Individual investors are constantly looking for a consistent fixed income, while corporations are looking for an investment that will help them expand their business. Though there are numerous options available in the market to meet the needs of both segments, the concept of corporate bonds has been widely written or discussed to a great extent lately. Though the concept has been around for a long time, it has recently received a lot of attention. Everyone may have a better understanding of corporate bonds as a result of the recent publicity surrounding them, but many of us may be unaware of “the journey of corporate bonds in India” thus far.

What are corporate bonds?

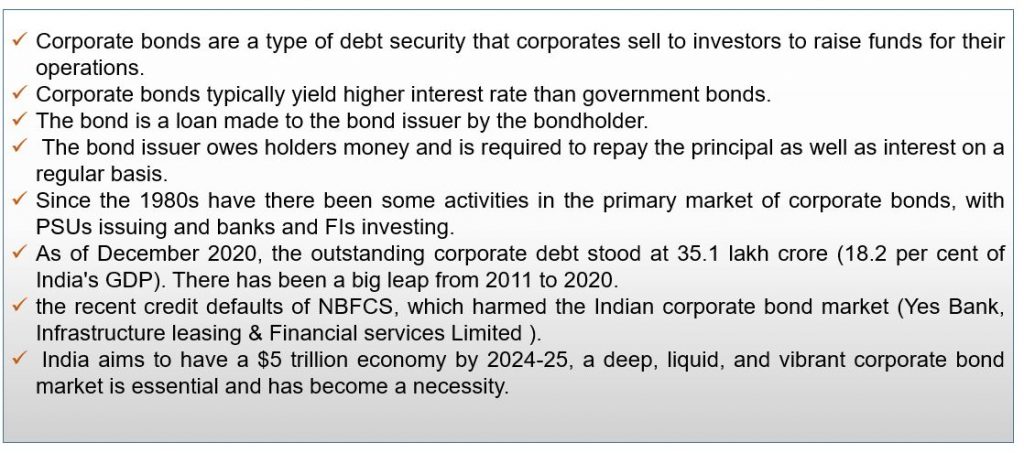

Corporate bonds are a type of debt security that corporates sell to investors to raise funds for their operations or expansion. The principal or interest earned over a period of time is repaid in full.

To understand in simple words; by purchasing this type of bond, you are giving a loan to the corporation to fund its operations. These bonds are not the same as stocks. Bonds are legal agreements that obligate the corporation to repay the borrowed funds to you with interest at predetermined intervals. Corporate bonds typically yield higher interest rate than government bonds.

Why do corporate sells bonds?

The primary reason for bond sales is to raise funds. Companies can raise funds through a variety of channels and methods. They can raise funds by selling equity (initial public offering if it is the first time or rights issue if the company is already listed), borrowing from a bank, or issuing bonds. The bond is a loan made to the bond issuer by the bondholder. The bond issuer owes holders money and is required to repay the principal as well as interest on a regular basis. Because of the fixed-rate interest component (we refer to fixed-rate bonds), bonds are also known as fixed-income securities.

What’s a corporate bond? How to select one.

Corporate bonds in India

A well-developed corporate bond market promotes economic growth. It serves as an alternative source of finance and supplements the banking system in order to meet the needs of the corporate sector in raising funds for long-term investment. When the equity market is volatile, this segment is thought to act as a stable source of finance, allowing firms to tailor their asset and liability profiles to reduce the risk of maturity. It also aids in the diversification of system risks.

The Indian economy has always relied on banks for financing. Only since the 1980s have there been some activities in the primary market of corporate bonds, with PSUs issuing and banks and FIs investing. Previously, corporates relied heavily on Domestic Financial institutions (DFIs) such as ICICI, IDBI, and IFCI to finance long-term investments. With the conversion of these DFIs into banks, obtaining financing for long-term projects has become difficult. Banks have performed this function, but their capacity is limited due to asset-liability mismatch issues in providing long-term credit.

