|

Getting your Trinity Audio player ready...

|

High Yield | AAA/Stable Rated | Minimum Investment: 10k Only

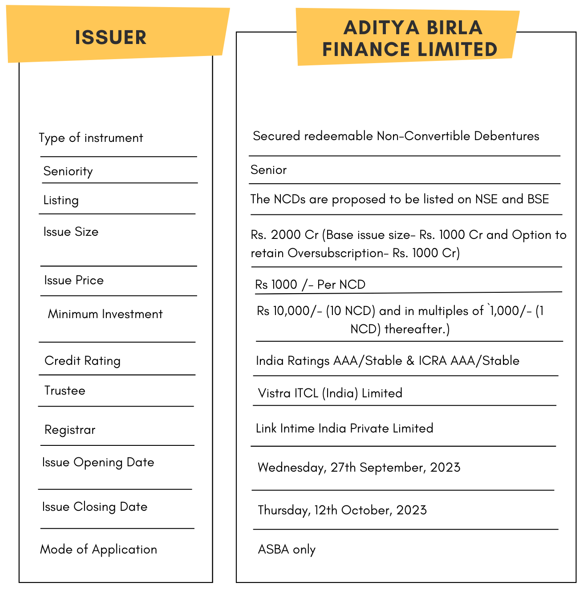

Bond overview

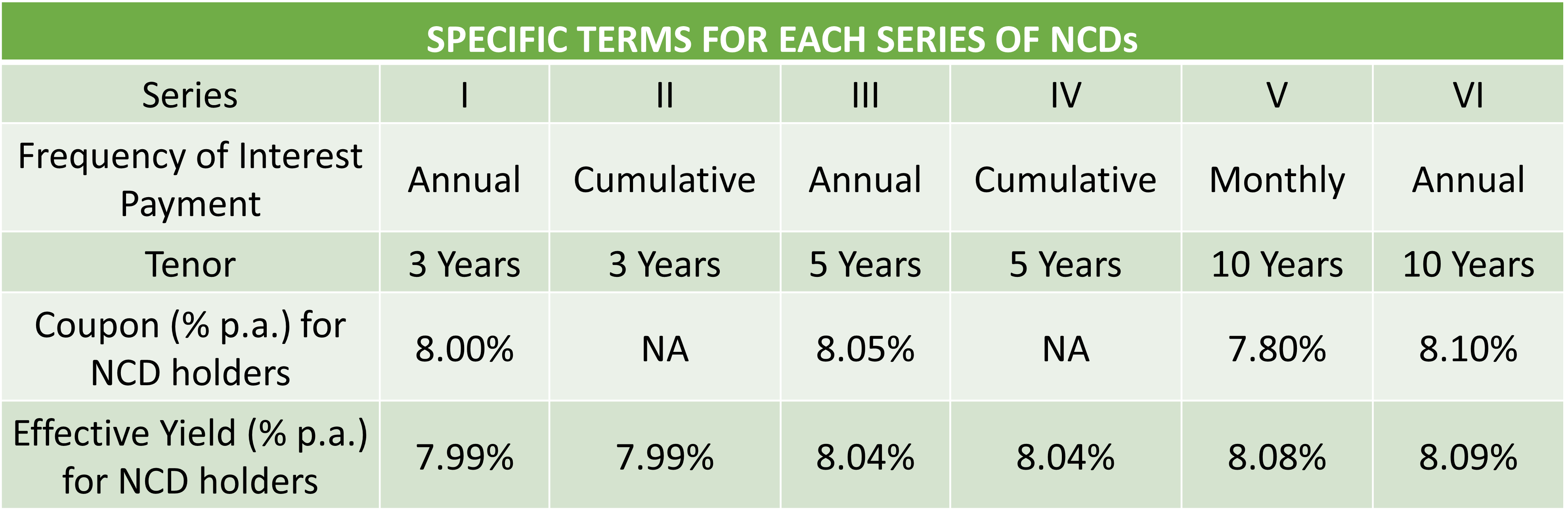

Aditya Birla Finance Limited is issuing the Non-Convertible Debentures. These NCDs are “AAA/Stable” rated by India Ratings and ICRA. The NCDs are being issued in six series: coupon ranges from 8.00% to 8.10% p.a. and different tenures of 3, 5 and 10 years. The NCDs are secured and redeemable in nature.

