|

Getting your Trinity Audio player ready...

|

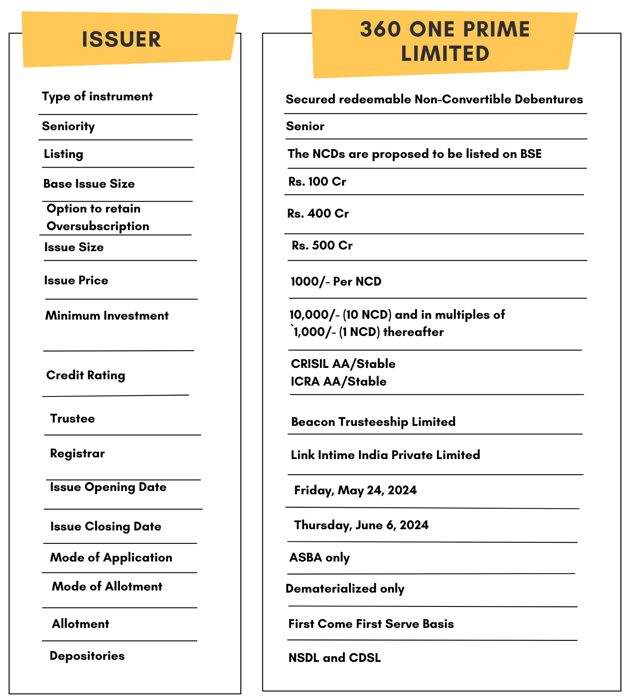

High Yield | AA/Stable Rated | Minimum Investment: 10k Only

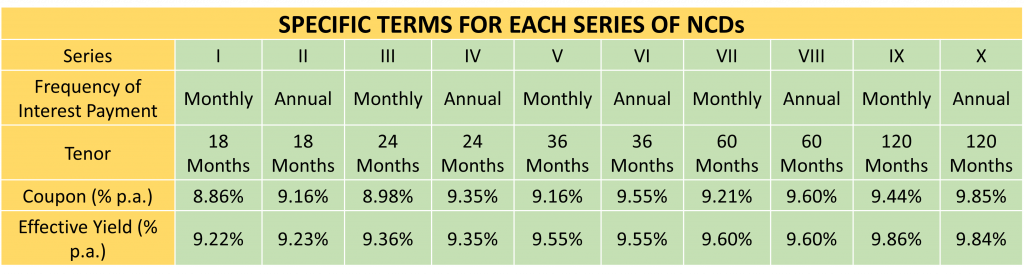

360 One Prime Limited is issuing the Non-Convertible Debentures. These NCDs are AA/Stable rated by CRISIL & ICRA. The NCDs are being issued in ten series: coupon ranges from 8.86% to 9.85% p.a. and different tenures of 18 months, 24 months, 36 months, 60 months and 120 months. The NCDs are secured and redeemable in nature.

