|

Getting your Trinity Audio player ready...

|

High Yield | A+/Watch Negative | Minimum Investment: 10k Only

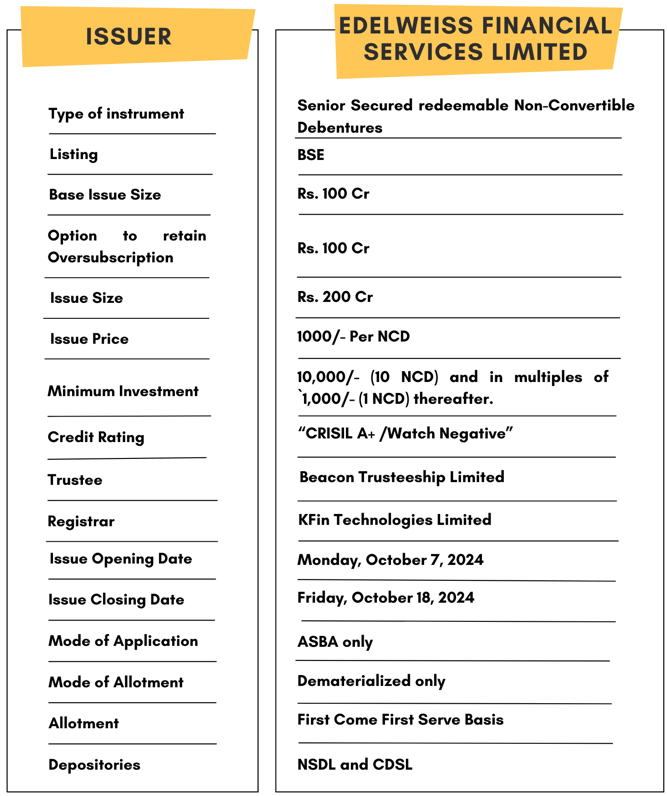

Edelweiss Financial Services Limited is issuing the Non-Convertible Debentures. These NCDs are A+/Watch Negative rated by CRISIL. The NCDs are being issued in twelve series: coupon ranges from 9.5% to 11% p.a. and different tenures of 24 months, 36 months, 60 months and 120 months . The NCDs are secured and redeemable in nature.

Edelweiss Financial Services Limited NCD IPO: Coupon rates and effective yield for each of the series

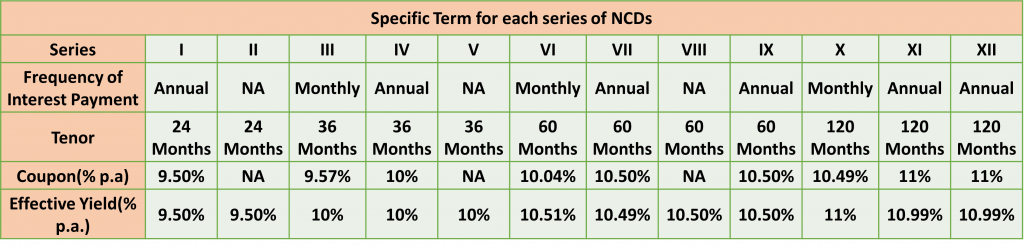

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to know the application ratio for Edelweiss Financial Services Limited NCD-IPO.

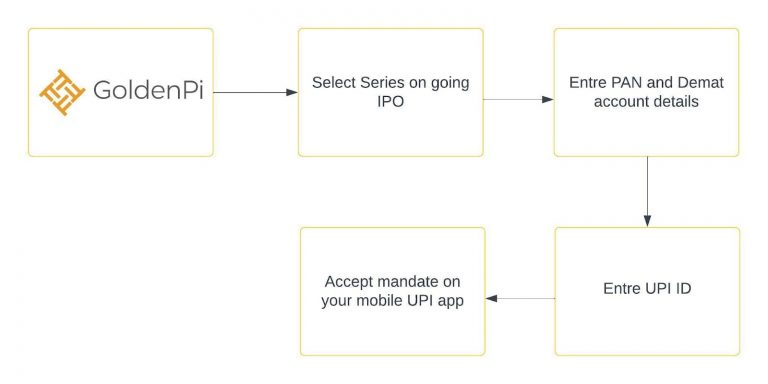

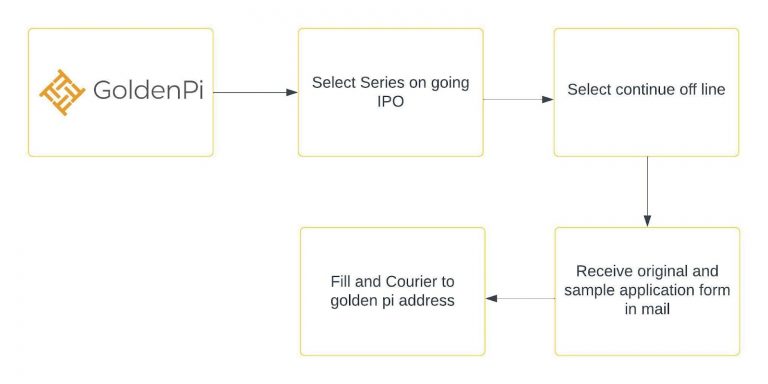

Investment Process for Edelweiss Financial Services Limited NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

