A typical situation!

You work hard and save money, and when you need to invest, you go for Fixed Deposit most of the time. The “fixed deposit” is fixed in your mind.

Hey, a fixed deposit is a good option, but not always. Let’s explore what the other types of Fixed Income Securities are.

Fixed-Income securities are instruments that pay

a fixed amount of interest every year till they mature.

A few of the Fixed Income Securities are explained here.

Fixed Deposits:

Traditionally, Fixed Deposit is the most popular investment among investors. These instruments are offered by banks and non-banking financial organizations that return fixed interests. During the year 1987, the FD rates were around 10%, and it was about 13% during the early 1990s. Hence, the FDs were lucrative. Unfortunately, the present FD rate is approximately 5.4% (for a tenure of five years to ten years).

Typically, FD rates are lower than that of other fixed investment options (such as bonds). Let’s understand why. Banks have to maintain Cash Reserve Ratio(CRR) as per the regulations laid down by the central bank. The banks have to reserve a portion of capital received via FDs; the entire capital can’t be lent. This reserved capital can be utilized to supply closures (or pre-closures) in FD.

Investors don’t receive actual cash flow from FDs. Investor’s money is locked till maturity. For FD, with a particular scheme that pays out annually, the effective returns are even lower. The investor has to pay the penalty on premature closure of FD.

Pros:

- The risk associated with FDs is as low as zero for PSU banks.

- FD tenure ranges from 7 days to 10 years, and the investor can choose the term to match his/her requirements.

- The investor can take a loan against FDs; banks usually give loans up to 60-90% of the deposit value.

Cons:

- In the case of FDs, the interest rate is very low, and if an investor opts for regular payouts or early withdrawals, that results in a lower return.

- FDs are not tradable: investors can’t sell FDs. Once an investor makes a choice of tenure, he has to stick to that.

- Interest income from FDs attracts TDS and capital gain tax.

To know why investors need to think beyond FDs, read this blog.

Public Provident Fund:

PPF is a saving scheme offered by the Central Government. The interest rate is around 7.10%, and the lock-in period is 15 years, and early withdrawals subject to penalty. There is no taxation on the capital gains earned at maturity from PPF. PPFs are not connected to the market hence are free from market volatility and not tradable either. The maximum investment is 1.5 Lakhs per year.

Pros:

- The rate of interest is slightly higher than FDs.

- After completion of three years, the investor can take a loan against his PPF investment.

- The Central Government backs PPFs hence they are Risk-free.

- Interest incomes and returns at maturity are 100% exempted from tax.

Cons:

- It is a long term investment, and early withdrawals come with many clauses resulting in loss of returns.

- An investor can’t opt for PPF if he plans to invest more than 1.5 lakhs in the same year.

National Savings Certificate

It is a savings bond scheme initiated by the Government of India that you can be availed at the post office. They offer an interest of about 6.8%(quarterly rate of interest is revised). The interest is compounded quarterly but paid to the investor only on maturity. Tenure is of 5 years and, the minimum investment is 100Rs. And there is no upper limit on the amount of investment.

Pros:

- One can take a loan against NSCs.

- The investor can choose his/her nominee.

- TDS is not applicable; however, investors can enjoy tax rebates as long as the investment amount is less than or equal to 1.5 Lakh.

Cons:

- Partial or early withdrawals are not possible in NSC; hence invested amount is locked for five years.

- There is no actual cashflow: the interest payments are reinvested, and the investor is paid only on maturity.

- The rate interest, i.e., 6.8%, can’t beat the inflation rate, so effective returns are relatively low.

Recurring Deposit

Recurring deposit is a low-risk saving option offered by banks, post office, and NBFCs. Instead of investing a lumpsum amount at once, investors can invest a small amount every month for a fixed duration. Usually, interests are calculated every quarter but paid during maturity. The minimum monthly investment is Rs. 10, and there is no upper limitation on investment amount though this fact may differ from one bank to another. The rate of interest may range from 5% to 8%.

Recurring deposit is a low-risk saving option offered by banks, post office, and NBFCs. Instead of investing a lumpsum amount at once, investors can invest a small amount every month for a fixed duration. Usually, interests are calculated every quarter but paid during maturity. The minimum monthly investment is Rs. 10, and there is no upper limitation on investment amount though this fact may differ from one bank to another. The rate of interest may range from 5% to 8%.

Pros:

- As the investor can invest a small amount of his choice every month, that reduces the burden of investing a massive amount at once, which helps the investor to meet other financial needs or execute other investment plans.

Cons:

- Once you choose the amount for the monthly investment, you need to invest the same amount; there is no flexibility to modify it.

- This may turn out to be a little troublesome if you face any unexpected situations.

- Partial withdrawals are not allowed, and early closures of RD will attract a penalty or loss of returns.

Bond Exchange-Traded Funds:

Bond ETFs consist of a set of underlying debt securities like corporate bonds or sovereign bonds. ETFs are listed on all major stock markets, traded on NAVs, and highly liquid in nature. ETFs are an option to invest in multiple bonds at a time. These ETFs provide monthly interest payments but the value of coupons varies with underlying Bonds. ETFs do not come with a fixed maturity. Interest earned from ETFs subject to capital gain tax and TDS.

