Investors constantly worry about the security of their money and are constantly looking for choices for a protected form of investing. There are many different investment alternatives and instruments available on the market, but one of them is thought to be one of the safest investments because it has substantial asset backing which is covered bonds.

The industry of structured finance may be revolutionized by covered bonds. These are the only financial instruments that survived the global financial crisis of 2007 and 2008. The only instruments that have never defaulted are these.33 covered bond issuers defaulted between 1997 and 2019 in total.

The instrument, however, does not observe a default in any of the circumstances. Given that covered bonds may be crucial for the development of structured finance.

What are covered bonds?

Covered bonds are a sort of hybrid debt instrument that combines regular secured corporate bonds, asset-backed securities, and securities backed by mortgages. To put it another way, these debt securities are issued by banks or NBFCs and secured by a collection of assets.

Financial institutions, both banking and non-banking, package several loans and sell them as bonds. Some of the most popular loan kinds that are bundled and issued as bonds include loans to the public sector, loans for vehicles, and mortgage loans. These loans are bank investment pools that provide the lender and investors with a consistent cash flow. A special purpose vehicle, a distinct company entity that provides bankruptcy remoteness, typically issues a covered bond. Along with providing recourse to the holders of covered bonds, the issuer also transfers the assets from the cover pool to the special purpose vehicle.

It may still be confusing for many of us, let us understand with an instance.

ABC Limited is a housing finance company. ABC limited gives out loans to home buyers. These loans often have a long maturity period of 15 to 30 years. Additionally, they are supported by mortgages on the homes. Because of this, these loans are also known as mortgage loans.

These loans are usually of long maturities, like 15 to 30 years. And these are backed by mortgages on the houses. That is why these loans are also called mortgage loans.

Now, capital is blocked for a considerable amount of time when ABC Limited lends to homebuyers.

ABC Limited may now require money for ongoing operations. There are now two conventional sources of funding for ABC Limited. One possibility is that it might apply for a loan from a bank. Additionally, it might issue equity. It is apparent that equity issuance will be extremely expensive. ABC Limited’s second choice is to apply for a loan from a financial institution.

In order to lend loans with such high long durations, lenders ought to have excellent credit ratings. Apparently, ABC limited is a small lender and does not have a very high credit rating

In these scenarios, structured finance is applicable, allowing ABC Limited to issue bonds that are guaranteed by the home loans it currently has on its books. This pool of assets that will be backing the bonds is called Cover pool.

ABC Limited will issue covered bonds that are backed by a pool of mortgage loans.

These mortgage loans will now only exist on paper. While remaining in its books, this will give more security to the investors.

Unfortunately, if ABC Limited is unable to pay or makes a default in paying the interest and principal, investors will have a right on the receivable of the Cover pooling.

Covered bonds often offer the investor two levels of security. The first is that it will have recourse against the issuer. Secondly, it will have a remedy for the cover pool. Due to this specific characteristic, covered bonds are often referred to as dual recourse bonds.

Cover pool is nothing but a dynamic collection of various, it means that the assets that constitute this pool may be changed but the characteristic of the pool does not. So, an issue of Rs.5 million and an amount of Rs.6 million is assigned to the cover pool. Now, some assets will be collected which altogether from a pool of 6 million. Some of these assets are prepaid or repaid which will result in a reduction in the value of the pool.

ABC limited will have to bring in new assets to replenish the pool every time there is a repayment so that the value of the pool is kept intact until these bonds are redeemed.

What is Green Bond?

History of covered bonds

The initial covered bond issuance occurred in Prussia in 1769. During Pusher’s seven years of employment, the nation’s finances significantly improved. A public association of landowners was to be established at this time, according to an order given by the nation’s then-king Frederick the Great. Through this association, the landowner will be able to issue fully recourse bonds to increase agricultural financing. These bonds gave the investors a claim against both the assets of the organization and the issuer, which in this case was the group of landowners.

Covered bonds continued to be a thing in Europe until the twenty-first century. In the US, covered bonds were first issued in 2006. One of the main causes of the global financial crisis that occurred in 2007 and 2008 was securitization backed by subprime mortgages. Around this time, many began considering covered bonds as a securitization substitute.

Asia launched its first issue in 2009, following the US. India released its first batch of bonds in 2019 when the total global issuance of powered bonds had reached 117,000,000,000 billion euros.

