|

Getting your Trinity Audio player ready...

|

Gold has a long history in India and is now consumed worldwide, becoming a culturally significant metal that has a place in both Indian homes and hearts. In India, gold as a metal is valued for its auspicious qualities and is in high demand. The precious metal is bought as an investment on auspicious occasions and is advantageous due to its lower market risk. Even though the majority of Indians prefer to purchase gold in physical form, the government and the Reserve Bank of India provide Sovereign Gold Bonds as a superior option to owning gold in physical form.

What are Sovereign Gold Bonds?

The Government of India introduced Gold Bonds as a substitute for buying physical gold in November 2015. They are classified as government debt products and were first offered as a product. Government securities known as sovereign gold bonds are valued in kilos of gold. Investors must pay the issued price in cash (up to a maximum of Rs. 20,000), cheque, demand draft, or electronic banking. The bonds must be redeemed in cash at maturity, unless otherwise stated.

Examples of SGBs launched in past-

During 2021-22, Under this scheme so far, the RBI has issued 10 tranches for an aggregate amount of Rs. 12,911 crore accounting for 27 tonnes. Also since the inception of this scheme since November 2015, a total of Rs. 38,693 Crore (90 tonnes) has been raised.

How do SGBs work?

- Throughout the fiscal year, the RBI issues SGBs in a variety of tranches. Banks, brokers, post offices, and online marketplaces all provide access to these assets.

- To encourage investors to acquire SGBs online, a 50 INR per gram discount is given to those who do so digitally.

- It is worth noting that the RBI continuously offers new SGB series for sale in the market. So, if someone misses the most recent issue that was announced, one may always wait for the release of the following one.

- Investors have the option of purchasing the bonds in digital or dematerialized form. After completing a physical purchase of these bonds, investors can specifically request to have them credited to their demat accounts. The bonds are kept in RBI’s records up until the point at which they have finished their part of the dematerialization process.

- Dematerialization is also possible after allocation. Investors can purchase their units via stock exchanges or on the secondary market if they prefer not to do so directly from the RBI.

Features of SGB-

- Denomination: The bonds will be worth 1 gram of gold and multiples of that amount.

- Minimum size: Minimum permissible investment will be 1 gram of gold.

- Maximum limit: Maximum limit of subscription shall be of 4 kg for individuals, 4 kg for Hindu Undivided Family (HUF) and 20 kg for trusts and similar entities notified by the government from time to time

- Interest rate: Investors will receive interest on their initial investment amount at the semi-annual rate announced by the RBI at the time a particular tranche was launched.

- Tenor: The bond will have an 8-year tenor with an exit option exercisable starting in the fifth year on the dates of interest payments.

- Redemption: The redemption price will be determined in Indian Rupees and will be based on the simple average of the closing price of 999-purity gold over the previous three business days as reported by the India Bullion and Jewelers Association Ltd.

- Holding certificate: The customers will be issued Certificate of Holding on the date of issuance of the SGB.

Benefits of SGB-

- Safe Investment: SGBs are issued by the Government of India and are backed by sovereign guarantee, making them a safe investment option.

- Hassle free: Ownership of gold without any physical possession (No risks and no cost of storage)

- Returns: SGBs offer a fixed rate of interest of 2.50% per annum, payable semi-annually on the initial investment amount. Additionally, you can earn capital gains if the price of gold goes up when you sell the bonds.

- Tax treatment: The capital gains tax that would have been due upon repurchasing SGB by an individual has been waived. Long-term capital gains that are realised by any individual upon the transfer of a bond shall be eligible for the indexation benefits.

- Tradability: Within a fortnight of the issuance, bonds will be tradable on stock markets on a date that the RBI will announce.

- Transferability: By signing a transfer instrument in compliance with the guidelines of the Government Securities Act, bonds may be transferred.

Limitations of Gold Bonds-

- Inversely related to the Stock Market- Gold prices have an inverse relationship with stock prices, wherein any upturn in stock market leads to reduction in gold prices.

- Susceptible to Currency Fluctuations- Any changes in the currency of the country tends to have an impact on the price of gold in that specific country. For instance, during higher inflation times, if the benchmark currency, US dollar appreciates, then the gold prices for that country would fall.

Why should an investor in Sovereign Gold Bonds in India today?

- Diversification: Investing in SGBs provides diversification to an investor’s portfolio, as it is an asset class that is not closely correlated with other traditional investment instruments.

- Protection against inflation: Gold has historically been considered a hedge against inflation. By investing in SGBs, investors can protect themselves against inflationary pressures in the economy.

Sovereign Gold Bond and Digital Gold

KYC Documents Required

The following KYC documents are required to invest in Sovereign Gold Bonds:

- Proof of identity (Aadhaar card/PAN or TAN / Passport / Voter ID Card)

- KYC process will be carried on by bond issuing banks, agents or post offices.

Eligibility-

Only resident Indian entities, including people, minors, HUFs, trusts, universities, and charitable organisations, are permitted to purchase the bonds. Additionally, a minor may invest in SGB with the guardian submitting the application on their behalf.

How much will you earn if you invest in SGB?

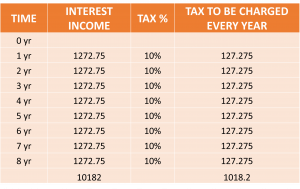

Lets understand how much an investor will earn by investing in SGB through an example. For instance, if an investor invested in 10 units of SGB 2022-23 Series I, at the rate of 2.5% paid semi-annually. The below table shows the cash flow-

Taxation Rules-

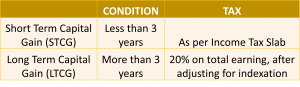

Returns from Sovereign gold bonds can be classified into 2 categories-

- On the maturity of the bonds- Capital gains earned

- Earnings disbursed Semi-annually- Interest income

Investors who hold bonds till the maturity are exempt from paying any long term capital gains tax.

However, Interest income is treated as income from other sources and is taxed as per the income tax slab of every individual investor.

Taking the previous example, wherein we analysed how much an investor would earn after investing in SGB, let’s take the same example to understand how much the person would pay on the interest income received through investing in SGB, if he or she falls in 10% income tax slab.

Resale in Secondary Market-

At what price are SGBs sold?

The nominal value of Gold Bonds shall be in Indian Rupees and shall be based on the simple average of the closing price of 999-purity gold for the final three business days of the week prior to the subscription period as announced by the India Bullion and Jewelers Association Limited.