The bond market is full of complex concepts, terminology, and acronyms. “Bond Glossary” is a one-stop resource for finding the meaning of terminologies and phrases any investor may encounter in the Bond Market.

A

ADDITIONAL TIER I BONDS (AT1 BONDS)

Tier I Bonds also called Perpetual Bonds. As per BASEL III norms, theoretically, these bonds can be carried on till infinity. In reality, they come with a call option after 5 years or 10 years from the date of issuance. It is a popular option among Banks to raise capital to meet their core capital (Tier1 capital) needs as instructed by RBI.

This category carries considerable risk and hence pays high-interest rates to investors. The issuer can skip interest payments if the current year business is in the loss. In dire conditions, it can get converted to equity (with approval from RBI). Hence they are also called “quasi-equity”. If RBI approves it can be written off up to the full value as well (with approval from RBI).

Note: In case of winding up of the issuer, if any payment is to be made to Tier I capital holders, AT I bondholders are paid before equity holders. However, in case the Bank is getting merged with another Bank due to its non-viable business state, then AT1 Bonds can be written off fully while keeping the equity capital unaffected.

ACCRUED INTEREST

This is the interest earned by an investor for a given period of time,

The bond issuer pays the bondholder a fixed interest on a predetermined schedule. However, if a bond were sold between its interest payment dates, the purchaser would have to pay the market price of the bond plus the appropriate fraction of the accrued coupon interest earned but not yet received by the party selling the bond.

Example: A has a 1 unit of a Bond with a face value of Rs 1 Lac and a coupon rate of 10% (payable annually). Every year A receives Rs 10 K from the issuer on a specific date. Then, after 6 months from one such payment, A sells this Bond to B. B then has to pay Rs 5K as an accrued interest to A along with the principal value of the Bond to A.

B

BASIS POINTS (BPS)

One Basis Point(BPS) is equal to 1/100th of 1%. It is a standard unit of measurement used to indicate a change in bond yield or percentages in the bond market. Small changes in yield or interest rates make a huge impact. Measuring and expressing such minute changes in the market is essential, and the same is done in terms of BPS.

BID PRICE AND ASK PRICE

Market prices depend upon the demand and supply of the bonds and the credit rating of the issuer. During a transaction, buyers and sellers bargain to decide the price of the bond. The buyer’s maximum price is the “bid price” (which means the buyer is not willing to pay beyond the bid price). The lowest price quoted by the seller is the “ask price” (means the seller is not willing

to sell the bonds below the ask price).

Note: Narrow gap between the “bid price” and “ask-price” is called the spread. A lower spread indicates that a bond is actively traded and hence is liquid. Illiquid Bonds (lower ratings, mostly below A) typically have large spreads.

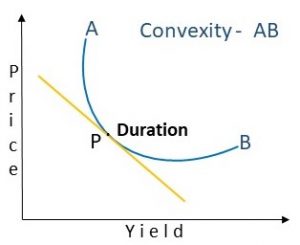

BOND CONVEXITY

The measure of the change in the bond duration for every 1% change in the market interest rates is called the Bond Convexity.

The measure of the change in the bond duration for every 1% change in the market interest rates is called the Bond Convexity.

There can be an accelerated change in bond price with a change in the interest rate in the market. As an example, say 1% change in the market interest rate causes the Bond price to change by x% then 2% change in the interest levels, may cause the Bond price to change by more than 2X. It’s not a linear relationship. This measure, called convexity, helps understand and predict bond price movements in the market with fluctuating interest rate regimes.

Note:

- There are different kinds of bond durations. The bond duration that we are discussing here is called”Modified Bond Duration.”

- Bonds with a positive convexity gain a higher price with a fall in yields than an increase in yields. Bonds with negative convexity lose a greater price with an increase in yields than a fall in yield. The higher the Convexity, the higher will be the market risk.

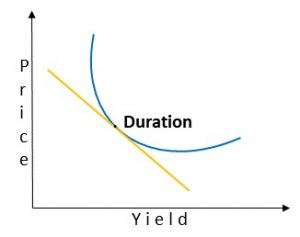

BOND DURATION

Bond Duration measures the percentage change in a Bond’s price with a 1% change in its yield level. For example, if a Bond has a duration of 5 years, then it means that for a 1% change in its yield, the Bond price will change by 5%.

Say Bond Price is 100, Bond Yield is 6%, and Bond Duration is 5 years.