Coupon rates and effective yield for each of the series

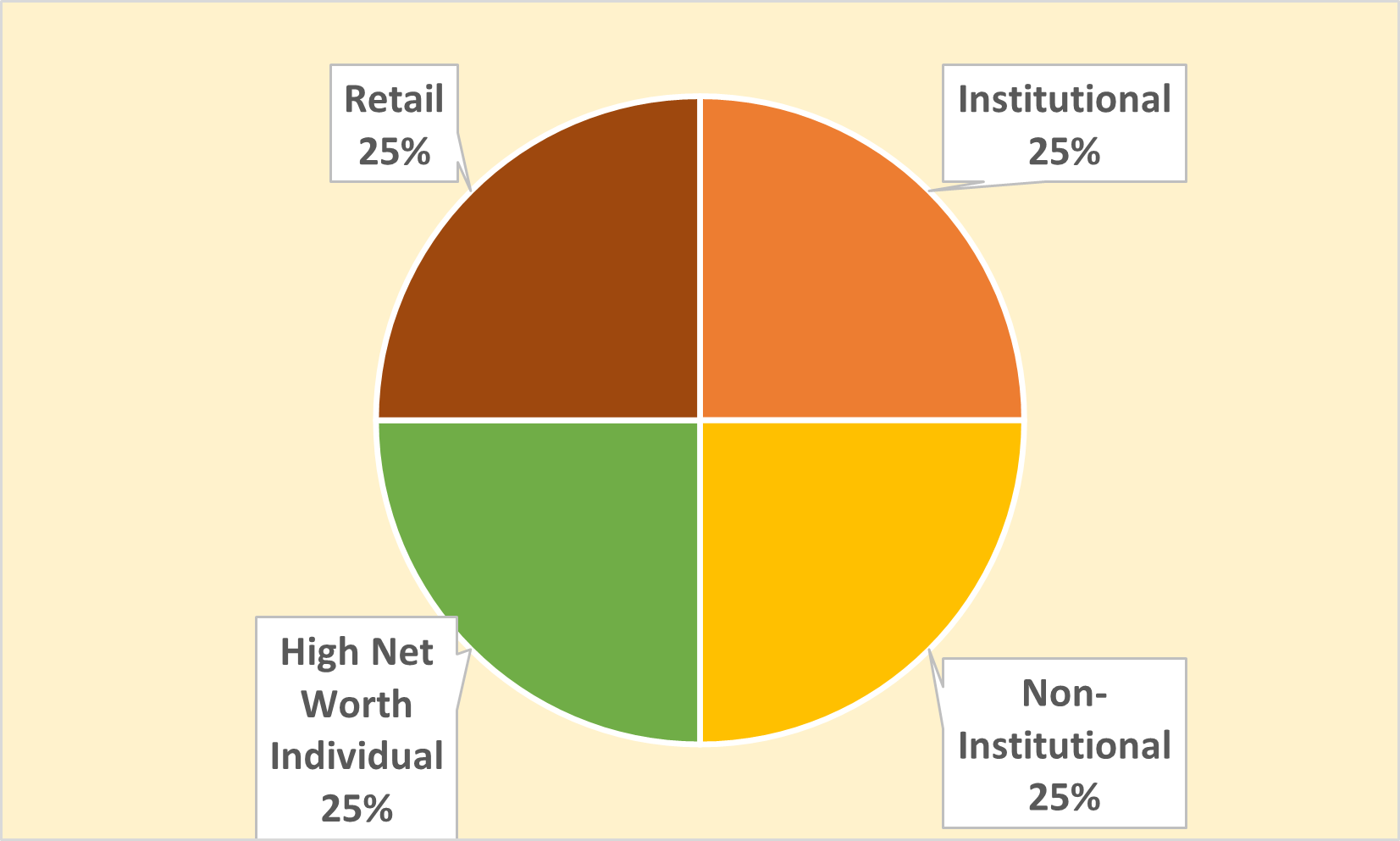

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Aditya Birla Finance Limited NCD-IPO.

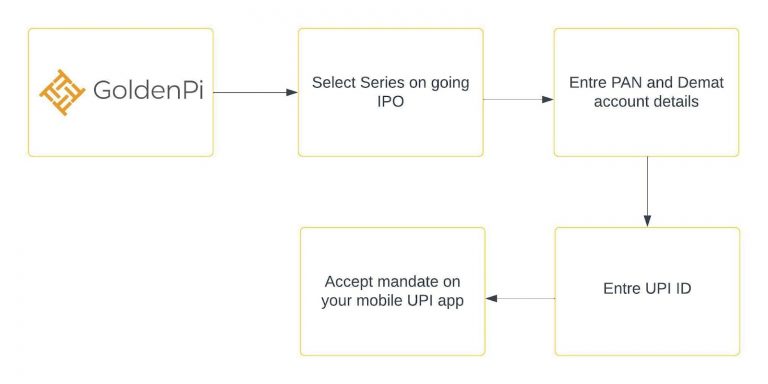

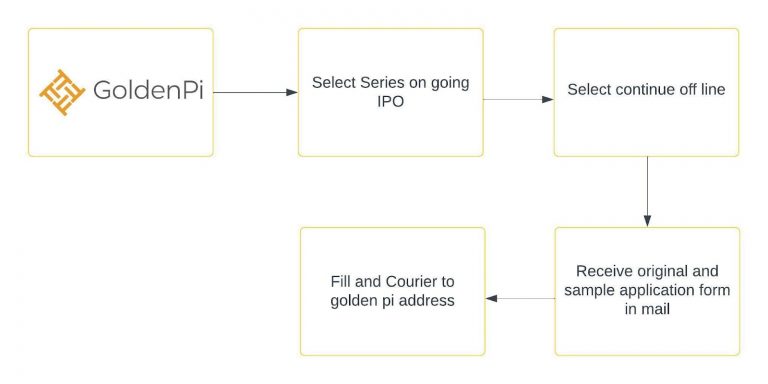

Investment Process for Aditya Birla Finance Limited NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

Issue analysis

Pros

- Classified as ‘Upper Layer’ NBFC by RBI. Leading position in Indian Non-Banking Financial Sector. Significant year-on-year gains

- Low NPAs attributed to robust risk management. Strategic borrowing relationships.

- AAA credit rating: The NCDs have been rated IND AAA Outlook Stable by India Ratings and [ICRA]AAA (Stable) by ICRA Limited. This indicates that the company has a very high creditworthiness and is unlikely to default on its debt obligations.

- Attractive interest rates: The NCDs are offering attractive interest rates, which are higher than the current fixed deposit rates offered by banks. This makes them a good option for investors who are looking for higher returns on their investments.

- Regular income: The NCDs offer regular interest payouts, which can be a good source of income for investors.

- Liquidity: The NCDs are listed on the stock exchanges, which means that they can be easily traded if needed.

- Diversification: Investing in NCDs can help to diversify an investor’s portfolio and reduce overall risk.