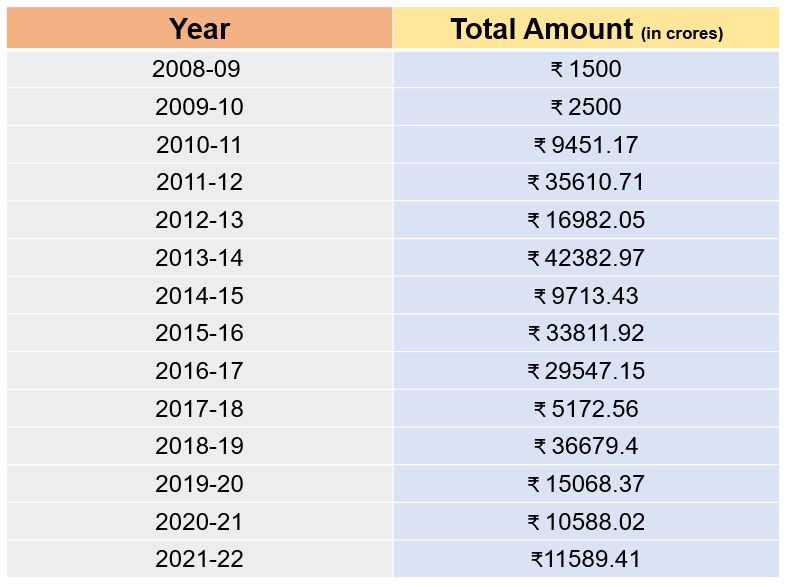

Since 2008, the corporate bond market has seen increased investment flows, primarily from institutional investors.

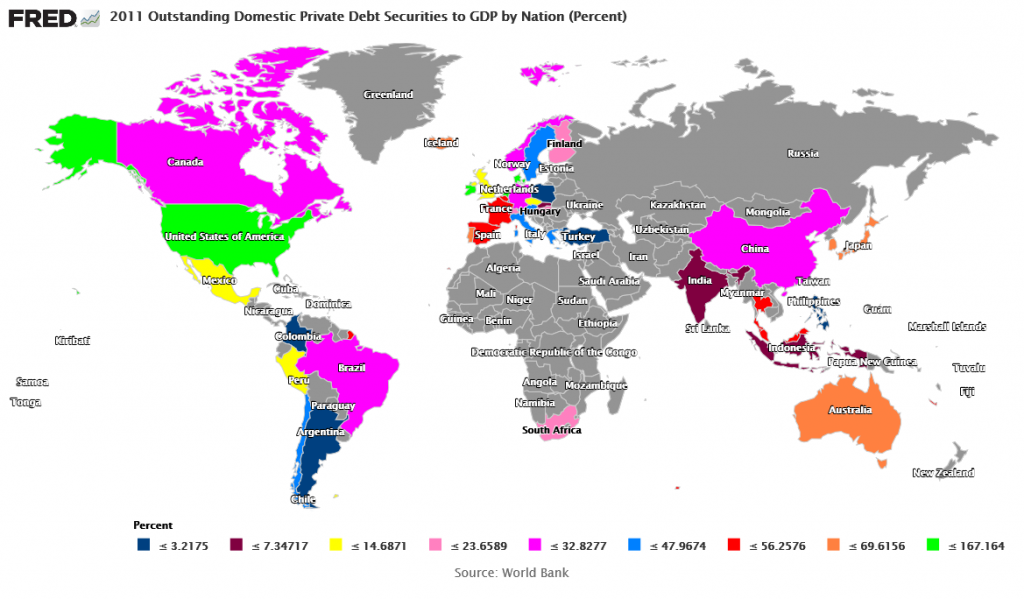

The map below shows the contribution of corporate bonds to a nation’s GDP.

As of December 2020, the outstanding corporate debt stood at 35.1 lakh crore (18.2 percent of India’s GDP). There has been a big leap from 2011 to 2020. However, developed countries such as the United States (123.47%), South Korea (74.3%), and Malaysia (44.5%) had a higher corporate debt market to GDP ratio in 2018.

As of December 2020, the outstanding corporate debt stood at 35.1 lakh crore (18.2 percent of India’s GDP). There has been a big leap from 2011 to 2020. However, developed countries such as the United States (123.47%), South Korea (74.3%), and Malaysia (44.5%) had a higher corporate debt market to GDP ratio in 2018.