Covered Bond Market Size

Global Market Size

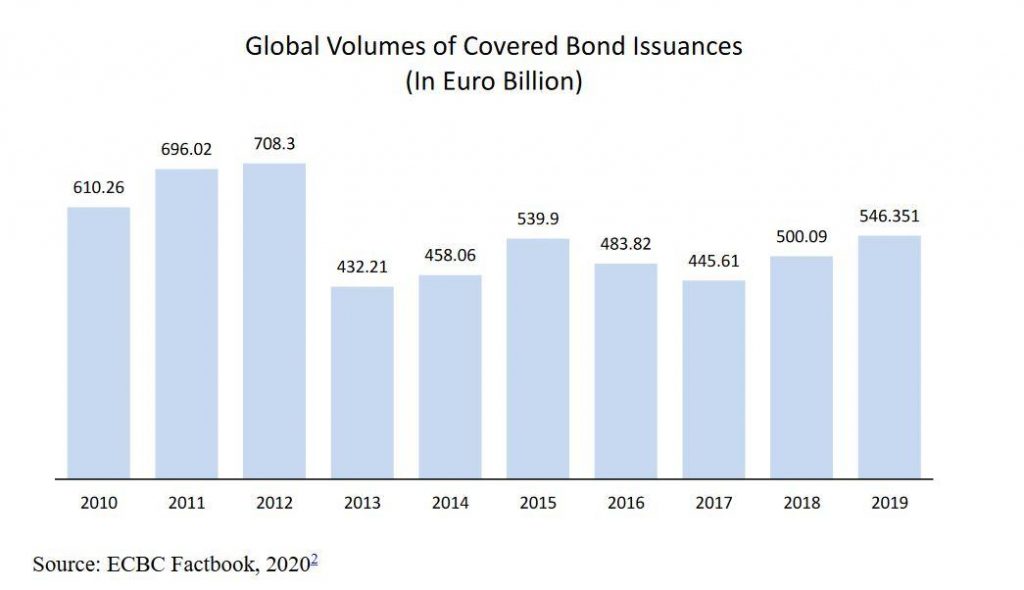

There is 2.70 trillion euros worth of covered bonds outstanding globally at the moment.18% of the GDP in Europe is made up of covered bonds.

Indian Market Size

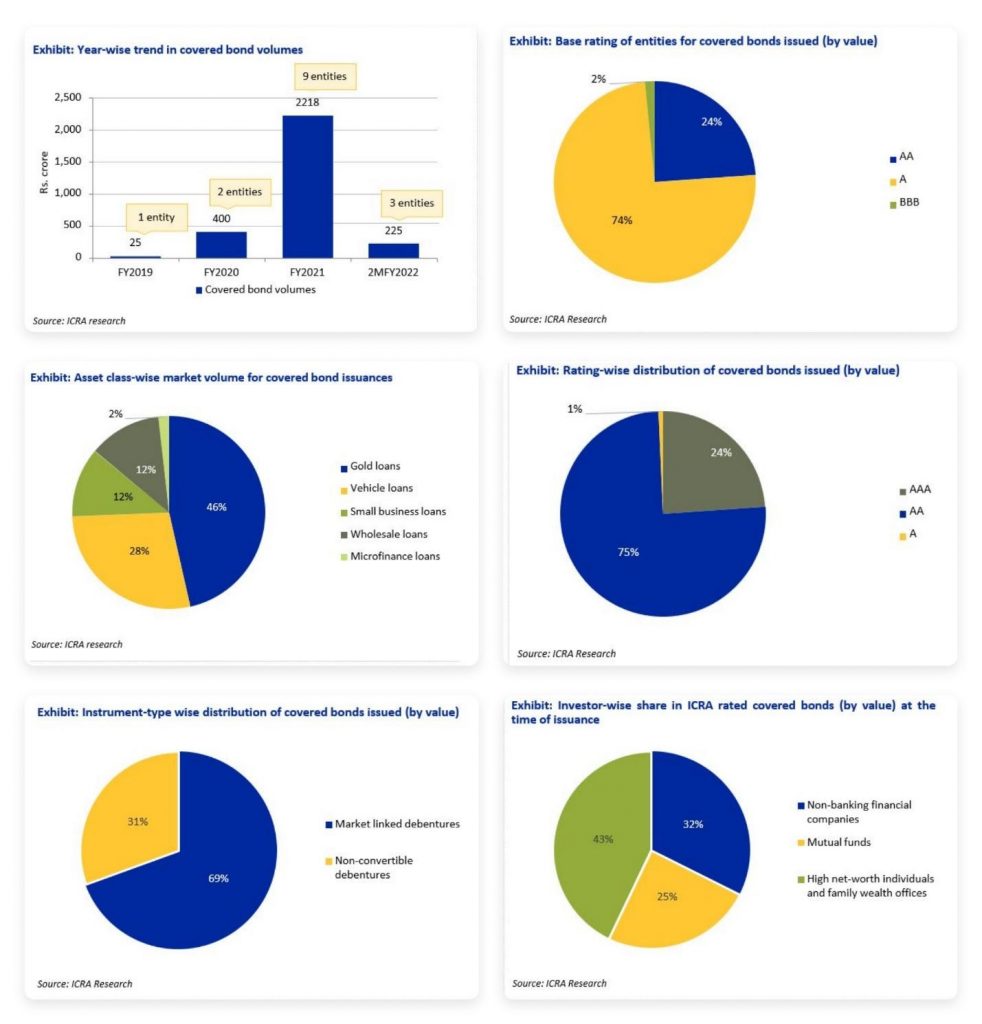

The covered volumes climbed from Rs 400 crore in FY2020 to Rs 2,200 crore in FY2021, according to ICRA’s estimations.