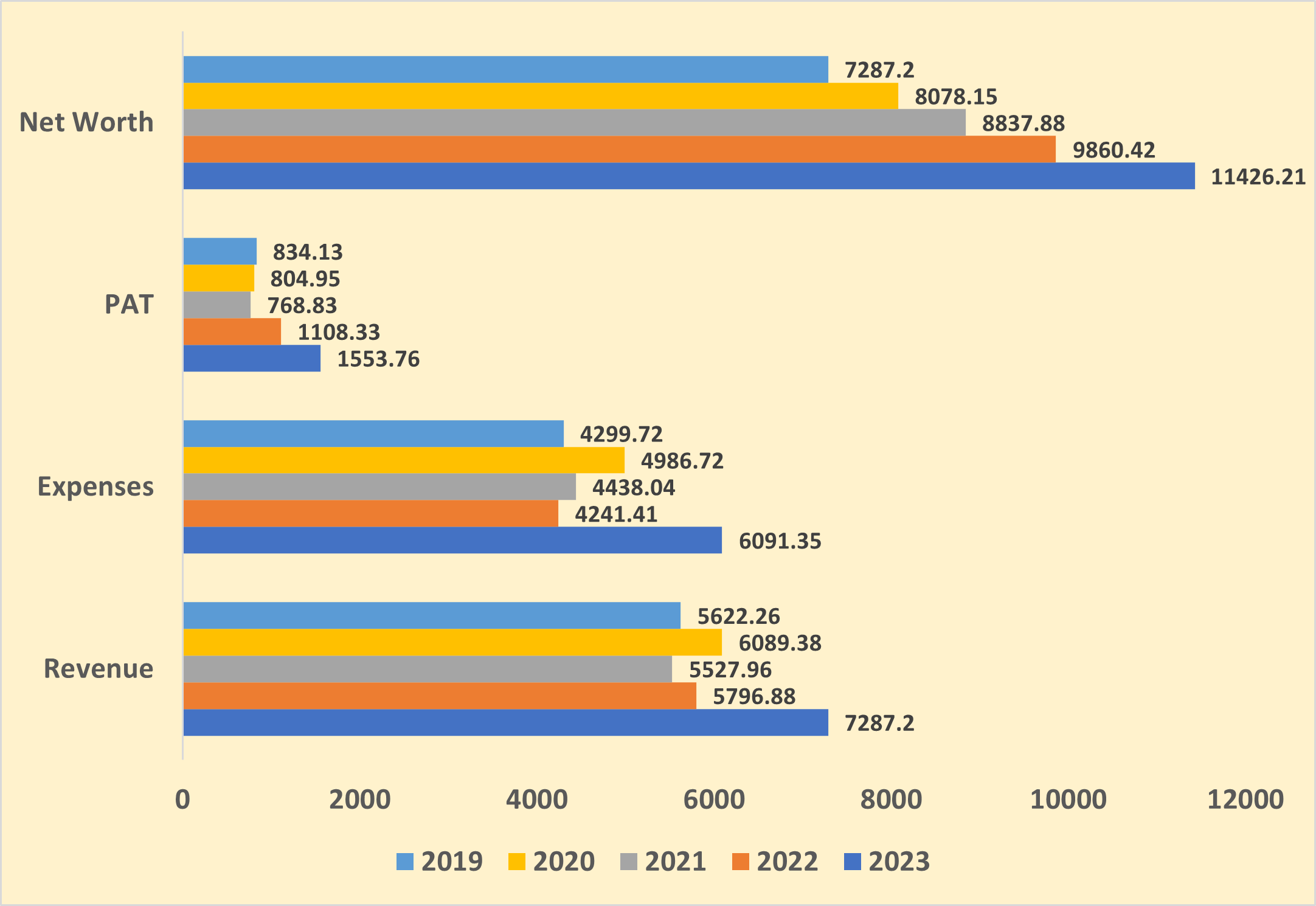

Financial Overview

Snapshot stating the Revenue, Expenses, Net Worth and PAT (In crores)