Case 1 : Yield increase : +1% , Bond Price : 95

Case 2: Yield decrease: -1%, Bond Price: 105

As you can see, bonds with higher duration values will be more susceptible to large price changes when their yields change due to changes in market interest rates.

Note:

- Bond Price and market interest levels are inversely related. When interest rates fall, bond prices rise. When interest rates rise in the market, bond prices fall.

BOND OPTIONS: CALL OPTION & PUT OPTION

Bond Option is a contract between seller and buyer to be executed in the future at a predefined time and price (irrespective of current market price). A call option gives the buyer the right to buy the bonds but does not create an obligation on either party to execute the option. A put option provides the seller with the right to sell the bonds but does not create an obligation on either party to complete the option. Bonds with embedded call options are called callable bonds, and Bonds with embedded puttable options are called puttable options.

Bond Option is a contract between seller and buyer to be executed in the future at a predefined time and price (irrespective of current market price). A call option gives the buyer the right to buy the bonds but does not create an obligation on either party to execute the option. A put option provides the seller with the right to sell the bonds but does not create an obligation on either party to complete the option. Bonds with embedded call options are called callable bonds, and Bonds with embedded puttable options are called puttable options.

Examples:

Callable bonds from SBI

ISIN: INE062A0B249 ; Callable date: 9-Sep-2025 ; Maturity date: Perpetual; Coupon: 7.74%

Puttable Bond from Shriram City Union Finance Ltd.

ISIN: INE722A07AG5 ; Puttable date: 05-06-2021; Maturity date: 05-03-2023 ; Coupon: 9.25%

Note: The writer of the option is the ” option seller,” & another person who accepts this contract is the “option buyer.”

BRICKWORK RATINGS

Brickwork Ratings is a SEBI registered credit rating agency that has also been accredited by RBI and impaneled by NSIC. Brickworks has rated issues of a large number of banks including SBI, Bank of Baroda, Bank of India, Canada Bank, Corporation Bank, Punjab National Bank, Andhra Bank, and many others.

BOND MARKET

The bond market is a financial market where debt securities are issued and traded. The issuers sell bonds or other debt instruments in the bond market to fund the operations of their organizations.

BONDS

A debt security issued by entities such as corporations, governments or their agencies (eg. statutory authorities). A bondholder is a creditor of the issuer and not a shareholder.

C

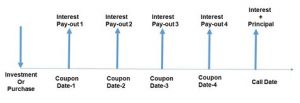

CALL DATE

The callable bond is a bond that the issuer can redeem before it reaches the maturity date also known as a redeemable bond. The call date is when a bond issuer can redeem a callable bond according to the schedule. If the interest rates fall, the issuer can buyback bonds. And with revised interest rates, the issuer can issue bonds at lower interest rates to reduce borrowing costs. Callable bonds offer a higher rate of interest than noncallable bonds of equal quality. And callable bonds are repurchased by the issuer at a premium price.

There is a concept called the “call protection period.” Within the call protection period, bonds can’t be called.

CAPITAL GAIN BONDS (54EC BONDS):

54EC Bonds are Capital Gain Tax Exemption Bonds that provide100% tax exemption on the long term capital gain earned by selling any property. These bonds are the best options to save tax after the property sale. But conditions apply, such as the time gap between property sale and bond investment can not exceed six months. Also, the investment limit in 54EC Bonds is 50 lakhs.

Note: 54 EC Bonds do not provide any exemption on short term capital gains.

COUPON

The Coupon or Coupon rate is the rate of interest paid by fixed-interest security such as Bond/ Debenture. It is the annual payment towards the face value of a bond. The bond issuing company pays it to the bond investor.

Example :

You buy a bond with the face value of Rs. 10,000, coupon rate of 10 %, and maturity five years. Let us assume that the date of payment is on 5th August every year. The Bond will also mature in the 5th year on 5th August. You will receive the annual interest payment for five years on every 5th August. The annual payment or the coupon value will be 10% of the face value of the Bond i.e., Rs. 1000 (10% of 10000). And at the date of maturity i.e., 5th August of the 5th year, you will get back your principal amount i.e., Rs 10,000 plus the last coupon payment of Rs 1000

Note:

- Face value is the price of the bond at which it is issued.

- The maturity of the bond refers to the date when Bond expires. On this date, the investor receives his principal amount and any outstanding interest payment from the issuer.

COUPON PAYMENT

A coupon payment is an annual interest that is paid to the bondholder from the date the bond is issued until the maturity date.

CONSIDERATION AMOUNT

The loan amount or principal paid by the bond investor is a consideration, in exchange for the borrower or bond issuing company’s promise to repay the principal and interest as per the agreed clauses.