360 One Prime Limited NCD IPO: Coupon rates and effective yield for each of the series

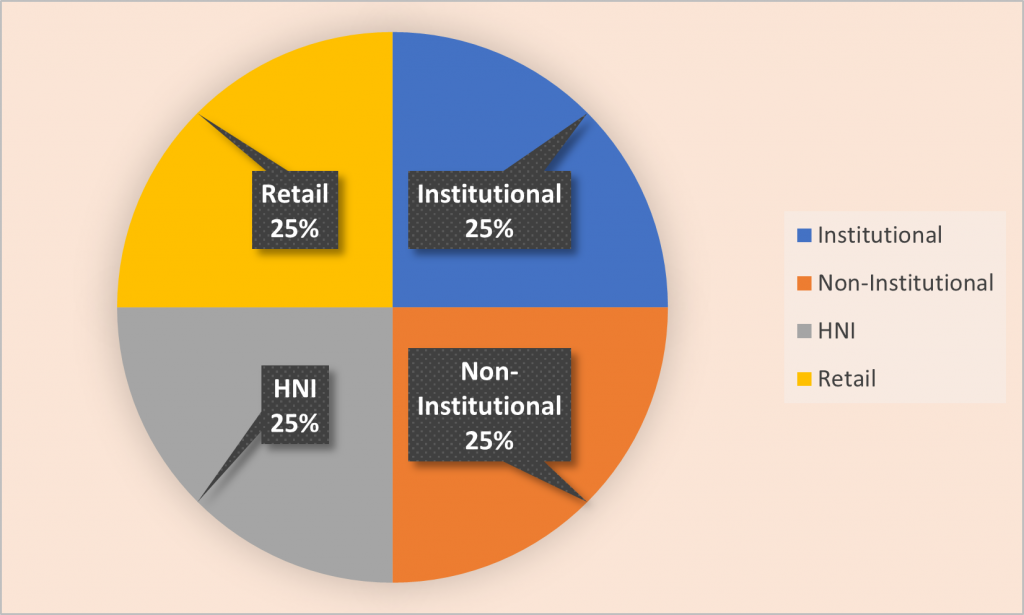

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for 360 One Prime Limited NCD-IPO.

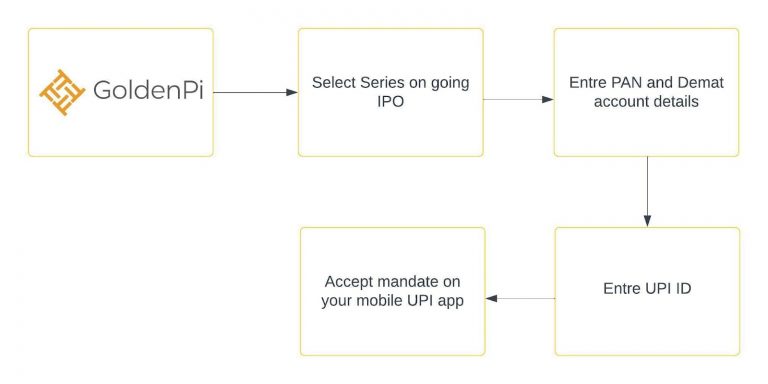

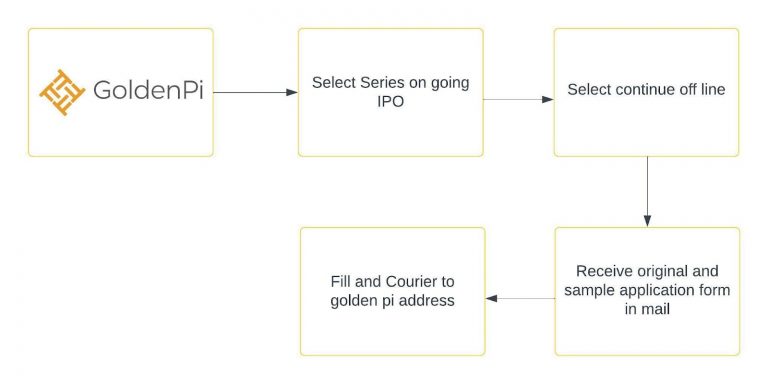

Investment Process for 360 One Prime Limited NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