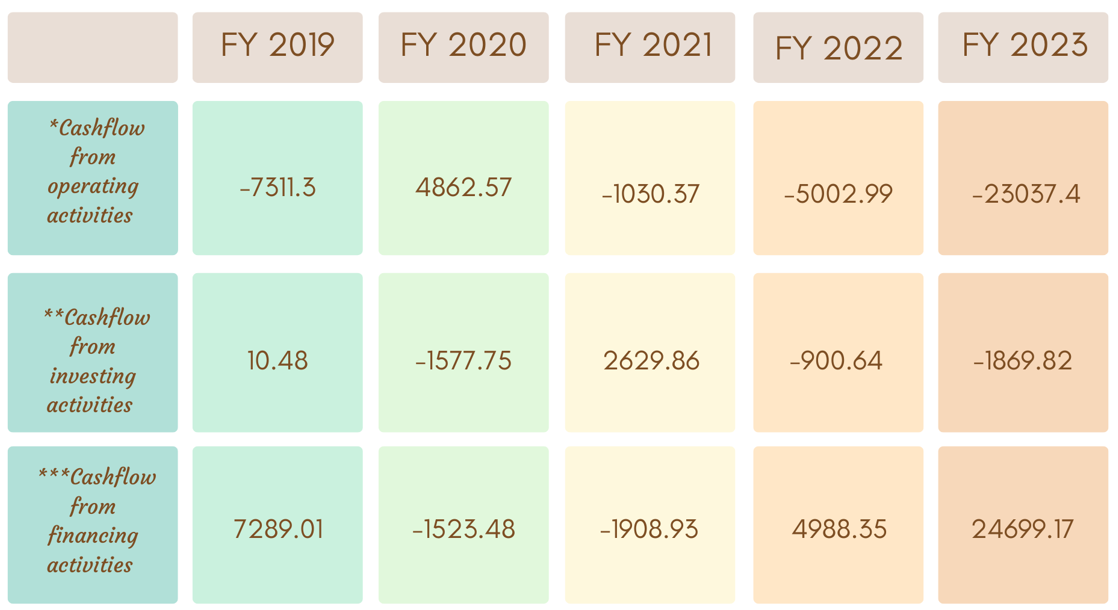

Cash flow for last few years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

