Over the last few decades the world has witnessed innumerable crisis occurrences that have adversely affected the social-economic, financial and political environments. Each event has had distinctive effects and impacts on the world market that prevailed for the long haul. The most recent events are the Iraq-USA war, trade conflicts between China and USA, Brexit, climate emergency, the Covid-19 pandemic and the existent war between Ukraine and Russia. Each of these affairs somehow impacted the global financial market.

Entrepreneurs, corporates, market participants (independent investors), investment decisions predominately pin their hopes on world affairs. Various factors imply the cause of the financial market crisis, however geopolitical issues (Risk) have become the fundamental determinants for financial investment. According to 2017 Gallup survey, 75% of respondents expressed concern about the economic impact of various military and diplomatic conflicts taking place around the world, ranking geopolitical risk ahead of political and economic uncertainty. Similarly, European Central Bank highlighted geopolitical uncertainties as a salient risk to economics in its Economic bulletin and the internal monetary fund.

This article focuses on the impact of geopolitical crisis (issues) on the debt market, in view of the fact that the sudden escalation of conflict is what triggers investors’ panic. Also, it will explain what geopolitics crisis & risk is and then the selected military and geopolitics crisis since 1939. It will also look at the ongoing war between Ukraine and Russia and its effects on the debt market.

What is geopolitical risk?

The Federal Reserve System defines Geopolitical risk as the risk associated with wars, terrorist acts and tension between states that affect the normal and peace course of international relations.

Note: Natural calamities, Covid-19, and other acts of God do not come under Geopolitical crisis.

How does Geopolitics risk impact the debt market?

Countries and their economies are dependent on each other for trade, services, investments, etc. If a large nation, at any crucial geography, gets involved in Geopolitical issues, it could impact the movement of goods, disrupt supply chains and much more. Therefore, it eventually leads to rise in the price of the commodity.

Rise in the price of the commodity→ Increase in Inflation→ Impact on currency rates of nations

The Indian Rupee will be affected, greatly due to ongoing geopolitical issues. Rupee value can fall further in case the US federal bank reserve was to increase the interest rate. Furthermore, it is expected to narrow down the interest rate difference between India and the US. Hence, increasing the outflow from India.

Moreover, Geopolitical risks trigger the basic tendencies of investors i.e. to reduce the risk, eventually affecting the financial markets globally. Investors tend to move towards safer investments like government bonds, meanwhile reducing investments or withdrawing money from the riskier market (Stocks). Investors also believe in shifting their money from riskier regions like developing economies to developed economies.

Geopolitics incident history

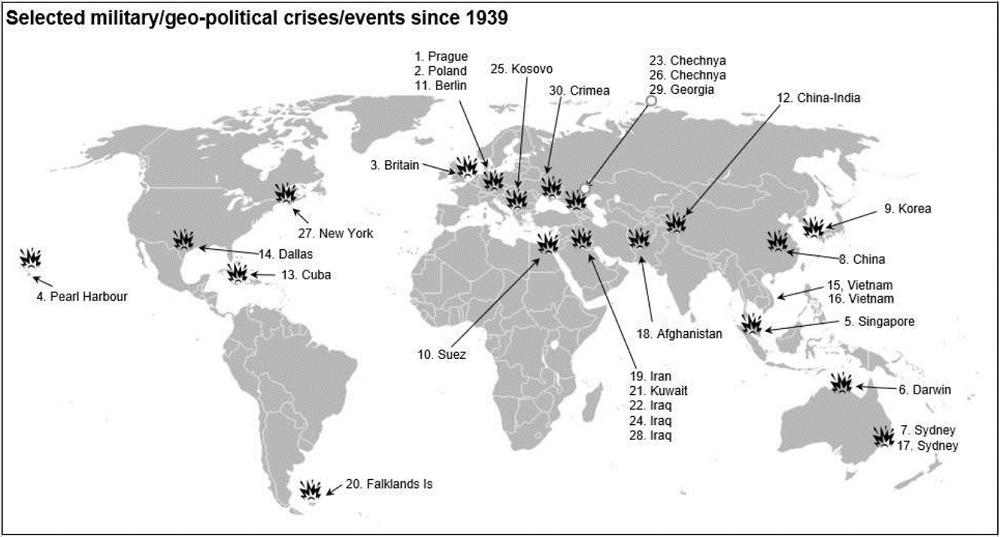

There were hundreds of other incidents and wars during the past century, including dozens of post-WW2 wars for colonial independence across the world. Figure 1 will show a few selected main events affecting major powers across the world.

Geo-Political issues market impacts- post 1990’s

Table will showcase that we have selected a few geopolitical crisis incidents which occurred post the 1990’s. It will also explain how the crisis has impacted various asset classes.