COUPON RATE

The coupon rate is the rate of interest paid by fixed-interest security. It is the annual payment towards the face value of a bond made by the bond issuing company to the bond investor.

CONVERTIBLE BONDS

Convertible Bonds are the corporate bonds that bear the provision to be converted into a predetermined number of common stock or equity shares. Like any other Bond, these Bonds pay coupons regularly too. Conversion to common stock happens at a specific time before maturity and usually at investors’ discretion. The issuer also can force conversion to skip the redemption of bonds.

By issuing convertible bonds, companies can keep the company’s sale of equity under check and hence control promoter holdings dilution. As these bonds come with an extra feature of convertibility, they come with a lower coupon rate, reducing borrowing costs. If share prices are high, the investors can opt to convert bonds into shares; otherwise, they will continue to receive regular coupon payments.

CREDIT RATING

A credit rating is an evaluation of the credit risk of a prospective debtor, predicting their ability to pay back the debt, and an implicit forecast of the likelihood of the debtor defaulting.

CURRENT YIELD

The current yield is the present interest rate that the bond is offering to its owner. This is the rate of interest that a potential buyer can expect if they acquire this bond and hold on to it for a year.

Current Yield = Annual interest payment/ Current bond price.

CORPORATE BONDS

A security issued by a company in which the company acknowledges that a stated sum is owed and will be repaid at a certain date. A corporate bond, like a government-issued bond, usually pays a stipulated amount of interest throughout its life to the holder.

F

FIXED INTEREST RATE

A fixed interest rate is an unchanging rate paid on bonds. It remains the same for a predefined period of time (it can apply for the part of the term or entire term).

FOREIGN BONDS

Foreign firms issue bonds in domestic countries, and transactions happen in domestic currency; such bonds are called foreign bonds. Foreign Bonds carry additional risk, i.e., Currency Risk. They come with a high coupon rate to attract domestic investors. With foreign bonds, the issuer gets exposure to a broader range of investors. If the borrowing cost in the domestic country is relatively less, then foreign bonds can help the issuer to reduce borrowing costs. The examples for Foreign Bonds are Matilda bonds and Bulldog bond

G

GOVERNMENT BONDS

A government bond or sovereign bond is a bond issued by a national government, generally with a promise to pay periodic interest payments and to repay the face value on the maturity date.

H

HIGH-YIELD BONDS

The set of bonds that offer relatively much higher yields than investment-grade bonds is called High-Yield Bonds or Junk Bonds. Default risk is high; they carry a low credit rating. To compensate investors for taking the risk, the issuer of high-yield bonds offers a higher interest rate. The price of high-yield bonds is volatile. Companies with high debt ratio issue high-yield bonds.

Note: In India, bonds rated below “BBB” are considered high-yield bonds.

I

INFLATION LINKED BONDS

Inflation-Linked Bonds (ILBs) are bonds for which the principal value varies with inflation. The principal rises with inflation and decreases with deflation. Inflation-Linked Bonds are designed to protect investors from inflation risk.

Inflation-Linked Bonds (ILBs) are bonds for which the principal value varies with inflation. The principal rises with inflation and decreases with deflation. Inflation-Linked Bonds are designed to protect investors from inflation risk.

Suppose a bond gives annual returns of 7% in a year and inflation is 3 %. Then the real returns are not 7%, but 4%.

The yield of ILBs varies with inflation. Investors of ILBs will pay tax on interest earned beyond the inflation rate for that year. ILBs are taxed like other regular bonds.

Example: In 2013, Larsen & Toubro (L&T) issued 10 year-ILBs at 1.65% over wholesale price inflation. The company could raise the capital of Rs. 100 crores via ILBs.

INTERNATIONAL SECURITIES IDENTIFICATION NUMBER

International Securities Identification Number(ISIN) is the universally recognizable unique code given to securities. The respective country’s National Numbering Agency provides ISIN. In India, SEBI has assigned ISIN’s responsibility to the National Securities Depository Limited (NSDL). RBI regulates NSDL. ISIN consists of 12 alphanumeric digits: the first two digits represent the country’s code, the next nine digits are computer-generated security code, and the last digit is the check number. ISIN helps in preventing counterfeiting and forgery.