The total amount that Indian corporate companies raised funds through corporate bonds (The list only includes listed companies)

Source: sebi public data base

What is the difference between Corporate and Governments Bonds?

Indian corporate bonds challenges

Corporate bonds have faced numerous challenges, but still, it prevailed. Initially, there were no structural reforms available where corporations could raise funds or invest. Though structural reforms were gradually implemented in the system, the corporate bond market was small in comparison to the government bond market. Over the last decade, sovereign bonds have dominated the Indian bond market, with corporate bonds accounting for a smaller share (27 per cent).

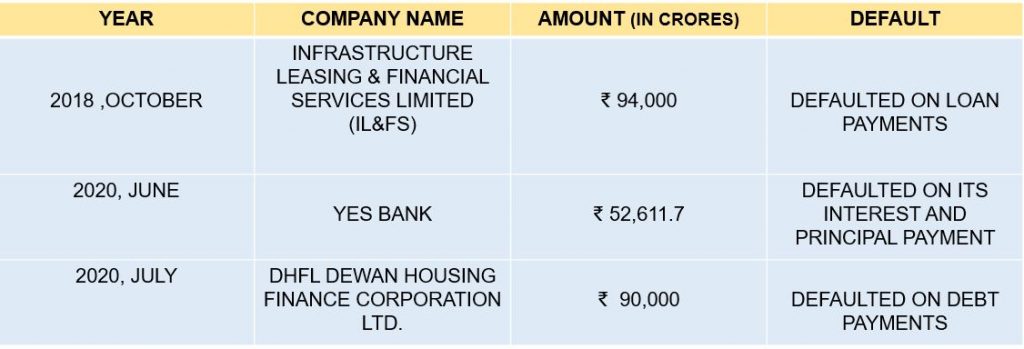

Corporate bonds faced a supply and demand problem because government securities were issued to a large extent, reducing space for corporate bonds. Other factors influencing supply and demand included constant inflation, higher interest rates, limited diversification options, the absence of credit default swaps/insurance, and the recent credit defaults of NBFCS, which harmed the Indian corporate bond market.

Another major challenge for corporate bonds was persuading individual investors to invest in bonds because most of them were accustomed to investing in fixed deposits (FD), mutual funds (MF), life insurance (LIC), and so on. Because retail investors had been habituated, they did not have enough interest to gather adequate information on corporate bonds or the financial market. According to a survey, more than 76% of Indian adults do not understand basic financial concepts such as interest rates, inflation, and currency exchange rates.

Another major challenge for corporate bonds was persuading individual investors to invest in bonds because most of them were accustomed to investing in fixed deposits (FD), mutual funds (MF), life insurance (LIC), and so on. Because retail investors had been habituated, they did not have enough interest to gather adequate information on corporate bonds or the financial market. According to a survey, more than 76% of Indian adults do not understand basic financial concepts such as interest rates, inflation, and currency exchange rates.

Corporate bond issuances were dominated by the financial sector (72%), rather than other sectors that need to be developed in order to improve the country’s economy. Manufacturing, information technology, and other industries received less attention. The credit rating was complicating matters because AAA, AA, and A-rated bonds were only thought to be less risky than other lower-rated bonds. However, ‘AAA-rated companies account for only 0.85 percent of the market in India, the lowest among emerging economies, according to Crisil. This would negate a significant number of industries’ fund requirements, potentially stalling the country’s growth.

Since India aims to have a $5 trillion economy by 2024-25, a deep, liquid, and vibrant corporate bond market is essential and has become a necessity. It will increase the country’s GDP growth and may allow it to achieve the desired results.

Key Highlights

Why should millennials consider investing in Bonds and Debentures

Why should millennials consider investing in Bonds and Debentures

4 comments

Thank you for your kind words and keep reading our blogs.

Very informative article

Thank you for your kind words and keep reading our blogs.

Thank you for your kind words and keep reading our blogs.

Comments are closed.