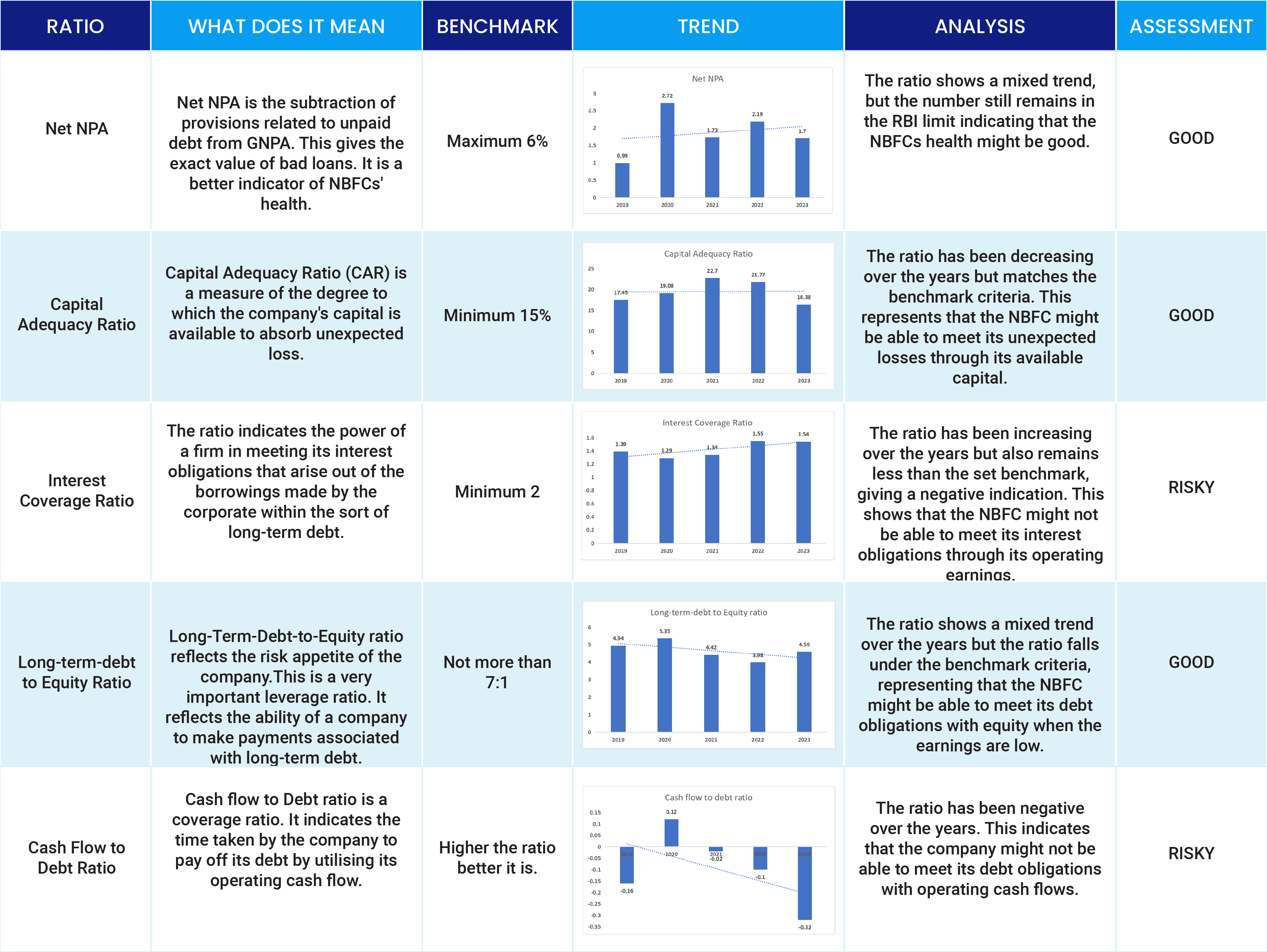

Ratio Analysis

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Aditya Birla Finance Limited

Aditya Birla Finance Limited (ABFL) is a leading non-banking financial services company (NBFC) in India. It is a subsidiary of Aditya Birla Capital Limited (ABCL), the holding company for the Aditya Birla Group’s financial services operations. Numerous financial services and products are provided by ABFL, such as credit cards, personal loans, house loans, business loans, mortgage loans, and loans for mortgages and homes.

According to assets under management (AUM), ABFL is one of the biggest NBFCs in India. With more than 1,000 branches and 200,000 agents, it has a significant presence all throughout the nation. ABFL is renowned for its cutting-edge goods and solutions as well as its dedication to client pleasure.

Strengths

- Diversified business model: ABFL has a diversified business model, with operations across personal loans, home loans, mortgage loans, business loans, credit cards, and wealth management. This diversification helps to reduce risk and improve profitability.

- Strong brand recognition: ABFL is a well-known and respected brand in India. This gives it a competitive advantage in attracting customers and raising capital.

- Experienced management team: ABFL has a team of experienced and qualified professionals who have a deep understanding of the Indian financial services market.

- Strong financial position: ABFL has a strong financial position, with a healthy capital base and good asset quality.

Weakness

- Vulnerability to economic downturns: ABFL’s business is vulnerable to economic downturns, as this can lead to an increase in defaults and a decrease in demand for loans.

- Asset quality challenges: ABFL’s asset quality has deteriorated in recent years, due to the impact of the COVID-19 pandemic. However, the company has taken steps to improve its asset quality.

- Competition from other NBFCs and banks: ABFL faces stiff competition from other NBFCs and banks in the Indian financial services market.