Bonds are considered a low -risk assets, but bonds do come with a couple of risks.

The term “Risk in Bond Investment“ sounds like an oxymoron. Because once we hear the word “Bonds”, what comes to our mind is: bonds are debt investments, they give fixed returns and are stable.

True, bonds can be relatively safer than a few other asset classes. Nevertheless, bonds do come with a couple of risks. Let’s get aware of them and learn a few simple strategies on how to mitigate them. If you are not sure of terminologies used in the Bond market you may refer our Glossary. Else, we are good to go.

Imagine this situation: It is Monday morning and you are in your office canteen. You had a nice breakfast and are now looking for your mobile to pay for the bill. But you have left it in the laptop bag. Thanks to Monday blues. Understandably, in the present era of digital payment, you do not prefer to carry cash either. Helplessly, you tell the canteen owner “ Hey, I will pay along with the lunch bill”. The canteen owner raises his eyebrows. He is entitled to receive money from you, so he is worried. If the canteen owner can think so much for credit of Rs.50 (usual cost of breakfast), then bond investors becoming skeptical about the return on their investment is no surprise.

In the bond market, risk of not getting interest payments/principal amount back on your investment is termed as “Default Risk”

Default Risk:

One of the key risks of investing in Bonds is the risk of facing non-payment of interest or principal or both by the Bond issuer. This loss to the bond buyer is called the default risk. It can happen if the bond issuer runs into financial trouble and is incapable of paying. Hence, while picking up bonds, it is especially important to invest in entities that have sound financial performance.

As a rule of thumb, consider credit ratings of bonds before investing. You may consider Investing only in high rated bonds e.g. AAA, AA, or A to secure your investment.

In addition to default risk, there can be few risks like Interest rate risk and Liquidity Risk. These risks come into picture only when an investor wants to sell off his/her bonds before its maturity date.

Interest Rate Risk:

Note: Bond prices and interest rates are inversely proportional. Interest Rate Risk is the risk of getting a lower sell price than the price at which the bondholder bought the bonds in the first place. Different factors influence Interest Rates i.e. Monetary Policy, Inflation, and the strength of the economy. If interest rates increase the price of the bond decreases. At this time if the investor wants to sell the bonds he/she has to sell at a discount price.

However, the flip side is that, if the interest rates in the economy decrease, the selling price of bonds will increase. At such a time, an investor can make capital gains by selling his bonds at a premium to his buy price.

Example:

Let’s assume you are holding bonds issued by XYZ company at a purchase price of 100. At this time, the interest rates in the market are 7%.

Case 1: Now if interest rates increase to 8 %, bond price will fall in the market, to say 99Then if you sell the bonds, you will lose Re 1 per bond.

Case 2: If the interest rate falls to 6%, then the bond price can increase to, say Rs 101. Then if you sell the bonds, you will earn capital gains of Re 1 per bond.

(Note: Above interest rates and corresponding bond price values are just representative and may not be mathematically accurate)

Liquidity Risk:

Liquidity is the ease of selling off a bond in the market and getting cash in return. If you find difficulty in selling your security/ Bond in the market, you have to lower your sell price to get potential buyers. This risk of monetary loss due to less number of buyers/ low demand for a given security is termed as Liquidity Risk.

Note: Liquidity risk arises only when you want to sell off the bond before it matures. Factors that influence liquidity risk are:

– Demand

-Market Price

-Associated Risk

-Lack of information

One major factor that triggers liquidity risk is ‘Lack of information’ on the demand side. When a seller is unaware of the number of buyers looking to buy bonds, we can say he is unaware of demand and may develop a misconception of low demand. He then agrees to sell the bonds at a discount price. Innovation in technology can mitigate this liquidity risk. Technology (all to all) can connect buyers and sellers. This can give real-time data on demand and supply. Liquidity Intelligence is under limelight since 2017 but yet in the nascent stage.

How to proceed?

Resolution for default risk: Go for “AAA” rated bonds, these bonds are less risky than other lower-rated bonds.

Liquidity risk and Interest rate risk would not come into picture if you plan to hold bonds till maturity. This is called the HTM strategy (HTM).In case you want to sell bonds before maturity, the interest rate risk is still minimum compared to the risk associated with other securities. Liquidity risk can be handled efficiently with the help of the latest connective technological innovations and Liquidity Intelligence would be a boon to sellers.

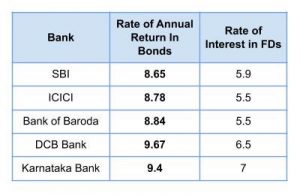

A brief data-driven comparison: In investment Risk Pyramid(Refer figure 1) Debt securities (Bonds etc.) and FDs (Bank Accounts) are at the base of the pyramid. It indicates that the risk with debt securities and FDs is the least.

Now you need to compare between FD and Bonds.

Use the table on interest rates, it is self-explanatory. Returns from FDs are much lower than the returns from bonds.

Final word:

Returns from FDs are much lower than the returns from bonds.

Verdict: If you want to bypass the volatility of the equity market and surpass the FD rate, high yield bonds could be the right option for you.

Bonds do come with a couple of risks; we made you aware of them in this blog. Pick the right ones that suit your needs.

And yes, Bonds can mitigate your Portfolio Risk efficiently.

5 comments

Hi Ajaykumar,

Whoever is the Demat provider, the bond investment process remains the same. Our team will get in touch with you to assist you in bond investment. Thank you for showing interest in our services.

GoldenPi Team

I would like to buy bonds could u pls advice me and contact me immediately

Hi Jitty,

Please drop a mail at contact-us@goldenpi.com. Our Relationship Manager will get in touch with you.

Thank you

GoldenPi Team

I would like to buy bonds from golden Pi but I have an hdfc demat account can I do it or will I have to open I demat account from zerodha or axis

Hello Ravi,

To buy bonds you can have a Demat account with any of the Demat Providers.

Regards

GoldenPi Team

Comments are closed.