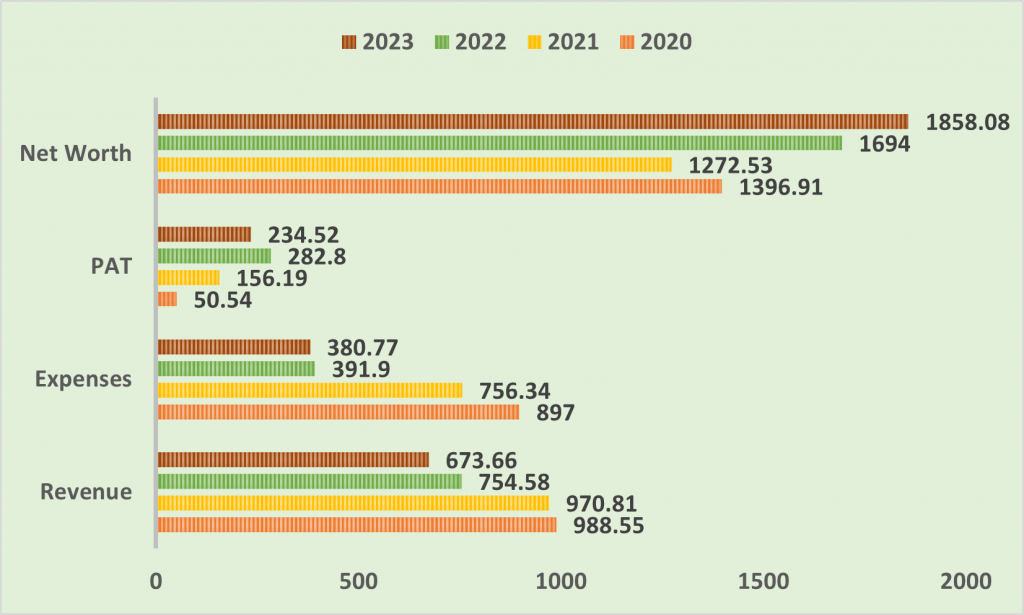

Financial Overview

Snapshot stating the Revenue, Expenses, Net Worth and PAT (In crores)

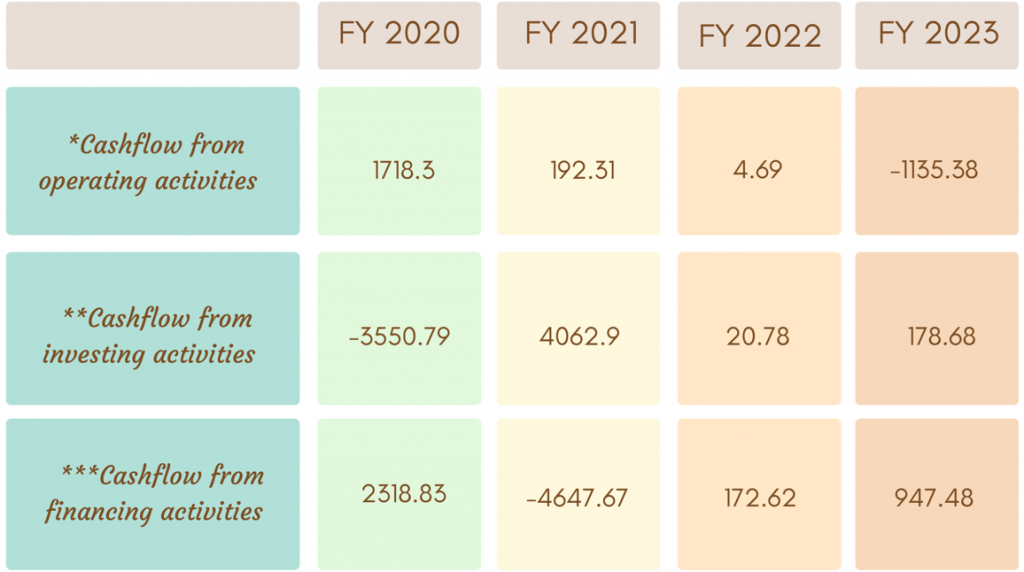

Cash flow for last few years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