International Securities Identification Number(ISIN) is the universally recognizable unique code given to securities. The respective country’s National Numbering Agency provides ISIN. In India, SEBI has assigned ISIN’s responsibility to the National Securities Depository Limited (NSDL). RBI regulates NSDL. ISIN consists of 12 alphanumeric digits: the first two digits represent the country’s code, the next nine digits are computer-generated security code, and the last digit is the check number. ISIN helps in preventing counterfeiting and forgery.

Example: Issuer: SP Jammu Udhampur Highway Limited | ISIN: INE923L07266

Note:

- The United States and Canada use the CUSIP numbering system, similar to ISIN.

- ISIN is also used in Clearing Settlement of the securities

INVESTMENT-GRADE BONDS

The set of bonds that carry relatively low risk are called as Investment Grade Bonds. Default risk is very low; hence they are given high credit ratings. Yields for investment-grade bonds are lower than the non-investment grade bonds.

Note: In India, “AAA” to “BBB” rated bonds are considered as investment-grade bonds.

M

MATURITY DATE

The maturity date is the date on which the principal and due interest amount are paid to the bondholder by the issuer. The maturity date defines the lifespan of the bond. The bondholder is entitled to receive interest payouts till the date of maturity. After the maturity date, the contractual obligation of the bond issuer gets terminated. Longer is the term of maturity higher will be coupon rate. ”Call Date” and “ Maturity Date” are mentioned in the term sheet.

MASALA BONDS

Bonds issued by Indian entities in foreign countries are called Masala Bonds. And masala bonds are traded in Indian currency. The minimum maturity period is three years. The country where masala bonds need to be issued, that country must be a member of the International Organisation of Securities Commission. Indian companies who could raise capital via masala bonds are HDFC, NTPC, and Indiabulls Housing.

MUNICIPAL BOND

Municipal Corporation or its associate issues bonds to finance public projects such as schools, hospitals, parks, roads, and bridges. These bonds are called Municipal Bonds or Muni Bonds.

According to the SEBI’s guidelines, the municipality should not have a negative net worth in three previous years, and it should not have any default in the repayment of debt. Municipality directors should not be enlisted as a wilful defaulter by RBI. Municipal Bonds are generally tax-free. In the case of Municipal Bonds, underlying risk and returns are lower compared to corporate bonds. These bonds traded on all major stock exchanges. Examples of municipal bonds in India are Smart Cities and Atal Mission for Rejuvenation and Urbanisation Transformation.

P

PAR-VALUE AND MARKET PRICE

Par value is the price at which the Bond issuer issues a Bond unit. Par value is also called the face value. When a bond matures, the Bond issuer returns back the face value of the bond to the bondholder along with any outstanding interest payment.

The interest payouts are also calculated based on the par value of the bond. However, bonds need not be traded at par value; it can vary from par value. The price at which bonds are traded between buyers and sellers is called market price. Par value of the bond is always fixed: par value is one of the characteristics of bonds that define bonds as “fixed income instrument.”

PERPETUAL BONDS

Perpetual bonds are debt instruments that do not have fixed maturity, but they are callable in nature. Since there is no fixed maturity, the issuer must pay coupon payments forever or until the issuer calls the bonds. The bondholder can sell these bonds in the secondary market to get back his/ her investment. Investors are subject to perpetual credit risk, but perpetual bonds offer a higher coupon rate than redeemable bonds. Perpetual bonds are also called “consol bonds” or “perps.”

PRIMARY MARKET

The Capital market where companies or governments directly issue securities (debt-based or equity-based) to raise funds is called Primary Market. In the primary market, the issuer sells securities at predetermined prices. The buyers in the market can be financial institutions, corporates, mutual funds, and individuals.

Consider this market as the place where the security is being sold for the first time to buyers.

S

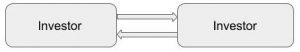

SECONDARY MARKET

The secondary market is the capital market where securities are traded among investors. Trading can happen between Financial institutions, individual investors, or both. The issuer doesn’t participate in trading. The price of the securities in the Secondary Market is dependant on current demand and supply.

The advantage of the Secondary market is, it facilitates trade between investors and makes securities available to investors who could not participate in the Primary Market. The secondary market plays a vital part of ensuring liquidity. This away helps the issuing entity to raise capital in the future as investors are assured of liquidity/ exit option when needed.

SECURED and UNSECURED BONDS

Secured Bonds are bonds that are collateralized by an issuer’s asset or future cash flows. If the issuer defaults, then bondholders can claim the asset or the cash flow generating source.

Unsecured Bonds don’t come with any collateral. If the issuer defaults, unsecured bondholders can’t claim any of the issuers’ assets. Here investment decision is taken purely on trust on the issuer and credit history of the issuer. All unsecured bonds are not unsafe creditworthiness of the issuer’s matters.

