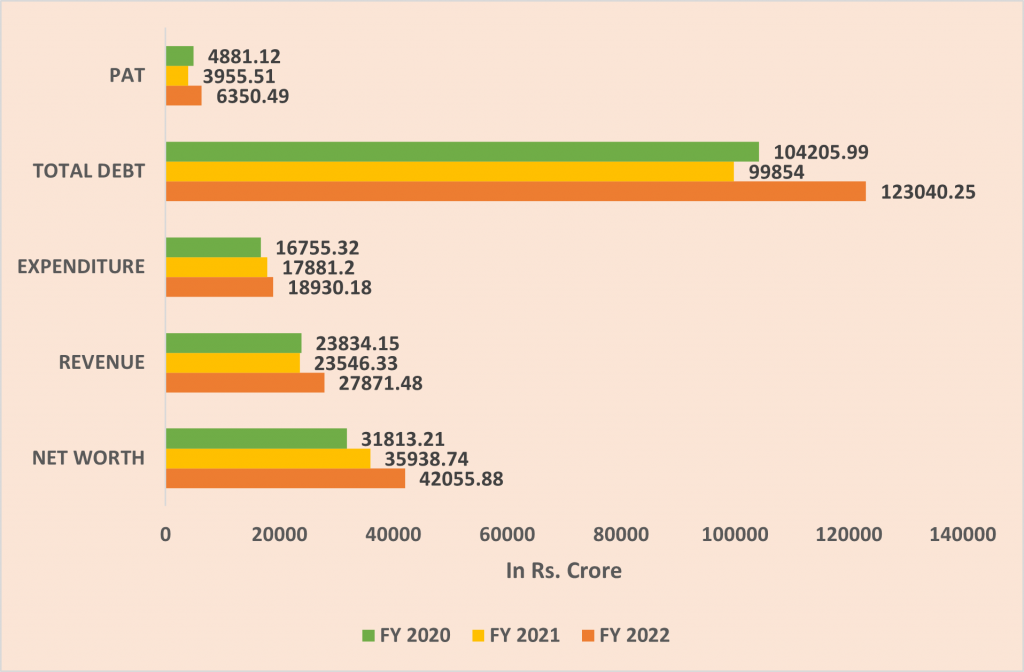

FINANCIAL OVERVIEW

Snapshot stating the Net worth, Revenue, Expenditure, Total Debt and PAT-

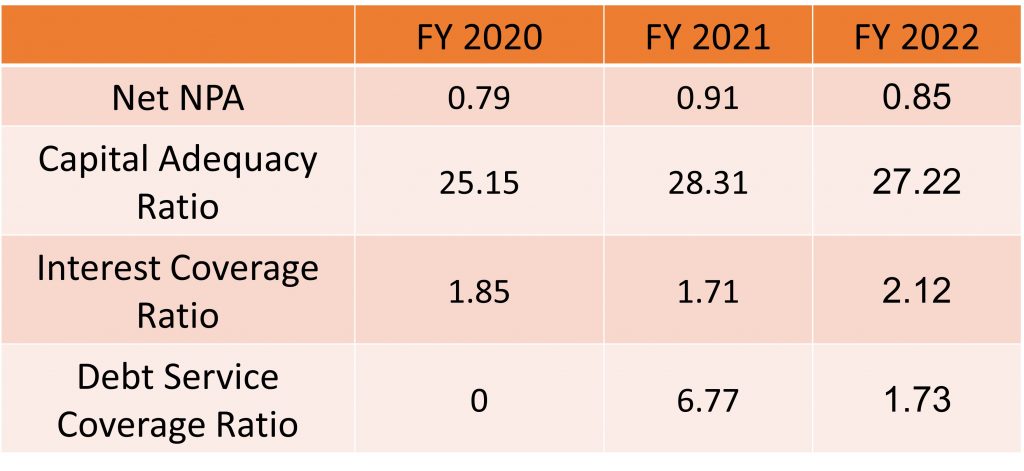

Financial Ratios-

CORPORATE FIXED DEPOSITS : A PRIMER!

STRENGTHS OF THE COMPANY

Well Diversified NBFC

One of the major NBFCs for retail asset finance in India, Bajaj Finance, continues to pursue a two-pronged approach to increase scale and maximise profit.

Strong Capitalisation

As of March 31, 2022, the capitalization was strong, with a sizable standalone net worth of Rs. 42,056 crore and appropriate Tier-I capital ratios of 24.8% and 27.2%, respectively. The ability to absorb possible losses on its portfolio is improved by the solid capitalization; the adjusted net worth to net NPAs ratio was 34 times as of March 31, 2022 (35 times as on March 31, 2021).

Growth of Assets under Management

Assets under management (AUM) increased to Rs. 146,743 crores as of March 31, 2022, up 27% year over year and 10% quarter over quarter. The expansion in consumer finance, commercial finance, and rural lending portfolios were the main contributors.

Robust Earnings profile

A significant fraction of high-yield companies and competitive borrowing costs promote earnings. Lower provisioning costs of Rs. 4,622 crore compared to Rs. 5,721 crore in fiscal 2021 and an increase in reported total income (net-off interest expenses) of Rs. 20,298 crore in fiscal 2022 compared to Rs. 16,100 crore in fiscal 2021 have helped to strengthen the earnings profile.

Strong expectation of support from the Bajaj Group

BFL is strategically significant to the Bajaj group, and its parent company, Bajaj Finserv, provides the company with substantial financial, administrative, and operational support. Additionally, it benefits from synergies from serving as Bajaj Auto Ltd.’s captive financier.

LIQUIDITY OUTLOOK

The liquidity position of the company remains comfortable on a standalone basis. The total repayments of BFL as on 31 March 2022 is of Rs. 13,827 Cr which is supported by the monthly collection of Rs. 11,000 Cr, as well as cash and cash equivalents and unutilised working capital of Rs. 11,351 Cr excluding collections.