Cumulative Returns as a reaction to Geopolitical event (%)

Contemporary Geopolitical issues between Russia –Ukraine

We persuade ourselves to think that the Russia- Ukraine war will have a minor economic and financial impact globally, given the condition that Russia merely represents 3% of the world economy. But the economic and financial fallout from the war and the resulting stagflationary (It refers to an economic condition that’s caused by a combination of slow economic growth, high unemployment, and rising prices) shock will be at its highest in Russia and Ukraine. The European Union will have a similar impact because of its heavy dependence on Russian Gas. The US is also expected to be affected as well because the world energy markets are profoundly integrated, and a spike in global oil prices would strongly affect the US crude oil market.

In order to contain Russia’s invasions of Ukraine and to prevent the resultant economic collapse, the developed nations have announced various sanctions against Russia. These sanctions would inevitably hurt Russia but it would affect the US and other emerging markets. Nonetheless, they have been imposed on Russia.

- removing some Russian banks from the Swift messaging system for international payments;

- freezing the assets of Russian companies and oligarchs in western countries;

- restricting the Russian central bank from using its US$630 billion (£473 billion) of foreign reserves to undermine the sanctions.

Impact on the Global Economy

Description- The above flow chart shows the immediate effects of the Russia-Ukraine War on the major economies.

Description- The above flow chart shows the immediate effects of the Russia-Ukraine War on the major economies.

Impacts on the debts market

The sanctions would impact Russians utilising their money to fund their war operations and the purchasing power parity. In response to these sanctions, the rating agencies have downgraded Russia’s credit rating to junk status. These agencies consider that Russia might default on its debt in the near future, therefore diverting new investments from across the world. The sanctions have impacted the debt market in several ways.

a) Threat to the banks

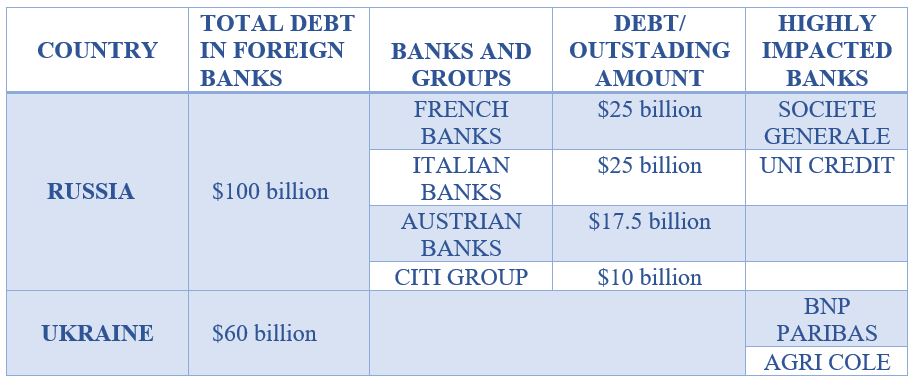

Russia and Ukraine have over US$160 billion in debt in foreign banks. It might serve as a potential risk to banks outside Russia and Ukraine.

If these figures default, it would kick off a 2008-style Liquidity crisis, wherein banks panic about their solvency and stop lending to one another.

Banks stop lending to each other → Low money circulation in the economy→ people will have less money to spend, hence lower consumption→ Increase in price of commodities → Increase in inflation

Increase in inflation→ Increase in Fiscal deficit→ More bond issuance → More supply in market → Price of existing bonds drop → Yields of existing bonds increase → New bonds issued will bear higher coupon rates to match high yields in the market

b) Hike in the price of Crude oil

After the Russia-Ukraine crisis, Brent crude oil prices have shot up to approximately $100/bbl. This has impacted bond yields, as the yield on 10-year bonds has moved up by 6bps to close the day at 7.75%. There would be oil coming into the market but with the pertaining tension, its supply could be affected. Due to the uncertainty, countries might buy excessive just to fill up storage so that no shortage would be faced in the future.

Higher Crude Oil price → Good and Commodities remain expensive→ CPI Inflation higher for longer period of time → RBI to Increase its Interest rates→ Increase in the yields of new bonds in the debt market

Summary

Market just does not work on the mechanism of demand and supply. Black swan events, like wars, can also play a very dominant role in the debt market, which leads to market volatility. These geopolitical events might often come up with short-term reactions like the current war would affect the banking system for most of the major economies, also the shift in crude oil prices would serve as one of the major reasons. It was expected that inflation would be in control until the second half of 2022 but since crude oil price has been shifting, cooling off inflations seems to be a far-fetched dream. These macroeconomic factors lead to volatility in both the markets, debt or equity.

In view of the current events, the market has to wait to taste the real impact of the situation. It seems to be too early to assess anything given the recent geopolitical trends.

Find the right bonds to diversify your portfolio