Note: During bankruptcy, secured bonds are paid before unsecured bonds.

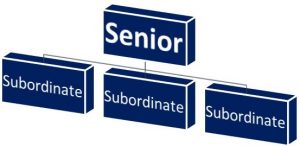

SENIOR BONDS AND SUBORDINATE BONDS

Senior Bonds are the bonds that are considered before other junior bonds in the hierarchy of payment during liquidation. Senior Bonds come with lower risk. Subordinate bonds come with higher returns and relatively higher risk. In the extreme case of liquidation of the Bond Issuing company, “senior bonds” are paid off before “subordinate bonds.

SETTLEMENT AMOUNT

The settlement amount is the amount the buyer has to pay to own the bonds. The settlement amount is the sum of the market price of the Bonds and accrued interest.

Settlement Amount = Market Price + Accrued Interest

Accrued interest is the amount that the borrower( bondholder) is supposed to get from the bond issuer, but it is yet to be paid. If the present bondholder sells his Bond, he has to get the interest until the date of the sale. There can be a time gap between the last coupon payout until the date he sells it for which he should be paid interest in addition to the market price of the Bonds. The next interest payout goes to the new bondholder.

Daily Interest = Annual Coupon Payment / Number of days in the year

Accrued Interest = Daily Interest X Accrued interest period

Example :

First Coupon Date: 1/1/2019

Second Coupon Date: 1/1/2020

Settlement date: 30/1/2019

Period of Accrued Interest: 30

Market Price of Bond: Rs. 2,00,000

Annual Coupon Payment: Rs. 20,0

Daily Interest = Rs.20,000/365 = Rs. 54.794

Accrued Interest= Rs.54.794 X 30= 1,643.836

Therefore, the Accrued Interest for a period of 30 days is Rs.1,643.836.

Settlement Amount = 2,00,000 + 1,643.836

Therefore, Settlement amount = Rs. 2,01643.836

Note: Stamp duty of 0001% (of settlement amount) to be added to the settlement amount. This stamp duty is payable by the buyer.

SPECIAL PURPOSE VEHICLE

Special Purpose Vehicle is a subsidiary created by the parent company with a specific purpose. Subsidiary and parent company act as two separate companies, legally and financially. Companies create SPVs to limit the risk of the newer project. Usually, parent companies guarantee the SPV’s debt, such as bonds or bank loans. Another name for SPV is Special Purpose Entity.

Example: Oriental Nagpur Betul Highway Limited (ONBHL)- Oriental Nagpur Betul Highway Limited (ONBHL) is a Special Purpose Vehicle (SPV) of Oriental Structural Engineers Private Limited (OSE).

STAGGERED MATURITY BONDS

Staggered Maturity Bonds are the bonds that repay the principal amount in multiple installments. Redemption(repaying the debt) may start at any time before the bond matures, as mentioned in the Information Memorandum (IM). In the staggered maturity process, the principal amount is paid partially along with regular interest payments.

After redemption starts, subsequent coupon payments will be made based on the outstanding principal amount. Staggered maturity dates and cash flows are defined by the bond structure that may vary from one tranche to another. The issuer is the one who proposes the structure of the bond.

Example :

UP Power Corporation has issued Staggered Maturity Bonds. Here are the details of one1 such tranche’.

Face Value- 10,00,000 INR | Coupon Rate- 10.15% ,

Maturity Date- 1/20/2026 | Payment Frequency – Quarterly

When redemption starts in 2025, the principal amount and outstanding interest are paid off as per the following schedule :

18th Apr, 2025 : 2,74,471.23 (interest + 25% principal)

18th Jul, 2025 : 2,68,979.11 (interest + 25% principal)

20th Oct, 2025 : 2,63,069.86 (interest + 25% principal)

20th Jan, 2026 : 2,56,395.89 (interest + 25% principal)

T

TIER II BONDS

As per BASEL III norms, Banks raise money via Tier II bonds to meet regulatory norms around capital adequacy. Tier II bonds are subordinated debt and hence not first to be paid during the liquidation process. Tier II bonds are senior to Tier I Bonds.

Note: When a bank has to write off losses, it will first write off Tier I bonds and then, if required, move on to Tier II bonds. It also can be written off if PONV (point of non-viability) is triggered.