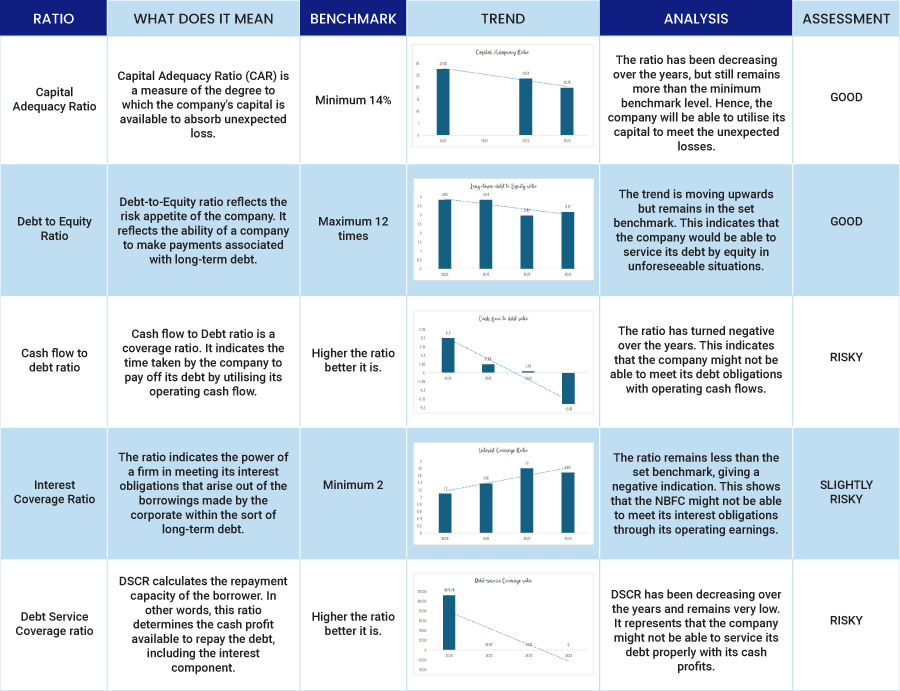

Ratio Analysis

Issue analysis

Pros

- The NCD is AA rated security with a stable outlook.

- The coupon rate is between 8.86% to 9.85% which is much higher than FDs.

Cons

- Shifting to a fee-based model (360 ONE Plus) with recurring revenue recognition provides stability to the company’s income stream. However, client adoption of 360 ONE Plus has been slower than initially projected by management.

Liquidity

- Centralized Liquidity Management: 360 ONE manages the cash flow of all its subsidiaries collectively.

- Strong Liquidity Position: As of October 31, 2023, 360 ONE WAM held sufficient liquid assets (Rs 2,602 crore) and untapped credit lines to cover upcoming debt obligations (Rs 2,337 crore) maturing by December 2023. This includes Rs 655 crore in commercial papers (CPs) expected to be renewed.

- Active Debt Management: 360 ONE proactively raises fresh capital by issuing debt in the market, further strengthening their liquidity position.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About 360 One Prime Limited

360 ONE Prime, established in March 2016, is a subsidiary of 360 ONE WAM Limited, a leading Indian private wealth management firm. 360 ONE WAM boasts an impressive AUM (Assets Under Management) of approximately ₹454,000 crore and is known for its focus on building long-term client relationships based on trust, transparency, and industry expertise. 360 ONE Prime caters specifically to existing 360 ONE WAM clients by offering them loan services against their securities. Together, these companies empower over 7,000 families in India and beyond to secure their financial future through wealth preservation, protection, and growth strategies.

Strengths

- Market Leader: 360 ONE group is a dominant player in India’s non-bank wealth management space. Their AUM grew significantly (23%) in H1 FY2024, reaching ₹3.48 lakh crore.

- Experienced Management: The team boasts over a decade of experience in wealth management. Key leaders, like Mr. Bhagat and Mr. Shah, have been instrumental in the company’s success since its inception (2008).

- Strong Capitalization & Supportive Investors: 360 ONE enjoys comfortable capital reserves with a net worth of ₹3265 crore and a manageable gearing ratio (2.4x as of September 2023). Their transition to an advisory-focused model has also reduced capital needs for growth.

Weakness

- Regulatory Risk: The wealth management industry is more susceptible to regulatory changes compared to lending operations. While credit events may have less impact on capital, unexpected regulations could pose a risk.

- Limited Lending Diversity: 360 ONE Prime, established in 2016, primarily offers LAS (Loan Against Securities) to clients of 360 ONE WAM. This limited lending portfolio is heavily influenced by capital and money market fluctuations, both domestically and internationally.

Invest in Bond IPO online in just 5 minutes

Source – Tranche II Prospectus May 16, 2024

Disclaimer – The information is published as on date 23/05/2024 based on information available on Tranche II Prospectus May 16, 2024. The information may be subject to change in case of change in terms of prospectus or any other reason as the case maybe. Contents which are exclusively for educational information/knowledge sharing on capital market concepts and has no influence the investment/sale decisions of any investors