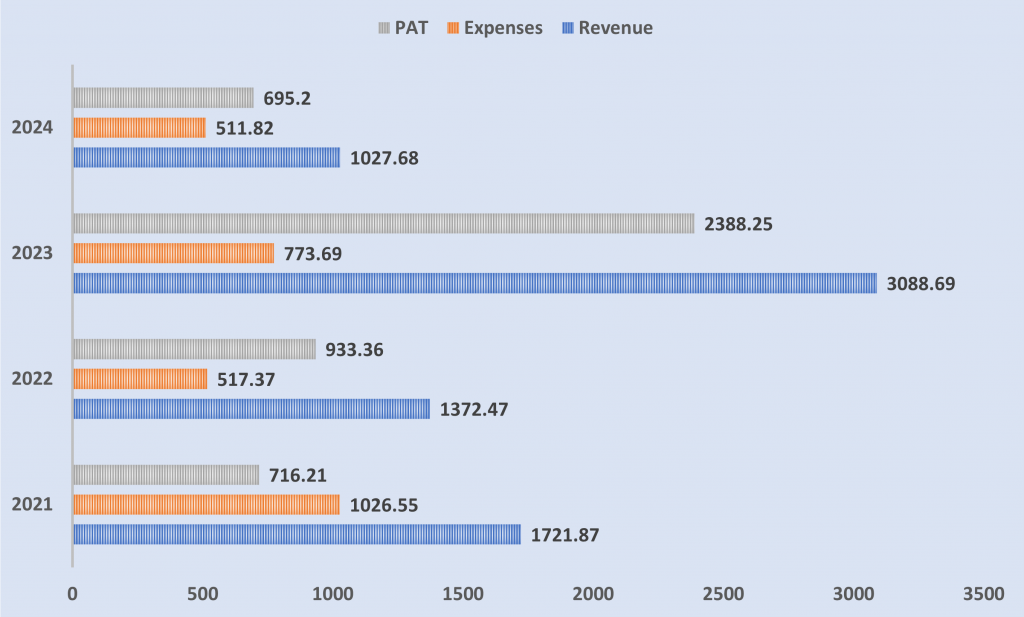

Financial Overview

Snapshot stating the Revenue, Expenses, Net Worth and PAT (In crores)

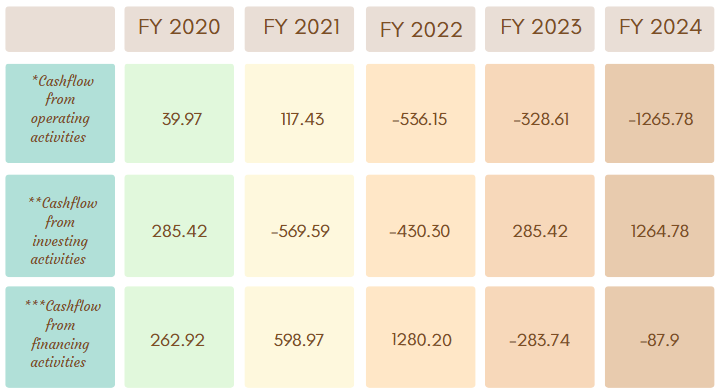

Cash flow for last few years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