TIER I BONDS (ADDITIONAL TIER I BONDS)

Tier I Bonds also called Perpetual Bonds. As per BASEL III norms, theoretically, these bonds can be carried on till infinity. In reality, they come with a call option after 5 years or 10 years from the date of issuance. It is a popular option among Banks to raise capital to meet their core capital (Tier I capital) needs as instructed by RBI.

They carry considerable risk and hence pay high-interest rates to investors. The issuer can skip interest payments if current year business is in the loss. In dire conditions, it can get converted to equity (with approval from RBI). Hence they are also called “quasi-equity”. If RBI approves, then it can be written off up to the full value as well

Note: In case of winding up of the issuer, if any payment is to be made to Tier I capital holders, ATI bondholders are paid before equity holders. . However, in case the Bank is getting merged with another Bank due to its non-viable business state, then AT1 Bonds can be written off fully while keeping the equity capital unaffected.

TERM SHEET

The term sheet is a nonbinding agreement between the issuer and bondholder. It specifies the bond features such as maturity date, coupon, interest payment, liquidation preference, callability, and convertibility. Though the term sheet is nonbinding in nature, it serves as a basis for other legally binding agreements. Term sheets can reduce conflicts between the parties. Hence expenses associated with premature legal actions can be reduced with a term sheet.

Y

YIELD

The yield is the effective interest rate on bonds. The yield will vary inversely with the market price of the bond.

Yield= (Coupon/ Market Price of Bond) X 100

Example:

Let’s assume that

Market Price of Bond = Rs 5000

Coupon= Rs 200

Let’s calculate the yield:

Yield= (200/5000)X 100 = 4%

-If the market price of the bond goes up by Rs.500 then the yield reduces.

Yield= (200/5500) X 100= 3.64%

– If the market price of the bond reduces byRs. 700 then yield increases.

Yield = (200/4300) X 100= 4.65 %

Note: When bond price increases the yield decreases and when the bond price decreases the yield increases.

YIELD CURVE

Yield Curve is a line formed by joining yields having equal credit quality and have varying maturity.

There are three types of the yield curve & they are:

- Normal: Upward yield curve indicates higher yields for bonds with longer maturity. It implies a better economy in the future, i.e., economic expansion.

- Inverted: Downward Yield represents a lower yield for bonds with longer maturity. This indicates a recession in the future.

- Flat: A flat curve represents a very narrow gap between the yields of bonds with longer maturity and shorter maturity. This indicates an economic transition.

YIELD TO CALL

Some bonds have a call option where the bond issuer can redeem the bond before the maturity date. The issuer needs a call option to reduce interest rate risk and avoid damage when interest rates decline. Having a call option will allow the issuer to redeem bonds and reissue them at a lower interest rate. However, there are some preset terms and conditions that have to be met. The calculation of yield to call depends on the coupon rate, the call date, and the price at which the bond was purchased by the holder.

YIELD TO MATURITY (YTM)

The yield to maturity is the total return expected from a bond if it is held to maturity. In other words, it is the internal rate of return (IRR) of a bond if the investor holds the bond until maturity, and if all payments are made as per schedule.

YIELD TO WORST (YTW)

Yield to Worst is the measure of the lowest yield that a bond can return without defaulting. Yield to maturity can be the same as Yield to Worst but can be more than Yield to Worst. Generally, Yield to Call is the same as Yield to Worst. The calculation of YTW helps the investor understand the minimum returns that a bond can give in worst cases.

YIELD SPREAD

The yield spread is the difference between yields of two bonds issued by the same or different issuer and may come with varying maturity, credit rating, and risk. The yield spread is calculated and expressed in percentage or basis points.

The ten-year GSecs are considered a benchmark; hence yield from corporate bonds is frequently compared with yield from Gsec. The study of yield spread helps to understand the economy.

ZERO-COUPON BONDS

Zero-coupon bonds do not pay interest, but they are sold at a discount and return full face value on redemption. The bondholder can sell these bonds before maturity at market price. The difference between the purchase amount and face value is the return that the investor gets. If a bondholder sells bonds before maturity, returns will be the difference between purchase value and selling price.

In the case of zero-coupon bonds, the longer the tenure higher will be the discount. Compared to the regular bonds, the pricing of zero-coupon bonds is more volatile.

Note: Investors of Zero-Coupon Bonds are subjected to capital gains tax only.

4 comments

Thank you, Selvaraj.

Explanation as simple as it could be. All credit to the author for making it simple. Looking forward to similar posts in related areas.

Good information in the bond glossary help to understand a lot of jargons!

Thank you for your kind words and keep reading blogs

Comments are closed.