The number of covered bonds, which was Rs. 225 crores in 2MFY2022, is anticipated to gradually increase with improved stakeholder awareness and increased investor involvement.

Who issues covered Bonds in India?

The organizations that issue covered bonds in India are as follows:

- Banks

- Non-Banking Financial Institutions (NBFCs)

- Corporations.

Types of Covered Bonds in India

Legislative Covered Bonds

A legislative covered bond is one that is backed by a regulatory framework that adheres to the key provisions of legislation governing covered bonds. This has an impact on decreasing the likelihood of instrument bankruptcy. In India, there are currently no specific legislative structures for controlling and regulating certain bond types.

Contractual Covered Bonds

The only distinction between contractual covered bonds and their legislative equivalents is the foundation for the bond’s bankruptcy remoteness, which in this case is based on the terms of a contractual agreement.

Types of Government Bonds

Features of Covered Bonds

- They offer two types of recourse: security from underlying cover pools and issuer liability to bondholders.

- A covered bond is a safe investment option for investors that ensures competitive interest rates and includes extra security.

- Covered bonds are generally an on-balance sheet instrument and cover pool stays on the balance sheet of the issuer.

- The first recourse in the case of covered bonds is always on the issuer. Therefore, the issuer has control and entire responsibilities. The second recourse lies on the ring-fenced cover pool which makes the covered bonds a dual recourse instrument.

- The cover pools are often dynamic pools with assets ring-fenced to be a part of them, meaning the issuer may continuously add or remove specified assets from the pool. Covered bondholders have priority over other creditors in relation to the cover pool to the amount of the money owed to them as a result of the assets in the cover pool being ring-fenced.

- Typically, the over-collateralization cover in the cover pool is pre-defined.

- Cover pools are designed to be insolvency resistant.

- Prepayment is protected for covered bonds.

- The risk of prepayment of the underlying assets is totally transferred to the investors while the issuer retains a call option.

- Ratings for covered bonds are frequently in the range of corporate bonds (higher) and mortgage-backed securities (lower). The covered bonds’ rating is a few notches higher than the issuer’s due to the backing of the cover pool.

- Mismatched assets and liabilities are the basis for covered bonds. Most covered bond repayments take the form of a bullet repayment. The cover pool’s assets are, nevertheless, regularly paid back. A mismatch between the asset (cashflows from the pool) and liability (redemption of the bond) is therefore an inherent one.

Benefits of Covered bonds

- Thanks to the twofold recourse they provide, they are safer investment possibilities than the majority of conventional investment instruments.

- High interest rates of up to 12.75% make them an alluring investment option. For investors with a low risk tolerance, purchasing a covered bond is the best option.

How a covered bond differs from the two parts of which it is made. That refers to asset-backed securities and corporate bonds.

A covered bond and a secured corporate bond have some similarities. Both of them are protected by securities, and the issuer is responsible for paying investors back. In the case of a secured corporate bond, the bond is backed by one or more non-ring-fenced assets.

That they are not ring-fenced, obviously. The assets do not belong exclusively to the investors.

Investors must place a security interest on the underlying assets in order to assert their rights in the event that the issuer defaults on repayment. With covered bonds, investors begin receiving payments from the cover pool as soon as the issuer makes a default.

Investors in secured corporate bonds will be treated similarly to other secured creditors in the event of the issuer’s bankruptcy, while investors in covered bonds will have sold rights to the covered bonds.

Closing Thoughts

The market is getting bigger and bigger, offering investors a lot of investment alternatives and investors can track upcoming bond IPOs in India to participate in secure and well-structured bond issuances. However, investors need to choose intelligently where to deposit their money in order to receive higher returns.

Frequently Asked Questions

1. Who issues covered Bonds in India?

The organizations that issue covered bonds in India are as follows:

- Banks

- Non-Banking Financial Institutions (NBFCs)

- Corporations.

2. Who are the Main Investors in Covered Bonds?

The buyers of these bonds range in size from tiny retail buyers to significant institutional buyers. These investors intend to hold their investments for a long time and are risk-averse. The following are various bondholders for covered bonds: Asset managers, insurance companies, pension funds, central banks, and bank treasuries.

3. What Makes a Covered Bond Secure?

Covered bonds may resemble asset-backed securities in some ways to the uninitiated or novice investor. They do, however, remain on the issuer’s balance sheet, in contrast to asset-backed securities. As a result, bondholders have two sources of recourse: they can access the underlying cover, or investment pool, of assets in addition to having priority over business assets in the event of bankruptcy. Investors who own secured bonds additionally receive periodic interest payments and the full principal amount at maturity. Covered bonds are significantly safer investments than mortgage-backed securities because of the dual recourse of corporate bond security and access to a specific pool of underlying assets.