Pros:

- Bond ETFs give instant diversification to an investor’s bond investment portfolio.

- Bond ETFs are very liquid in nature. They can be sold off on the exchange easily.

Cons:

- Bond ETFs don’t have maturity; hence an investor needs to sell an ETF to get his principal back. This means that the investor has to keep a constant eye on the price fluctuations of his ETF.

- The rate of interest is less if compared to underlying Bonds.

- Investors can’t take a loan against Bond-ETFs.

- The monthly coupon payments are assured but the value of the coupon is not fixed. This fluctuation may affect the investor’s financial plan.

Exception: The way Bharath Bond ETF works is quite different from regular Bond ETFs. Bharath Bond ETFs do come with a fixed maturity. Bharath Bond ETFs don’t provide regular cashflows because they act as growth funds where interest earned is reinvested.

Bonds and Debentures:

Bonds and debentures are debt investment instruments with a Fixed Rate of Return and Fixed Maturity Period. Bonds are securities that are mostly issued by the government, whereas debentures are always issued by corporations. Bonds and Debentures are issued by the entities to raise money from investors as a loan used to fulfill business objectives like entering new markets, starting a new project, or scaling existing businesses.

Bonds and debentures are debt investment instruments with a Fixed Rate of Return and Fixed Maturity Period. Bonds are securities that are mostly issued by the government, whereas debentures are always issued by corporations. Bonds and Debentures are issued by the entities to raise money from investors as a loan used to fulfill business objectives like entering new markets, starting a new project, or scaling existing businesses.

For every bond/debenture issue, fixed interest payments (Coupons) are made regularly on pre-specified dates. The principal loan amount(face value per unit of Bond/ Debenture) is paid back on the pre-specified maturity date. Bonds are tradable: an investor can sell/buy bonds in the secondary market at the current market price.

The interest rate varies from one issuance to another, though generally, they are higher than that of FDs and other fixed investment options mentioned above.

Investors can get around 8% to 12 % fixed annual returns

from AAA to A-rated bonds.

Interest earned from bonds will not be subjected to TDS deduction. However, Capital gain tax is applicable if the bond is sold off in between or when a discounted price bond matures at face value. Tax-free bonds are 100% tax-free: investors need not pay a single penny on interest income.

Pros:

- Bonds provide regular cash flows and come with a fixed maturity so that investors can rely on bond returns.

- Investors can sell bonds in the secondary market at any time.

- If bond prices increase then, investors can resell to earn capital gains.

- Investors can take a loan against bonds. To meet your emergency requirement, you need not sell bonds. You can avail loans and continue to hold bonds or can sell them whenever market conditions are in your favor.

Cons:

- The investor is exposed to default risk. By investing in high-rated bonds, e.g., AAA default risk can be mitigated.

- Bonds are not easily accessible to individual investors; hence they are not very liquid in nature.

To explore A to AAA-rated bonds, click here.

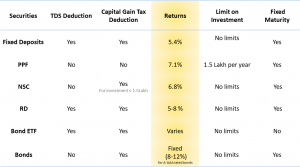

All fixed income instruments fall into the category of low-risk investments. Which is the best?

Bond ETFs have no maturity. The maximum amount that can be invested in PPF is 1.5 lakh per year. FDs are not tradable. Whereas Bonds have fixed maturity, there is no limit on the investment amount, and are tradable. The advantages of bond investment are listed here in this blog; you can read it.

Every investment instrument comes with a few advantages, so investors need to match their financial goals and investment. We hope this blog helps you to understand and appreciate the Fixed Income Market so that you can diversify and balance your investment portfolio.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.

13 comments

Sure, our Operations Manager wil reach you soon.

Hello Mrs. Maheshwari,

We have an exclusive collection of bonds suitable for Senior Citizens. Please click here to view the collection of bonds.

Regards

GoldenPi Team

Dear Sir,

Please inform me the minimum amount of invest in bond every month. The plans available like 5 yrs, 7 yrs ? explain

Dear Johnson,

In bond investment, there is no monthly option. Every investment is considered a fresh deal. However, you can plan to purchase bonds at different intervals: that will help you with the distribution of investment and diversification of the portfolio.

You can start investing in bonds for as low as Rs. 10,000. However, it could vary depending on your investment choice. For further clarification, you can write to us at contact-us@goldenpi.com.

Regards

GoldenPi Team

Where should I invest Rs.1,000,000 to get maximum return and a fixed monthly income?

Can you please tell me what options are available for a retired person to invest in bonds to generate a fixed monthly income for the future with less taxation?

Thank you, Sujata.

Thank you, Rohit.

Income from bond and ncds treated as interest or capital gain in Income tax?

Hello Mathew,

The Interest earned from bonds is considered as income and the gains earned by selling/redeeming bonds are considered as capital gains.

Regards

GoldenPi Team

Would like to know about Central Govt guaranteed bonds with 15 years term for senior citizens (60 years) with fixed guaranteed return of 8.5 to 9%.. Also, exit options in case of emergency. Thanks

Hi Vasishta,

Please, go through our bond collections.

https://goldenpi.com/collections

Regards

GoldenPi Team

we’re working on it.

Comments are closed.