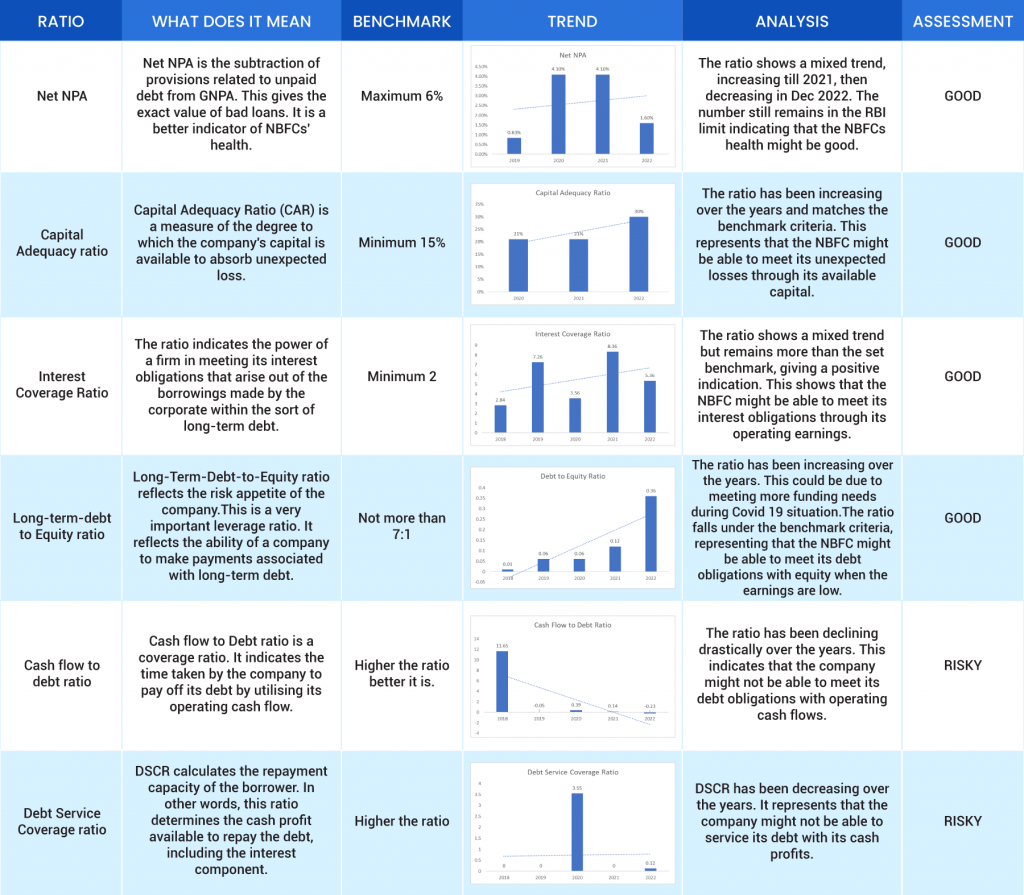

Ratio Analysis

Issue analysis

Pros

- The yield offered is up to 11% which is much higher than many traditional fixed-income investments like FDs.

- The NCDs are A+ Watch Negative by CRISIL, ensuring safer investments.

- The company maintains a good Capital Adequacy Ratio, indicating that it has a sufficient capital buffer to absorb unexpected losses.

- The capital gearing ratio of 3.2 times as of 31st March 2024, compared to 2.5 times in 2023, demonstrates the company’s strategic increase in leveraging debt to potentially enhance returns on equity.

Cons

- Of the various businesses that the company operates, more than 70% of its PAT comes from alternate asset business, making it highly skewed.

- Despite recent improvements, Edelweiss Financial Services Limited profitability remains subdued with increasing operating costs.

Liquidity

Edelweiss Financial Services Limited has a strong liquidity profile with unencumbered cash and liquid investments of 46.1 Crores as of 31st March,2024.The upcoming public issuance of NCDs in July 2024 is expected to further enhance its liquidity profile.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About Edelweiss Financial Services Limited

Edelweiss Financial Services Limited is one of India’s leading financial services conglomerates, offering a robust platform to a diversified client base across domestic and global geographies. The company has mainly four business verticals namely Retail Credit, Asset Management, Asset Reconstruction and Insurance services. Apart from that the company has also been providing Merchant Banking services since 1995. Edelweiss Financial Services Limited is listed on the stock exchange having a market capitalization of more than 6,000 Crores as of July,2024.

Strengths

- Adequate Capitalisation– Edelweiss group has demonstrated its ability to raise capital from global investors, as of now the company has raised a total of 4,400 Crores from investors.

- Diversified Business– The company has diversified business across verticals and has attained the leading position in alternate asset and asset reconstruction business

- Market Leader-The group’s asset management business is a market leader in the alternate asset segment, with its mutual fund AUM growing steadily from Rs 1,51,500 crore in 2023 to Rs 1,81,700 crore as of March 31, 2024.

Weakness

- Subdued Profitability– Profit margins historically low, showing modest improvement recently.

- Economic Sensitivity: Edelweiss Financial Services business performance may be sensitive to macroeconomic factors such as interest rates, inflation, and overall economic growth, potentially affecting loan demand and credit quality.

- Negative Cash flow– For the Financial year 2024, the company reported a negative cash flow of 1,265 Crores from operating activity highlighting core business inefficiencies and cost management issues.

Invest in Bond IPO online in just 5 minutes

Source- Prospectus September 30, 2024

Disclaimer – The information is published as on date 10/08/2024 based on information available on Prospectus September 30, 2024. The information may be subject to change in case of change in terms of prospectus or any other reason as the case maybe. Contents which are exclusively for educational information/knowledge sharing on capital market concepts and has no influence the investment/sale decisions of any investors