Information is the key to everything lately and Perhaps the most daunting challenge that modern investors face is the sheer speed and volume of information. The investors are rigorously seeking the necessary and adequate information about their investment plans and their choice of financial instruments. In recent years, bond investment has been the talk of the town and adequate information is being made available through various ways still, there are a few confusions over the concepts of bonds or debenture among the early investors that’s “what is the difference between convertible and non-convertible debentures.

This blog would help to understand the basic differences between those two

What is debenture?

Debentures are long-term debt instruments that a business offers to entice investors’ funds. It has a fixed interest rate for a given time. A company may issue both convertible and non-convertible debentures, among several other categories. It is possible to convert convertible debentures into corporate equity shares. Non-convertible bonds do not have such options, however, do have this choice upon maturity.

What is Convertible Debenture?

A convertible debenture is a type of long-term financial instrument that a company issues and that, after a certain amount of time, may be converted into equity shares. They can be convertible either partially, completely, or maybe both ways. As it is not attached to any primary securities, they are considered unsecured bonds.

Companies typically issue these financial products to take advantage of tax perks.

For instance, if a company issues debentures, it may be able to claim a tax credit for the interest that would be paid to the holders.

The investors (bondholders) can convert the bonds into shares whenever they’d like, depending on their financial needs, or else they can hold the bonds until they mature. As the company’s lenders, the holders of these debentures have the discretion to convert them into equity shares.

What is the difference between Coupon Rate and Yield to Maturity?

How can bond to be converted?

As an example, suppose XYZ released a convertible bond with a face value of Rs. 10,000 and a 5% interest rate. The bond has a 5-year maturity and a conversion ratio of 5, meaning an investor can exchange one bond for 5 shares of common stock. The price of the bond divided by the conversion ratio determines the conversion price of the convertible bond.

The conversion price is determined by multiplying the bond’s par value, in this case, Rs. 10,000/ 5, which equals Rs. 2000. The conversion price falls to Rs. 1000 if the conversion ratio is 10.Therefore, in order to convert the bond, the market price must surpass the conversion price. Lower conversion ratios result in higher conversion prices, whereas greater conversion ratios result in lower prices.

What is a Non Convertible Debenture?

Debentures that are not convertible into the issuing company’s stock are known as nonconvertible debentures. Investors are compensated with a greater interest rate than they would receive from convertible debentures to make up for the absence of convertibility.

Two kinds of non- Convertible debentures

1) Secured debentures – The secured NCD is the safer option than unsecured NCD because it is backed by the company’s assets or any available collateral. Investors may be able to recover their money by selling the company’s assets if it doesn’t make the agreed payment on time. However, these NCDs have low-interest rates.

2) Unsecured debentures– These are not backed by the company’s assets or any other form of security and are riskier than secured NCDs. Unsecured NCD holders are forced to wait until they are paid if the company is unable to repay the investors. The business has no assets to use to recoup its debts. In other words, the company only pays these investors once the holders of secured NCDs have been paid. Additionally, these NCDs have an interest rate that is greater than Secured NCDs.

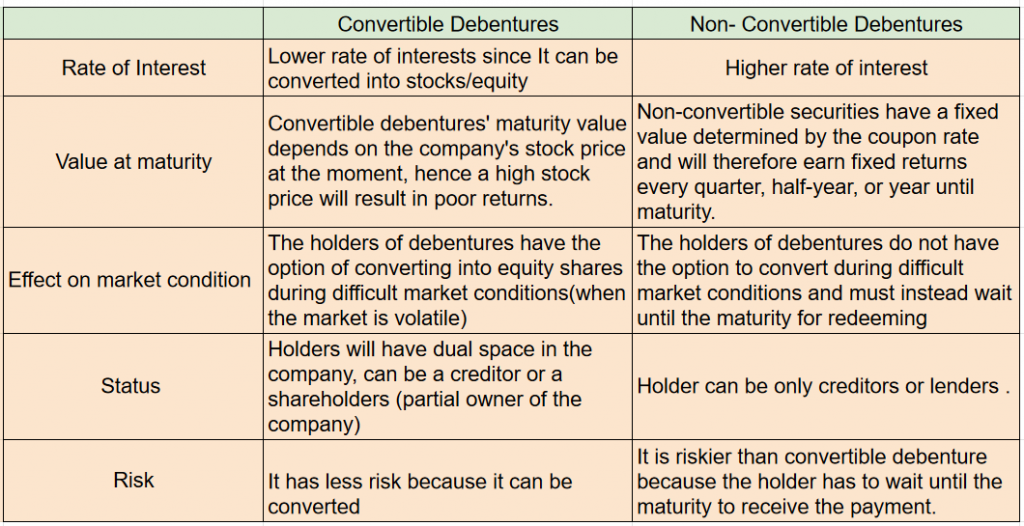

Difference between Convertible and Non- convertible debentures

Why do companies Issue Convertible and Non-convertible Debentures?

A company might want to raise money through the sale of convertible bonds for two main reasons. The expense to the company is very persuasive. Compared to standard non-convertible debentures, convertible bonds often have cheaper interest payments; these interest cost savings can be substantial. Due to the conversion option’s potential to profit from gains in stock price, investors are willing to tolerate the lower interest payments.

In the same way , whenever companies need a quick fund for the operations and expansion, the companies tend to issue non- convertible debentures which may attract more investors due to the fact of higher coupon rate—especially when evaluating upcoming NCD issues. It would solve both parties’ issues, the company gets its necessary funds for expansion or operation and the investors get higher returns.

By issuing bonds the company is able to maintain the trust of both the forms of investor to the company as in equity and debenture holders.

What is the difference between Corporate and Governments Bonds?

FAQ’s on Difference Between Convertible and Non-Convertible Debentures?

1. What are non-convertible debentures?

Non-convertible debentures (NCDs) are debt instruments issued by companies to raise funds. They cannot be converted into company shares and offer interest payments until maturity.

2. What are convertible debentures?

Convertible debentures can be converted into company shares after a specific period (subject to bond terms). Until conversion, investors earn pre-determined interest, and after conversion, they become equity shareholders.

3. What is the main difference between convertible and non-convertible debentures?

The primary distinction lies in “convertibility” into equity shares. Convertible debentures give investors the option to convert their debentures into equity shares of the issuing company after a specified period. In contrast, non-convertible debentures (NCDs) cannot be converted into shares and remain pure debt instruments until maturity.

Latest Updated: 23-02-2026