|

Getting your Trinity Audio player ready...

|

High Yield | AA/Stable Rated | Minimum Investment: 10k Only

IIFL Finance Limited is releasing the non-convertible debts.

Should you invest in IIFL NCD 2023 Finance Ltd.’s?

IIFL Finance Limited provides AA/Stable-rated NCDs with a high rate of return ranging from 8.35% to 9% per year within the terms of 24, 36, and 60 months. The minimum investment will be ₹10,000.

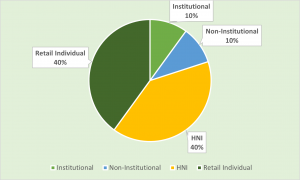

Bond overview

IIFL Finance Limited is issuing the Non-Convertible Debentures. These NCDs are AA/Stable rated by CRISIL and ICRA. The NCDs are being issued in seven series: coupon ranges from 8.35% to 9% p.a. and different tenures of 24 months, 36 months and 60 months. The NCDs are secured and redeemable in nature.

Coupon rates and effective yield for each of the series

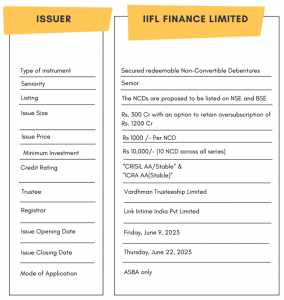

Allocation Ratio

The allocation ratio is prepared based on norms laid down by SEBI. Before announcing the allocation ratio, the same has to be approved by SEBI. Once the IPO subscription closes, applications will be divided into different categories. The category-wise allocation ratio is always decided and declared during the launch of the particular IPO. Considering the Allocation Ratio, units will be assigned to applicants. Refer to the chart to get the infographic of application ratio of IIFL.

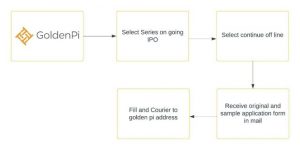

Investment Process for IIFL Finance Ltd. NCD IPO

You can invest in IPOs via GoldenPi in 3 easy steps.

If the investment amount is less than & up to 10 lakhs, retail investors can apply for an IPO online.

If the investment amount is more than 10 Lakhs.

Financial Overview

Snapshot stating the Revenue, Expenses, PAT (In crores)

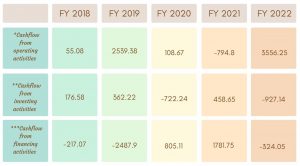

Cash flow for last 5 years (In crores)

Cash flow refers to the movement of cash in and out of the business at a specific point in time. It represents the net balance of the cash movement.

-

- *Cash flow from operating activities reflects the amount a company generates through its product of services.

- **Cash flow from investing activities reflects cash generated and spent relating to investing activities, like purchase of assets, sales of securities etc.

- ***Cash flow from financing activities gives an insight into the financial stability of a company to its investors. It reflects the net flows of cash that are used to fund the company.

Ratio Analysis

Issue analysis

Pros

- The NCD is AA rated security with a stable outlook.

- The yield offered is 9% which is much higher than FDs.

Cons

- Average Profitability.

To get better returns than Bank FDs, invest in NCD-IPOs online.

About IIFL Finance Ltd.

The IIFL Finance group’s listed holding firm, IIFL Finance, is recognised as a systemically important NBFC. Gold loans, home loans, LAP, business loans, and microloans are among the many retail lending products the organisation offers. These core sectors account for 93% of the group’s AUM, while the remaining portion is made up of capital market-based lending and construction and developer finance.

Promoters owned 24.9% of IIFL Finance as of March 2022, while Fairfax Holdings, headed by Mr. Prem Watsa, held 22.3% of the company, and CDC Group PLC held 7.8%.

Total Employees – 32452

Over 8+ million happy customers

Quick walk through on Financials details for 2023

- Loan Asset Under Management – Rs. 55,302 Cr

- NNPA – 1.2%

- Free Cash & Undrawn lines – Rs. 8,191 Cr

Strengths

- Diversified retail lending profile and a wide network of 3,296 branches as of March 2022, spread across 1260 towns/cities.

- Adequate Capitalisation with networth of around Rs. 6470 Cr as on March 31, 2022.

- Liquidity stays strong with free cash and undrawn lines.

Weakness

- Low Profitability.

Invest in Bond IPO online in just 5 minutes

Key Takeaways

- Interest rates range from 8.35% to 9% per year, and they are higher than the average FD rate.

- Available in different tenures, i.e., 24, 36, and 60 months, to match different investment needs.

- The company has shown ordinary profitability, which may alert some investors.

- Free cash and undrawn lines: Rs. 8,191 crore.

- For investments up to ₹10 lakhs, easily apply online through GoldenPi.

- Investments above ₹10 lakh may require a few more steps.

FAQ

1. What is IIFL?

The listed holding company of the IIFL Finance group, IIFL Finance, is acknowledged as a systemically important NBFC. Among the many retail lending products the company offers are microloans, business loans, home loans, LAP, gold loans, and business loans. Ninety-three percent of the group’s assets under management (AUM) are comprised of capital market-based lending and developer and construction finance.

2. Which bonds do IIFL offer?

IIFL offers bonds with high grades in security

| Details | Maximum yield | Overall Issue Size | Credit Rating | Start Date | Closing Date | For more details |

|---|---|---|---|---|---|---|

| IIFL FINANCE LTD. NCD IPO – JUNE 2023 | 9% | 300 cr | CRISIL AA Stable, ICRA AA Stable | June 9, 2023 | June 22, 2023 | More Details |

| IIFL NCD IPO January 2023 | 9% | 1000 cr | ICRA, CRISIL AA (Stable) | January 6, 2023 | January 18,2023 | More Details |

| IIFL NCD IPO December 2021 | 8.75% | 100 cr | BWR, CRISIL AA | December 8, 2021 | December 28, 2021 | More Details |

| IIFL NCD IPO September 2021 | 8.75% | 1000 cr | CRISIL AA (Stable) | September 27, 2021 | October 18, 2021 | More Details |

| IIFL NCD IPO July 2021 | 10.03% | 100 cr | CRISIL AA | July 06, 2021 | July 28, 2021 | More Details |